Alvarez & Marsal Releases UAE Banking Report for Q1 2020

Dubai – Leading global professional services firm Alvarez & Marsal (A&M) released its latest UAE Banking Pulse for Q1 2020 today. The report suggests that the top 10 UAE banks reported a combined 6.3% quarter-on-quarter (QoQ) drop in interest income, largely due to the low interest rate environment. The net profit declined by 22.4% QoQ, on account of a 3.6% drop in operating income and a 35% increase in provisioning. Consequently, the average return on equity (RoE) for the universe was impacted by the reduced operating income due to a series of rate cuts and increased provisioning.

The Covid-19 pandemic has negatively affected the real estate market in the UAE with banks’ exposure reduced by about 100 bps compared to the last quarter. The subsequent pressure on the real estate sector is imminent, underpinned by economic slowdown and persistent oversupply. The UAE Central Bank has provided some relaxations for lending activity to help bolster the sector; however, banks are required to hold additional capital.

Alvarez & Marsal’s UAE Banking Pulse examines the data of the 10 largest listed banks in the UAE, comparing the first quarter of 2020 (Q1 2020) against the previous quarter (Q4 2019).

The prevailing trends identified for Q1 2020 are as follows:

- When compared to Q1 2019, banks’ loans and advances (L&A) and deposit growth was the slowest amid tight market conditions. Total L&A and deposits increased 0.9% and 0.5%, respectively. Despite the completion of Dubai Islamic Bank’s (DIB’s) acquisition of Noor Bank, the L&A and deposit growth for the top 10 banks increased at a marginal pace only (Noor Bank was not a part of our coverage universe before the acquisition). Consequently, loans to deposit ratio (LDR) increased to 87.8% from 87.4% in Q4 2019.

- Operating income declined after increasing for two consecutive quarters. The operating income sank by 3.6% from Q4 2019 as major income streams reported reduced contributions. Net interest income (NII) dropped by 3.1% as low interest rates fully offset a marginal increase in L&A and non-interest income dropped by 4.9%, which impacted total operating income.

- Net interest margin (NIM) witnessed sizeable contraction by about 15 bps to 2.54% in Q1 2020, on account of a sharp decline in interest rates. NIM decreased after rising for two consecutive quarters. Seven of the top 10 banks reported a decline in NIM.

- Cost-to-income (C/I) remained one of the few areas where some progress was seen. After rising throughout 2019, C/I ratio fell by about 1.1% points to reach 34%. C/I ratio declined largely on the back of a 6.8% QoQ decline in operating expenses. Cost-cutting measures adopted by the banks resulted in some improvement as eight of the10 banks had reduced their operating expenses.

- Total loan loss provisions saw a sharp increase by 35% from Q4 2019, while non-performing loans (NPL) to net loans ratio increased substantially to 5.2%. Tough market conditions due to COVID-19 headwinds was the primary factor that led to increased provisioning. Cost of Risk (CoR) increased to 1.8% as banks took increased provisioning because the challenging operating environment weighed on asset quality.

- Return on equity (RoE) continues to exacerbate in Q1 2020 with 9% compared to 15.4% in Q1 2019. A low interest environment and increased provisioning impacted the net profit of the top 10 UAE banks. Profitability metrics (RoE and RoA) declined to multi-period low levels on the back of lower operating income and increased provisioning, which weighed on the net income.

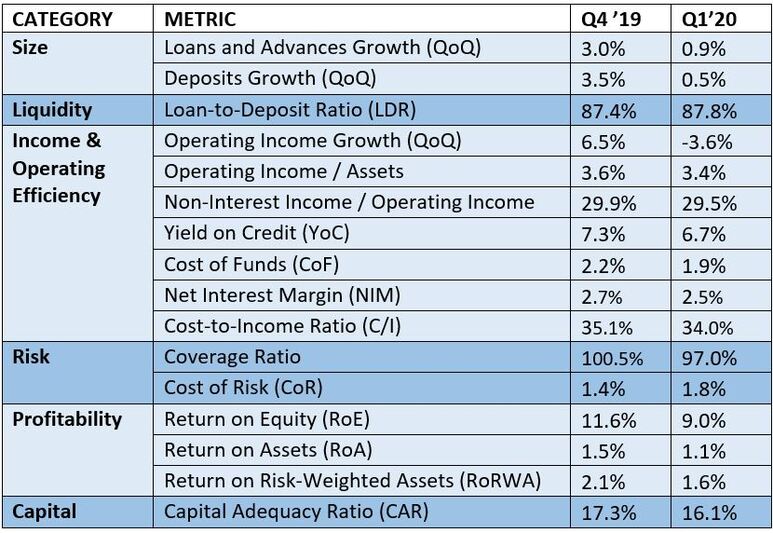

Alvarez & Marsal’s report uses independently sourced published market data and 16 different metrics to assess banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability, and capital.

The country’s 10 largest listed banks analysed in A&M’s UAE Banking Pulse are First Abu Dhabi Bank (FAB), Emirates NBD (ENBD), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Mashreq Bank (Mashreq), Abu Dhabi Islamic Bank (ADIB), Commercial Bank of Dubai (CBD), Emirates Islamic Bank (EIB), National Bank of Ras Al-Khaimah (RAK) and Sharjah Islamic Bank (SIB).

OVERVIEW

The table below sets out the key metrics:

Source: Financial statements, investor presentations, A&M analysis

Dr. Saeeda Jaffar, A&M Managing Director and Head of A&M Middle East, and Asad Ahmed, A&M Managing Director & Head of ME Financial Services, co-authored the report.

Mr. Ahmed commented: “Profitability of the top UAE banks in Q1’20 has showed signs of vulnerability, with declining interest income and increased provisioning weighing on the net profit. It is almost certain that the banking sector will see a big spike in bad loans. This stress is not fully visible so far as there was only one truly bad month in the first quarter. Additionally, there were certain reliefs available as a result of the Central Bank’s guidance relaxations, such as moratorium on loan and interest payments and capital buffer reliefs for the banks, which could have a delayed impact on bank financial statements.”

Mr. Ahmed further added, “In order to emerge from the effects of the pandemic, we see banks adopting several key initiatives such as an increased focus towards new age banking and a tech-first approach; an urgent evaluation of their portfolios not only from a quality and grading perspective, but perhaps much more importantly from a directional view of industry and customer segment; and a return to managing operational cost to achieve better nimbleness and re-evaluation of corporate governance. Indications at this point suggest a challenging year for the banks.”

###

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 4,500 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators and industry authorities with a shared commitment to telling clients what’s really needed for turning change into a strategic business asset, managing risk and unlocking value at every stage of growth.

To learn more, visit https://www.alvarezandmarsal.com. Follow A&M on LinkedIn, Facebook and Twitter.

###

CONTACT:

Kiran Makhija, Hanover Middle East, +971 5547 10294

Sandra Sokoloff, Senior Director of Global Public Relations, Alvarez & Marsal, +1 212 763 9853