Alvarez & Marsal Releases Saudi Arabia Banking Pulse for Q1 2022

- Saudi banking sector profit remains well diversified

- Increase in operating income, better cost efficiencies and lower impairments boosted sector profitability, especially for smaller banks

- Loans & advances and deposits grew substantially by 5.2 percent and 3.9 percent quarter on quarter (QoQ), respectively

Kingdom of Saudi Arabia – June 06, 2022 – Leading global professional services firm Alvarez & Marsal (A&M) has released its latest Saudi Arabia (KSA) Banking Pulse for Q1 2022. The report suggests that aggregate profitability of top Saudi banks increased substantially by 17.6 percent quarter on quarter (QoQ) in Q1’22 driven largely by operational income growth of 5.6 percent QoQ. Better cost efficiencies and lower impairment charges also supported growth, with most banks showing improved coverage ratios and net loan ratios, highlighting their improving credit profile.

Higher net interest margin (NIM) could be attributed to increased focus on retail lending, as compared to corporate lending, which typically provides better asset yields compared to corporate loans. Return ratios witnessed a rise in the current quarter as compared to Q4’21, with improved profitability and higher return on equity (ROE).

At a sectoral level, loan growth reflected increased market confidence potentially driven by the economic rebound, increased consumer expenditures and higher oil prices. Loans and advances (L&A) and deposits of the top banks increased by 5.2 percent and 3.9 percent QoQ, respectively.

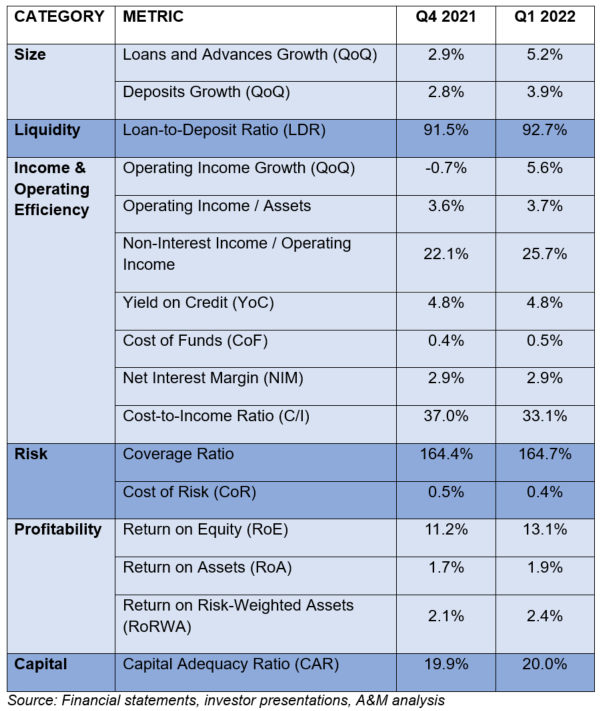

A&M’s KSA Banking Pulse examines data of the 10 largest listed banks in the Kingdom, comparing the Q1’22 results against Q4’21 results. Using independently sourced published market data and 16 different metrics, the report assesses banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability, and capital.

The country’s 10 largest listed banks analyzed in A&M’s KSA Banking Pulse are Saudi National Bank (SNB), Al Rajhi Bank, Riyad Bank (RIBL), Saudi British Bank (SABB), Banque Saudi Fransi (BSF), Arab National Bank (ANB), Alinma Bank, Bank Albilad (BALB), Saudi Investment Bank (SIB) and Bank Aljazira (BJAZ).

The prevailing trends identified for Q1 2022 are as follows:

1. L&A and deposits grew substantially in Q1’22. L&A of the top ten banks increased by 5.2 percent QoQ in Q1’22 while deposits grew by 3.9 percent in Q1’22. Consequently, as the L&A growth outpaced deposits growth, the loan to deposit ratio (LDR) increased marginally by 1.1 percent QoQ to 92.7 percent from 91.5 percent in Q4’21.

2. The operating income witnessed an uptick by 5.6 percent QoQ as compared to -0.7 percent QoQ in Q4’21. The increase was primarily driven by a 9.5 percent QoQ rise in net fees & commission and gains from foreign exchange income and trading related income, +46.1 percent QoQ. Non-interest income (NII) increased marginally by 0.8 percent QoQ.

3. NIM dropped to its lowest levels since 2019, however it is expected to increase in the coming quarter due to interest rate hikes. Seven of the top ten banks have reported contraction in NIM with aggregate NIM decreasing by 7 bps QoQ. NIM deteriorated to 2.86 percent as aggregate net interest income of +0.8 percent QoQ grew at a slower pace as compared to net interest-bearing assets of +3.9 percent QoQ. The yield on credit remained stable at 4.8 percent for Q1’22, while the cost of funds increased by 6.0 bps to 46.2bps.

4. The banks reported a considerable improvement in cost efficiencies during Q1’22. Cost-to-income (C/I) ratio improved substantially by 3.9 percent points QoQ to reach 33.1 percent. The improvement in C/I ratio was driven by reduction in operating expenses by 5.5 percent QoQ while operating income increased by 5.6 percent QoQ.

5. The cost of risk (CoR) improved by 10bps to 0.44 percent on the back of lower aggregate loss provisions. Eight out of top ten banks reported a decline in CoR. The total impairments dropped by 15.0 percent QoQ in Q1’22 to SAR 2.2bn, primarily due to lower impairments for SABB at -85.5 percent QoQ, BJAZ at -41.1 percent QOQ and SNB at -24.2 percent QOQ.

6. Sector profitability improved as net earnings increased for eight out of ten banks. Aggregate net income increased by 17.6 percent QoQ and as a result the return on equity (RoE) and return on assets (RoA) improved by 1.9 percent QoQ and 0.2 percent QoQ respectively. SABB reported the highest increase in RoE by 4.5 percent QoQ to 7.6 percent stemming from the bank’s lower impairment charges of-85.5 percent QoQ.

OVERVIEW

The table below sets out the key metrics:

Mr. Asad Ahmed, Managing Director and Head of Middle East financial services at A&M commented: “The first quarter saw broad-based profitability improvement across the banking industry. Overall efficiency improved during the quarter as witnessed by decline in cost-to-income ratio by 3.9% points QoQ in Q1’22.

In May’ 2022, Saudi Arabia Central Bank (SAMA) increased its interest rates by 50 bps in line with the US Federal Reserve hikes. Recent interest rate increases in KSA mirror the increase in the US dollar rates and are likely to provide an impetus to banking sector profitability given the Gulf currencies’ linkages to the dollar.

A buoyant energy market, interest rate hike, and increase in consumer spending bode well for a continued a positive outlook for the Saudi banking sector. We expect SAMA to continue matching rate hikes by the US Federal Reserve, which will help boost the sector’s NIMs and reflect broad-based profitability improvements. Saudi Arabia posted a budget surplus of USD 15.33 bn for the first quarter which is well above the earlier estimates of USD 24bn for 2022. This is the first surplus since 2014 and will have a positive economic impact.”

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 6,000 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators and industry authorities with a shared commitment to telling clients what’s really needed for turning change into a strategic business asset, managing risk and unlocking value at every stage of growth.

To learn more, visit: AlvarezandMarsal.com. Follow A&M on LinkedIn, Twitter, and Facebook.

CONTACT: Kiran Makhija / Prerna Agarwal, +971 55 471 0294 / +971 52 787 3189

Hanover Middle East

Sandra Sokoloff, Senior Director of Global Public Relations, +1 212-763-9853

Alvarez & Marsal