Alvarez & Marsal 2020 UAE Banking Pulse Expects the Sector to Rise in 2021

Net interest margin (NIM) compressed due to lower interest rate environment but improved in Q4’2020;

Cost-to-income increased despite a decrease in operating expenses; Aggregate capital adequacy ratio of the UAE banks remained robust at 17.6% at the end of FY’2020

Dubai – Leading global professional services firm Alvarez & Marsal (A&M) has released its latest UAE Banking Pulse for FY 2020. The report suggests that while operating environment for the UAE’s banking sector is expected to remain less volatile in 2021 compared to last year, banks might witness deterioration of their asset quality after the completion of Central Bank of the UAE’s deferral programme in June 2021. Aggregate net profit of the top 10 UAE banks declined by 38.3% YoY, on the back of lower operating income and increased provisions.

Net interest income (NII) decreased ~2% YoY, as system-wide rates decreased substantially after the Central Bank of the UAE slashed rates to counter the effects of the Covid-19 pandemic. However, NIM improved as banks were able to reduce their funding costs further.

The UAE banking sector showed signs of instability due to the low interest environment and sluggish economic conditions, which weighed on overall profitability and return metrics. Operating efficiency (C/I ratio) also deteriorated, as operating income decreased at a higher rate compared to operating expenses. Despite a challenging business environment, aggregate capital adequacy ratio of the UAE banks remained robust at 17.6% at the end of December 2020, compared to 17.3% at the end of December 2019.

Alvarez & Marsal’s UAE Banking Pulse examines the data of the 10 largest listed banks in the UAE, comparing the full year results (FY’ 20) against the previous year (FY’ 19).

The prevailing trends identified for FY’ 20 are as follows:

-

Growth in aggregate L&A increased at a marginal rate of 1.4% YoY in FY’20, as economic slowdown due to the outbreak of the pandemic impacted credit demand. Dubai Islamic Bank (+30.3% YoY) reported the highest increase in L&A, largely due to the acquisition of Noor Bank. Similarly, deposit growth slowed to 3.0% YoY during the period. Consequently, aggregate LDR fell to 86.2% from 87.5%.

-

Operating income decreased, as low interest rates impacted income stream. Total operating income declined 4% YoY. Net interest income (NII) decreased ~2% YoY, as system-wide rates decreased substantially, after the UAE’s central bank slashed rates to counter the effect of pandemic. Fee income decreased 9% YoY, as lockdown impacted the income arising from cards and new business volumes.

-

NIM improved for most of the banks in Q4’2020. Aggregate net interest margin (NIM) compressed further by 28 bps YoY to 2.3% in FY’20, largely on the back of low interest rate environment. Yield on credit declined by 129 bps YoY, while cost of funds fell 69 bps YoY. Despite the increase, aggregate NIM continue to remain at multi-period low levels in the UAE banking sector.

-

Cost-to-income (C/I) ratio increased by 1.0%-point YoY to 34.5%, despite 1% YoY decline in operating expenses. C/I ratio increased as operating income dropped at a higher rate compared to operating expenses. The decrease in expenses can be partially attributed to cost cutting measures implemented by major banks like ADCB and ENBD.

-

Total loan loss provisions increased by 79% YoY to AED 28.1bn, as challenging economic environment and exposure of banks on several high profile publicly disclosed cases resulted in higher impairments. Cost of risk increased sharply by 69 bps YoY to 1.71%. Coverage ratio also declined to 91.9% from 97% a year ago. Aggregate NPL ratio increased to 6.1% at the end of 2020 from 4.6% at the end of 2019.

-

Aggregate net profit declined by 38.3% YoY, on the back of lower operating income and increased provisions. Thus, profitability ratios such as RoE and RoA declined to 7.7% and 0.9% from 13.3% and 1.6%, respectively.

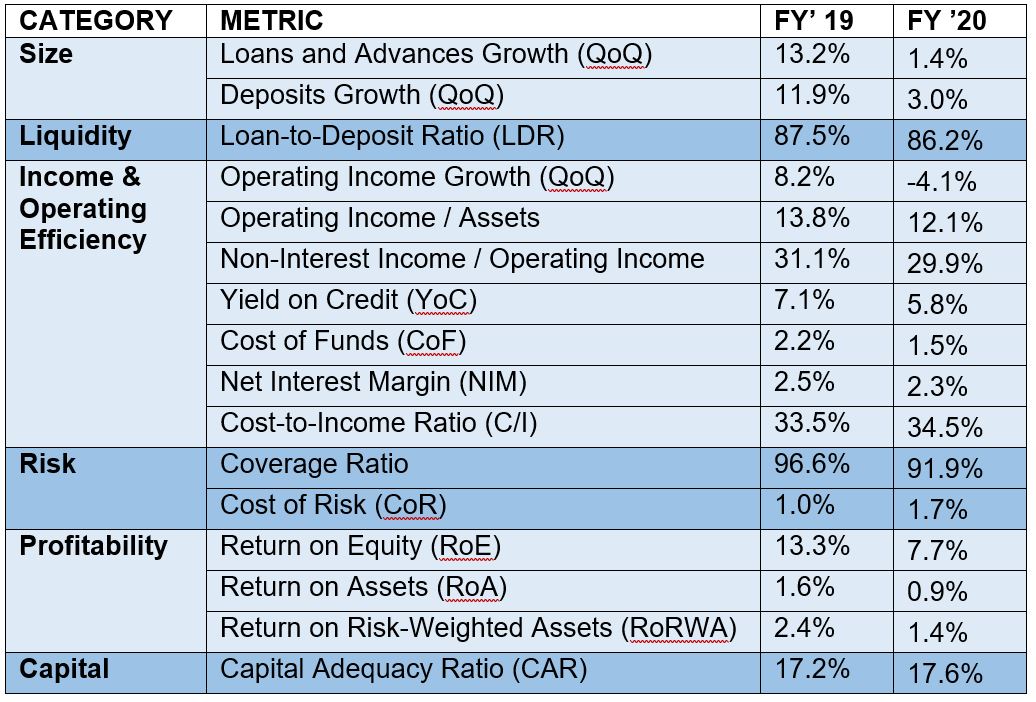

Alvarez & Marsal’s report uses independently sourced published market data and 16 different metrics to assess banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability and capital.

The country’s 10 largest listed banks analysed in A&M’s UAE Banking Pulse are First Abu Dhabi Bank (FAB), Emirates NBD (ENBD), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Mashreq Bank (Mashreq), Abu Dhabi Islamic Bank (ADIB), Commercial Bank of Dubai (CBD), National Bank of Fujairah (NBF), National Bank of Ras Al-Khaimah (RAK) and Sharjah Islamic Bank (SIB).

OVERVIEW

The table below sets out the key metrics:

Dr. Saeeda Jaffar, A&M Managing Director and Head of Middle East, and Asad Ahmed, A&M Managing Director and Head of Middle East Financial Services, co-authored the report.

Mr. Ahmed commented: “The anticipated economic recovery in 2021 should support the operating environment and the fundamentals of banks in the UAE. Profitability in the sector has shown signs of vulnerability with declining interest income and increased provisioning weighing on the net profit. However, we expect 2021 to be less volatile for the UAE banking sector compared to 2020. Events such as Expo and a gradual economic improvement are expected to be the key catalysts for the sector in the near term. However, post the end of the loan forbearance period in June 2021, banks might have to book additional provisions which could be detrimental to their profitability and asset quality. Interest rates are expected to remain low in the foreseeable future, which could impact income stream for the banks.”

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 5,000 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators and industry authorities with a shared commitment to telling clients what’s really needed for turning change into a strategic business asset, managing risk and unlocking value at every stage of growth.

To learn more, visit: AlvarezandMarsal.com. Follow A&M on LinkedIn, Twitter, and Facebook.

###

CONTACT

Prerna Agarwal, Hanover Middle East, +971 52 787 3189

Sandra Sokoloff, Senior Director of Global Public Relations, Alvarez & Marsal, +1 212 763 9853