2016 Qualified Transportation Benefits

Congress recently passed the Protecting Americans from Tax Hikes Act of 2015 (the “PATH Act”). You probably have already heard about the PATH Act, even if you did not realize it, because it delays the healthcare Cadillac Tax for two years to 2020.

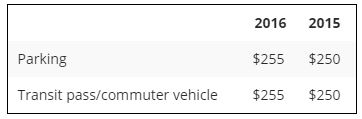

In addition to the delay on the Cadillac Tax, the PATH Act contained various other employee benefit provisions which were met with much less fanfare. One such provision changes the 2016 monthly limit for transit pass/commuter vehicle benefits from $130 per month to $255 per month,and the 2015 monthly limit (retroactive to January 1, 2015) for transit pass/commuter vehicle benefits to $250 per year. The 2015 and 2016 monthly limits for parking benefits remain unchanged at $250 and $255, respectively.

2015 Form 5500 to Include New Internal Revenue Service (“IRS”) Compliance Questions

Recently released versions of the 2015 Form 5500 include new compliance questions for retirement plans that all plan sponsors should review and consider.

You can find the new questions, which are optional for the 2015 plan year, on Schedule H (Financial Information), Schedule I (Financial Information – Small Plan) and Schedule R (Retirement Plan Information).

Schedule H & Schedule I

The new questions on these equivalent schedules are designed to gather additional information relating to:

- Unrelated business taxable income;

- In-service distributions; and

- Additional trust information.

Schedule R

Added to Schedule R is Part VII (IRS Compliance Questions), which addresses additional issues related to the plan’s compliance with certain qualification requirements, including:

- Whether the plan is a 401(k) plan;

- How the plan satisfies coverage and non-discrimination testing requirements;

- Whether the plan has been timely amended for all tax law changes;

- What is the date of the last plan amendment or restatement; and

- What is the date of the plan’s determination letter or advisory letter.

Action Steps

At the very least, plan sponsors should get together with their Form 5500 preparers and decide if and how the new compliance questions are going to be answered. Although answering the compliance questions is optional for the 2015 plan year, plan sponsors should consider reviewing the questions and determining the appropriate answers even if they do not report the answers on the 2015 Form 5500. Reviewing and analyzing these questions while preparing the 2015 Form 5500 will only make the process easier when preparing the 2016 Form 5500 (when answering the questions is expected to be mandatory).

IRS Issues Guidance on IRC Section 162(m) Limits for CFOs in Smaller Reporting Companies

On October 23, 2015, the IRS issued a Chief Counsel Advice memorandum (the “Memo”) providing additional guidance on how the compensation disclosure requirements for smaller reporting companies impact the provisions of Internal Revenue Code (“IRC”) section 162(m). In the Memo, the IRS concludes that the Chief Financial Officer (also referred to as the Principal Financial Officer) of a smaller reporting company is a covered employee only if he or she is one of the two highest compensated executive officers, other than the Chief Executive Officer.

Background

IRC section 162(m) generally provides a $1 million deduction limitation on certain “covered employees.” Pursuant to IRC section 162(m)(3), an individual is a covered employee if (A) he or she is the Chief Executive Officer of the company or (B) the employee’s compensation is required to be reported to shareholders as a “Named Executive Officer” under the Securities Exchange Act of 1934 by reason of such employee being among the four highest compensated officers for the taxable year (other than the Chief Executive Officer). The definition of “covered employee” was originally drafted to track the U.S. Securities and Exchange Commission (“SEC”) definition of “Named Executive Officer.”

In 2006, however, the SEC changed the definition of Named Executive Officer for reporting purposes. The amended definition of Named Executive Officer generally requires reporting of employee compensation for: (1) the CEO, (2) the CFO, and (3) the three most highly compensated executive officers other than the CEO and CFO. Following this change, the IRS issued Notice 2007-49, which provided that despite the SEC’s amended definition, the term “covered employee” did not include individuals whose compensation was reported solely on account of the individual serving in the role of the taxpayer’s CFO.

Further, following Notice 2007-49, the SEC adopted less onerous disclosure requirements for “smaller reporting companies.” Specifically, the less onerous disclosure requirements provide that a smaller reporting company must disclose the compensation of (1) the CEO and (2) the two most highly compensated executives other than the CEO. The SEC regulations define smaller reporting company as a public company that had a public float of less than $75 million or had annual revenues of less than $50 million during the most recent fiscal year.

Chief Counsel Advice

The Memo specifically addresses the definition of a covered employee in light of the revised disclosure requirements for smaller reporting companies. Specifically, the Memo considers whether the CFO of a smaller reporting company is a covered employee for the purposes of IRC section 162(m) if the CFO is the second highest paid executive. The Memo concludes that while a CFO is generally not included as a covered employee, the CFO of a smaller reporting company is a covered employee if she is one of the two highest paid executives, other than the CEO. The Memo noted that, in this scenario, the CFO is a covered employee by virtue of her compensation level and not on account of her position as CFO.

Impact

Although Chief Counsel Advice memoranda do not carry precedential authority, they provide insight into how the IRS interprets its rules and regulations. The position that the IRS adopts in the Memo makes clear that smaller reporting companies should carefully consider whether to include their CFOs as covered employees under 162(m) if their CFO is one of the top two highest paid executives.

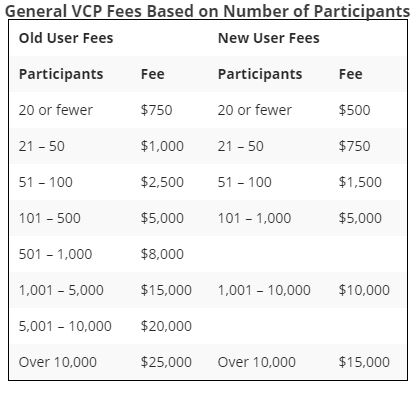

The IRS Updates Voluntary Compliance Program Fees

In another effort to encourage employers to take advantage of the Voluntary Correction Program (“VCP”), one of three IRS programs for correcting plan errors that together form the Employee Plans Compliance Resolution System, the IRS has reduced the fees for many new VCP submissions. The IRS announced the reduced user fees in Revenue Procedure 2016-8 and noted that the effective date is February 1, 2016. See below for a comparison of the old user fees to the new user fees.