EMPLOYMENT TAX SERVICES

A&M’s Australian Employment Tax Services team helps Clients manage the ever-changing world of compliance regulations in relation to their workforce. We assist across the full lifecycle of employment, from initial onboarding to worker separation. We provide expert consulting and advice for obligations such as Pay As You Go withholding, superannuation, fringe benefits tax and payroll taxes, including assessment of payments to contractors and directors.

Our team has the experience and expertise to keep Clients compliant with various payroll taxes by accurately calculating the required obligations across Australia’s eight states and territories. A&M provides Clients with the confidence that they are compliant with their employment taxes and can design strategies to forecast tax requirements during times of transition in the business, such as expansion or location of business activity into Australia for the first time.

WHY OUR CLIENTS CHOOSE US

Senior-led team: A&M’s engagements are all directly led by senior leadership. Through our hands-on approach, we provide tax law experience and knowledge to Clients and deliver strategic solutions during times of business transition.

Expertise: We offer deep experience in the Australian employment tax profession, allowing us to provide services that meet organisations’ relevant employment tax obligations and to make process that appear overwhelming manageable for Clients.

Independence: A&M’s Australia Employment Tax Services team is not bound by audit restrictions and can advise on all manners of employment tax issues.

Agility: Our team meets the needs of our Clients without the significant overhead that some firms carry. A&M’s bias to action approach quickly helps employers solve problems in a highly responsive manner.

Simplification: While the Australian employment tax regulations are very complex and broad in nature, particularly with superannuation and payroll tax, we make it simple for the Client to meet obligations. A&M is fluent in tax law across Australia and up to date on judicial cases that can impact regulations.

Analytic technology: Sophisticated data analytics solutions are used to review large data sets, including payroll information, to identify potential misstatements that can give rise to underpayments and that carry significant reputational risk.

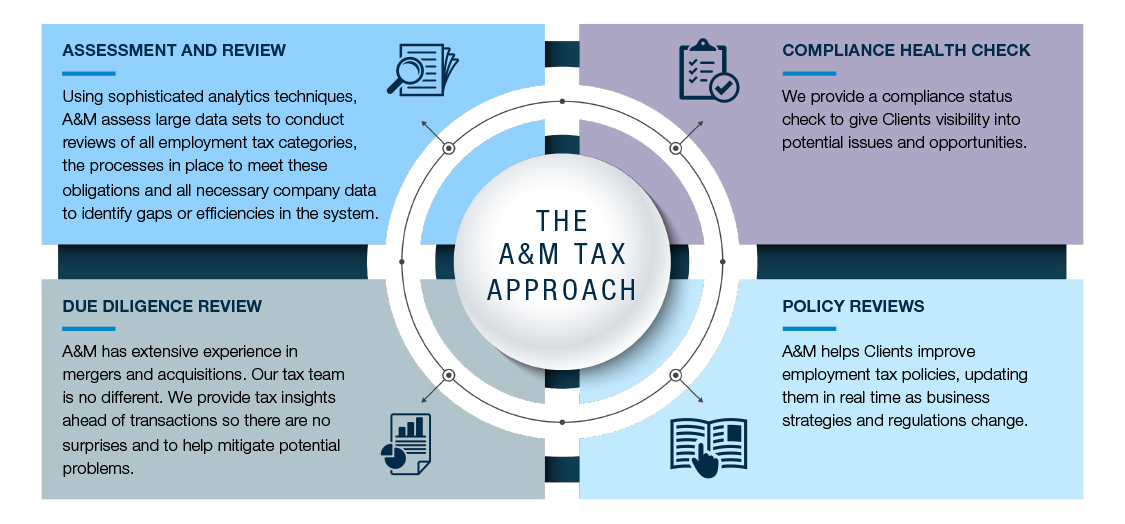

THE A&M TAX APPROACH

THE A&M DIFFERENCE

BESPOKE SERVICES

A&M provides employment tax solutions tailored to the organisation and its needs, ranging from a hands-on, partnership approach to a light touch health check of employment tax compliance.

REPUTATIONAL MANAGEMENT

Identifying and mitigating employment tax gaps, particularly regarding superannuation shortfalls, prior to investigation by the ATO is an important step to prevent loss of goodwill from noncompliance.

COMPLIANCE CONFIDENCE

In addition to helping prevent employment tax noncompliance, A&M offers health checks of the overall employment tax system to give Clients assurance they are meeting their obligations.

PROACTIVE PLANNING

Given the complexity and conflicting legislation covering workers in Australia, A&M works with Clients to ensure workers are engaged under appropriate and fit for purpose arrangements. A&M set up processes to maximise worker relations and minimise compliance burdens.