TAX RISK GOVERNANCE AND MANAGEMENT

A&M’s Tax Risk Governance and Management Services team provides independent Tax Risk Management & Governance support. The team offers a senior-led approach to designing, implementing and testing tax risk management frameworks that are fit for purpose, practical and that align with the Australian Taxation Office’s (ATO’s) Tax Risk Management and Governance Review Guide and GST Governance Data Testing and Transaction Testing Guide.

WHY OUR CLIENTS CHOOSE US

Senior-led team

A&M’s engagements are all directly led by senior team members with cutting-edge thought leadership and technology. Through their hands-on approach, they provide value to clients and deliver a personal approach.

Expertise and relationships

Our team offers a deep and broad knowledge of the Australian tax landscape through years of experience in corporate tax advisory. Members of our team also have operational experience with the ATO and provide fit-for-purpose advice and guidance.

Independence

A&M is not an audit firm, so our Tax Risk Governance and Management team is truly independent. This also gives us the freedom to move nimbly.

Holistic solution

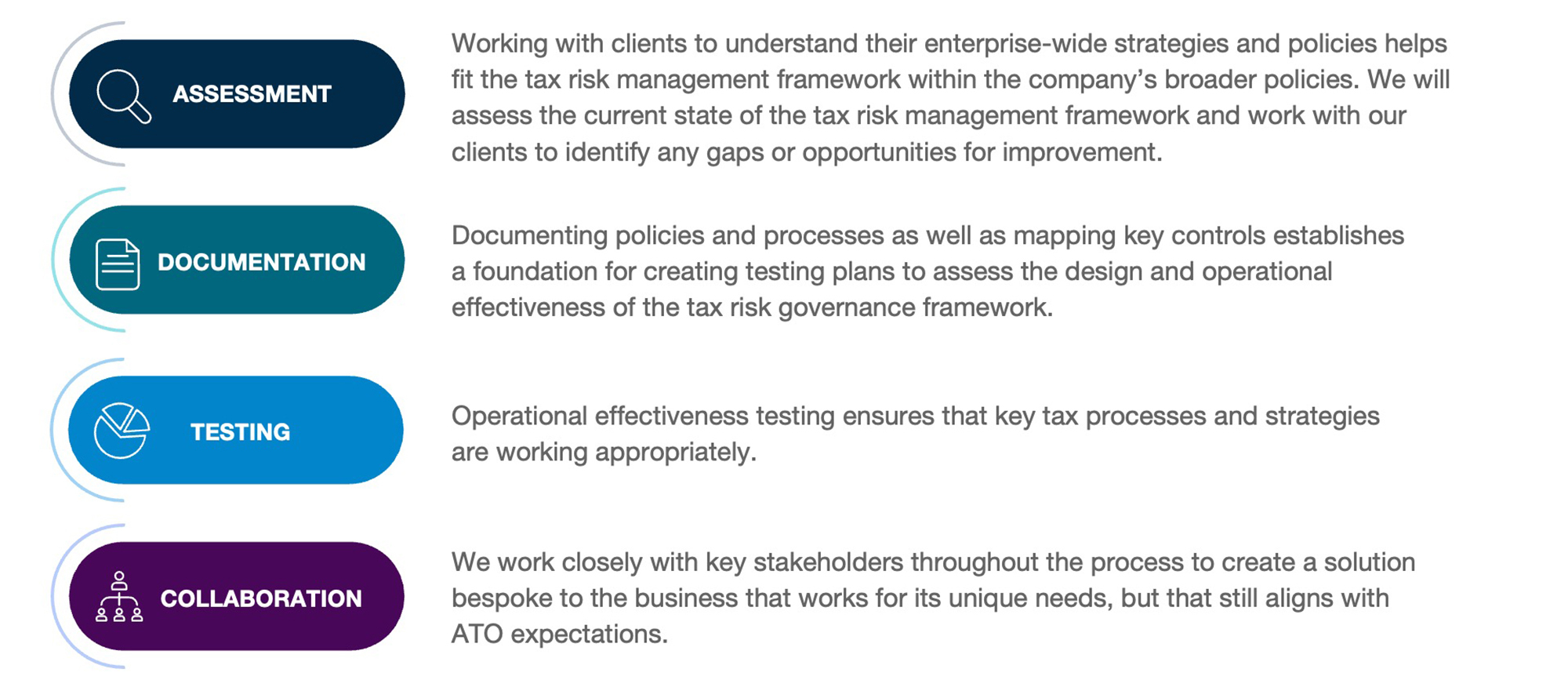

We provide an end-to-end service, from documenting and designing effective tax policies to operationalizing frameworks and testing operational controls. We also work closely with our corporate tax teams to ensure that we have an understanding of the big picture for our clients.

Focus on transactions

Due to our expertise in post-transaction integration at A&M, we specialize in creating and designing processes and policies for post-transaction situations.

THE A&M DIFFERENCE

ENSURE COMPLIANCE

Compliance with ATO governance guidelines leads to a lighter regulatory touch in the future and reduces the risk of future audits and reviews.

STREAMLINE PROCESSES & REDUCE COSTS

A robust tax governance framework presents an underlying benefit to companies as it ensures efficient processes, which, in turn, can reduce compliance costs, saving companies money.

IMPROVE REPUTATION

Improved tax governance can lead to increased transparency, both of which fall under environmental, social and governance goals and can improve reputations with shareholders and communities locally and globally.