Navigating New Horizons – How Hong Kong's Inward Re-Domiciliation Regime Affects the Indirect Transfer Under China Tax Rules

Inward Re-Domiciliation Regime in Hong Kong

The Legislative Council passed the Companies (Amendment) (No. 2) Bill 2024 (the Bill), along with various proposed amendments (referred to as Committee Stage Amendments or “CSAs”),[1] on May 14, 2025. This legislation implements the inward company re-domiciliation regime (the Regime), marking a significant step in attracting more foreign companies and investment to Hong Kong. This initiative is part of Hong Kong’s broader strategy to enhance its status as a premier business hub. By providing a streamlined and cost-effective re-domiciliation process, the Regime allows foreign companies to shift or establish their operations in Hong Kong while maintaining their legal identity and business continuity.

The Regime enables non-Hong Kong incorporated companies to transfer their domicile to Hong Kong and become "re-domiciled companies.” This process is open to both private and public companies limited by shares, as well as private and public unlimited companies with share capital. Importantly, there is no economic substance requirement, meaning that companies of any size or those without an operating business can also apply to re-domicile to Hong Kong. However, the Regime does not permit outward re-domiciliation; that is, companies cannot relocate their domicile from Hong Kong to another jurisdiction. For detailed insights about the Regime, please refer to our publication dated February 18, 2025 [Inward company re-domiciliation regime in Hong Kong].[2]

Amendments have been made to the original Bill, and the government has responded to submissions received on various occasions. Key amendments include, but are not limited to, a specified timeline for submitting a legal opinion that confirms the satisfaction of various eligibility criteria, as well as clarification of the 75 percent threshold concerning members’ consent requirements. The government has also provided clarifications regarding the application for a Hong Kong Certificate of Resident by a re-domiciled company and the unilateral tax credits available for such companies, which are very welcome.

The Bill was gazetted on May 23, 2025, and the Regime will take effect from this date.

How the Regime Affects the Indirect Transfer Under China Tax Rules

Despite the fact that traditional offshore financial centers, such as Jersey, Guernsey and the British Virgin Islands (BVI), are actively implementing the OECD’s Pillar Two initiative in response to the increasing global demand for tax transparency,[3],[4] many large multinational companies are still considering re-domiciling their offshore companies (for example, those in the BVI) to other jurisdictions like Hong Kong, Singapore and the United Kingdom to align with global tax standards and benefit from more stable and business-friendly environments.

When assessing the feasibility and potential impact of the re-domiciliation to Hong Kong, it is crucial to consider whether it may trigger any China tax liabilities due to China’s indirect transfer rules.

Indirect Transfer Rules in China

According to China’s indirect transfer rules (i.e., State Taxation Administration Announcement [2015] No.7, referred as “Announcement 7”), [5] where a nonresident enterprise indirectly transfers equity interests in a China resident enterprise or other taxable assets (collectively referred to as “China taxable assets”) through an arrangement that lacks reasonable business purposes and is primarily intended to avoid corporate income tax (CIT) obligations, the China tax authorities may recharacterize the transaction as a direct transfer of China taxable assets. In such case, the tax authorities are empowered to impose 10 percent CIT on the capital gains attributable to the transferor arising from the transfer of the China taxable assets.

Therefore, when a non-China tax resident enterprise intends to redomicile to Hong Kong pursuant to the Regime, it should carefully assess whether it indirectly holds any China taxable assets and whether such re-domiciliation could potentially be regarded as an indirect transfer of the China taxable assets. If so, it should further assess the risk of such re-domiciliation being recharacterized as a direct transfer and subject to 10 percent CIT.

Given the lack of clear and comprehensive guidance under the prevailing China tax laws and regulations on this matter, a detailed tax analysis as well as proactive communications with the authorities are critical. The case study below is referenced to illustrate potential implications under Announcement 7. For the avoidance of doubt, the comments regarding the “continuity” of the BVI/Hong Kong company are provided solely for illustrative purposes and do not constitute legal advice. Companies are advised to obtain formal legal opinions on this matter.

For nonresident enterprises that directly hold China taxable assets and are considering re-domiciliation to Hong Kong, the following analysis may also be relevant in assessing the potential China tax implications.

Example

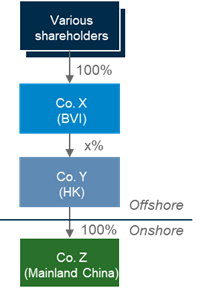

Background – A multinational company holds its China subsidiary (which is not land-rich) [6] through a Hong Kong company, which in turn is owned by a BVI company. The shareholding structure is illustrated in the diagram below. In light of the OECD’s Pillar Two initiative, the multinational company is evaluating the re-domiciliation of Co. X to Hong Kong.

Analysis – The most important factor to consider is whether the re-domiciliation leads to a change in the indirect shareholder of China taxable assets. Essentially, the issue is whether a re-domiciled company should be regarded as a continuation of the same legal entity, with the only change being its jurisdiction of incorporation — from the BVI to Hong Kong. The legal framework in the BVI affirms the continuity of a BVI company’s existence before and after the re-domiciliation. Similarly in Hong Kong, it is also well established that the re-domiciliation of a foreign company does not result in the creation of a new legal entity and does not affect its property, rights, obligations or liabilities; that is, there is no legal transfer of any underlying property (including equity interests and assets), rights, obligations or liabilities as a result of the re-domiciliation to Hong Kong. On this basis, there is an argument that such a re-domiciliation should not be treated as a “transfer (including re-organization)” and therefore should not trigger any tax consequences under Announcement 7.

However, other factors may also need to be considered, for example, whether the jurisdictions involved have Double Taxation Arrangements/Agreements (DTA) with Mainland China, and whether the articles of these DTAs provide the same tax treatment, etc. Most important of all, there should be no intention to avoid CIT obligations. In this captioned case, for example, if Co. X transfers the shares of Co. Y and the transfer is recharacterized as a direct transfer of Co. Z under Announcement 7 (due to a lack of reasonable business purpose), the tax implications are as follows:

- Before Co. X re-domiciles to Hong Kong, it would be required to pay 10 percent CIT in China on its capital gains since there is no DTA between the BVI and Mainland China;

- After Co. X re-domiciles to Hong Kong and becomes a Hong Kong tax resident, if Co. X indirectly holds less than 25 percent of the equity interests of Co. Z, and assuming it is a non-land-rich entity, the capital gains article of the DTA between Hong Kong and Mainland China would limit Mainland China's right to impose CIT on such (deemed) direct equity transfer of Co. Z if Co. Y is looked through. Accordingly, a subsequent indirect equity transfer of Co. Z after Co. X is re-domiciled to Hong Kong could potentially fall under the safe harbor provisions of Announcement 7 (and thus not taxable in China). Therefore, the PRC tax authorities could argue that the re-domiciliation of Co. X to Hong Kong is conducted for the primary purpose to avoid taxation in Mainland China upon a future equity transfer of Co. Z.

The possible different China tax treatments before and after the re-domiciliation of Co. X could adversely affect the assessment of the re-domiciliation intention, potentially driving the China tax authorities to adopt a more conservative approach in assessing whether such a re-domiciliation will be regarded as a direct transfer of China taxable assets.

Takeaway – It is equally important to consider how the jurisdictions from/to which the company is re-domiciling view the continuity of the entity. Additionally, re-domiciling to Hong Kong is not particularly complex, but it does require further assessment, especially when re-domiciling from those jurisdictions that do not have a DTA with Mainland China and/or when the articles of the DTA are different from those in the DTA between Hong Kong and Mainland China.

Actions

As noted, there is currently no explicit guidance in China regarding the treatment of overseas re-domiciliation. Therefore, it is recommended to engage with the local tax authorities to clarify their view regarding the taxability of a re-domiciliation of the direct or indirect shareholder that holds the China taxable assets. Ideally, this could begin with informal communication at an early stage. Where appropriate and feasible, companies may also consider applying for an advance tax ruling from the tax authorities, which is currently feasible under the pilot programs implemented in several cities, including Beijing, Shanghai, Shenzhen, etc. Note that the advance tax ruling is currently not available on a nationwide basis yet.

Taking Shanghai and Beijing as examples, while the scope of advance rulings has not been explicitly defined, the local tax authority has clarified that the following types of matters are not eligible:[7],[8]

- Matters without a clear project plan or that are unlikely to occur within two years

- Matters lacking a reasonable business purpose or that are clearly prohibited by national laws or regulations

- Matters that are already clearly addressed by existing tax laws and regulations

- Matters that are substantially similar to transactions completed by the applicant in previous years, where those transactions are still under discussion with the tax authorities and no final tax treatment has been concluded

Given the lack of guidance under prevailing China tax laws and regulations regarding the re-domiciliation of a foreign entity that owns China taxable assets (directly or indirectly), provided that the re-domiciliation does not fall under the other types noted above, the matter discussed in this article could be eligible for an advance ruling application. However, it is important to note that local rules may vary, and each case should be assessed based on its specific circumstances. Even if a formal advance ruling cannot be obtained, it is still advisable to engage in prior communication with the tax authorities to seek informal guidance so as to reduce as much uncertainty as possible.

How A&M Can Help

As the Regime reshapes the landscape for cross-border structuring, it is crucial to proactively manage the potential tax risks arising from a deemed indirect transfer of China taxable assets. Our team is here to help you navigate this evolving environment with confidence.

- We can help you evaluate the likelihood of a transaction being re-characterised by the China tax authorities as a direct transfer of equity interests in China-based entities. Leveraging our global network of tax and legal professionals, we can provide tailored insights and practical solutions to mitigate exposure.

- We can assist you with informal communications with the competent tax authorities to gain their preliminary views and perspectives, helping you assess whether it would be appropriate or worthwhile to pursue the matter further.

- Where appropriate, we can assist in preparing and submitting advance ruling applications to gain clarity and certainty from the relevant tax authorities, helping you make informed decisions with reduced risk of tax exposures and penalties.

- In the event of a challenge or inquiry by the China tax authorities, we can act as your trusted tax representative in communicating with the China tax authorities. Our experienced team can support you in resolving disputes efficiently and effectively, safeguarding your interests throughout the process.

Please reach out to the authors mentioned above if you have any questions or would like to discuss any aspects of the Regime.

[1] Companies (Amendment) (No. 2) Bill 2024, May 14, 2025, https://www.legco.gov.hk/yr2025/english/counmtg/papers/CB(2)724_2025(01)_e.pdf

[2] James Badenach et al., “Inward company re-domiciliation regime in Hong Kong,” Alvarez & Marsal, February 18, 2025, https://www.alvarezandmarsal.com/insights/inward-company-re-domiciliation-regime-hong-kong

[3] Pillar two developments tracker, OECD Pillars, https://oecdpillars.com/pillar-tab/pillar-two-implementation/

[4] “BVI Releases 2025 Budget,” Wolters Kluwer, November 22, 2024, https://www.vitallaw.com/news/bvi-releases-2025-budget/gdn01168740?refURL=https%3A%2F%2Fwww.google.com.hk%2F#.

[5] Announcement 7, State Taxation Administration Announcement [2015] No. 7, February 3, 2015, https://shanghai.chinatax.gov.cn/zcfw/zcfgk/ssxd/201502/t412657.html

[6] According to the DTA between Hong Kong and Mainland China, a non-land-rich entity is defined as a Chinese entity that, at any time during the three years preceding the disposal, directly or indirectly derives 50 percent or less of its share value from Chinese immovable properties.

[7] “Announcement of the Beijing Municipal Tax Service of the State Taxation Administration on Issuing the Measures for Advanced Tax Rulings of Beijing Municipal Tax Services (Trial),” State Taxation Administration, May 8, 2024, http://beijing.chinatax.gov.cn/bjswj/c104695/202405/cd66b5ebf28f45ff993c49e0e5b55052.shtml

[8] “Announcement of the Shanghai Municipal Tax Service of the State Taxation Administration on Issuing the Management Measures for Advance Tax Rulings of the Shanghai Municipal Tax Service,” December 29, 2023, https://shanghai.chinatax.gov.cn/zcfw/zcfgk/zhsszc/202312/t469904.html