February 11, 2026

Swiss Alert | Adjustment of Swiss Federal Tax Administration’s Practice on Securities Transfer Tax and Employee Participation Plans

The Swiss Federal Tax Administration has aligned its practice with the Federal Supreme Court decision issued in November 2024 in the face of controversy.

Background

Swiss securities transfer tax applies on the transfer of taxable securities against a consideration, where either a contracting party or an intermediary qualifies as a Swiss securities dealer within the meaning of the Swiss Stamp Duty Act. In the employee participation plan context, Swiss securities transfer tax becomes relevant when shares are transferred to employees against consideration - either directly or through intermediaries.

The Federal Supreme Court has issued a decision in November 2024 clarifying that the transfer of employee shares against no consideration does not trigger securities transfer tax (i.e. if shares are issued to an employee for free). This decision directly affects the circumstances under which securities transfer tax is levied and has led to an amendment of the administrative practice by the Swiss Federal Tax Administration (“SFTA”).

The adjustment of the SFTA’s practice published on 5 February 2026 regarding the securities transfer tax treatment of employee share plans provides welcome legal certainty for stakeholders. The SFTA notes that (i) the referenced Federal Supreme Court decision has prompted adjustments to its current practice and (ii) in this context, the SFTA also provides further clarification on additional aspects of its practice regarding the Swiss securities transfer tax in connection with employee participation plans. Specifically, the SFTA outlines and clarifies its position on consideration and taxability from a Swiss securities transfer tax perspective.

Adjustment of SFTA’s practice

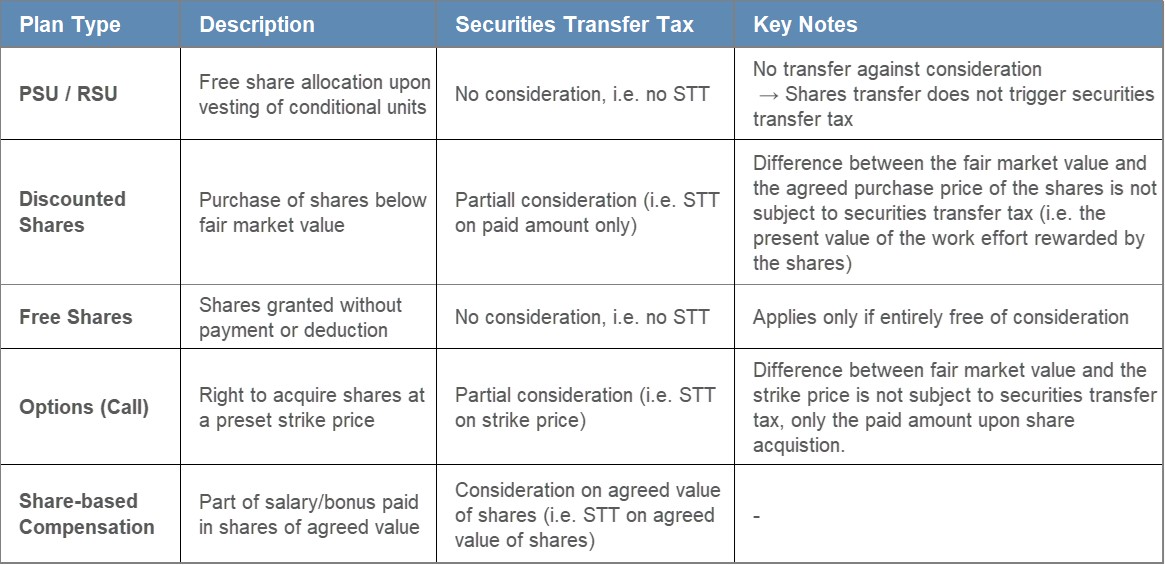

The clarifications, which relate to the acquisition of shares within each respective category, cover the following types of employee share plan transactions:

Our Opinion

The SFTA’s adjustment of its practice is now aligned with the practice with the Federal Supreme Court decision from 25 November 2024 (9C_168/2023 and 9C_176/2023), a decision that had been met with notable criticism in academic literature.

A key point of criticism was the Federal Supreme Court’s position that an employee’s work performance could not be attributed a fair market value (and hence the shares received for work could essentially not be valued). This view appeared problematic to large parts of the doctrine, given that an employment contract is a synallagmatic relationship in which both performances (i.e. work and remuneration in the form of shares) are expected to correspond in value. In other words, the economic value of the employee’s work should equal the value of the shares granted. This valuation topic is also a routine discussion for income tax purposes, where work-arounds have been designed and benefits from share allocations are routinely valued, also when underlying shares are not listed. Nevertheless, the Federal Supreme Court put forward coherent and conceptually sound arguments by analysing the stamp duty system – which includes the securities transfer tax – through a teleological lens. The Federal Supreme Court particularly emphasised that stamp duties are designed to tax specific legal transactions, not the securities themselves. Through this lens, the Federal Supreme Court’s arguments can be seen as once again highlighting the formalistic (rather than economic) character of stamp duties.

Moreover, the Federal Supreme Court supplemented its reasoning with a constitutional analysis, referencing the notion of documents concerning commercial transactions. Under this framework, stamp duty applies only to acts that form part of commercial or profit‑oriented economic activity. By contrast, the allocation of shares as a component of employee remuneration clearly does not constitute a commercial transaction, nor does it represent a market‑driven exchange of securities, in the narrowest sense of those terms.

From our perspective, the Federal Supreme Court’s reasoning – and the SFTA’s decision to align its practice accordingly – is both consistent and commendable. Historically, Swiss stamp duty has been conceived as a formalistic legal‑transaction tax, rather than a tax grounded in economic substance. The revised administrative practice therefore restores conceptual clarity, resolves longstanding ambiguity, and establishes a more predictable legal framework. For companies operating employee participation schemes, this development brings significant certainty and generally positive news.