Navigating tariffs – Rethink your Operational strategy in ASEAN

In a world where tariffs are rising, trade agreements are shifting, and supply chains are being reconfigured, businesses must act now to navigate an increasingly uncertain global trade landscape. Will your company be left behind as trade barriers change the game?"

For years, companies have optimized their supply chains to minimize costs, relying heavily on lower manufacturing costs in Asia. But today, the tide has shifted given the rapidly evolving tariffs policies, including the trade war with China, tariff hikes under the Trump administration, and ongoing efforts to address trade imbalances and national security concerns. The growing uncertainty around tariffs has fragmented global trade, creating rising costs and regulatory challenges.

The recent announcement of new reciprocal tariffs has amplified this challenge, having a significant impact on ASEAN exports:

- 10% baseline tariff on all imports: This affects a wide range of products from ASEAN countries, including electronics, textiles, and machinery

- Country-specific tariffs: Countries like Vietnam, Malaysia, Thailand, and Indonesia now face custom reciprocal tariff ranging from 20 – 50 percent.

- 25% tariff on all foreign made automobile: Countries such as Thailand and Malaysia, which export automobiles, will be directly impacted by this new tariff.

This shift presents both challenges and opportunities for ASEAN. As countries like Vietnam, Malaysia, and Thailand face higher tariffs on key U.S. exports, they are starting to feel the strain. ASEAN’s role as a crucial part of global supply chains—particularly for electronics and textiles—has been threatened, with the new tariffs making products from the region less competitive. Additionally, the trade rerouting that was once seen as a boon during the U.S.-China trade conflict, may now face new limitations as ASEAN countries face tariffs on goods traditionally manufactured in China.

Despite pressures from higher tariffs, ASEAN countries still offer relatively lower operational costs compared to other regions. Local government incentives, such as tax breaks and subsidies, continue to make the region an attractive destination for foreign investment. Moreover, the Regional Comprehensive Economic Partnership (RCEP), strengthens trade relationships within the region, promoting smoother regional trade. This combination of lower operational costs, favourable government incentives, and a robust regional trade agreement kept ASEAN a strategic location for companies looking to optimize their supply chains.

Businesses must now adapt to the evolving trade environment to fully capitalize on the region’s potential for growth in a rapidly changing global market.

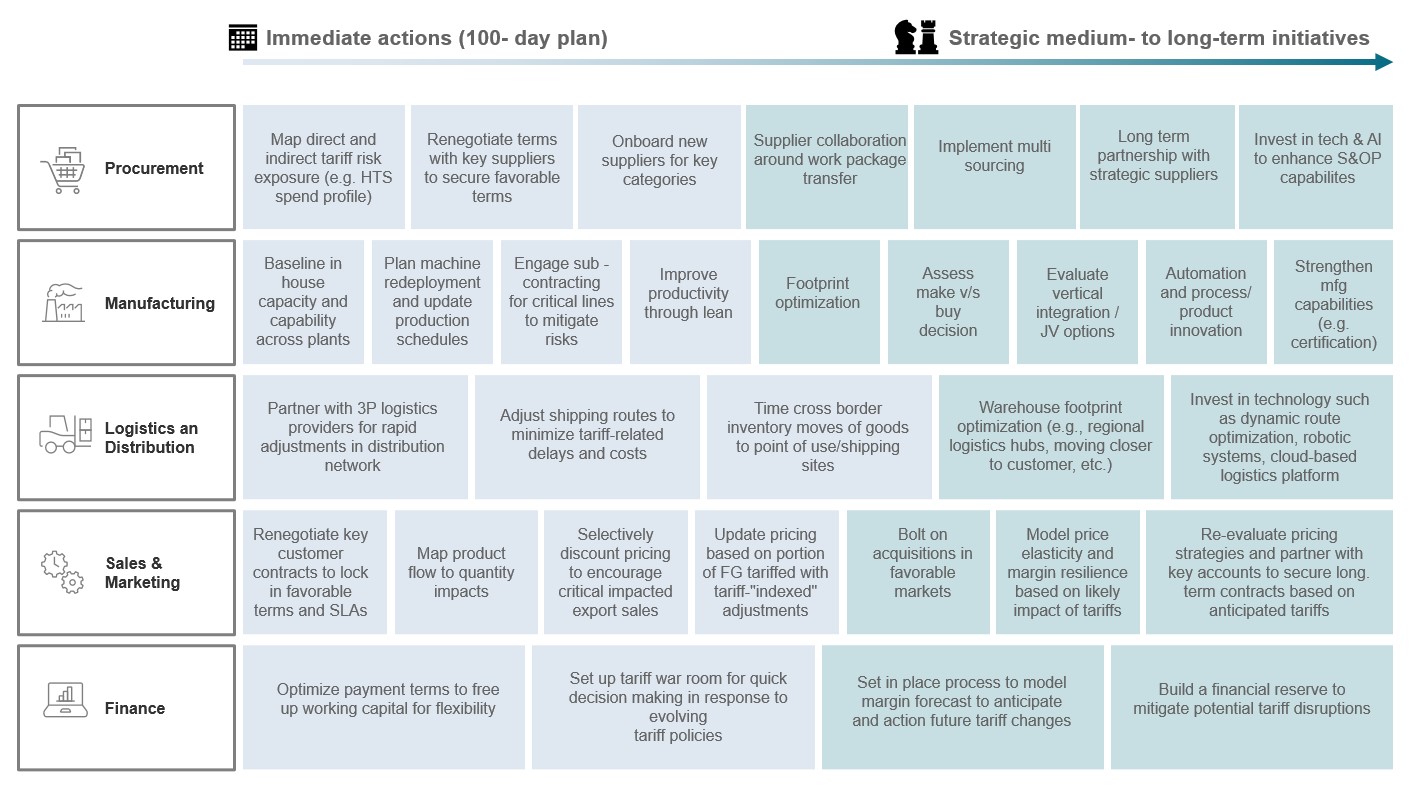

Strategic adaptation, not just reaction, is crucial in today’s shifting trade landscape

Building agility into supply chains and manufacturing operations is crucial for businesses to thrive in this new era of tariffs and trade uncertainty. To navigate into the world of unknown, companies must take immediate actions and consider longer term strategic initiatives such as realignment of the entire supply chain if the tariff sticks. For example, in the backend electronics manufacturing sector, Malaysia’s lower tariffs, competitive ecosystem, and well-developed infrastructure could present a more attractive value proposition than Vietnam, which faces higher tariff rates.

A&M Tariff Response and Mitigation Playbook

Succeeding in the Age of New Trade

Trade disruptions are the new normal, not just a passing obstacle. Companies that embrace resilience, adaptability, and foresight will not only survive, but also revolutionize their respective industries. Those who can quickly change course, transform obstacles into opportunities, and create supply chains that are as dynamic as the markets they serve will be the ones of the future.

In this era of uncertainty, one thing remains certain: adaptability isn’t just an advantage—it’s the foundation for long-term success.