How a Lake of Data Can Power Your Strategic Tax Centre

Overview: Data as a Foundation

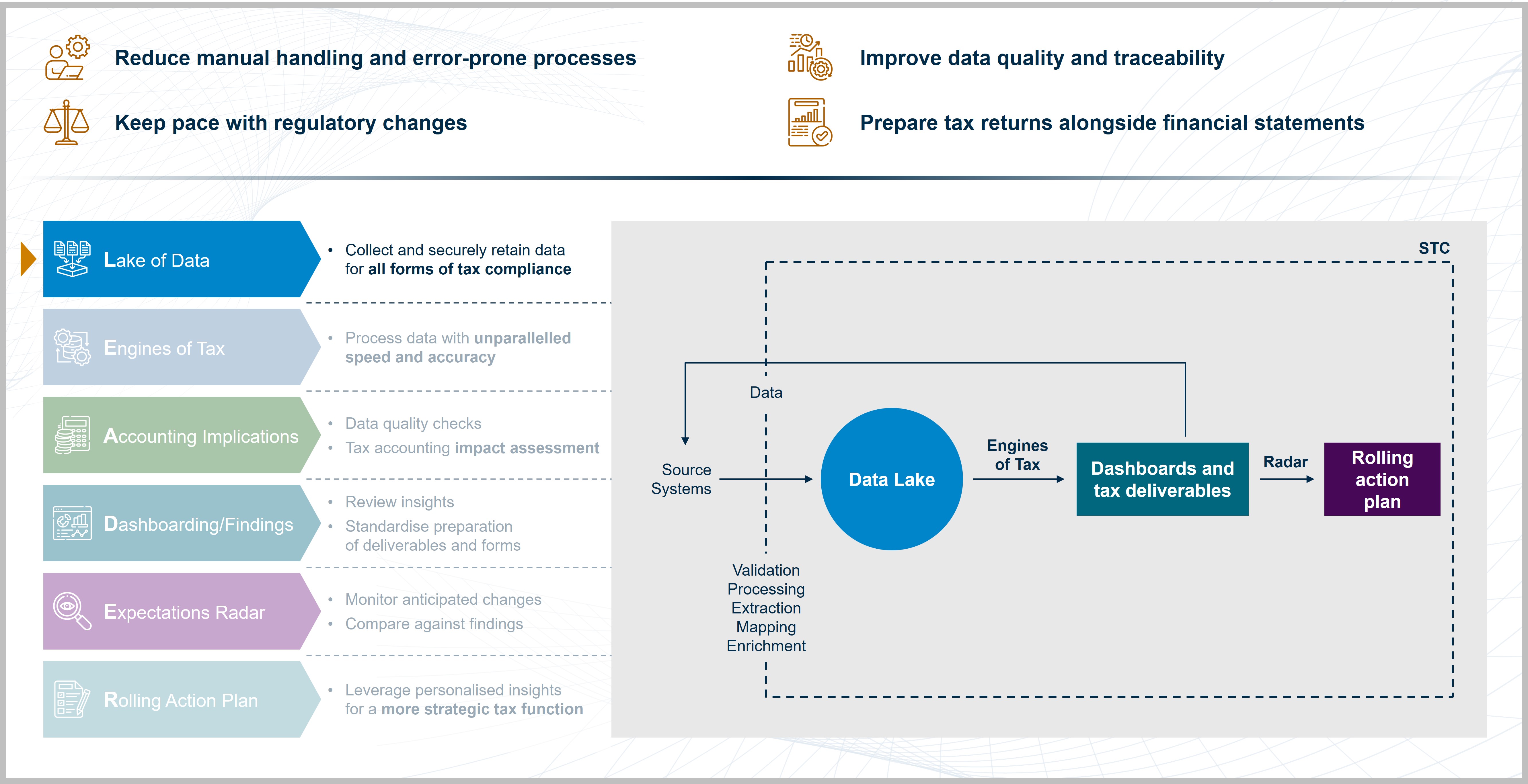

The LEADER framework, as introduced in Beyond Compliance: How the Strategic Tax Centre Is Redefining Tax Management, begins with L – Lake of Data as its foundational pillar. Building this robust data infrastructure is essential for any organisation in their tax transformation journey, helping to turn their tax function into a strategic asset.

The Modern Tax Function

Organisations’ tax and finance functions have evolved significantly in recent years. Gone are the days of hand calculations and rows of filing cabinets—tax and finance teams now have access to near-instantaneous calculations and vast amounts of digital data. This digital revolution is ongoing, with new technologies and advancements in AI continuing to emerge almost faster than organisations can keep up.

Issues and Challenges Facing Tax Functions Today

Despite these advancements, many modern tax functions still face a significant challenge: fragmented and inconsistent data ecosystems that undermine decision-making and efficiency. Many in-house tax teams report spending between 30% and 40% of their time simply extracting data from systems and manually ensuring it is in the required format—time that could be better spent on strategy and analysis. Reliance on siloed systems including ERP ledgers, local tax software, and spreadsheets, all held together by manual entries, invariably leads to:

- Records that are incomplete, erroneous or inconsistent.

- Additional manual effort spent on data cleansing and error remediation.

- Limited potential for automation and adoption of advanced tools due to poor data quality.

In many organisations, these challenges compound and further entrench data issues, leading to purely reactive decision-making and increasing the risk of non-compliance.

Unlocking Opportunities with Data

By cultivating a lake of clean, structured, and high-quality data, organisations stand to:

- Improve data linkage and interoperability between systems.

- Introduce efficiencies and reduce manual effort through automation.

- Empower tax and finance functions to adopt sophisticated, data-driven tools.

- Significantly reduce audit risks.

- Free up tax and finance teams to focus on key issues and strategic decisions.

How A&M is Helping

A&M collaborates with proactive organisations to develop and refine their strategies for tax technology adoption and enablement. Areas of support include:

- Identifying error-prone segments of current tax compliance processes.

- Assessing and improving data quality for tax provisions and compliance.

- Strengthening data infrastructure to support the adoption of AI tools.

Regardless of where you are in your tax transformation journey, A&M has the expertise to help you leverage your data as a strategic asset.

In the next instalment of this series, we will explore how Engines of Tax can leverage clean, structured data to automate compliance processes and drive strategic insights.

A&M's Strategic Tax Centre