Code of Practice 9 – What Is It and Is It Right for You?

Please contact Alvarez & Marsal’s Tax Risk and Dispute Management Team for an immediate, confidential conversation at +44 161 518 1089.

Introduction

Code of Practice 9 (COP9) is the process through which serious and suspected deliberate tax irregularities (tax fraud) are investigated by HMRC via civil means, as an alternative to criminal investigation. Taxpayers being investigated under COP9 are offered the opportunity to enter into the underlying Contractual Disclosure Facility (CDF). Taxpayers can also request CDF as a means of making a voluntary disclosure, where it is accepted that underpaid tax exists, due to deliberate conduct.

Given the nature of COP9 investigations, it is imperative that taxpayers take specialist advice to determine if this is the best route for their disclosure and navigate the investigation from the outset. Alvarez & Marsal’s Tax Risk & Dispute Management team have extensive experience in supporting clients through a COP9 investigation.

‘Tax Fraud’ and ‘Deliberate Behaviour’

Tax fraud refers to any dishonest, deliberate behaviour in respect to an individual’s liability to pay tax, duties or levies.

The term ‘deliberate behaviour’ refers to where a person:

- Submitted documents to HMRC containing information that they knew was incorrect.

- Failed to inform HMRC at the right time about information that they knew was relevant to a liability to tax, or duty.

- Made a claim for a payment from HMRC to which they knew they were not entitled.

What are the Benefits of COP9?

Tax fraud, by its very nature, is a criminal offence and where a taxpayer knowingly/deliberately underpays taxes they can be criminally prosecuted. A key benefit of using the COP9 process is that it ultimately creates a ‘contract’ between the taxpayer in question and HMRC, whereby HMRC agrees to pursue matters civilly without the risk of criminal prosecution, on the basis that the taxpayer makes a complete, accurate, open and honest disclosure of all tax irregularities during the investigation.

How Does the COP9 Process Work?

The CDF can only be entered into by individuals. Where COP9 is to be used to investigate tax fraud occurring within a company, the CDF will be offered to the Director(s) and will cover both their personal affairs and those of the business.

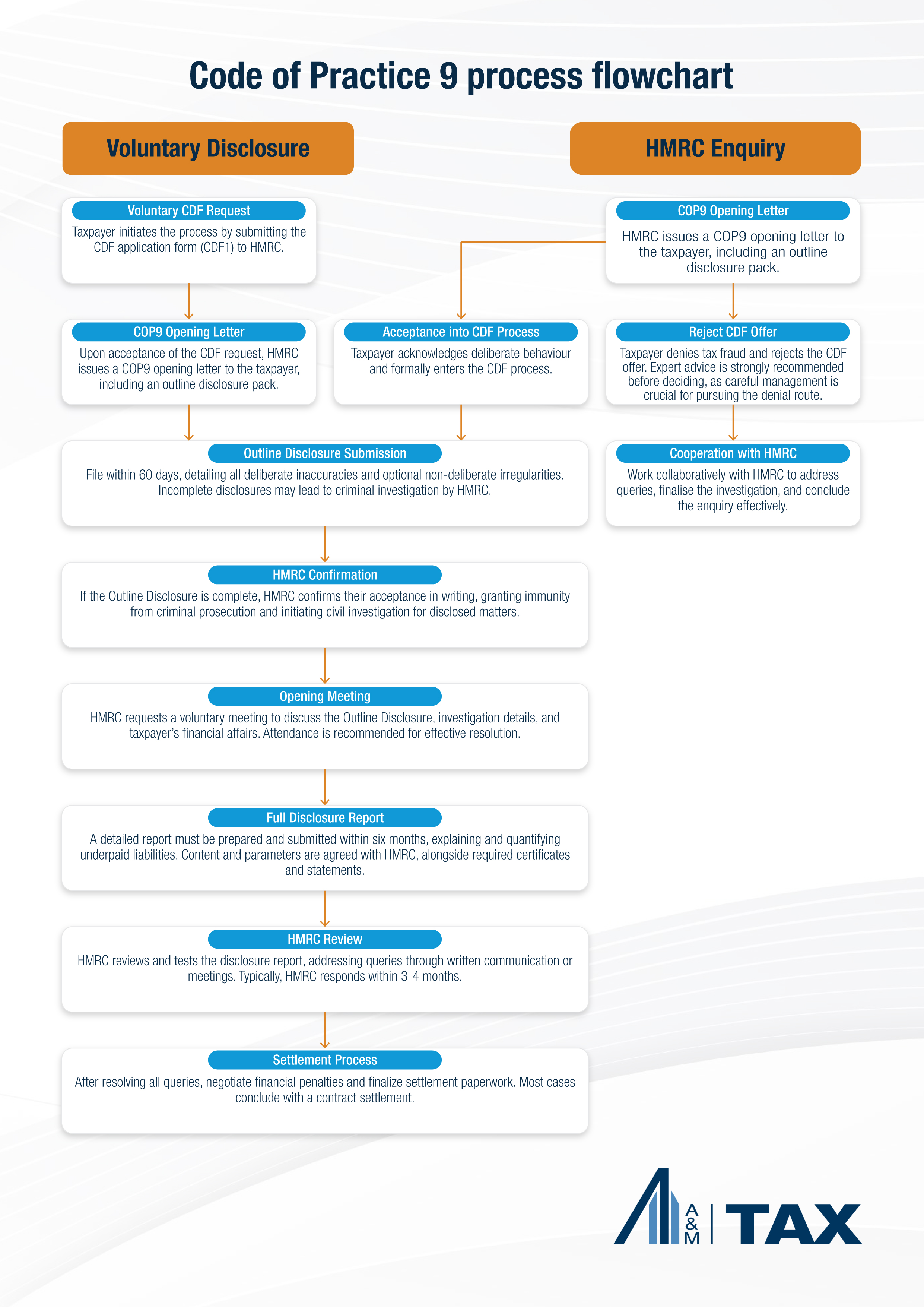

A COP9 investigation follows a structured pathway which is set out below.

What Should you do if you Have Received a COP9 Letter?

If you have received a COP9 letter from HMRC, or you need to make a disclosure involving tax fraud, it is essential to seek expert advice as soon as possible.

At A&M we can help you determine the best course of action for your specific circumstances and fact pattern. We will help guide you through the process. We regularly work alongside our clients’ existing advisors to ensure that they benefit from our extensive experience in managing Code of Practice 9 enquiries, whilst maintaining these relationships.