A year in review: 2025

This edition of the Automotive Industry Spotlight will focus on key industry themes from 2025.

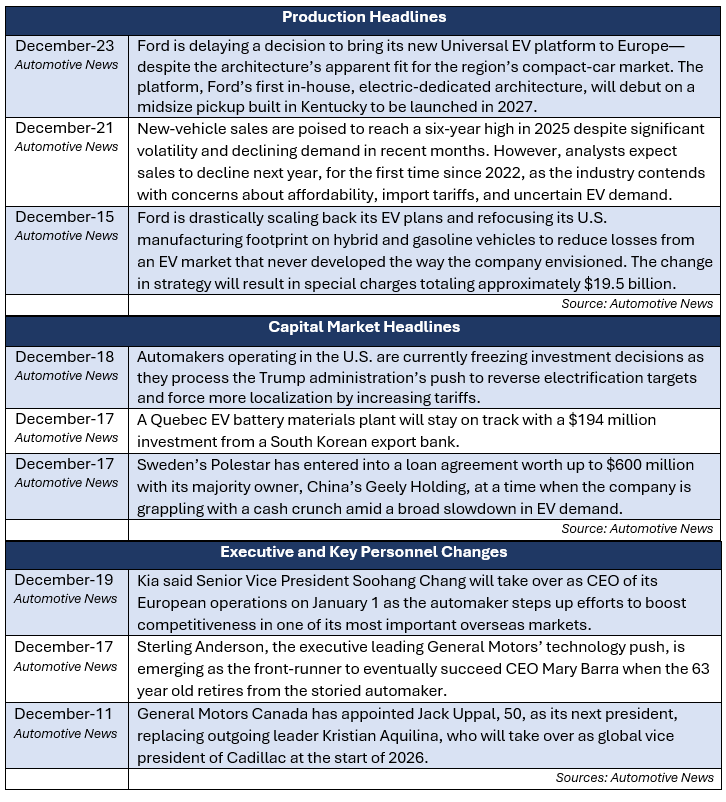

In industry news, Ford announced it is scaling back its electric vehicle (EV) manufacturing, a shift in strategy that will come with $19.5 billion in charges. Polestar has entered into a $600 million loan agreement amid softened EV demand and a liquidity crunch. Sterling Anderson, the executive leading General Motors’ technology push, is emerging as the front-runner to eventually succeed Mary Barra as CEO once Barra is set to retire from the automaker.

In regulatory news, the National Highway Traffic Safety Administration (NHTSA) projects the continued use of stop-start technology, an emissions-reduction tool that has been a target of the Trump administration’s Environmental Protection Agency (EPA). Tesla’s car sales in California are poised to be suspended for 30 days due to alleged misleading marketing to consumers. Mercedes-Benz has reached a $150 million settlement with 48 states to resolve the long-running investigation into allegations of diesel emissions cheating.

Industry Focus: 2025 in Review

2025 was a year of uncertainty, continuous change, and strategic realignment. EV strategies continued to be dynamic in light of low volumes, policy risk reentered the conversation as tariff impacts materialized, and rapid advancements in artificial intelligence (AI) laid the groundwork for future capabilities.

EVs, Hybrids, and the Manufacturing Reset

In 2025, the industry moved from EV ambition to manufacturing pragmatism. EV production remained challenging. Battery costs stayed volatile, margins were pressured by price competition, and large-scale profitability remained elusive. As a result, original equipment manufacturers (OEMs) slowed production ramps, stretched timelines, and reassessed capital allocation to EV programs.

At the same time, hybrids emerged as a critical stabilizer. Demand remained strong and gave OEMs flexibility. With their lower battery intensity, familiar powertrain architecture, and more predictable production economics, adding hybrid capacity mid-cycle introduced complexity and cost, but it reduced exposure to EV-specific risks and helped maintain plant utilization. Hybrids continue to appear as the necessary transition product during the industry’s longer-term phasing of EVs.

Tariffs Reenter the Strategic Risk Conversation

Proposed and existing tariffs on steel, aluminum, batteries, and certain imported vehicles continued to influence cost structures across the industry. For OEMs with global supply chains, even modest tariff changes had outsized effects on sourcing decisions, supplier negotiations, and plant economics. Components that cross borders multiple times before final assembly became particularly exposed.

Beyond direct cost impact, uncertainty proved just as influential. The possibility of expanded tariffs on vehicles or parts from Mexico, China, or Europe forced manufacturers to reassess long-term assumptions before policies were finalized. In many cases, this slowed capital deployment or pushed companies toward more regionalized, higher-cost supply chains.

Looking ahead, the U.S. Supreme Court is expected to weigh in during early 2026 on the legality of certain tariffs implemented under the Trump administration, a decision that could either reverse or uphold current tariffs and possibly open the door for additional tariffs in 2026. [1]

AI’s Expanding Capabilities

While manufacturing and policy dominated headlines, 2025 also marked notable advancements in broader AI capabilities, furthering opportunities for use cases across the automotive industry. Outside of vehicle systems, much of the early adoption of AI in the industry occurred in retail. From dealership tools that improved lead management and pricing decisions to platforms that helped buyers narrow down choices more efficiently. However, the broader implication goes beyond the point of sale. AI adoption expanded across inventory planning, demand forecasting, marketing, and customer engagement, even if the impact was incremental rather than transformative. Over the next few years, AI’s role is likely to deepen, improving how vehicles are matched to buyers, how inventory is positioned geographically, and how manufacturers and dealers respond to real-time market signals.

Conclusion

Looking back, the defining theme of 2025 wasn’t necessarily disruption, it was adjustment. Manufacturers recalibrated EV strategies while hybrids absorbed volatility, tariffs reintroduced policy risk into long-term planning, and AI quietly laid the groundwork for long-term change in capabilities.

Sources

[1]. AutoNews: Major tariff decisions loom for automakers in 2026. Here’s what to expect

Additional insights are included below.

Industry Update

November inventory levels ended at 2.78 million units, a 123,000-unit increase from October. Days’ supply closed at 52, approximately 25% above the five-year average. The month-over-month increase in absolute inventory levels was evident across all major OEM groups.

Regulatory Landscape

Stop Start Technology: The NHTSA’s proposed rule for loosening fuel economy standards projects the continued use of stop-start technology, an emissions-reduction tool that has been a target of the Trump administration’s EPA. If the current plan moves forward as proposed, 30.7% of vehicles from the 2031 model year would have 12-volt stop-start non-hybrid technology. Stop-start features are present in 38.7% of vehicles from the 2026 model year. [1]

Tesla Sales Suspension: Tesla’s car sales in California are poised to be suspended for 30 days over marketing practices that allegedly mislead consumers about the automated driving capabilities of its vehicles. The California Department of Motor Vehicles accused the company of exaggerating the abilities of features marketed as autopilot and full self-driving and had asked an administrative judge to weigh whether a suspension was warranted. On December 16, the agency announced that the suspension wouldn’t take effect for 90 days to give Tesla time to appeal or come into compliance. [2]

Mercedes Diesel Settlement: Mercedes-Benz has reached a $149.6 million settlement with 48 states to resolve a long-running investigation into allegations of diesel emissions cheating by the German automaker, New York Attorney General Letitia James said on December 22. According to the automaker, the deal effectively ends its legal issues in the United States over the emissions scandal that was first uncovered at Volkswagen in September 2015. [3]

Regulatory News Source

[1]. Automotive News: EPA has trashed stop-start technology. The NHTSA CAFE changes assume it will stick around

[2]. Automotive News: Tesla’s sales in California face suspension over Autopilot marketing

[3]. Automotive News: Mercedes agrees to $150 million settlement with states over diesel scandal

Stay connected to industry financial indicators and check back in February for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive