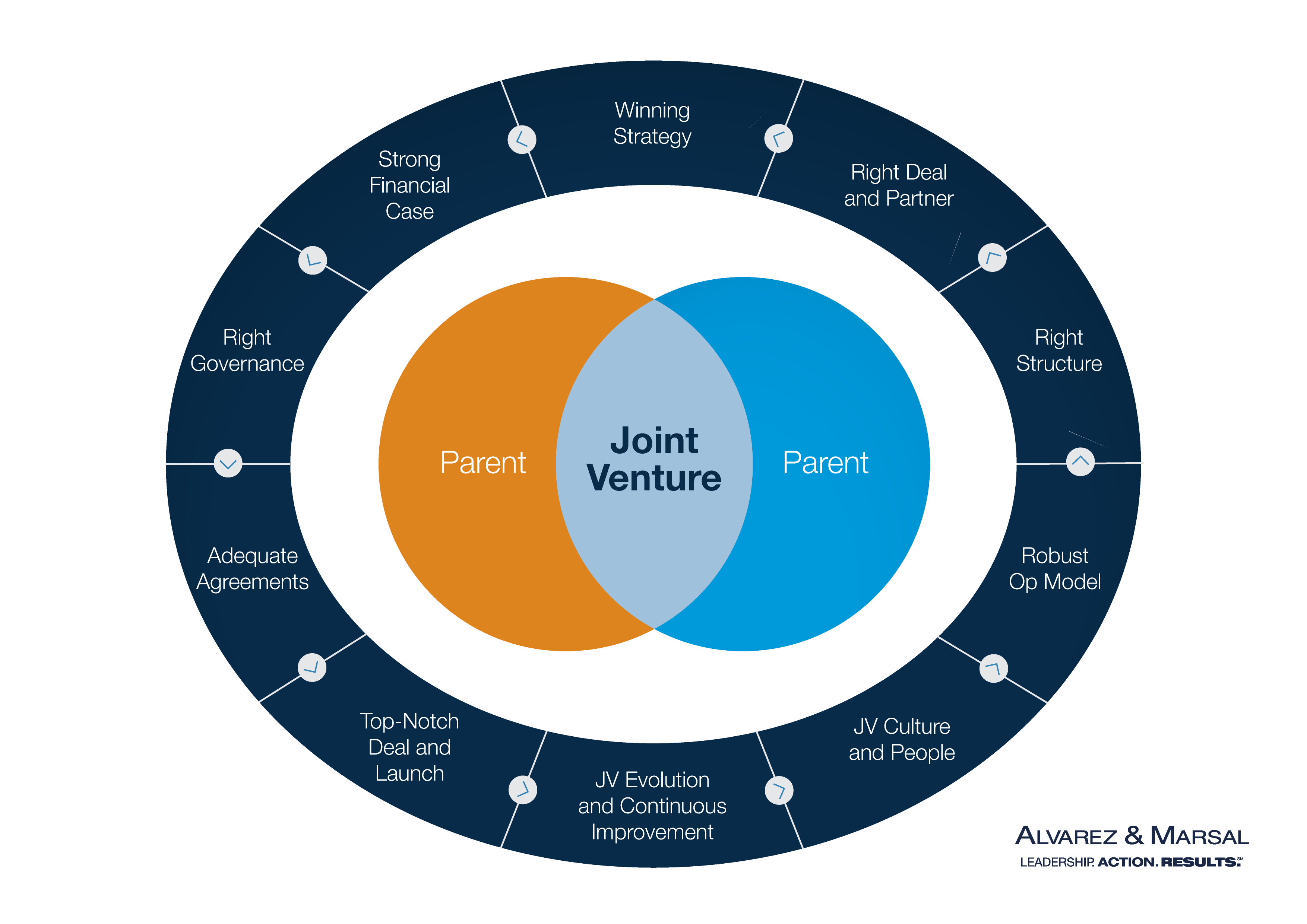

10 Ways to Defy the Odds of Joint Ventures’ Failure

Sobering statistics indicate that success in joint ventures is elusive: Failure rate hovers around or over 50 percent,[1] and standing up a joint venture (JV) is a complex, ambitious endeavor that requires strategic alignment, meticulous planning and strong governance.

While M&A deals typically entail an economic premium to reap synergies (usually ~20–30 percent of the seller’s market value), successful JVs require a “complexity premium,” i.e., a significant upfront investment to structure the JV, test-drive the collaboration between JV partners, and effectively launch the venture. Creativity and strategic foresight are key to unlock JV benefits, ranging from rapid access to new markets, capabilities and scale while sharing financial and operational risks. Here are some best practices that can lead to successful joint ventures, based on insights from our experience and case studies.

Winning Strategy

The foundation of a successful JV is the trifecta of well-defined strategies for both the JV parents and the JV itself. This is harder said than done as it implies alignment of strategic goals across the partners and a consistent JV strategy as well.

While, in general, a winning strategy addresses key questions such as the target market segments, go-to market strategies, and competitive and industry dynamics, JVs are created for different objectives: to achieve manufacturing scale, enter otherwise inaccessible geographies (where governments mandate local partnerships), or cross-pollinate industries or ecosystems to create new offerings (e.g., auto and tech companies creating EVs and self-driving cars). Regardless, no successful JV stems from flawed or misaligned strategies.

The Right Deal and Partner Fit

The JV partner should be sought and selected only after corporate strategies are shaped and the JV option is thoroughly vetted against other pathways (i.e., organic growth, M&A, and simpler supply, distribution, marketing and licensing agreements). Once the JV emerges as the best formula and an initial set of potential partners are identified, a thorough due diligence should be conducted on partners’ financial stability, breadth and complementarity of strategic capabilities, cultural fit (i.e., risk tolerance, desired level of control), as well as on the specific assets contributed to the JV (tangible or intangible).

JV partners should not only align on high level objectives and guiding principles for the JV, but also truly challenge the business plan and its assumptions before signing the deal.

Strong Financial Case

The deal model needs to be informed by the asset’s financials, future JV’s strategy and scenarios of potential evolution of JV scope. Total JV economics include not only projections of JV P&L and related value distributions but also other parent-JV flows that indirectly contribute to value creation (e.g., new terms and flows with trading partners resulting from the JV, TSAs for services provided to the JV, and cost and revenue synergies). Depending on the type of JV deal and partner contributions, carve-out financials may be required. Both partners should thoroughly review and challenge the deal model and underlying assumptions, and ensure that expected returns exceed the WACC.

Right Structure

Critical structure decisions relate to partners’ contributions into the JV (tangible or intangible assets, capabilities or capital), ownership (50/50 vs. minority JV, depending on the value of contributions), and voting rights (which can be aligned with or asymmetrical to percent of ownership). Deal structuring has far-reaching downstream implications that must be carefully ascertained, for example, on decision-making rights and JV’s level of independence from its parents.

Right Governance and Decision-Making

Effective governance involves defining clear responsibilities for the JV parents (shareholders), JV board and JV management team, as well as mechanisms for conflict resolution. For example, JV parents typically drive foundational decisions such as approval of JV agreements and future amendments, new ownership, JV dissolution, and issuance of debt or securities, while the JV board oversees business decisions on annual or long-term plans and budgets, appointment of CEO, contracts with affiliated parties, etc. Finally, JV management defines the JV organizational structure, institutionalizes policies, and drives strategy execution and day-to-day operations.

Adequate Contractual Framework

JV agreements (JVAs) establish accountability for parents and create legal guardrails that formalize the desired governance and decision rights. These help in reducing the "governance tax" on management and address potential gridlocks.

For example, while 50:50 JVs are the most frequent JV structure, they are often plagued by decision gridlock, which escalation provisions included in JV agreements may not be enough to overcome. Creative contractual solutions such as de-linking ownership from voting interests, arbitration or mediation, sole risk provisions and indemnification clauses can provide flexibility and ensure JV continuity even when partners reach an impasse. Noncontractual solutions may also be applied, for example, the creation and enforcement of JV guiding principles, appointment of independent directors, creation of BOD advisory committees, and a higher degree of delegation to JV management.

Lastly, while JVAs formalize the basic requirements for governance, no contractual framework can substitute for the partners’ cultural fit and ability to collaborate toward the JV goals and overcome misalignments.

Robust Operating Model

The JV's operating model is essential to day one JV operations as well as its continuous evolution over time. The op model determines which capabilities (people, processes, technologies) the JV needs to stand up, which ones will be transferred by the parents (e.g., formally conveyed to the JV), and where the JV will rely on support or services provided by its parents (for example via TSAs or longer team agreements). The right operating model is key to unlocking the unique value proposition of the JV, i.e., its ability to produce at a lower cost, reach new markets, create synergistic portfolio offerings, leverage alternative distribution channels, etc.

JV deals are often more complex to design and achieve since they simultaneously encompass elements of divestures as well as mergers and, therefore, require the ability to separate (e.g., production plants, entire country operations, GTM capabilities, specific brands, etc.) while simultaneously integrate (e.g., achieve cost or revenue synergies while combining key capabilities from parents).

The degree of reliance on parents’ services needs to be planned carefully since it impacts the JV’s independence as well as parent’s financials; e.g., for unconsolidated 50/50 JVs parents should limit services in order not to de-facto control the JV and trigger consolidation requirements.

Top-Notch Deal and Launch Teams

JV formation requires a strong deal team and PMO, collaborative and iterative planning, and cross-functional and functional coordination and execution.

However, while JVs have a high degree of complexity, often companies don’t have dedicated professionals or expertise in JV formation and launch. In fact, corporate development teams (when they exist) are typically dedicated to defining and executing M&A deals, while JVs are sometimes left to business units to design and execute.

In addition, JV deals are sometimes prematurely handed over from deal teams to separate execution teams prior to day one (typically after MOU signing), resulting in loss of information and value creep.

Engaging external advisors with extensive JV experience may help avoid pitfalls during formation and launch.

People, Organization and Culture

Building a cohesive culture and organization is vital for a JV's success. This includes defining the rules for parent secondees, creating compensation and incentive plans, and establishing a compelling employee value proposition. The goal is to attract and retain high-caliber staff while leveraging the JV's ownership structure to offer unique career development opportunities. Cultural workshops can help in blending and reimagining parent cultures to create a nimble and innovative JV environment.

JV Evolution and Continuous Improvement

Finally, successful JVs require continuous improvement and adaptation after launch. This involves regularly reviewing and refining the JV's strategy, operating model and governance structure to respond to changing market conditions and partner dynamics. By fostering a culture of learning and innovation, JVs can maintain their competitive edge and achieve long-term success.

In conclusion, successful joint ventures are built on a foundation of strategic alignment, robust governance and effective management. By following these best practices, companies can navigate the complexities of joint ventures and unlock their full potential.

[1] Seung Ho Park, Michael V. Russo, “When Competition Eclipses Cooperation: An Event History Analysis of Joint Venture Failure,” University of Oregon College of Business Administration, 1996, https://business.uoregon.edu/sites/default/files/media/Park-Russo-Mgmt-Sci-1996.pdf