U.S. Restructuring Tax Services

Preserving a company’s value in periods of financial distress may require debt restructuring through bankruptcy or an out-of-court arrangement. Often, companies pursuing alternative financing structures face significant global tax issues that must be managed to avoid unanticipated cash tax leakage.

Alvarez & Marsal is in the unique position to offer a tax practice dedicated solely to the complexities of the restructuring process. As a team of specialized tax professionals, A&M’s Restructuring Tax Services is prepared to step in as interim tax advisors. We work hand-in-hand with the debtor’s restructuring team to manage complex issues irregular to routine tax providers.

Year-end tax obligations do not end with a restructuring, and tax authorities often increase their efforts to audit a company during this time. Going forward, compliance is still important but corporate tax departments may be unequipped to contend with non-routine tax issues, especially during strategic dispositions, liquidations and post-restructuring transactions. As trusted advisors, A&M is available to guide its clients through post-restructuring tax matters and support a company’s efforts in stabilizing internal tax department functions.

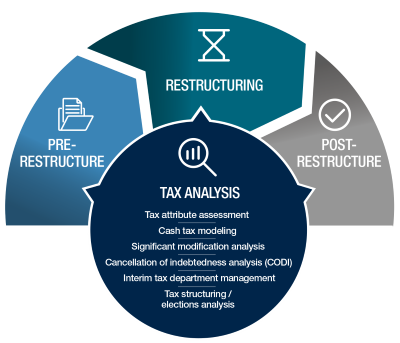

Beyond compliance, a variety of actions can trigger taxable events, inside or outside of court. A&M offers services before, during and after a restructuring to maintain tax attributes of the company and to proactively seek the optimal tax efficiencies required.

What can A&M Restructuring Tax Services offer?

As a dedicated, full-service, pre- to post-restructuring partner, we enable companies to take control of tax issues arising throughout the restructuring process. To create value, we identity risks and efficiencies from strategic sales and transactions; raise opportunities to preserve tax value; and validate and negotiate tax claims to reduce costs to the organization.

Our experienced restructuring and bankruptcy tax professionals work with debtors, creditors, creditor committees, hearing examiners, potential acquirers, investors and sellers on behalf of distressed companies, in bankruptcy and out-of-court.

|

Learn more about Restructuring tax planning strategies

What are the benefits of A&M’s Restructuring Tax Services?

With years of experience helping companies navigate the restructuring process, we have a unique ability to spot areas to improve tax structures, efficiencies and reduce risks during an uncertain time in an organization’s lifecycle. When companies engage our experienced professionals, they also benefit from:

- Straightforward business communication: It is our job to tackle the technicalities, and it is management’s role to make critical business decisions. That is why our professionals are committed to translating highly technical tax analyses into direct, easy-to-understand messaging that eliminates friction in management’s decision-making process.

- Execution: Deeply ingrained in the history of A&M as a restructuring firm is a bias towards action. Our team is prepared to execute from Day One and assess the company’s tax posture and potential risks and opportunities.

- Preservation of tax value: Preserving the value of tax attributes or net operating losses (NOLs) may be beneficial in offsetting a company’s post-restructuring tax liability.

- Risk mitigation: In situations where C-suite leadership face risk or personal liability, we work to keep them aware of how tax can play a larger role in the business operations.

- Reducing claims’ costs: Often in bankruptcy cases, state and local governments file claims to recover state income tax or use tax, for example. The team validates the claims to ensure they are not egregious and negotiates an agreed upon amount to be paid.

- Optimizing exit strategies: The team also plans post-restructuring strategies to ensure efficient tax structures in future asset sales or acquisitions.

- Unique expertise: A&M is one of the few consulting firms that has a dedicated tax practice for restructuring services.

Learn More

| More about RTS | Contact Us |