Trust Sandwich Tax Traps: Connectedness Is Tested at Trust Year-End

Overview

In Vefghi Holding Corp. v. Canada, 2025 FCA 143,[1] the Federal Court of Appeal (FCA) reversed the Tax Court of Canada’s (TCC or the Tax Court) 2023 ruling and held that in the context of a trust-designated dividend under subsection 104(19) of the Income Tax Act (Canada) (the Act), the determination of whether the corporate beneficiary is “connected” to the payer corporation for Part IV tax purposes must be made at the end of the trust’s taxation year, not on the date the trust receives the dividend, nor on any other day. The FCA arrived at this decision on the “trust sandwich” issue through a strict reading of subsection 104(19), where it determined that the designation could only be made at the trust’s year-end, and only once the designation is made can the determination of connectedness be undertaken.

This decision is consistent with the Canada Revenue Agency’s (CRA) longstanding administrative position and clarifies the timing for applying subsection 186(4) when trusts are involved in dividend planning involving corporate beneficiaries.

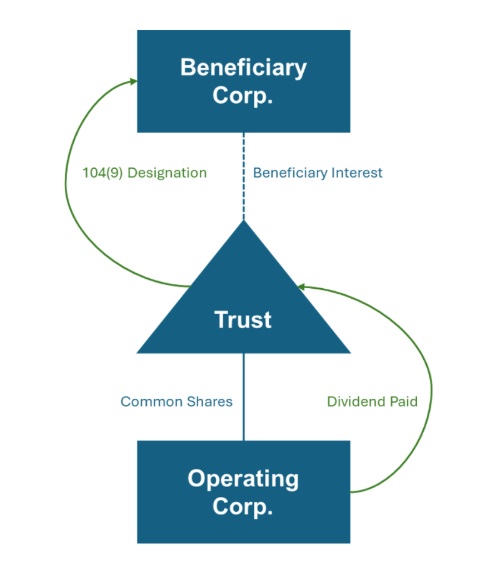

Trust sandwich structures typically utilize subsection 104(19) to flow dividends originating from an operating company, through an inter vivos trust, to a corporate beneficiary of that trust. Typically, such structures maintain a corporate tax deferral on the designated dividend income, and maintain and often multiply access to the lifetime capital gains exemption for individual beneficiaries of the trust.

Simplified Factual Background and TCC Decision

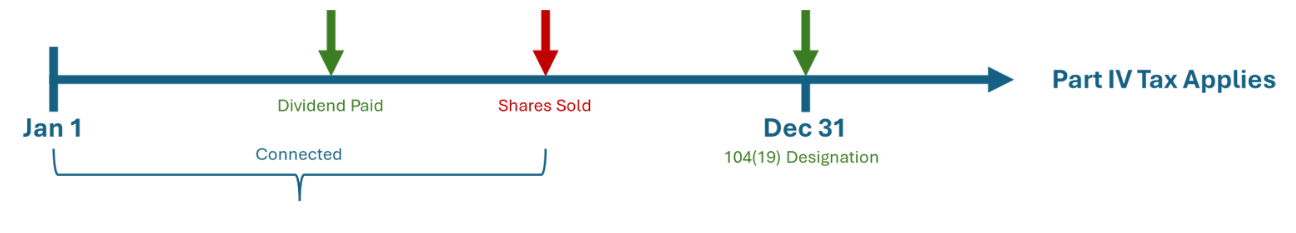

- A discretionary family trust received a dividend from an operating company (Opco) in July 2018.

- The trust designated the dividend to a corporate beneficiary (Holdco) under subsection 104(19).

- Before the end of the same taxation year, Opco was sold, severing the “connected” status between Opco and Holdco.

- CRA assessed Part IV tax on the designated dividend, asserting Holdco was not connected to Opco at the end of the trust’s year (December 31).

- The taxpayer argued that connectedness should be tested on the day the dividend was paid to the trust, on the basis that subsection 104(19) does not specify what point in time that connectedness should be tested. The taxpayer’s view was such that the declaration and payment of a dividend are actions that are closely tied with control or the exercise of significant influence, and as such, connectedness.

- The TCC considered that Part IV tax is levied on dividend received by a taxpayer, and not dividends paid by a payer corporation, and further considered that unless the legal fiction created by the deeming rule specifically results in the dividend being received at a different point in time, then the dividend is received by the corporate beneficiary on the same date as the date it was received by the trust. The TCC determined that connectedness is tested on the actual dividend receipt date, so long as that day falls within the tax year that also includes the trust’s year-end. The decision was appealed by the Crown.

Relevant Statutory Provisions

- Subsection 104(19)

Allows a Canadian-resident trust to “flow through” the character of taxable dividends it received from taxable Canadian corporations to its beneficiaries, by designation. Such dividend is deemed received in the beneficiary’s taxation year that includes the end of the trust’s taxation year. The effect of this provision and the timing fiction that it creates is at the centre of the FCA decision. - Subsection 186(1)

The charging provision for Part IV tax, which applies to taxable dividends received by a corporation unless the dividend payer is connected with the recipient. This provision creates the tax result that is in dispute in the FCA decision. - Subsection 186(4)

A dividend payer is “connected” with the recipient if:- (a) The recipient controls the payer, or

- (b) The recipient owns >10% of the voting shares and value of the payer

This provision is relevant to determining whether a payer and recipient are connected at the time as determined by the FCA, to avoid the application of Part IV tax.

FCA’s Decision

The FCA rejected the Tax Court’s focus on the dividend payment date, holding that:

- Subsection 104(19) creates a timing fiction: The beneficiary is deemed to have received the dividend only in its taxation year that includes the trust’s year-end, not on the same date as the trust.

- Therefore, the question of whether the payer is “connected” to the recipient must be assessed at the trust’s year-end, because only then is the dividend deemed to have been received by the beneficiary via designation.

- The Act does not support testing connectedness on the actual day the trust receives the dividend.

- If the corporate beneficiary held the shares directly, the dividend would be a connected dividend on the payment date and not subject to Part IV tax. However, the structure adopted by the taxpayers (i.e., interposing a trust) cannot be ignored and override subsection 104(19), which deems the dividend to be received once the conditions of this designation have been met, which as legislated cannot be made before the trust’s year-end.

Outcome: CRA’s assessment was upheld, and Part IV tax was applied to the dividend paid in July, because the payer and recipient were not connected on December 31 (the trust’s year-end).

Why This Matters

- Part IV connectedness under a subsection 104(19) designation is to be determined at the end of the trust’s taxation year, potentially causing mismatches in tax and commercial planning when connection changes before then (e.g., via sale or reorganization).

- The decision reinforces the CRA’s historical published views (e.g., 2020 STEP CRA Roundtable Q11[2]) and removes uncertainty stemming from the Tax Court’s 2023 ruling.

- The taxpayers have applied for leave to appeal to the Supreme Court of Canada (filed October 10, 2025). The timing issue may be revisited if the Supreme Court agrees to hear the appeal.

Key Insights

- Timing mismatch risk is real. Dividends paid in during the year may be caught by Part IV if connection is lost after the dividend payment date and before the trust’s year-end (typically December 31).

- Planning tools

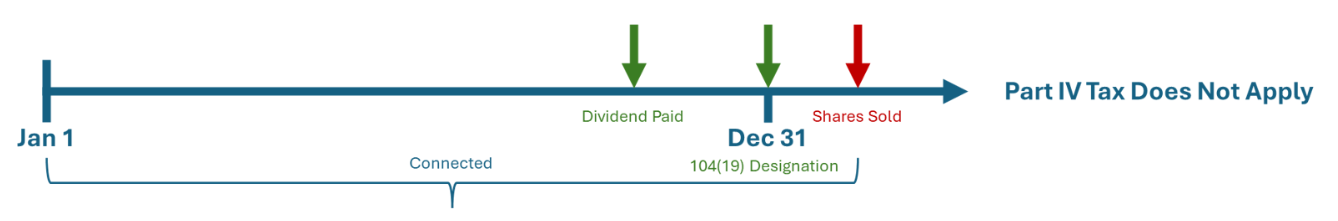

- Pay pre-closing dividend prior to year-end but delay sale until after trust year-end, if commercially viable.

- Preserve connectedness status until year-end (i.e., maintaining control or holding greater than 10% of votes and value in the corporation).

- Avoid making designations under subsection 104(19) where Part IV risk is high and material; consider alternative strategies, including a tax-deferred rollover of trust property (i.e., shares) to a corporate beneficiary under subsection 107(2) and a direct payment of a dividend thereafter.

- Model refundable dividend tax on hand (RDTOH) recovery if Part IV tax is unavoidable—Part IV tax is a prepayment of tax and in most cases can be fully recovered.

[1] “Canada v. Vefghi Holding Corp, 2025 FCA 143,” Tax Interpretations, August 11, 2025.

[2] “2020 STEP CRA Roundtable Q11 - Taxable Dividends from a Trust,” Tax Interpretations, November 26, 2020.