Beyond Compliance: How the Strategic Tax Centre Is Redefining Tax Management

Traditionally, tax compliance has been viewed as a retrospective process necessary to meet filing deadlines and ensure regulatory adherence. While timely compliance remains critical, today’s business environment demands a more agile, data-driven approach. A&M Tax is leading this transformation with its Strategic Tax Centre (STC): a model that elevates tax management to a proactive, insight-driven process enabling CFOs and Tax Managers to understand the impact of change before it hits the P&L.

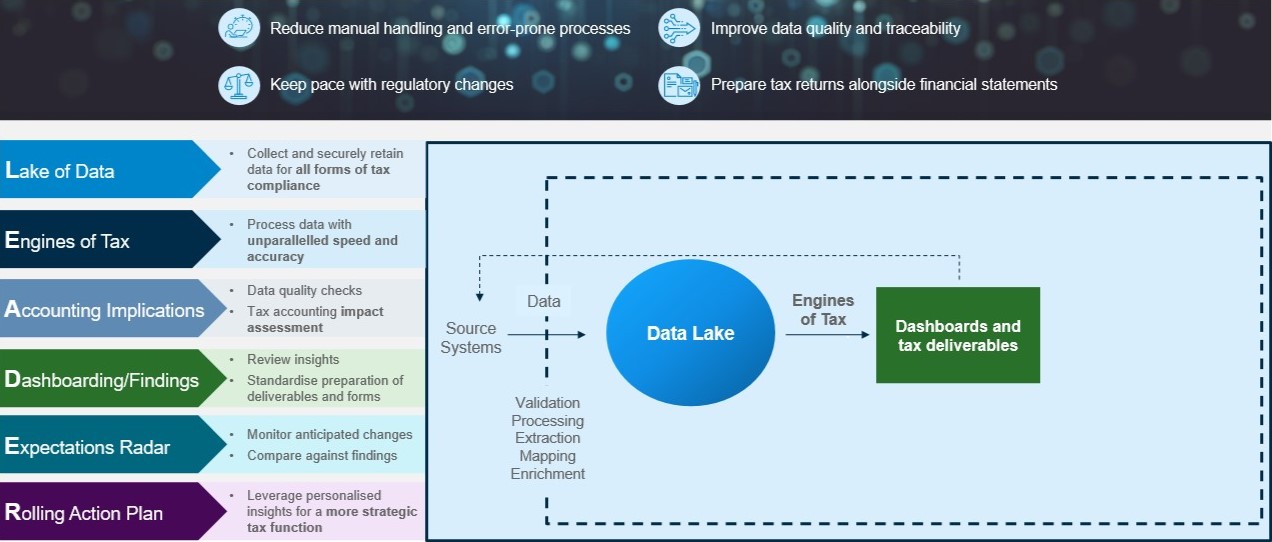

At the heart of this evolution lies A&M’s LEADER framework:

- Lake of Data: Harness clean, structured, and high-quality data as a foundation for smarter tax decisions.

- Engines of Tax: Deploy automated and swift tax engines to manage all tax obligations seamlessly, streamlining processing and reducing manual intervention.

- Accounting Implications: Move beyond compliance with real-time tax accounting, uncovering opportunities for incentives and deductions while flagging risks.

- Dashboarding: Use powerful dashboards to drive insights, provide clarity, and generate actionable findings.

- Expectations Radar: Employ AI-driven tools to predict tax reforms and enable adaptation well in advance of legislative changes.

- Rolling Action Plan: Implement a dynamic and continuous roadmap for agility in an ever-changing regulatory landscape.

By aligning people, processes, and technology, STCs will equip organisations to uncover savings, identify risks, and anticipate future changes—all in real time.

It’s time to shift the narrative. More than a cost centre, the modern tax function must be a strategic enabler. That starts with having the right operating model.

If you’re ready to elevate your tax function and explore what your data could be telling you, please connect with Paul Gallagher to discuss further.