China's Strategic Investment Surge in Brazil: M&A Activity Hits Eight-Year High

Chinese investment in Brazil reached new strategic heights in 2025, with first-half M&A deals totalling $1.7 billion—hitting an eight-year high [1]. Despite challenging global M&A market conditions, Chinese investments in Brazil jumped 64 percent year-over-year, though deal count dropped, signalling a mature shift toward fewer but larger, high-impact acquisitions.

This momentum accelerated following Brazilian President Lula's May 2025 Beijing visit, which secured over $4.5 billion in new Chinese investments [2], including: Envision Group ($1 billion sustainable aviation fuel), CGN Power (~$529 million wind/solar), Great Wall Motors (~$1.05 billion automotive), and Longsys (~$423 million semiconductors).

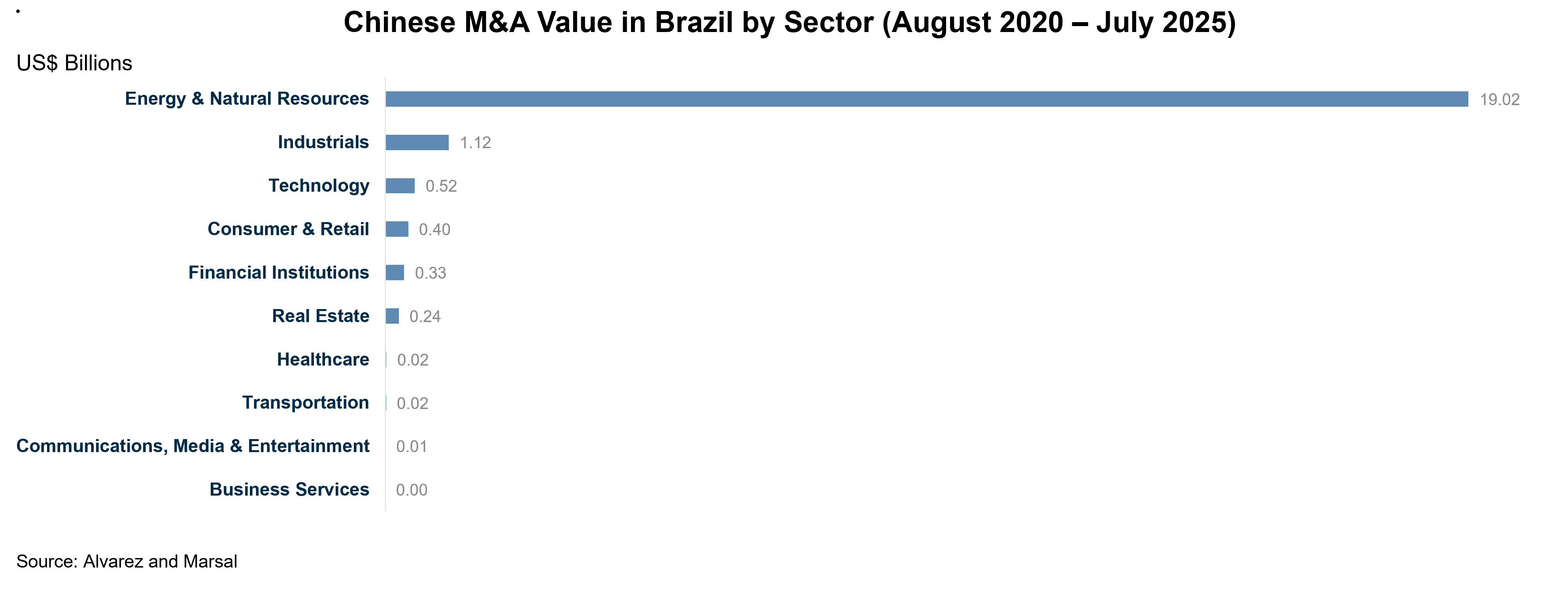

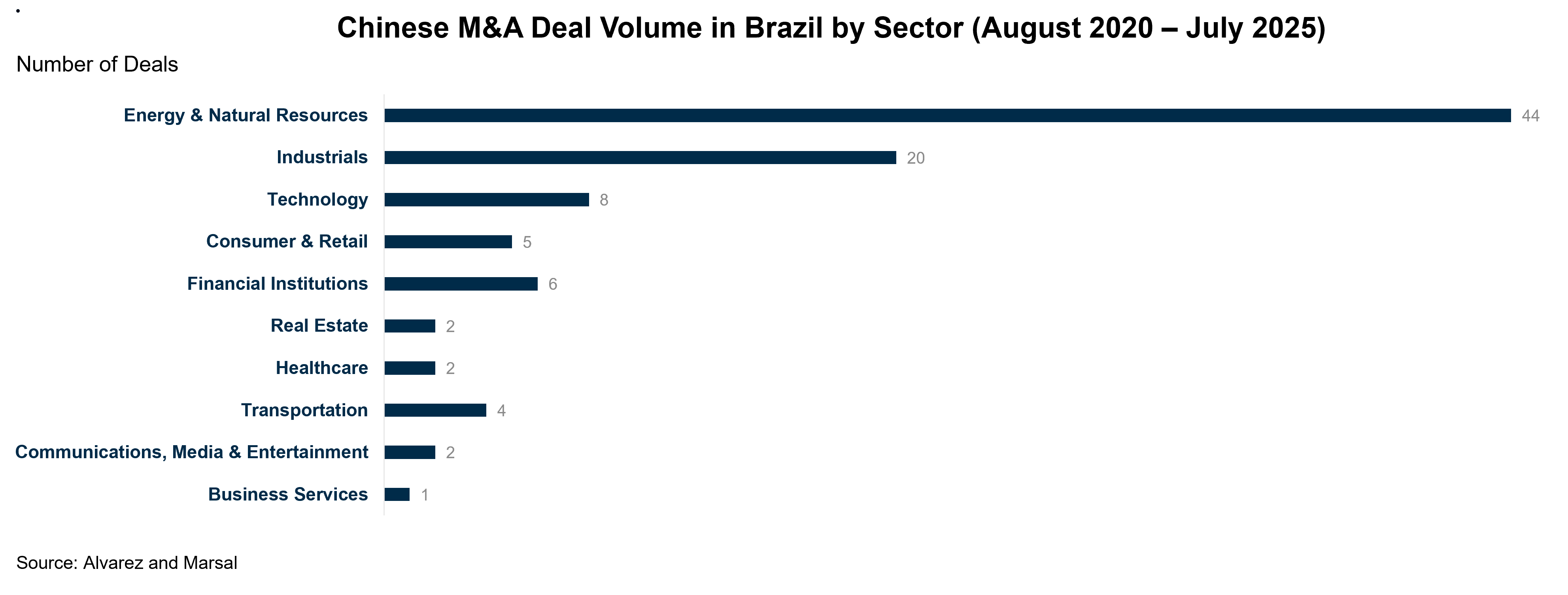

Energy and Critical Minerals Drive Investment Wave

A&M analysis of 94 Chinese investments over the past five years shows Energy and Natural Resources accounting for 85 percent of total announced deal value—over $19 billion.

Chinese companies are spearheading Brazil's renewable transformation: State Power Investment Corp leads major solar projects including the Luiz Gonzaga Complex, China Three Gorges has invested $68 million in hydro projects, and State Grid secured nearly $5 billion for transmission infrastructure. This supports Brazil's standout energy profile—90 percent of electricity from low-carbon sources, far outpacing the 41 percent global average [3].

China's focus on critical minerals, especially lithium, underpins this trend with major deals worth over $2.2 billion since August 2020. Brazil's emerging "Lithium Valley" offers compelling advantages: high-grade spodumene deposits, competitive production costs, and strategic proximity to US and European markets.

Strategic Spotlights

EVs: Chinese cars have become ubiquitous in Brazilian streets, with rapidly increasing market share. Chinese automakers captured 80 percent of Brazil's EV market share in the first half of 2025 [4], with BYD dominating pure electric vehicles at over 75 percent market share [5]. Local manufacturing by BYD and Great Wall Motors, combined with Geely's Renault partnership, further demonstrate strategic localization approaches, while positioning Brazil as Latin America's EV export hub.

Tech Expansion: Chinese technology companies are making strategic advances into Brazil's food delivery service industry. Meituan plans to invest $1 billion over five years to launch Keeta, representing a direct challenge to dominant player iFood [6], while DiDi relaunched operations through 99 Food in 2025 after a previous suspension [7]. These moves signal Chinese tech firms' search for growth overseas amid intense home-market competition.

AI Opportunity: Brazil's AI market is projected to reach $4.42 billion by 2025, and $17.91 billion by 2031 [8]. Brazilian Government support through the R$23 billion National AI Plan and renewable energy mandates for data centers creates opportunities for tech giants like Huawei (cloud service since 2019) and Tencent (São Paulo data center since 2021). Brazil is emerging as a key AI battleground where Chinese expertise offers an advantage, but success requires local partnerships to navigate evolving regulations and seize growth opportunities.

A&M Cross-Border Expertise

Successful China-Brazil investment execution requires deep expertise across regulatory environments, cultural contexts, and operational complexities. A&M brings deep expertise in helping Chinese companies access the Brazilian market and vice-versa, with experienced professionals in both countries.

A&M Strategic Recommendations

For Chinese Companies:

- Deploy real-time BRICS market intelligence—track minerals, renewable incentives, and regulatory shifts.

- Carefully vet local partners—select customs, tax, and compliance experts with China-Brazil credentials to avoid surprises.

- Identify funding partners early—prioritize those with local market coverage and currency capabilities.

- Accelerate your market-entry timeline—fast-track manufacturing to get ahead of rising EV tariffs.

For Brazilian Businesses:

- Integrate beyond raw exports—move up the value chain with processing and battery-pack capabilities.

- Build EV supply-chain readiness—align processes with leading OEM standards.

- Actively leverage digital partnerships—collaborate with Chinese tech leaders for e-commerce, AI, and logistics.

For Investment Professionals:

- Shift focus to deal quality—prioritize fewer, higher-impact transactions.

- Target "Lithium Valley" advantages—rigorously assess asset quality and cost structures.

- Evaluate AI and green energy platforms—capitalize on incentives and Brazil's strong renewables profile.

- Position Brazil as a BRICS hedge—diversify strategies to leverage Brazil's rising influence in EV and critical minerals amid global trade volatility.

Authors

- James Dubow, Co-Head of North Asia & Managing Director

- Fernando Szterling, Managing Director

- Nick Atkinson, Managing Director

- Eunice Tang, Managing Director

Sources

[1]. Mergermarket, "Chinese M&A deal volume in Brazil hits eight-year high for first semester – Dealspeak Latin America," Ion Analytics, accessed August 2025, https://ionanalytics.com/insights/mergermarket/chinese-ma-deal-volume-in-brazil-hits-eight-year-high-for-first-semester-dealspeak-latin-america/

[2]. Reuters, "Brazil's Lula courts trade ties in Beijing as China spars with Trump," May 12, 2025, https://www.reuters.com/world/brazil-seeks-china-trade-boost-amid-trump-tariff-chaos-lula-meets-xi-2025-05-12/

[3]. Ember, "Brazil Country Profile," accessed August 2025, https://ember-energy.org/countries-and-regions/brazil/

[4]. Reuters, "China floods Brazil with cheap EVs, triggering backlash," June 19, 2025, https://www.reuters.com/business/finance/china-floods-brazil-with-cheap-evs-triggering-backlash-2025-06-19/

[5]. Argus Media, "HEVs drive Brazil's 1Q EV sales up as BEVs fall," April 17, 2025, https://www.argusmedia.com/en/news-and-insights/latest-market-news/2679385-hevs-drive-brazil-s-1q-ev-sales-up-as-bevs-fall

[6]. Bloomberg, "Meituan boosts global push with $1 billion Brazil pledge," May 13, 2025. https://www.bloomberg.com/news/articles/2025-05-13/china-s-meituan-to-start-brazil-business-with-1-billion-budget

[7]. China Daily, "Didi relaunches food delivery service in Brazil with 700,000 active riders," April 7, 2025, https://www.chinadaily.com.cn/a/202504/07/WS67f39ec7a3104d9fd381df37.html

[8]. Statista, "Artificial Intelligence - Brazil Market Forecast," March 20, 2025, https://www.statista.com/outlook/tmo/artificial-intelligence/brazil