Decentralized vs. Centralized Procurement in the Nordic Construction Industry

In the Nordic construction industry, procurement isn’t just about acquiring concrete and components—it’s a strategic lever that shapes margins, timelines, quality, and ultimately, value creation. Especially in markets like Denmark, where the cost share of prefabricated materials is high, procurement decisions influence not only project outcomes but also the financial health of the entire organization. When up to 70% of construction costs are tied to external suppliers, procurement becomes a critical driver of profitability, risk mitigation, and long-term competitiveness.

But behind every purchasing decision lies a deeper debate: Should procurement be centralized or decentralized?

While the theoretical advantages of centralized procurement are well-documented—cost savings, consistency, and better governance—many construction companies in the Nordics are built on decentralized DNA. Especially in Denmark, where industry consolidation has stemmed from founder-led, self-organizing firms, project autonomy remains deeply embedded. For Building Directors who are used to managing their own supply networks, centralization isn't just a process shift - it's a cultural disruption and perceived as a threat to their key role in the organization.

The Real Struggle: Transitioning Procurement Responsibility Away from Project Directors

Taking procurement responsibility away from Project or Building Directors is often perceived as undermining their authority and undermining their ability to deliver successful projects. These individuals have historically been entrusted with end-to-end site accountability, including selecting suppliers based on trust, responsiveness, and personal relationships. The move toward centralization can therefore feel like a vote of no confidence in their judgment.

This shift also removes an informal network of decision-making that many directors have spent years cultivating. The risk? Resistance, low morale, or even attrition among key operational leaders.

One real-world example comes from a major contractor that attempted a rapid centralization rollout. Within six months, they saw delays in site mobilization and pushbacks from veteran directors who felt blindsided. Only after re-integrating local input into procurement planning and providing visibility into supplier selection criteria did performance stabilize.

However, another real-world example comes from the Copenhagen Municipality’s public procurement strategy (1), which introduced a centralized, partnership-based model through its "ByK" framework. Danish contractors such as NCC and Enemærke & Petersen were selected as strategic partners to deliver large-scale renovation portfolios over a multi-year period. Initially, there was skepticism from project-level stakeholders who were used to managing procurement autonomously. However, through structured governance, shared KPIs, and early involvement of project teams, the partnership model led to improved timelines, reduced conflicts, and stronger supplier relationships. This model demonstrated that centralization, when paired with local execution autonomy and clear roles, can deliver superior outcomes.

What Can the CEO Do to Overcome This? Hands-On and Proven Tactics:

Communicate “the WHY” early and often: CEOs must consistently articulate why procurement centralization is not about removing control but about unlocking value across the business. Frame it as enabling better outcomes for all, cost-wise, risk-wise and quality-wise.

Co-design with site leaders: Involve respected project directors in the redesign of procurement models. Let them shape category strategies, preferred supplier lists and escalation processes. Co-creation builds buy-in.

Pilot first: Start with pilot projects in specific categories or regions, measuring impact and learning from the experience. Use quick wins and positive testimonials from trusted peers to drive adoption.

Give back strategic control: Rather than stripping procurement authority altogether, redefine roles. Let site leaders remain responsible for contract execution, local adaptations and feedback loops, and let central teams manage negotiations, frameworks and governance.

Show data, build trust: Use spend-transparency tools to show how decentralized purchasing leads to higher variability and missed opportunities. When the numbers speak, resistance often gives way to curiosity.

Recognize and retain influence: Highlight and reward the leadership skills of project directors in forums beyond procurement. Make clear that their experience and judgment remain critical, even in a new operating model.

Create a visual feedback loop: Develop visual tools, including dashboards, category performance reports, supplier scorecards that are accessible to both central procurement and project teams. A shared view of performance metrics builds joint accountability and reduces friction.

Category | Decentralized Procurement | Centralized Procurement |

Flexibility | High flexibility—project teams quickly adapt to local needs. | Lower flexibility—central processes may delay site-level decisions. |

Local Knowledge | Strong—teams understand regional supplier dynamics. | Weaker—central teams risk overlooking local nuances. |

Cost Control | Lower leverage—limited ability to negotiate bulk pricing. | High—unified contracts and scale lead to savings. |

Standardization | Varies by site—practices often inconsistent. | High—standard quality and compliance easier to enforce. |

Governance & Risk | Fragmented control—greater risk of non-compliance or fraud. | Clear accountability—central oversight improves governance. |

Efficiency | Duplicate efforts increase admin overhead. | Streamlined—central tools and planning reduce redundancy. |

Ownership & Culture | High autonomy fosters engagement and innovation. | Risk of resistance—may be seen as disempowering. |

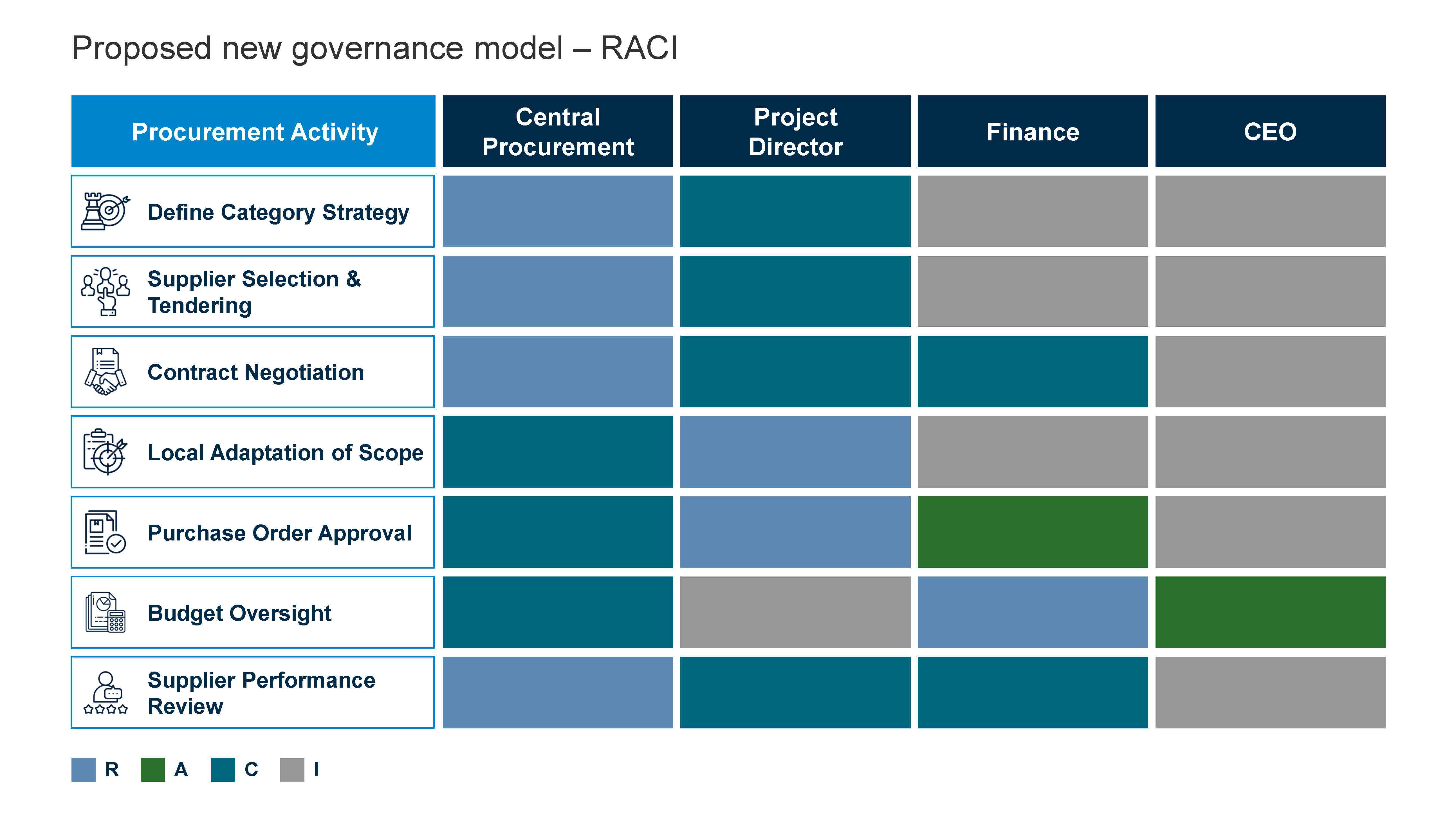

To operationalize an effective balance between central governance and local execution, a clear delineation of roles is essential. The following RACI matrix outlines the responsibilities of central procurement, project directors, finance, and the CEO in key procurement activities. This model helps ensure transparency, minimize ambiguity, and foster collaboration across functions.

Why is this important? – The real world EBIDTA impact

Across the Nordic region and beyond, procurement typically represents 60% to 70% of total construction costs, making it one of the most strategic levers for improving margins. However, due to high labor costs, mature supplier markets and strong contractor-supplier relationships, savings opportunities tend to be overlooked. This represents significant untapped potential, as even modest percentage gains in procurement efficiency can translate into substantial bottom-line improvements, particularly on large-scale projects.

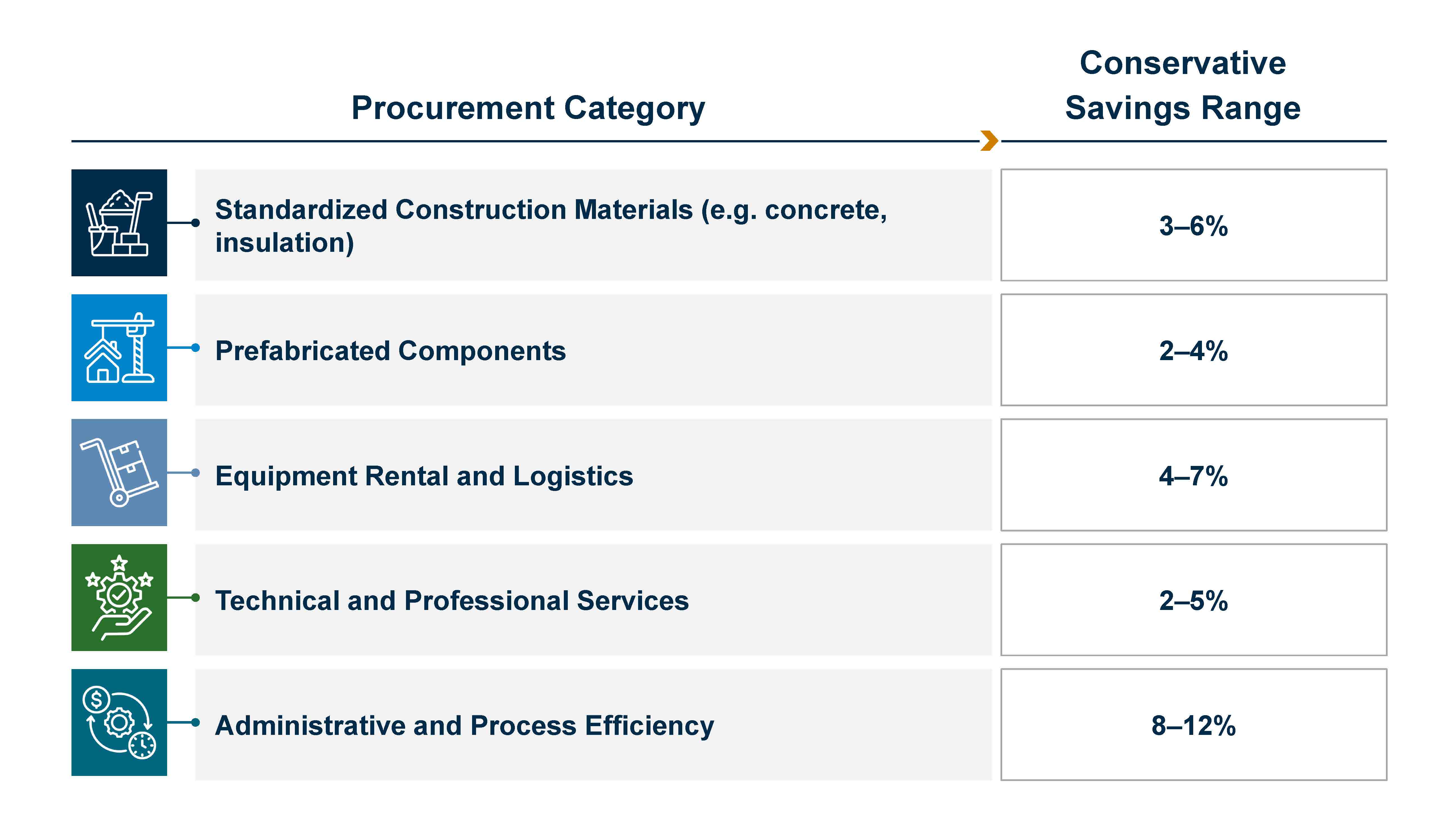

These savings can be achieved through the following practices:

Consolidated supplier agreements offering modest volume-based discounts

Increased price transparency and benchmarking across projects

Process streamlining, reducing purchase cycle times and errors

Improved planning to minimize urgent or last-minute procurement

Reduction in duplicated sourcing efforts across autonomous sites. Based on our own experience working with clients in the construction industry, the typical savings potential in a centralized procurement model for the Nordic market is as follows:

In the Danish context—especially in municipalities and large frameworks like the ByK model—savings were modest but sustainable, driven more by governance improvements and supplier performance gains than by aggressive price cutting. The Nordic ethos of quality, collaboration, and long-term supplier relationships means that savings should be measured not just in cost reductions but in risk mitigation, time reliability, and reduced conflict.

Even at the low end of achievable savings, the EBITDA impact for Nordic construction companies can be substantial. For example, a firm with €300 million in annual revenue and a current EBITDA margin of 5% could increase its EBITDA by more than 50% through a 4–5% improvement in procurement efficiency. In this scenario, procurement savings of just €7.8–9.75 million could elevate EBITDA from €15 million to over €22 million. In a sector where margins are traditionally thin, these gains present a rare opportunity to improve profitability without expanding top-line revenue. As such, procurement reform should not only be seen as a cost control measure, but as a strategic lever for sustainable financial performance.

The Call for Action - Strategic Imperatives for Builders

Cultural Resistance Is the Real Bottleneck

Telling a seasoned Building Director he can’t choose his supplier disrupts decades of autonomy. Procurement transformation is as much about culture as it is about cost.

Procurement Is a Strategic Lever

When up to 70% of construction costs hinge on supplier contracts, procurement isn’t a back-office function. It’s a boardroom conversation.

Hybrid Is a Strength, Not a Compromise

Use centralized functions for high-volume, low-variance categories like concrete or HVAC systems. Let site teams handle specialized or fast-moving buys. This dual model maximizes efficiency while preserving local agility.

Governance Enables, Not Restricts

Transparent sourcing rules and centralized dashboards should empower teams, not constrain them. Trust grows when everyone sees the same data.

Technology Is a Means, Not the End

E-sourcing tools, spend analytics, and digital catalogs can enhance any model—but only if they’re adopted and adapted by the people using them.

Inaction Comes at a Cost

Companies delaying procurement evolution risk fragmented spend, lost leverage, and unmanaged risk exposure. The status quo is not neutral.

Final Thoughts

In the construction sector, the procurement debate can’t be only about centralized vs. decentralized—it’s about strategic alignment and alignment with value creation. Companies that harmonize governance with empowerment, cost control with flexibility, and data with human judgment will not only optimize spending but future-proof their organizations. Procurement, when done right, becomes not just a function—but a strategic advantage.

(1) Byggeri København. (n.d.). Strategiske partnerskaber. Københavns Kommune. Retrieved July 16, 2025, from https://byk.kk.dk/for-leverandoerer/strategiske-partnerskaber