NAVIGATING NEW US TARIFFS: WHY UNDERSTANDING YOUR PRODUCT'S ORIGIN IS MORE CRUCIAL THAN EVER

Since President Donald Trump took office on January 20, 2025, the global trade environment has faced significant upheaval due to new US Proclamations and Executive Orders. [1] A key development was the April 2, 2025 order introducing the "reciprocal tariffs" on imports into the US. Although these tariffs (except for those imposed on China) were temporarily paused for 90 days (until July 8, 2025), the overall uncertainty for companies remains high.[2]

This article will help you navigate this new uncertain global trade landscape by:

- summarizing recent initial responses, particularly in Asia Pacific (APAC) from both governments and businesses;

- explaining the critical concept of Non-Preferential Country of Origin (NPCO); and

- outlining possible next steps for companies to consider

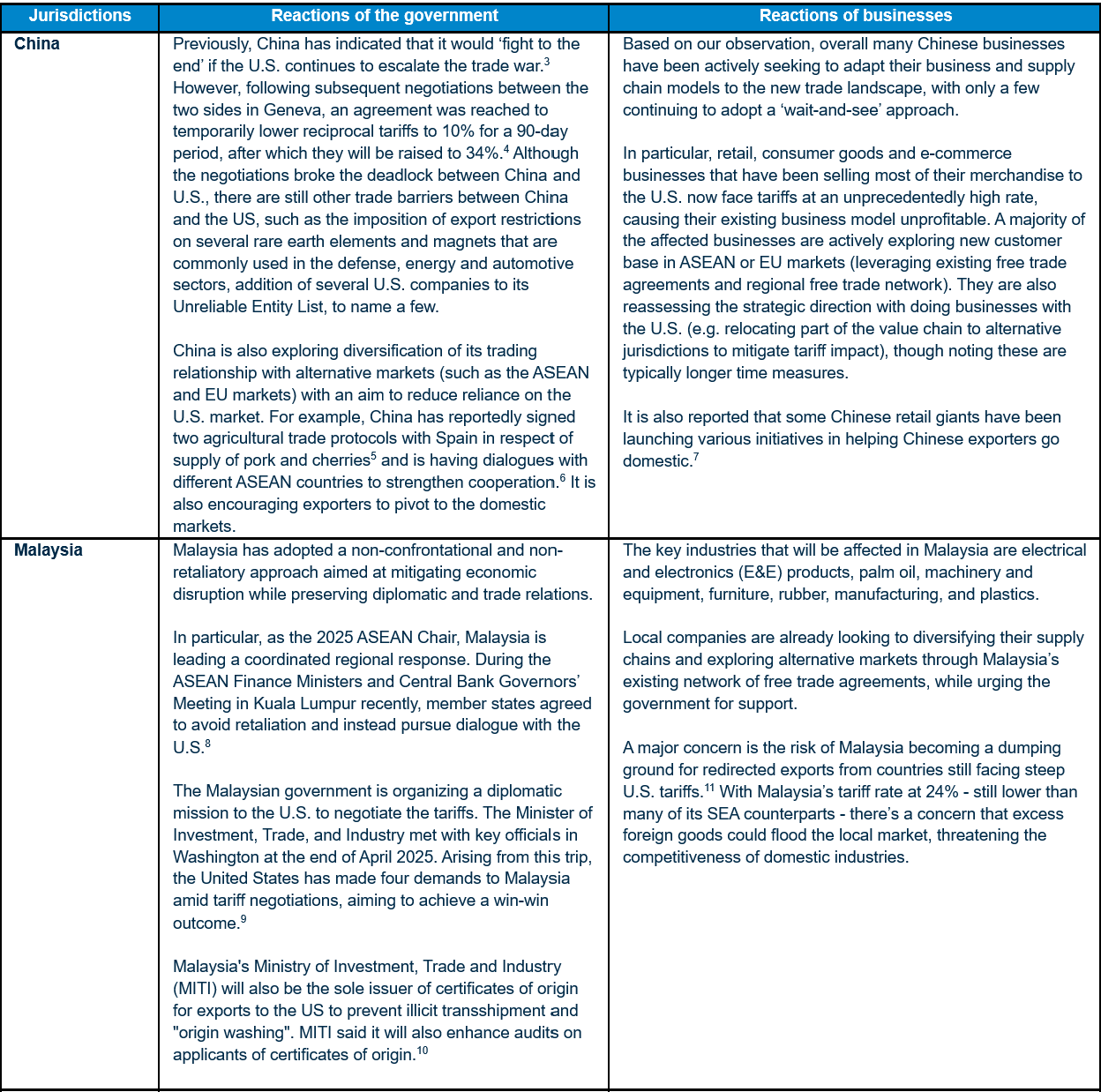

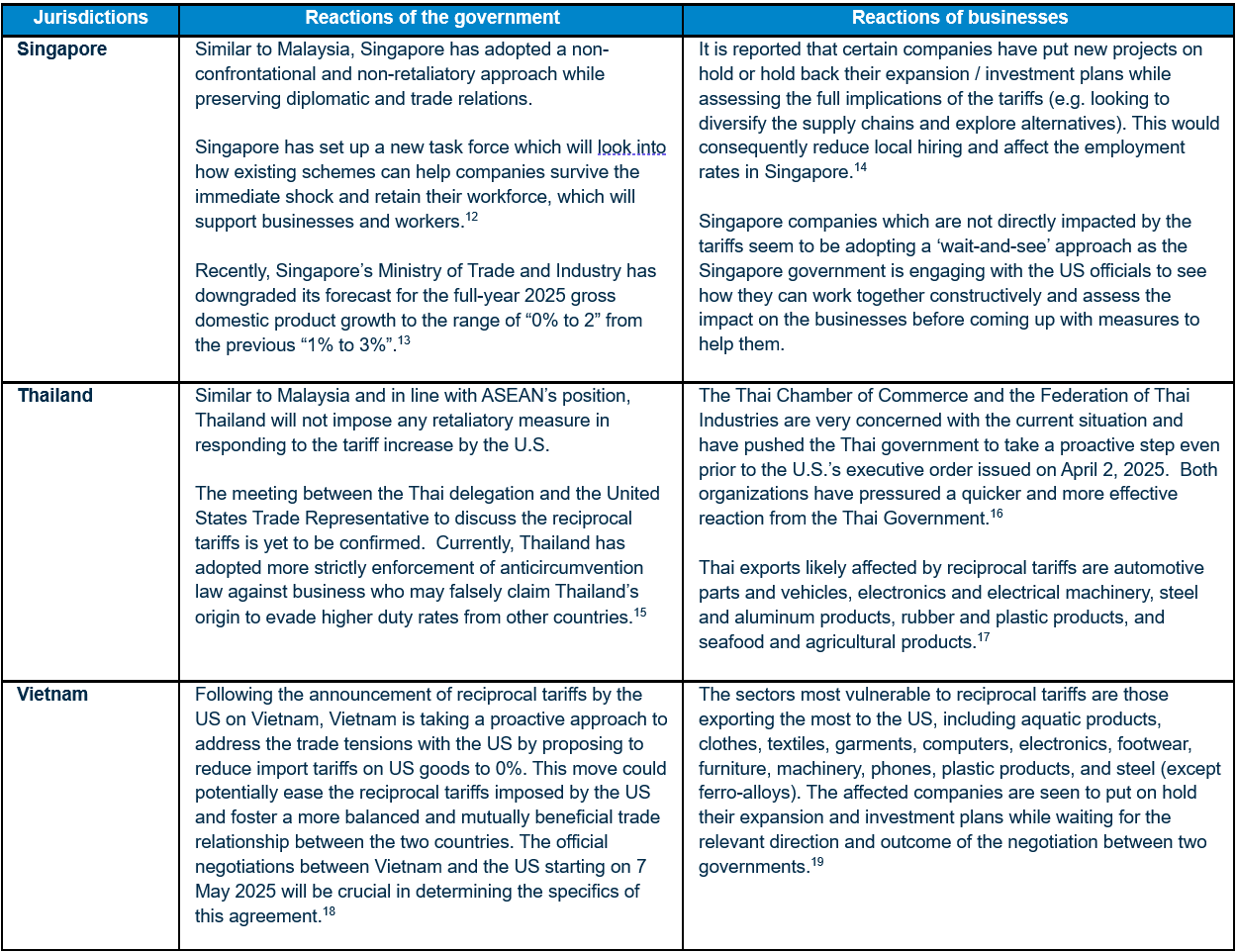

Initial reactions in Asia-Pacific region

|

|

Why "Country of Origin" Matters

A central factor in how these new tariffs apply is your product's Country of Origin. This isn't necessarily just where you ship it from. There are two main types:

- Preferential Country of Origin: This applies when goods qualify for lower tariff rates under a specific trade agreement (like a Free Trade Agreement or FTA) between the importing and exporting country.

- Non-Preferential Country of Origin (NPCO): This applies when no free trade agreement preference exists. This is particularly relevant for the new reciprocal US tariffs, as the NPCO determines which country's tariff rate applies.

In the US, the determination of country of origin of a product is administered by the Customs and Border Protection (US CBP), with reference to its regulations, prior interpretations, and court decisions. As a general rule of thumb, country of origin refers to:

- Where the products are ‘wholly obtained,’ in respect of products that are grown, produced or manufactured in a particular country; or

- Where the products undergo ‘substantial transformation,’ in respect of products that consist in whole or in part of materials from more than one country. The determination of whether and where a substantial transformation occurs will generally be made by the CBP on a case-by-case basis, taking into consideration the totality of the circumstances.[20]

It is common for a product to comprise materials that are sourced from multiple jurisdictions. The processing or assembly of the materials may happen in different jurisdictions (e.g. where labour cost is low, or complicated labour skillset is required). The tariff rates of the same product could be different depending on which country is regarded as the NPCO by the US CBP.

For example, a product may have been shipped from Malaysia but could still be considered by US CBP as ‘originating’ from China because of ‘minimal’ operations carried out in Malaysia, and/or because the key components of the final product were imported from China with minimal value added in Malaysia. In such case, US CBP would apply the reciprocal tariff of 30%-54% instead of the 24% that would have applied for Malaysia originating products.

Key Considerations for Businesses

In this evolving environment, businesses must be agile and forward-thinking. Short-term actions should focus on reviewing tariff classifications (HS codes) to identify whether your products are exempted from the reciprocal tariffs, identifying impacts across supply chains, validating whether your products contain US content of at least 20% (if any) in order to potentially reduce your duty payment,[21] and considering possible flexible pricing structures that can respond to sudden cost changes.

In the medium term, businesses should explore options to reclassify their products and minimize customs values, including applying the ‘First Sale For Export Rule’[22] and unbundling of non-dutiable elements, such as post-importation expenses from the customs value. Over the long term, companies may consider dual sourcing, relocate manufacturing bases where appropriate, especially with lower applied punitive tariffs, and invest in broader cost-reduction initiatives, e.g. available duty and tax incentives in manufacturing locations to mitigate and hedge the tariff impact.

Businesses should collectively start the lobbying process with governments to further liberalize some of existing FTAs, e.g. RCEP (covering ASEAN, Australia, New Zealand, Japan, Korea and China) and ASEAN plus FTAs. Each of these strategies must be tailored to a company’s operational scale, data maturity, and strategic goals. Importantly, organizations should recognize that trade volatility will increasingly influence operational, legal, and financial planning.

Increased US CBP’s Scrutiny & APAC Responses

US CBP is likely to increase scrutiny of import documentation and origin claims. Incorrect or false claims could lead to significant penalties and higher tariffs. Misdeclaring country of origin, whether by negligence or fraud, may lead to both civil and criminal penalties. Goods may be denied entry, seized, or subject to additional duties and penalties.[23]

Recognizing the risk of potential higher scrutiny by the US, some of Asia-Pacific governments, for example, Thailand, Vietnam, and Malaysia, already announced that they will apply stricter checks on origin certificates being issued to their exporters, aiming to ensure legitimacy. [24] In response to this risk, businesses should take a more vigilant approach in their exports to the US by carrying out origin compliance review from both exporting countries as well as the US sides.

How A&M can assist

Our experienced Global Trade team at A&M can conduct a thorough review of your products, manufacturing processes, and sourcing to verify if they meet the origin requirements (both from a relevant country’ and US perspective). We can also assist you with looking into your product’s current supply chain and consider whether any preferential trade agreements could be utilized to mitigate the reciprocal tariff effects. Furthermore, equipped with deep expertise across wide-range and complex areas of tax and operation, A&M can help you navigate this intricate environment through a comprehensive multidisciplinary approach. By helping businesses better understand the situation, prioritize pressing issues, and craft confident, data-driven decisions, A&M empowers companies to not only mitigate risks but also seize growth opportunities amid global uncertainty.

[1]See Proclamation 10895 on Adjusting Imports of Aluminum Into the United States (Feb 10, 2025); Proclamation 10896 on Adjusting Imports of Steel Into the United States (Feb 10, 2025); Proclamation 10908 on Adjusting Imports of Automobiles and Automobile Parts Into the United States (Mar 26, 2025); and Executive Order 14257 on Regulating Imports With a Reciprocal Tariffs To Rectify Trade Practices That Contribute to Large and Persistent Annal United States Goods Trade Deficits (Apr 2, 2025);

[2] See Executive Order 14259 on Amendment to Reciprocal Tariffs and Updated Duties as Applied to Low-Value Imports From the People’s Republic of China (Apr 8, 2025) and Executive Order 14266 on Modifying Reciprocal Tariff Rates To Reflect Trading Partner Retaliation and Alignment (Apr 9, 2025).

[3] “Spokesperson: China ready to fight till end if US is bent on tariff war,” April 9, 2025, english.scio.gov.cn/pressroom/2025-04/09/content_117814095.html#:~:text=China%20is%20ready%20to%20fight%20till%20the%20end,an%20additional%2050%20percent%20tariff%20on%20Chinese%20imports.

[4] Joint Statement on U.S.-China Economic and Trade Meeting in Geneva – The White House, May 12, 2025, https://www.whitehouse.gov/briefings-statements/2025/05/joint-statement-on-u-s-china-economic-and-trade-meeting-in-geneva/

[5]“China expands access for Spanish pork as trade tensions with US mount,” Reuters, April 11, 2025, https://www.reuters.com/markets/commodities/china-expands-access-spanish-pork-trade-tensions-with-us-mount-2025-04-11/

[6] “China ready to work with ASEAN to strengthen trade cooperation,” Reuters, April 9, 2025, https://www.reuters.com/world/asia-pacific/china-ready-work-with-asean-strengthen-trade-cooperation-2025-04-10/

[7] “China's retail giants pledge to help exporters go domestic amid trade war,” Reuters, April 11, 2025, https://www.reuters.com/business/retail-consumer/chinas-jdcom-spend-200-billion-yuan-help-exporters-go-domestic-amid-trade-war-2025-04-11/

[8] “Miti: Asean seeks non-retaliatory strategy against US tariffs, opts for diplomacy over retaliation,” Malay Mail, April 10, 2025, https://www.malaymail.com/news/malaysia/2025/04/10/miti-asean-seeks-non-retaliatory-strategy-against-us-tariffs-opts-for-diplomacy-over-retaliation/172570#google_vignette

[9] “[UPDATED] US makes 4 key demands to Malaysia in ongoing trade negotiations,” New Straits Times, May 5, 2025, https://www.nst.com.my/news/nation/2025/05/1211787/updated-us-makes-4-key-demands-malaysia-ongoing-trade-negotiations

[10] “Miti to be sole issuer of certificates of origin for exports to US starting May 6,” The Edge, May 6, 2025, https://theedgemalaysia.com/node/753968

[11] “What Trump’s tariffs mean for Malaysian industries,” The Malaysian Reserves, April 14, 2025, https://themalaysianreserve.com/2025/04/14/what-trumps-tariffs-mean-for-malaysian-industries/

[12] ”Singapore task force tackles US tariff impact with communication, support, long-term strategies,” The Business Times, April 16, 2025, https://www.businesstimes.com.sg/singapore/singapore-task-force-tackles-us-tariff-impact-communication-support-long-term-strategies

[13] “US tariffs impact could include global trade war; Singapore may downgrade full-year growth forecast: DPM Gan,” EDB, April 7, 2025, https://www.edb.gov.sg/en/business-insights/insights/us-tariffs-impact-could-include-global-trade-war-singapore-may-downgrade-full-year-growth-forecast-dpm-gan.html

[14] https://www.businesstimes.com.sg/singapore/singapore-task-force-tackles-us-tariff-impact-communication-support-long-term-strategies

[15] “US tariff negotiations postponed to review 'issues', says Paetongtarn,”. Bangkok Post, April 22,2025, https://www.bangkokpost.com/business/general/3008416/us-tariff-negotiations-postponed-to-review-issues-says-paetongtarn

[16] “Thai private sector calls for Trump tariff team,” Bangkok Post, March 25, 2025, https://www.bangkokpost.com/business/general/2974741/thai-private-se%20%20ctor-calls-for-trump-tariff-team

[17] “US trade policies hit four major Thai industries, FTI warns,” The Nation Thailand, April 10. 2025, https://www.nationthailand.com/business/economy/40048610

“Thai Auto Sector Frets Over US Tariffs,” Bangkok Post, March 27, 2025, https://www.bangkokpost.com/business/general/2989117/thai-auto-sector-frets-over-us-tariffs

[18] “Vietnam to begin trade talks with US on May 7,” VnExpress International, May 4, 2025, https://e.vnexpress.net/news/business/economy/vietnam-to-begin-trade-talks-with-us-on-may-7-4881738.html

[19] "Manufacturing sector deteriorates amid US tariff announcements,” Vietnam Economic Times, May 5, 2025, https://en.vneconomy.vn/manufacturing-sector-deteriorates-amid-us-tariff-announcements.htm

[20] See “Rules of Origin: Substantial Transformation,” International Trade Association, Accessed May 7, 2025, https://www.trade.gov/rules-origin-substantial-transformation

[21] See Sec. 3(f) in the Executive Order 14257 on Regulating Imports With a Reciprocal Tariffs To Rectify Trade Practices That Contribute to Large and Persistent Annal United States Goods Trade Deficits (Apr 2, 2025), The Federal Register, April 14, 2025, https://www.federalregister.gov/documents/2025/04/14/2025-06378/amendment-to-reciprocal-tariffs-and-updated-duties-as-applied-to-low-value-imports-from-the-peoples

[22] “First Sale Declaration,” U.S. Customs and Border Protection, Last modified: Aug 04, 2023 https://www.cbp.gov/trade/programs-administration/entry-summary/first-sale-declaration

[23] “Marking of Country of Origin on U.S. Imports,” U.S. Customs and Border Protection, Last modifed May 22, 2024, https://www.cbp.gov/trade/rulings/informed-compliance-publications/marking-country-origin-us-imports

[24] https://www.thansettakij.com/economy/trade-agriculture/625688; https://www.reuters.com/world/china/vietnam-clamps-down-fraud-us-exports-document-shows-2025-04-22/; and https://www.straitstimes.com/asia/se-asia/malaysia-tightens-rules-on-transshipment-of-foreign-goods-amid-growing-scrutiny-by-us-authorities