March 11, 2025

Restructuring of Swiss Corporations | Swiss tax considerations of selected common financial restructuring instruments

Background

Generally, Swiss tax law provides tax-efficient instruments for the financial restructuring of Swiss companies. However, the tax consequences can vary significantly depending on the chosen instrument as well as the party providing financial restructuring assistance to a Swiss entity in need of such.

The following shall provide an overview of the Swiss tax consequences of often-used restructuring measures by considering latest clarification from the Swiss Federal Tax Administration (SFTA) stipulated in its circular letter 32a as well as recent jurisprudence. This overview does not cover all potentially possible restructuring measures, but only selected instruments.

Potential Swiss tax benefits in connection with financial restructuring measures

In financial restructurings, a primary objective is to ensure that financial contributions to the ailing corporation are effectively channeled to the company undergoing restructuring, ideally without any tax leakage and negative cash flow. Swiss tax law offers certain relief measures to prevent unwelcome tax leakage consequences from becoming a roadblock to restructuring efforts.

In order to understand when and how financial restructuring measures are indicated by Swiss law, it is first necessary to get a brief overview of respective nomenclature.

Swiss law distinguishes between (i) an underbalance, (ii) a capital loss and (iii) an over-indebtedness. The below graph illustrates these concepts, according to the Swiss Code of Obligations. The respective degree of financial difficulty, in which the company finds itself, has an impact on the severity of the resulting obligations on the board of directors and the management, to initiate restructuring measures (or initiate bankruptcy proceedings, if the situation is severe enough).

- For Swiss tax purposes, the qualification of these “states of financial trouble” is different, as the main consideration for the applicable tax treatment is whether hidden reserves (i.e. undervalued assets / overvalued liabilities) are available to improve the situation and reach a better state than displayed by statutory book values. This is referred to as a “real” or “unreal” respective state. In an unreal state, enough hidden reserves exist to mitigate the issue, if they were realized.

- In the event of a real underbalance (i.e., no sufficient hidden reserves to cover a book value deficit), a company can profit from an unlimited period for offsetting tax losses carried forward, as opposed to the usual limitation of 7 years. This means that instead of deducting losses from the previous seven financial years, losses from an indefinite number of prior periods can be deducted from the taxable profit resulting from (taxable) financial restructuring measures carried out in this context, for example a debt waiver from a third party.

- Furthermore, transactions involving contributions to the equity from the direct shareholders are generally subject to Swiss share issuance tax (SIT) of 1% if the general exemption threshold of CHF 1m has been consumed. In the event of a financial restructuring (whereby the definition is more lax than for corporate income tax purposes), a company can apply for an extended SIT relief threshold of CHF 10m or a complete SIT relief due to obvious hardship if certain additional criteria are met. These additional criteria should be analyzed in detail if it is intended to claim the complete SIT relief.

- If a company has an unreal underbalance (i.e., sufficient hidden reserves), the SFTA will only grant the extended SIT relief threshold of CHF 10m, without an option to receive a full relief of the SIT.

- However, despite recent decisions of the Swiss Federal Administrative Court which pointed in another direction, the SFTA only grants reliefs from SIT (CHF 10m threshold or complete exemption) if the contributions made are indeed offset with losses, which is interpreted as the losses being set-off accounting-wise. In this regard, a company must decide to offset losses at the ordinary general assembly that approves the annual financial statements for the period in which the restructuring occurred at the latest. Furthermore, the losses must be eliminated until the financial year following the restructuring. This practice by the SFTA and the subsequent decision of the Federal Supreme Court backing this treatment with regard to the SIT threshold exemption have been subject to criticism in academia, since from an economic point of view, it should not be relevant whether losses are indeed offset with contributions made or just covered by the newly contributed equity. Since both measures are suitable for restructuring a company and based on commercial law, the accounting-wise offsetting of losses should not be required. However, this debate has been closed and the position stands in practice: Losses do need to be offset.

- Capital contributions without considerations as well as debt waivers from direct shareholders booked via equity should qualify as capital contribution reserves (CCR), provided the contributions made are not offset with losses and accordingly recognized for statutory accounting purposes. Such CCR are beneficial as they can be distributed to shareholders free of Swiss withholding taxes (WHT) and – for individual Swiss resident shareholders - income taxes. Therefore, in accordance with the current practice by the SFTA, a company must decide whether it prefers a relief from SIT by offsetting losses with the contributions made or declare CCR.

Cash contributions

In general, both capital increases as well as capital contributions without consideration by the receiving entity are recognized directly at the equity of a company and therefore tax-neutral for CIT purposes. If a capital contribution from a direct shareholder would be recognized in the P&L of a company, this would be treated as tax-neutral for CIT purposes (i.e., correction of accounting under commercial law for tax purposes and thus breach of the accounting prevalence principle).

Cash contributions without consideration from other affiliates may be performed without triggering SIT. However, such transactions have to be analyzed in detail with regard to arm’s length considerations and to ascertain whether they may be subject to CIT at the level of the recipient.

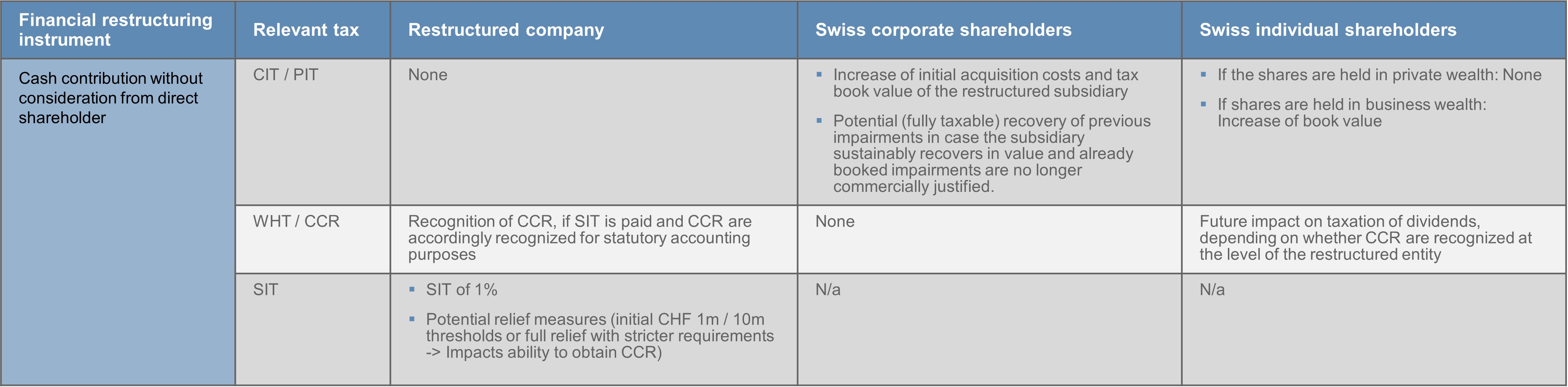

The following table summarizes the tax implications for CIT, WHT (incl. CCR), and SIT purposes for the respective stakeholders of a cash contribution without consideration from a direct shareholder:

Debt waivers

Debt waivers from direct shareholders, which are recognized in the P&L or the restructuring account in accordance with commercial law in the course of a financial restructuring are generally also offset with tax losses carried forward. However, for CIT purposes, the recognized profit from the debt waiver from direct shareholders is considered CIT-neutral if such loan (i) has been qualified as hidden equity prior to the debt waiving or (ii) the loan was granted for the first time or additionally due to weak business performance and third parties would not have granted such loan under the same circumstances.

However, debt waivers from direct shareholders, which have been recognized directly in the equity of the restructured company are always considered CIT-neutral. Therefore, the accounting impacts the CIT-treatment of the debt waivers from direct shareholders, depending on the circumstances.

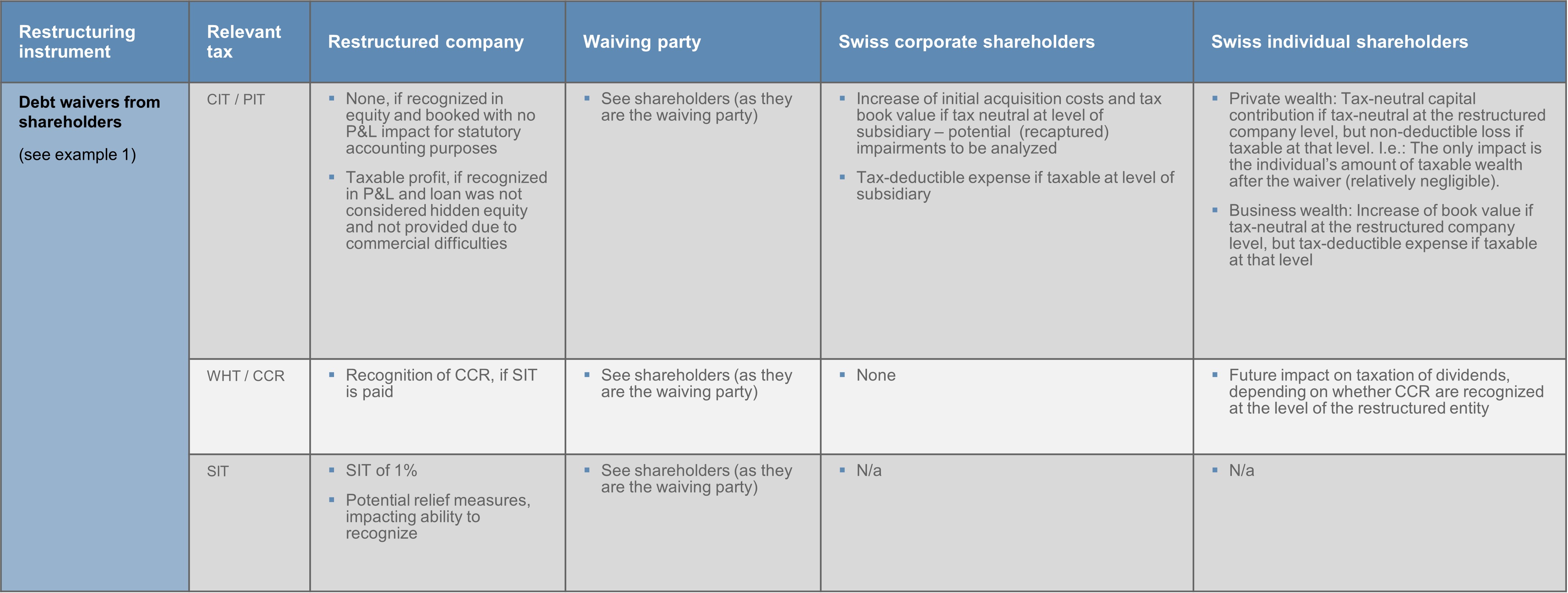

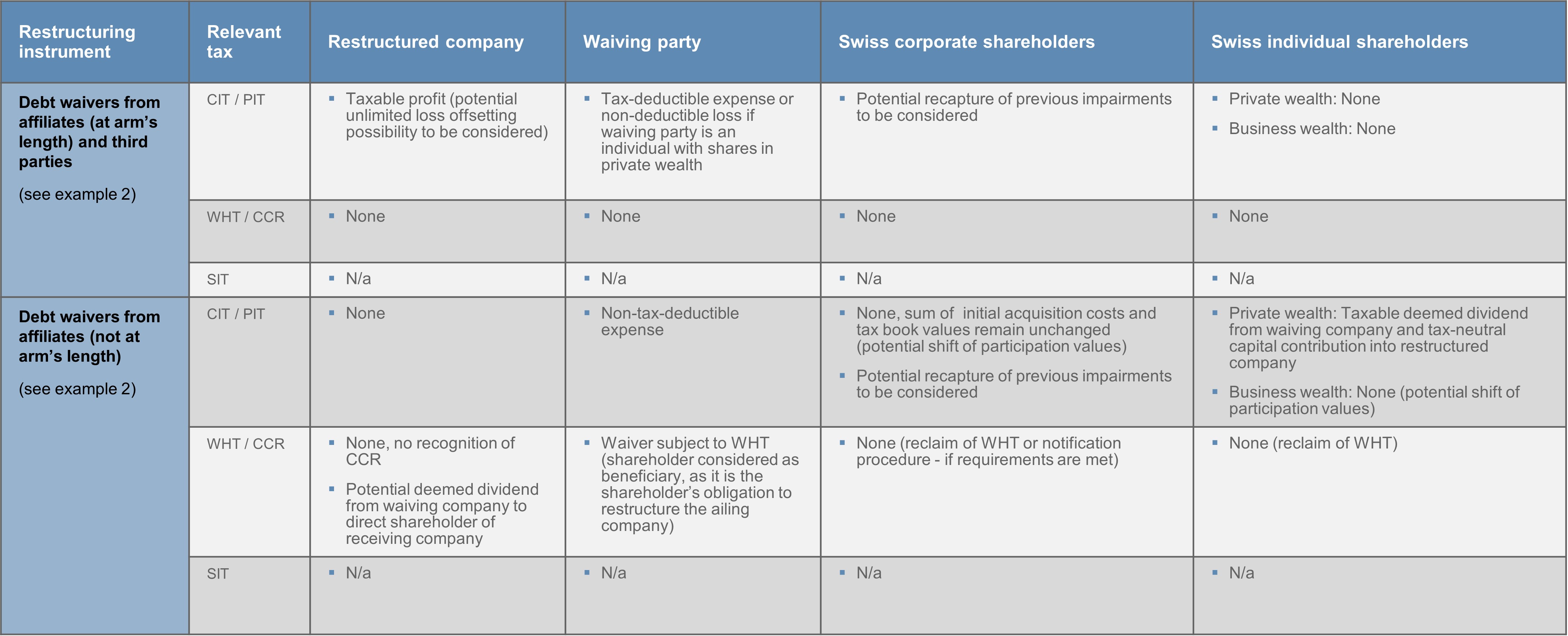

The following illustrative examples are intended to make the tax consequences shown in the table below more intuitive.

The following table summarizes the tax implications for CIT, WHT (incl. CCR), and SIT purposes, of debt waivers for the respective stakeholders:

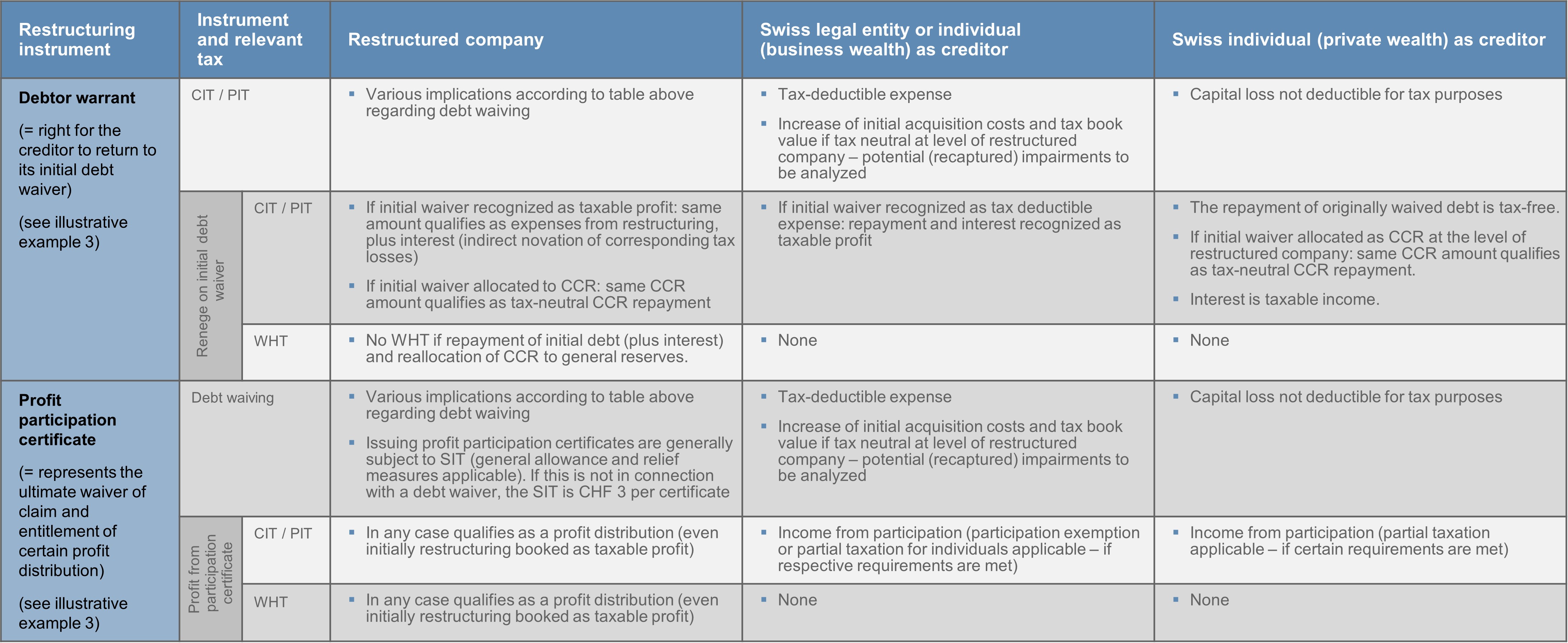

Debtor warrant and profit participation certificate as restructuring instruments

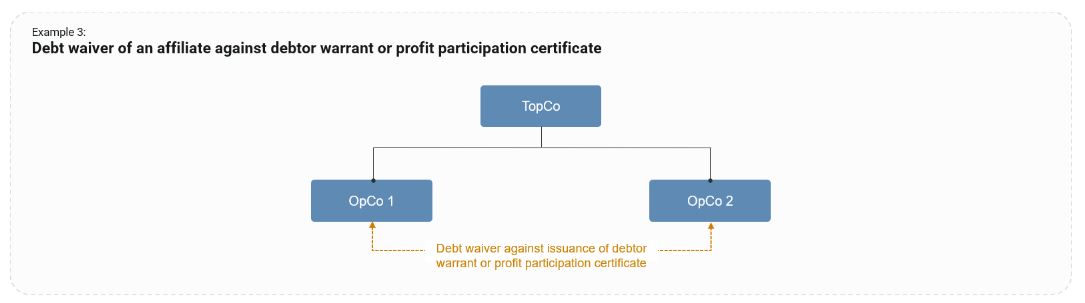

In case the waiving party wants to have the right to renege on its initial debt waiver or participate in the profits of the restructured company at a later stage, a debtor warrant or a profit participation certificate could be issued, depending on the case at hand.

From a tax perspective a debtor's warrant can be viewed as a type of debt instrument and a profit participation certificate can be seen as an equity vehicle. Based on this, the tax implications are aligned with this generalization.

While zooming in on the details, a case-by-case analysis would need to be carried out, but the consequences can be broadly summarized as follows.

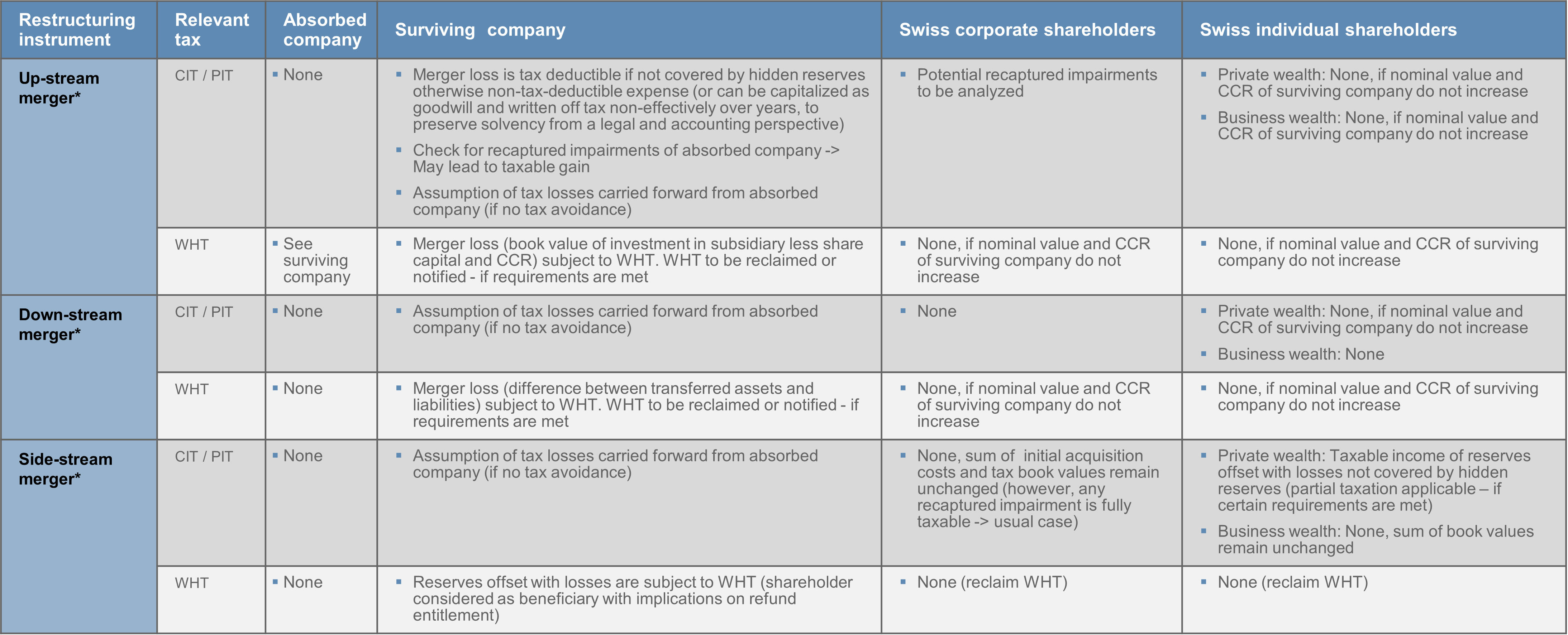

Reorganizations driven by a need for a financial restructuring

In general, reorganizations driven by the need for a financial restructuring are either mergers, demergers or simply transfers of assets to a loss-making company in need of being financially restructured.

A merger can be performed tax-neutrally in Switzerland if the tax liability remains in Switzerland and tax book values are taken over by the surviving entity. However, there are certain particularities to consider with mergers involving companies in need of restructuring with regard to tax consequences as well as commercial law requirements. For example, a company with a capital loss or overindebtedness may only merge with another company if the latter has freely distributable equity in the amount of the capital loss or overindebtedness of the company in need of reorganization.

The following table summarizes the tax implications for CIT, WHT (incl. CCR), and SIT of mergers involving overindebted companies and for the respective stakeholders:

Key takeaways

- Swiss tax law provides tax-efficient instruments for the financial restructuring of struggling Swiss companies, but the tax consequences can vary depending on the chosen restructuring instrument and the party providing restructuring measures.

- The SFTA has provided clarifications on the tax consequences of common restructuring measures in its circular letter 32a. While not new per se, the updated guidance has been brought up to date in regards to various Supreme Court rulings and practice changes brought forth over the past years.

- Swiss tax law offers relief measures to prevent tax consequences from becoming a roadblock to economically beneficial financial restructuring efforts. These include an extended period for offsetting tax losses carried forward and an extended SIT relief threshold of CHF 10m or a complete SIT relief due to obvious hardship if certain criteria are met.

- If a company incurs an unreal capital loss, the SFTA will only grant the extended SIT relief threshold of CHF 10m, with no option for complete SIT relief.

- The SFTA only grants relief from SIT if the contributions made are indeed offset with losses. This practice has been subject to criticism in academia, as it is not particularly favorable to the companies in question. The SFTA (supported by the Supreme Court) has taken a highly formalistic view in this regard.

- Capital contributions without considerations and debt waivers from direct shareholders should qualify as capital contribution reserves (CCR) provided that the contributions made are not offset with losses and correctly recognized for accounting purposes. Such CCR can be distributed to shareholders free of WHT and (for individual Swiss resident shareholders) income tax.

- Different restructuring instruments have different tax implications and it is crucial to ensure a congruent tax treatment on all levels, which involves coordinating early on with the involved tax authorities.

- The recent publication by the SFTA still leaves some points open for discussion. In this regard, general tax principles apply and a tax ruling is recommended to have a legally binding decision from the tax authorities regarding the tax implications at hand of a particular case.

Please contact the authors of this article directly to discuss any of the issues raised and to learn how A&M can help you.