A Deep-Dive into the UAE Transfer Pricing Rules

Introduction

On January 31, 2022, the United Arab Emirates (UAE) Ministry of Finance (MoF) announced its intention to implement a federal Corporate Tax (CT) in the country. Subsequently, on October 10, 2022, Federal Decree-Law No. 47 of 2022 was published —a landmark piece of legislation imposing federal taxation on taxable persons at rates of up to 9 percent (0 percent for Qualifying Free Zone Persons (QFZP). This legislation, commonly referred to as the UAE CT Law, marks a significant shift in the country’s fiscal framework. It establishes a comprehensive legal and regulatory foundation for corporate taxation in the UAE, detailing the obligations corporations must fulfill.

Subsequently, the Federal Tax Authority (FTA) released the Transfer Pricing (TP) Guide on October 23, 2023, broadly aligning the UAE TP provisions with the Organization for Economic Cooperation’s TP Guidelines for Multinationals and Tax Administrations (OECD TP Guidelines) and highlighting some UAE-specific TP requirements.

Within the UAE CT Law, there are specific provisions related to TP requirements (Chapter 10 – Transactions with Related Parties and Connected Persons). These provisions, outlined in Articles 34, 35, and 36 respectively, are critical for multinational corporations as they govern the pricing of transactions between Related Parties. Additionally, Article 55 of Chapter 17 of the UAE CT Law highlights requirements for preparing and maintaining TP documentation for qualifying taxpayers.

Further clarity was provided on the Disclosure Form for Related Party and Connected Person transactions with the release of the Tax Returns – Corporate Tax Guide in November 2024.

Finally, the introduction of Global Minimum Tax of 15 percent for large groups in the UAE further increases the need for corporations to get their transfer pricing affairs in order.

This article provides an overview of the UAE TP Rules and outlines practical implications for taxpayers.

Arm’s Length Principle

A cornerstone of the UAE CT Law, Article 34, relies on the Arm’s Length Principle (ALP), a fundamental concept in TP. It ensures that transactions between Related Parties and Connected Persons are conducted under the same terms and pricing as a comparable transaction between two unrelated parties. This encompasses goods, services, financial transactions, and intangibles.

Under the ALP, selecting an appropriate TP method is essential to ensure intercompany transactions reflect market conditions. The UAE TP rules outline methods such as the Comparable Uncontrolled Price (CUP) Method, Resale Price Method, and Cost-Plus Method, and Transactional Net Margin Method (TNMM) which are commonly used and generally aligned with OECD TP standards.

For transactions involving integrated services, the Profit Split Method may be a more appropriate approach. This method is also outlined in the UAE TP rules. Each method must be carefully assessed to ensure that pricing aligns with what independent entities would agree to under comparable circumstances.

The UAE TP Guidelines also permit the use of alternative TP methods if the standard five methods cannot be reasonably applied, provided there is robust documentation explaining the selection, including economic and commercial justifications. For instance, a Discounted Cash Flow (DCF) approach could be used by a person engaged in real estate development to demonstrate the arm’s length nature of controlled lease payments.

Some unique aspects of the UAE TP rules are outlined below:

- The UAE TP rules recommend using the Interquartile Range (IQR) rather than the full range suggested by the OECD. However, how this will be applied in practice remains to be seen, particularly in cases where transaction values fall slightly above or below the IQR (e.g., deviations may be automatically adjusted to the median).

- Business restructuring considerations are aligned with the OECD TP Guidelines; however, they also cover domestic restructurings for UAE TP purposes.

- Extreme benchmarking results, such as significant losses or unusually high profits, require further analysis to determine their underlying cause. Exclusion of such results is only warranted if a comparability defect has been discovered—not merely because the results differ substantially from those of other comparables.

- The FTA does not prefer a particular commercial database when searching for comparables, as long as the source is reliable and the geographical order for applying the comparables is followed (i.e., local, regional (Middle East), then other regions).

- There is a distinction between gross transaction value and arm’s length transaction value in the Disclosure Form. Taxpayers need to report both values independently, and the difference between them is automatically reported as an adjustment, as opposed to reporting the net impact.

The FTA maintains a clear position on downward adjustments: any adjustments to non-arm’s length transactions that result in reduced taxable income (or increased losses) must be reported to and approved by the FTA prior to submission. The approval process is yet to be announced.

- Assuming a double-tax treaty is in place and the application of the ALP leads to a TP adjustment by a foreign competent authority, the Taxable Person may request the FTA to apply a corresponding adjustment to their taxable income in accordance with the relevant double taxation agreement. The FTA will assess the foreign tax authority’s position and, if deemed appropriate, may implement the corresponding adjustment.

- There are also unique considerations regarding QFZPs, Connected Persons and Pillar 2 which are further elaborated in this article.

The UAE CT Law mandates that all intercompany transactions, whether cross-border, domestic, or involving free zone entities, must comply with the ALP. Even exempt entities and those that have elected for Small Business Relief are required to adhere to the ALP for their intercompany transactions. Taxable persons are also required to maintain contemporaneous documentation of their controlled transactions to demonstrate compliance with TP regulations. Businesses that exceed the thresholds outlined in the Transfer Pricing Documentation section will be required to maintain comprehensive TP documentation, including a Master File and Local File.

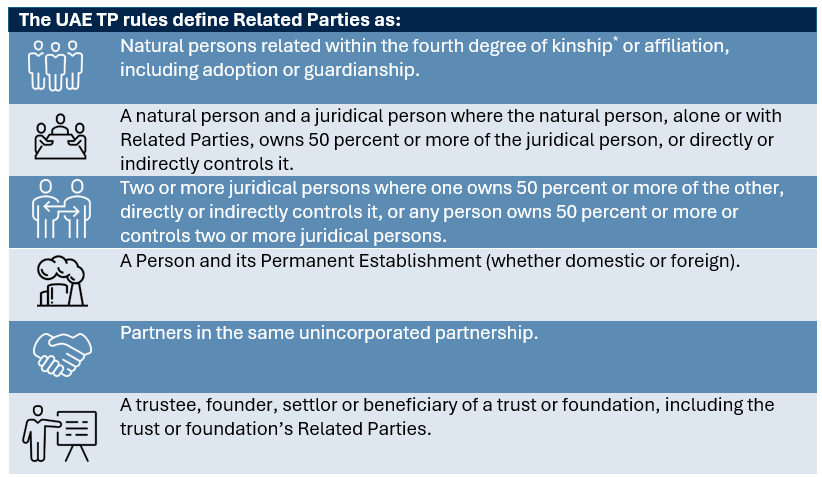

Related Parties

As per the UAE CT Law, all transactions between Related Parties and Connected Persons must be conducted in accordance with the ALP. Taxpayers are required to identify their Related Parties based on the definitions provided in Article 35 of the UAE CT Law and further elaborated in the UAE TP Guidelines. It is crucial to recognize that the definition of Related Parties varies between the UAE TP rules and the criteria outlined in the International Accounting Standards (IAS) 24 - Related Party Disclosures.

Notably, discrepancies exist in how Related Parties are identified and treated across these frameworks. Therefore, businesses operating in the UAE must conduct a comprehensive study to ascertain their Related Parties as defined under the UAE TP rules, rather than solely relying on Related Party disclosures within their financial statements or relying on the definitions per their global TP policies.

*Fourth degree of kinship including parents, grandparents, great-grandparents, siblings, first cousins, aunts/uncles, great aunts/uncles, children, nieces/nephews, grandnieces/grandnephews, and stepparents

The FTA has clarified that common ownership or control by the UAE federal or Local Government alone does not make entities Related Parties under Article 35 of the UAE CT Law. This clarification aims to reduce the need for analysis and documentation for transactions between entities that are under common government ownership or control.

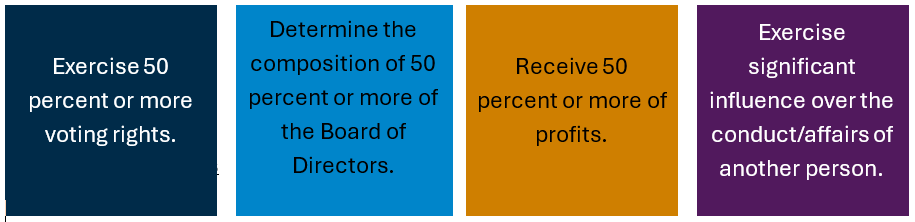

The UAE TP Guide defines control as the ability of a person to:

Connected Persons

Article 36 of the UAE CT Law 'Payments to Connected Persons', discusses the tax implications of transactions with Connected Persons and reiterates that the ALP must apply to such transactions. Otherwise, a CT deduction will be denied for non-arm’s length payments.

For UAE CT purposes, Connected Persons include:

- Individuals with direct or indirect ownership or control of the Taxable Person

- A director or officer of the Taxable Person

- An individual related to the owner or director/officer of the Taxable Person

- Any partner in an unincorporated partnership

- A Related Party to any of the above

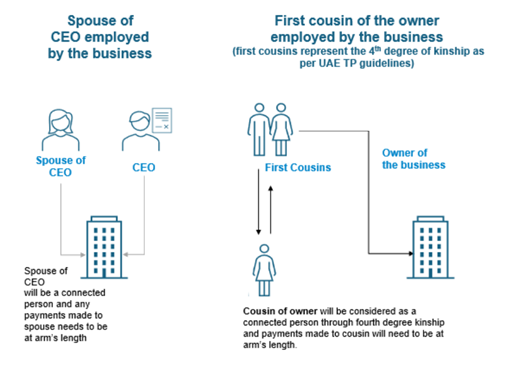

The diagrams below illustrate examples of Connected Persons as per the UAE TP rules:

CT deductions for any non-arm’s length payments will be denied for Connected Persons. Depending on the nature of the payment, it may also trigger a CT liability for the Connected Person.

It should be noted that there is an exemption from the requirement to comply with the Connected Person rules for Taxable Persons listed on a recognized stock exchange or Taxable Persons regulated by a competent authority in the UAE.

Tax Group – Transfer Pricing Considerations

The primary exception to the ALP applies to entities approved by the FTA to form a Tax Group for UAE CT purposes. Within a Tax Group, members are treated as a single taxpayer for CT purposes; therefore, the allocation of profits between these entities is not relevant as they are considered a single Taxable Person.

This reduces the compliance burden on individual entities by consolidating accounts and eliminating the need to report intra-group transactions. Nonetheless, specific circumstances necessitate the application of the ALP within tax groups for UAE CT purposes. These scenarios include:

Since a Tax Group is considered a single taxpayer for UAE CT purposes, it will only need to prepare one Local File and one Disclosure Form covering all the entities in the Tax Group (subject to meeting the relevant thresholds). Chapter 4 of the Tax Groups – Corporate Tax Guide of January 2024 provides additional information on the requirements for forming a tax group.

However, an entity-by-entity analysis may need to be undertaken (including multiple benchmarks, as required) in cases where entities within a Tax Group are either functionally dissimilar or engaged in unique related party transaction types. Special consideration must then be given to how such information is organized and presented within a single Local File covering all such entities.

Transfer Pricing Considerations for Qualifying Free Zone Persons

For a Free Zone Person (FZP) to qualify as a QFZP and benefit from the UAE’s 0 percent corporate tax rate, it must meet several key conditions. These include generating qualifying income from qualifying activities (e.g., Headquarter Services to Related Parties and Treasury and Financing Services to Related Parties), adhering to the ALP, and maintaining robust TP documentation.

Notably, TP documentation must be prepared separately for each QFZP if the relevant TP compliance thresholds (outlined in the table above) are met. Therefore, it is essential to maintain a TP defense file or memorandum, along with any benchmarking studies conducted, to support compliance in the event of a challenge.

A critical consideration for TP purposes is the interplay between a QFZP’s substance and functional profile. Among other requirements, to benefit from the 0 percent UAE CT rate, the entity must ensure that its functional profile accurately reflects the qualifying activities it is supposed to be performing (e.g., headquarter services or treasury and financing services to related parties) as outlined in Ministerial Decision No. (265) of 2023.

This will ensure that the remuneration of the QFZP is in line with the ALP and supports the overall substance of the QFZP. Additionally, transactions between FZPs and both domestic and foreign permanent establishments must be conducted at arm’s length to ensure compliance.

Transfer Pricing Considerations in Relation to Pillar 2

With the introduction of a Qualified Domestic Top-Up Tax (QDMTT) of 15 percent in the UAE, there are even more reasons to ensure transactions are priced on an arm’s length basis from the outset. The Effective Tax Rate calculations underpinning whether a top-up tax is required assume that the profits subject to tax are arm’s length in the financial statements.

Year-end TP adjustments that are not reflected in the financial statements —either due to GAAP differences, timing differences or because they are only reflected in the tax returns as a matter of principle—could impact both the Country-by-Country Reporting (CbCR) thresholds and the top-up tax calculations.

Specifically, while the Pillar 2 rules do allow and mandate transfer pricing adjustments, there are complications for unilateral TP adjustments that could result in double taxation or double non-taxation. This is particularly relevant for groups subject to the QDMTT in the UAE. Therefore, any TP adjustments (whether made by the taxpayer or the FTA) should also be assessed through a Pillar 2 lens.

Overall, the recommendation is to ensure that, wherever possible, all TP adjustments are made in the financial statements of all parties to a transaction within the financial year itself.

Tax Clarifications and Advanced Pricing Agreements

The FTA issued an updated Decision No.4 of 2024 outlining the future implementation of an Advanced Pricing Agreement (APA) framework under the UAE CT law. This allows taxpayers to apply for an APA concerning transactions or arrangements they have proposed or entered.

Additionally, via Decision No.2 of 2025, the FTA announced that applications for unilateral APAs shall be received from the 4th quarter of 2025, while the submission date for “other” APA applications will be announced after that date. “Other” could be interpreted to mean that "bilateral" APAs may be introduced in due course (i.e., agreements between the FTA, a UAE taxpayer, an overseas affiliated taxpayer, and the relevant overseas tax authority).

We expect further guidance on the entry requirements to the APA program, including eligibility thresholds, the complexity of proposed TP policies, compliance obligations, and whether UAE-specific tax considerations—such as the TP treatment of QFZPs and payments or benefits involving connected persons—will be covered.

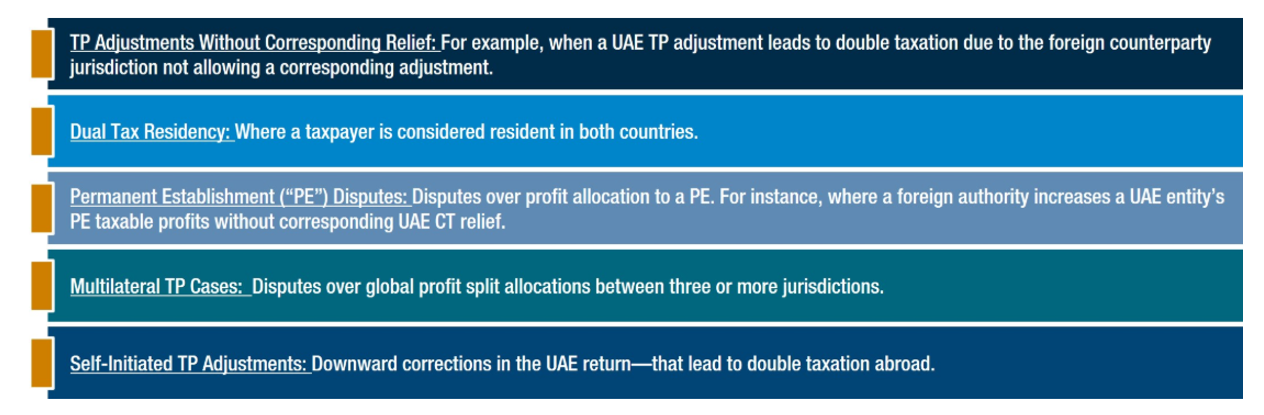

The UAE Mutual Agreement Procedure

The risk of conflicting tax assessments between jurisdictions is heightened now that CT and TP rules are in effect in the UAE, especially in cross-border situations involving permanent establishments, TP audits, or dual residency issues where overlapping tax claims may arise. The Mutual Agreement Procedure (MAP) offers a structured, treaty-based mechanism for resolving such disputes through bilateral negotiations between the Competent Authorities (CA) of the countries involved. In the UAE, MoF serves as the CA responsible for managing the MAP process and is supported by the FTA.

The MAP guidance issued by MoF in June 2025 outlines the circumstances under which taxpayers may seek relief through the MAP process. A request may be initiated where a taxpayer considers that the actions of one or both treaty partners would lead to taxation that is not in accordance with the provisions of the double tax agreement in place. This includes cases of actual or potential double taxation, as well as disputes concerning the interpretation or application of treaty terms. Common examples of scenarios where MAP may be relevant include:

UAE MAP requests must be submitted within three years from the date the taxpayer becomes aware of the issue. However, the CA allows early submissions, especially during ongoing TP audits. Requests are made via email and must include a clear explanation of the dispute, references to the relevant treaty provisions, and supporting documentation such as taxpayer details, the fiscal years involved, TP files, and any correspondence with the foreign tax authority. If the facts are consistent, a single request may cover multiple tax years.

Once an agreement is reached between the authorities, the taxpayer is notified and given one month to accept or reject the outcome. If the outcome is rejected, the MAP case is closed, and the taxpayer may pursue other avenues. Any resolution reached through MAP applies only to the specific years and facts under consideration and does not create a precedent for future periods. For our full article on the UAE MAP guidance, please read it here.

Transfer Pricing Documentation

Article 55 of the UAE Corporate Tax Law outlines the TP documentation requirements for Taxable Persons with fiscal years beginning on or after June 1, 2023. These requirements include the preparation of a Master File, Local File, Disclosure Form, and, where applicable, a CbCR:

| TP Compliance Requirement | Preparation Threshold | Submission Requirements |

| Master File & Local File | A Taxable Person is required to prepare and maintain a Master File and Local File if either of the following conditions is met during the relevant tax period:

Taxable Persons that are part of a UAE-headquartered group without business establishments outside the UAE are not required to maintain a Master File. | Prepared and maintained contemporaneously. Submission within 30 days of request by the FTA. |

| Disclosure Form - Related Parties | Taxpayers with an aggregate value of Related Party transactions amounting to AED 40 million, either recorded in the financial statements or determined at market value, must prepare and submit a Disclosure Form alongside the corporate tax return. Once this threshold is met, the reporting requirement for individual transaction types applies to those exceeding AED 4 million (Dividend between Related Parties do not need to be disclosed and should not be considered in determining the AED40M or AED4M thresholds). | Submitted with the UAE CT Return. |

| Disclosure Form – Connected Persons | Payments or benefits provided to Connected Persons with an aggregate value exceeding AED 500,000 must also be disclosed in the form. The arm’s length nature of these payments requires a detailed review from a corporate tax, transfer pricing, and reward perspective to ensure compliance. | |

| CbCR | The UAE CbCR requirements are only applicable to MNE Groups headquartered in the UAE with consolidated group revenue equal to or above AED 3.15 billion during the fiscal year immediately preceding the reporting fiscal year. | 12 months from the end of the accounting period. The CbCR notification must be submitted no later than the last day of the fiscal year, informing the FTA of the ultimate parent entity that will file the report. |

| TP Compliance Requirement | Document Description |

| Master File |

|

| Local File |

|

| Disclosure Form – Related Parties |

|

| Disclosure Form –Connected Persons |

|

| CbCR |

|

What should taxpayers consider as they approach their first periods?

- The burden of proof is on the Taxable Person when preparing the UAE CT Return. As such, Taxable Persons should apply arm’s length pricing in the first instance. By continually monitoring the controlled transactions, Taxable Persons can make real-time adjustments in their book of accounts before submitting their Tax Returns.

- TP adjustments may not be needed for transaction values in the Disclosure Form if the accounts are finalized after applying the ALP. However, if the TP analysis shows the transactions were not at arm's length, the required adjustments must be disclosed.

- Any adjustments to non-arm’s length transactions that result in reduced taxable income must be reported to and approved by the FTA prior to submission. Taxpayers are encouraged to actively monitor year-end transfer pricing outcomes to ensure compliance with the arm’s length standard. Where deviations exist, they should be identified and addressed before finalizing financial statements.

- Even if Taxable Persons are not required to prepare Master and Local Files, they must still adhere to the ALP. This requires them to maintain contemporaneous TP defence documentation demonstrating that their intercompany transactions are conducted at arm’s length, which can be presented in the case of an audit by the FTA.

- Article 50 of the Corporate Tax Law grants the FTA the authority to counteract or adjust transactions or arrangements that lack a legitimate commercial purpose. If the primary objective of a transaction is to obtain a CT advantage, the FTA may intervene to alter its outcome. It is therefore essential to ensure that all transactions are supported by a valid commercial rationale.

What should those tasked with Transfer Pricing governance do?

We have set out five steps to consider as you start your TP journey.

- Communicate the importance of TP to all stakeholders. For certain groups, TP has been a board level issue and is increasingly elevated as one of the most important risks to manage in the business.

- Assess the impact of the UAE TP rules on your business, identify the related and connected party transactions, the current transfer pricing policy (or not), and what the gaps are.

- Design new TP policies that consider the new regulations, and importantly, are reviewed from a corporate and indirect tax perspective. For example, what is the impact of withholding tax or custom duties on any new TP model.

- Implement the new TP policies. This will include preparing robust legal agreements, aligning finance and tax teams, and revisiting the data and technology requirements.

- Document your TP policies in compliance with the regulations and ensure this is ready to be submitted if required.

Finally, everything above should be undertaken with the possibility that you could be subject to a TP audit in the future. In addition to the 5 steps above, having a structured process in place to regularly review the TP policy, documentation and implementation can minimize the risk of material TP adjustments.

For support, please reach out to a member of the A&M Tax team for a discussion.