INTERNATIONAL TAX

Companies with a footprint stretching across multiple borders face regulatory and compliance demands that require a comprehensive tax strategy.

Alvarez & Marsal Tax international tax professionals bring years of experience helping our clients quickly navigate the increasingly complicated waters of international tax. International tax planning and strategy can drive significant value for companies by reducing costs, improving cash flow, and maximizing profits, so our clients can stay ahead of the competition, no matter where they operate their business.

OUR SERVICES

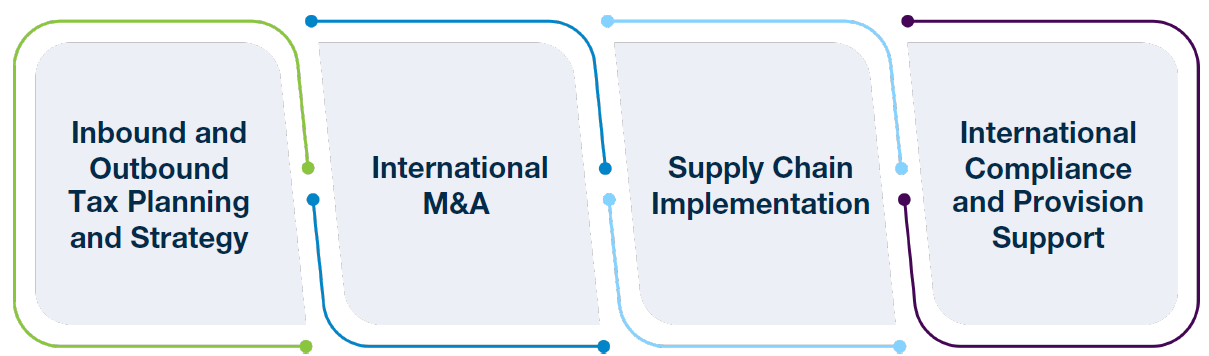

As part of the comprehensive international tax strategy process, we can assist with an overall plan to efficiently meet your global tax obligations. Our international tax services include:

WHY OUR CLIENTS CHOOSE US

Our broad operational expertise working with multinational companies empowers our clients to maximize competitiveness, maintain compliance across multiple locations, and generate value. Clients value us for our:

Expertise

Our team is nimble and efficient and has experience with every tax situation facing multinationals.

Operational Excellence

Our team's commercial approach allows us to address all facets of a tax issue.

Audit Independence

Free from audit independence issues, we can assist with implementing our solutions.