UAW Negotiations with Detroit’s Big Three Ramp Up as EV Manufacturer Earnings Paint Diverging Pictures

The International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (UAW) and Detroit’s Big Three (Ford, General Motors, Stellantis) officially open labor negotiations, with the current labor contract set to expire on September 14. An improving semiconductor supply environment leads to strong earnings for Honda, with North America leading the way. Inventory lags consensus estimates, a potentially troubling signal for the automotive industry when coupled with the high likelihood of a UAW strike.

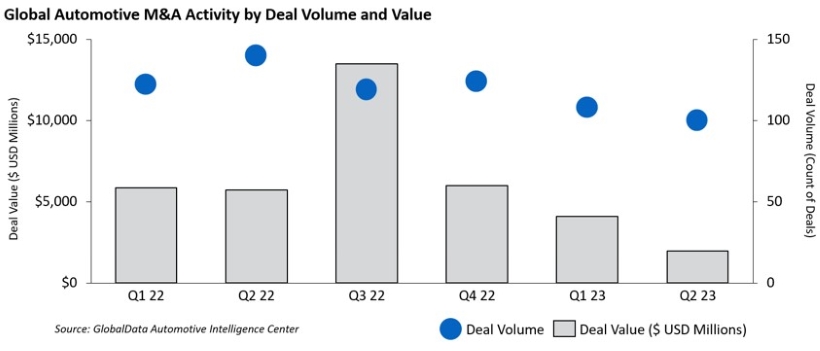

In transaction news, a high-level review of year-to-date transaction activity for the global automotive industry shows a slowdown in M&A activity and deal value, putting a spotlight on the ‘make versus buy’ decision framework for strategic transformative investments.

In regulatory news, the National Highway Traffic Safety Administration (NHTSA) announced a new set of fleetwide fuel economy regulation proposals. Ram Trucks face a NHTSA probe into the Ram 1500 model related to power steering issues for 2013-2016 model year vehicles. Ford announces a significant recall on the F-150, pushing the automaker over 4.4 million vehicles recalled so far this year.

Additional August insights are included below.

Financial Performance

The global semiconductor shortage topped 1.85 million vehicles cut from automakers’ production plans for this year, according to AutoForecast Solutions (AFS). AFS now expects approximately 2.4 million vehicles will be cut from production plans for lack of chips in 2023, an improvement from its prior forecast of 2.5 million. The shortage contributed to production cuts of 4.38 million vehicles and 10.56 million vehicles in 2022 and 2021, respectively.

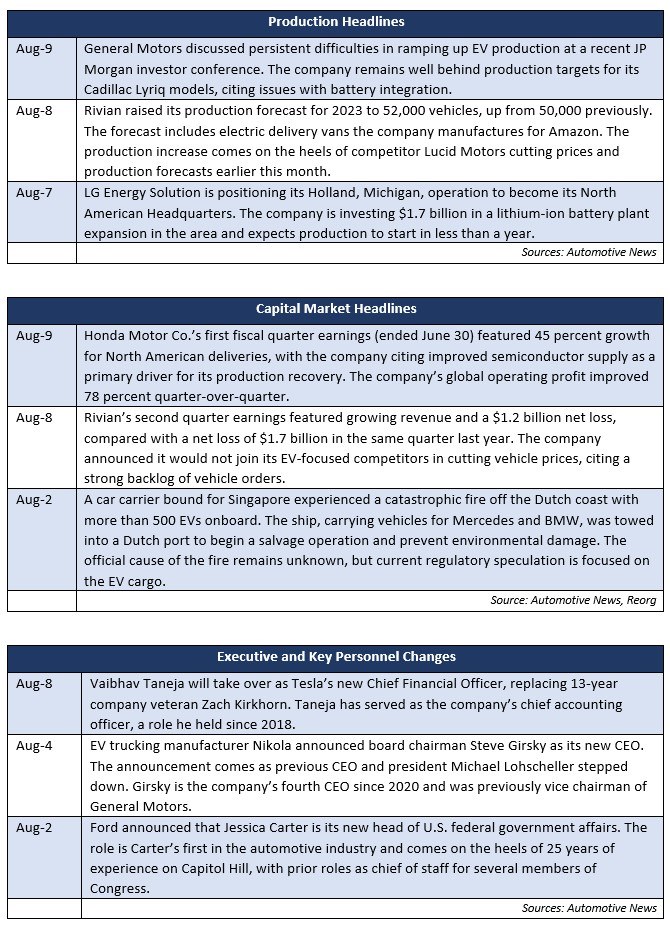

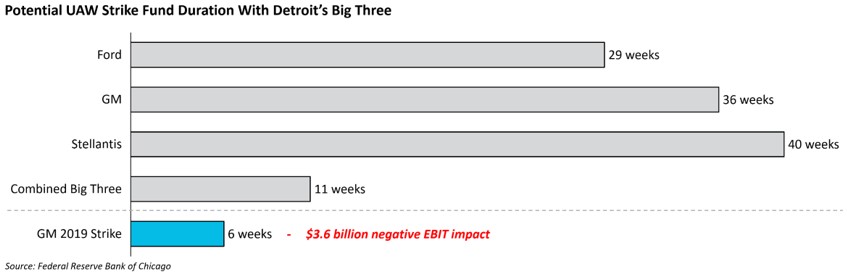

Industry Update

July inventory levels ended at 1.79 million units, a 119,000 unit decrease from last month. Days’ supply (DS) closed at 38, approximately 10 percent below the five-year average and a slight improvement over the last several months. The month-over-month decline in inventory comes as something of a surprise considering the high likelihood of a UAW strike against Detroit’s Big Three, an action typically preceded by a build-up of OEM inventory.

July U.S. light vehicle sales increased approximately 20 percent year over year, in line with Bloomberg consensus estimates. Vehicle mix continues to remain near record levels, trending toward large vehicles, as average transaction prices remain steady but elevated compared to this time last year. Expectations for full year 2023 remain moderate based on continuously growing production cuts and an increasingly unstable near-term macroeconomic environment, but signs continue to point toward a steeper recovery in 2024. The increasing likelihood of a strike by the UAW against the Big Three presents incremental risk to 2023’s full year forecast.

Industry Focus — UAW Negotiations with Detroit’s Big Three

The UAW and Detroit’s Big Three (General Motors, Ford Motor Co., and Stellantis) have opened labor contract negotiations for the first time since 2019. Current labor contracts for nearly 150,000 employees across the Big Three who are represented by UAW will expire on September 14th.

Recently elected UAW President Shawn Fain has promised a ‘different’ approach to negotiations this year amid a strong national labor movement across other industries. This month’s automotive newsletter aims to deliver a primer on this year’s negotiations, including:

- Understanding the key players on each side of the table

- Key considerations for how the UAW and OEMs will approach negotiations

- Key issues the UAW is hoping to address

- Negotiations so far

- Potential impact on automotive suppliers

Settling the table: A spotlight on key players

Sweeping changes to the UAW’s election process (covered in additional detail below) have given rise to new leadership within the union. While the head negotiators for the union are all long-time members, it will be a majority of the leadership team’s first time leading negotiations with such significant counterparties. The UAW’s key negotiators include:

Shawn Fain, UAW President

- Fain worked as an electrician in Stellantis’ Kokomo, Indiana, plant and has been a longtime member of the UAW. He was the first UAW president to be elected directly by members (as a result of the 2021 referendum vote stemming from the consent decree from the same year) and ran on a platform focused on eliminating corruption, tiered wages, and bringing a more militant approach to negotiations with OEMs. Fain has notably not endorsed President Joe Biden’s reelection campaign under the premise that laborers are being left behind in the broader automotive transition to electric vehicles.

Chuck Browning, UAW VP and Director of the UAW-Ford Department

- Browning has been a member of the UAW since 1987 when he worked at the Mazda plant in Flat Rock, Michigan, and has been part of the UAW’s staff since 2000. He currently oversees the UAW relationship with Ford Motor Co. and the union’s agricultural implements division. Browning notably led negotiations for John Deere’s contingent of UAW laborers where a militant strike led to historic gains for strikers, including the restoration of Cost of Living Allowance (COLA) payments. Browning was a political rival to Fain in March’s elections as running mate to former UAW president Ray Curry.

Mike Booth, UAW VP and Director of the UAW-GM Department

- Booth has been a member of UAW since 1991 when he joined Kelsey-Hayes in Romulus, Michigan. He was elected to his current role overseeing the UAW relationship with General Motors in December 2022, and also oversees gaming and gaming organizing departments. Booth is known for his focus on eliminating tiered wage systems and protecting benefits for retirees.

Rich Boyer, UAW VP and Director of the UAW-Stellantis Department

- Boyer joined the UAW in 1985 when he was hired into Chrysler’s Jeep plant in Toledo, Ohio, and was elected to his current role overseeing the UAW relationship with Stellantis in March 2023. Boyer ran on a platform focusing on day-one strike pay, increased strike pay, and eliminating tiered wage systems.

Key considerations on what will drive negotiations

Financial crimes and broader corruption with historical UAW leadership led to a historic 2021 consent decree. The deal placed the UAW under six years of independent monitoring, led to $1.5 million in fines, and resulted in a referendum vote that changed how the UAW elects its leaders. The consent decree had a direct impact on the March 2023 elections for new UAW leadership leading into a negotiation year. Previous voting processes saw members vote for local union delegates, who would in turn vote on appointments to the UAW’s International Executive Board (IEB).

The referendum vote led to members implementing a new direct voting system, where union members directly vote on appointments to the IEB. Fain is the first UAW President to be elected through the direct vote and defeated incumbent UAW President Ray Curry. Fain ran for election on the promise that members would be better represented by their leadership.

The OEMs will follow pattern bargaining guidelines, meaning each of the Big Three will start with the same basic economic principles. While the OEMs cannot compete on differential language, they are able to differentiate based on demographics and their respective business decisions. They will likely focus on a continuation of contingent pay policies, maintaining full decision authority over their manufacturing footprints and avoiding legacy costs such as COLA.

While each of the Big Three has indicated a clear direction toward a future dominated by EVs, the level of investment may drive a significant financial impact on the OEMs depending on how negotiations progress. EVs are a noted focus topic for the UAW.

Key issues the UAW is hoping to address

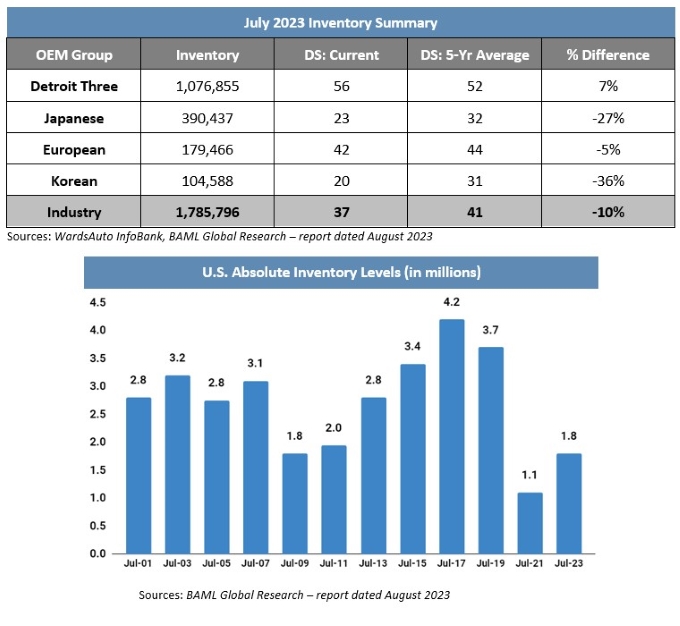

In a Facebook Live announcement on August 2, Fain announced the UAW’s 10 primary demands of the Big Three, with key points highlighted below:

- Eliminating the two-tier wage system that currently sees new hires make approximately 25 percent less than veteran workers. The International Brotherhood of Teamsters recently negotiated an end to tiered wages with UPS, delivering significant momentum to the UAW’s efforts.

- Restoration of the COLA payments and reversal of cuts to retiree benefits that occurred during the Great Recession. Browning led negotiations with John Deere in 2021 that saw restoration of COLA payments for its UAW employees.

- Double-digit pay increases in line with automakers’ financial success, citing executive payouts and federal subsidies related to EV sales. Fain specifically noted an average of 40 percent pay increase for Big Three CEOs in the last four years.

The graphic below denotes UAW’s full demands as presented by Fain:

Negotiations So Far

An initial round of bargaining kicked off by the UAW’s points detailed above has illuminated a significant gap between the manufacturers and the union. Based on calculations reported by Bloomberg earlier this month, the initial position from the UAW would nearly triple labor rates to more than $150 per hour per employee at all three companies. By way of comparison, hourly labor costs for Tesla are believed to be between $45 and $50 per hour. Labor experts have suggested the scenario as unrealistic and should be interpreted as nothing more than an opening position.

In response, Stellantis provided a draft of its own set of proposals that broadly omitted a majority of what the UAW is seeking. In response, Fain hosted a ‘Facebook Live’ broadcast that included putting a copy of the proposal into a garbage bin and described the proposal as an ‘insult’ to the union’s members.

Will the UAW strike the Big Three?

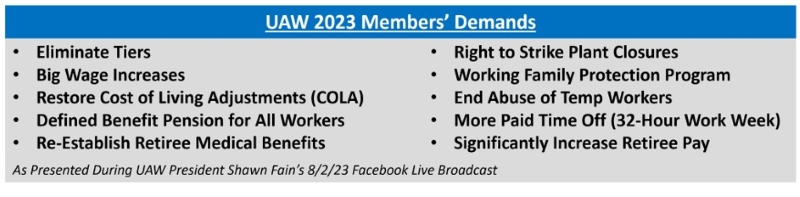

With Fain’s promise for a militant approach to negotiations, members have been prepared for a strike with any of the Big Three — and potentially more than one. With a strike fund of $825 million, the union is well-equipped to fund a lengthy standoff:

The last strike against one of the Big Three was in 2019 against GM. The automaker estimated the strike cost it $2.6 billion in earnings before interest and taxes (EBIT) during the fourth quarter and $3.6 billion in EBIT for the full year.

A concurrent strike against the Big Three would be unprecedented. A recent Bank of America Global Research report likened a simultaneous strike of the Big Three to shutting down approximately 2 percent of the USD GDP, which would likely lead to Congressional intervention – a move that would ultimately hinder the UAW’s negotiating strength. The UAW could also choose to strategically strike at select plants of each of the OEMs to have a broad impact but have a longer runway with its strike fund.

The 2019 strike’s impact was not limited to GM. Many tier-one automotive suppliers reported devastating impacts to financial results that resulted in layoffs:

- Lear Corp. estimated the strike caused a nearly $86 million negative impact to its fourth quarter net income, a 41 percent decline

- American Axle estimated revenue loss of approximately $243 million

- Aptiv estimated revenue loss of approximately $200 million

Impact on suppliers

Financial and operating conditions for automotive suppliers are materially different compared to 2019. While most suppliers have returned to pre-pandemic revenue levels, profits have generally lagged and cash on hand has eroded. Inflated material costs, lower predictability for assembly schedules, support for dual-powertrain programs and meaningfully higher interest rates have squeezed a significant part of the industry.

The risk of a potential strike with the Big Three has been in focus for larger suppliers and the Wall Street analysts covering them. Highlights from earnings calls earlier this month include estimates on the financial impact of a strike and countermeasures to minimize the effect of a strike on full year performance:

- Lear Corp. estimated each week of shutdown, if all three OEMs shut down, would represent loss of approximately $140 million in revenue

- BorgWarner estimated a shutdown of the Big Three would cost the company $250 million in revenue per month

While the prospective losses are significant, the playbook on preparing for strikes is not new for larger suppliers, but concerns linger for lower-tier and smaller suppliers supporting the Big Three.

Additional Actions to Take for Suppliers

With the existing labor contract set to expire on September 14, preserving liquidity to maintain operational flexibility should be top of mind for suppliers closely connected to the Big Three. Specific actions with this in mind include, but are not limited to:

- Build up a cash reserve

- Try to push out purchasing commitments as far as possible

- Monitor inventory levels and try to keep on the low side of normal

- Delay capital expenditures

- Identify actions ahead of time that could be taken if a strike occurs in order to reduce expenses and preserve cash

- Reaffirm credit facility availability and consider increasing borrowing capacity, if available

- Monitor shipping quantities to determine if OEMs may be increasing vehicle inventory, which may result in a pull ahead of sales that would otherwise occur in the fall

Transaction Activity

The global automotive industry has seen a significant slowdown in M&A activity in both deal volume and value on a year-to-date basis. Challenging macroeconomic conditions have led to a slowdown in deals focused on inorganic growth, but have not impeded progress on ‘transformative’ M&A. As the broader industry continues to shift toward electrification and technology-forward development, the ‘make versus buy’ decision framework will continue to guide strategic decisions for automakers.

Broader market conditions are also suggestive of an opportunity for market consolidation up the supply chain. Larger suppliers such as BorgWarner have played a very active role in driving M&A activity in the U.S., acquiring new technologies to secure its market position in an increasingly electric-focused future. BorgWarner has completed four acquisitions in the last twelve months, all focused on expanding its ability to support EV production.

Regulatory Landscape

NHTSA MPG Proposal: The NHTSA proposed a new standard of 58 miles per gallon for average fleet fuel economy for light-duty cars and trucks by the 2032 model year. By comparison, the agency finalized standards last year for a 49 miles per gallon standard for 2026 model year vehicles. The new standards are estimated to save consumers more than $50 billion on fuel over a vehicles’ lifetime. The proposed standard is not legally binding, but rather a projection to parallel EPA proposals.

NHTSA Opens Ram Truck Probe: The NHTSA announced a probe into 1.1 million Ram 1500 pickups related to complaints of power steering loss. The agency received 380 total reports detailing the issue that impacts 2013 to 2016 model years, including reports of three accidents. Fiat Chrysler (now Stellantis) recalled 440 vehicles in 2016, and the NHTSA is opening a recall query to determine if the scope of the recall was correct.

Ford F-150 Recall: Ford Motor Co. is recalling more than 870,000 F-150 pickups from model years 2021 to 2023 for an issue that causes the electric parking brake to unexpectedly activate while driving. The company is not aware of any injuries or accidents related to the issue and expects to notify owners by September 15. Ford has issued 35 recalls across 4.4 million vehicles this year, the most of any automaker.

Stay connected to industry financial indicators and check back in September for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive