Alternative Powertrain Product Roadmaps Take Shape as Automakers and Lawmakers Commit Significant Resources to an EV-Focused Future

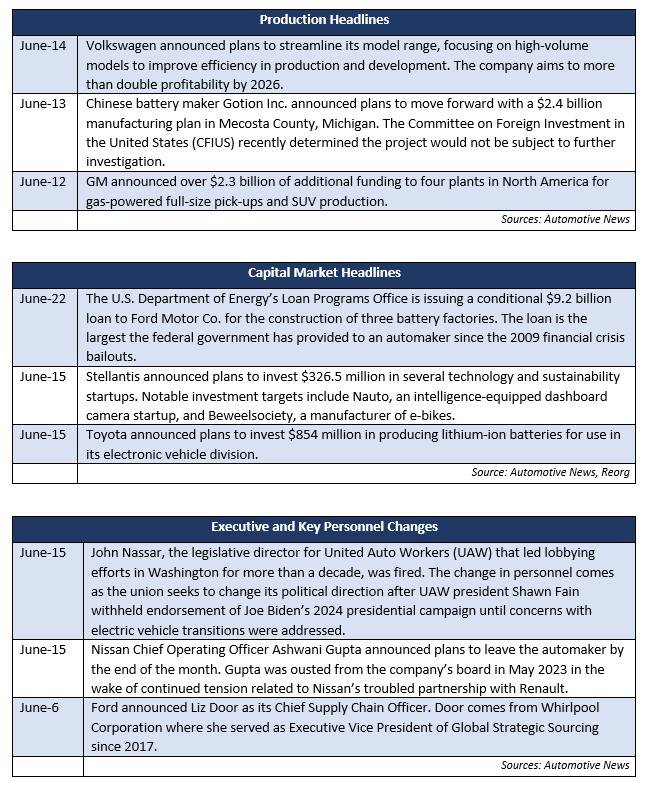

Automakers announce further investment in their manufacturing footprints for the future. Ford announces a historic loan from the Department of Energy focused on the development of battery factories in the United States. Inventory improvement misses consensus estimates but continues to improve against record historical lows.

In transaction news, Vitesco is partnering with Rohm Co. to secure its semiconductor supply for years to come. BorgWarner is acquiring Eldor Corp. to bolster its EV charging component supply business. Toyota and Daimler announced a joint investment in the Hino / Mitsubishi Fuso trucking alliance, looking to accelerate alternative technology development for commercial vehicles.

In regulatory news, Kia and Hyundai face a new lawsuit from New York City over continued issues with the manufacturers’ anti-theft capabilities. President Biden vetoed key legislation designed to rollback new emission restrictions for heavy trucks. Attorneys General from multiple states filed suit against the state of California over electric trucking proposals.

Additional June insights are included below.

Financial Performance

The global semiconductor shortage topped 1.39 million vehicles cut from automakers’ production plans for this year as of last week, according to AutoForecast Solutions (AFS). AFS now expects approximately 2.6 million vehicles to be cut from production plans for lack of chips in 2023, an improvement from its forecast of 2.8 million. The shortage contributed to production cuts of 4.38 million and 10.56 million in 2022 and 2021, respectively. May U.S. light vehicle sales were up 18 percent year over year, missing Bloomberg consensus estimates.

Industry Update

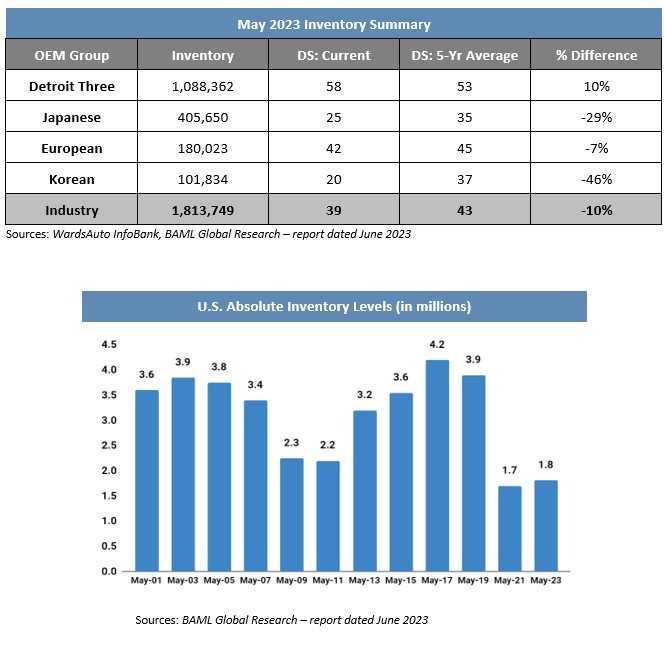

May inventory levels ended at 1.81 million units, a slight increase from last month. Days’ supply (DS) closed at 39, approximately 10 percent below the five-year average and consistent with the last several months of results.

April U.S. light vehicle sales increased approximately 18 percent year over year, missing consensus estimates from Bloomberg. Vehicle mix continues to remain near record levels, trending toward large vehicles, as average transaction prices remain steady but elevated compared to this time last year. Expectations for full year 2023 remain moderate based on continuously growing production cuts, but signs continue to point toward a steeper recovery in 2024.

Industry Focus — Product Roadmap

State governments and auto manufacturers alike have highlighted the end of the decade as a ‘deadline’ for a broader transition to electric vehicles (EVs) in the United States. As EVs currently make up less than 15 percent of the US domestic market share for new vehicles sold, these goals require significant investment in an EV-focused future (see our prior coverage on investment commitments here.)

As automakers’ investment commitments and EV program goals continue to take shape, delineating strategies for new products have become more apparent. Development for alternative powertrain mix and corresponding volume strategies separate domestic manufacturers, while internal combustion engine (ICE) vehicles likely have a long runway with consumer markets. Additionally, foreign manufacturers, while largely committed to a broader EV transition, have development plans that indicate hybrid vehicles are here to stay.

Product Volume vs. Market Volume

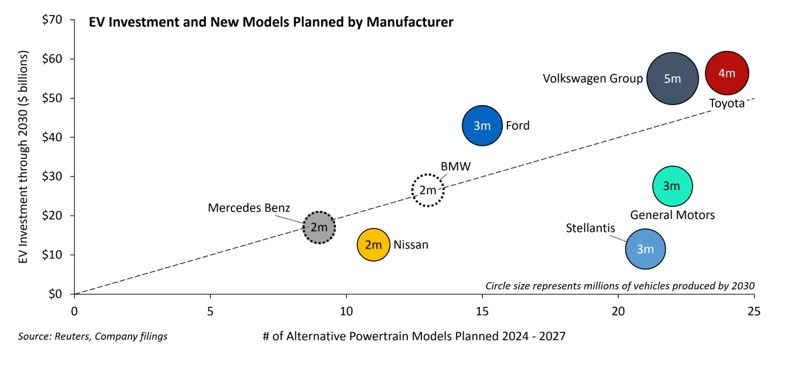

With relatively clear product launch roadmaps for model year 2024 through 2027 defined for most large automakers, two primary strategies are taking shape: a focus on breadth of offering at the cost of higher volumes per model, compared to a narrow range of EVs to simplify development, production and run units at higher volumes.

This split in strategy is notably apparent between Detroit’s Big Three. While GM, Ford, and Stellantis are all targeting production capabilities of three million vehicles by 2030, the focus on breadth of models and investment per model materially differs:

While the strategies for new models are generally reflective of the existing brand strategies, Ford and Volkswagen have implicitly and explicitly stated their intentions to streamline EV production and development, focus on higher volume models and segments, and accelerate their track to profitability with EVs.

ICE is here to stay... for now

In a series of recent announcements, GM signaled it expects to continue production on its most profitable combustion trucks for another 10 to 12 years, representing upwards of tens of billions of dollars in profit. While GM is planning a full switch to zero-emission EVs by 2035, this profitability runway presents a major funding opportunity for the EV transition. This includes new models tentatively planned in 2028 for the highly profitable Suburban / Yukon product lines.

Ford CEO Jim Farley recently suggested a similar track for the Dearborn-based automaker, specifically citing the company’s belief that it would not reach cost parity between ICE and EV vehicles until the early 2030s. While both companies have suggested ICE production will eventually slow down in favor of allocating more production resources to EVs, it’s clear that ICE models will continue to be an important enabler for EV development.

Hybrids remain a key part of the near future... on foreign soil

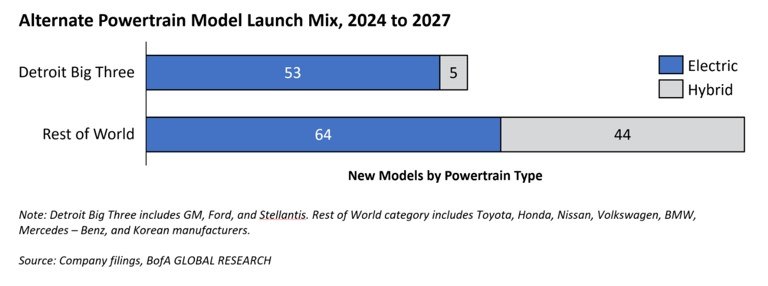

While the U.S. generally trails the rest of the world in EV mix, it lags even further in hybrid technology development and future hybrid model growth. For domestic manufacturers, Ford leads the way planning four hybrid models (with three of four models planned as SUVs) out of 15 total alternate powertrain models. Stellantis plans a single hybrid model in the next four years (under the Alfa Romeo brand), while GM does not have plans for a hybrid model.

Toyota specifically leads the sharp contrast that foreign manufacturers present compared to Detroit’s big three, with 40 percent of its alternative powertrain vehicles planned as hybrid models. The segment has been hugely profitable for the company since it first mass-produced the Prius, and recent announcements from the company indicate this profitability will be used to fund EV-specific development — similar to GM’s and Ford’s approaches with ICE trucks. On average, hybrids represent nearly 25 percent of all new vehicles planned (including ICE) for foreign manufacturers, compared to less than 5 percent for Detroit’s Big Three.

Transaction Activity

Vitesco Technologies is partnering with Rohm Co. to secure its supply for silicon carbide semiconductors through 2030. BorgWarner is acquiring EV charging component manufacturer Eldor Corp., further bolstering the company’s power electronics portfolio. Toyota and Daimler announced joint plans to invest in the Hino / Mitsubishi Fuso trucking venture, hoping to accelerate advanced technologies for commercial vehicles.

See below for additional details on recently announced transactions.

- (6/19) German powertrain supplier Vitesco Technologies announced a long-term agreement with Japanese microchip manufacturer Rohm Co. for more than $1.0 billion in silicon carbide conductors through 2030. Vitesco expects the chips to be integrated into inverters for EV powertrains starting in 2024.

- (6/19) BorgWarner announced plans to acquire Eldor Corp., an Italy-based manufacturer of EV charging components. The share purchase agreement values the deal at approximately $80.0 million. BorgWarner expects the company to generate more than $270.0 million in revenue by 2027.

- (6/1) Toyota and Daimler announced plans to invest equally in newly merged Hino and Mitsubishi Fuso truck makers. The move supports efforts to jointly develop hydrogen, autonomous and electrified technologies for commercial vehicles.

Regulatory Landscape

EPA Emissions Veto: President Joe Biden vetoed a bill approved by Congress that would overturn limits on emissions for heavy-duty trucks. The veto preserves the first updates to EPA restrictions on heavy-duty trucks in nearly two decades, and impacts delivery trucks, motor homes, refuse haulers, transit, tractor trailers and shuttle and school buses.

California Trucking Rules: A group of 19 Republican attorneys general filed legal challenges against California’s plans to require half of all heavy-duty trucks sold in the state to be electric by 2035. The filings argue the state’s proposed rules would decimate the demand for liquid fuels, and the Clean Air Act actively prevents states from responsive action.

Hyundai and Kia Lawsuits: New York City is the latest city to sue Kia and Hyundai over abnormally high rates of car thefts, citing the company’s failure to install industry-standard anti-theft devices. The automakers recently settled a class-action lawsuit related to the same issue for more than $200.0 million.

Stay connected to industry financial indicators and check back in July for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive