Online Shift Impacts Retail Dynamics As Consumers Embrace E-Commerce Platforms Across Retail Categories

• Consumer migration to e-commerce accelerates declining retail profits

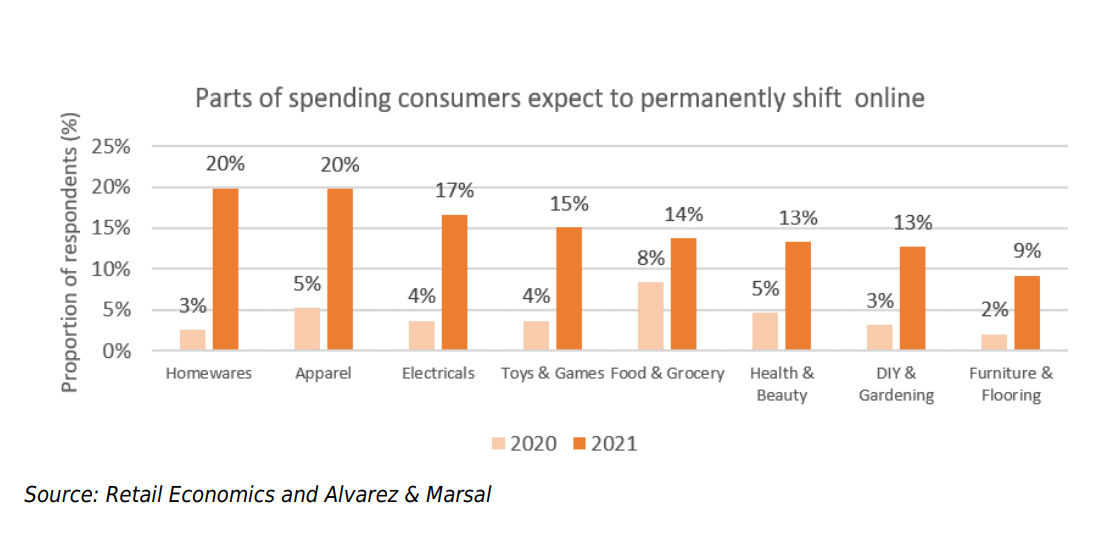

• Consumer behavior across apparel and homewares categories witnessed the greatest change

• Research reveals that businesses need to adopt a more detailed and data-driven approach to profitability

Dubai – A new report titled “The Shape of Retail: The True Cost of Online” by leading global professional services firm Alvarez & Marsal (A&M), in partnership with Retail Economics, noted that the COVID-19 pandemic has accelerated the shift towards online leaving many retailers with a channel-mix bias leaning towards physical stores.

However, COVID-19’s lasting impacts will not be felt equally across all retail categories, with some businesses significantly more vulnerable to pressures on profit margins than others. The research has identified apparel, homewares and electricals as categories which will experience a permanent step-change in consumer behavior stemming from increased online engagement and discovery since the pandemic’s onset.

In contrast, categories such as furniture and jewelry, where online experiences are typically less convenient and traditional in-store shopping is preferred, will most likely return to pre-pandemic conditions, despite some shift in spending.

Sabimir Sabev, Managing Director, Strategy and Performance Improvement, A&M in Dubai, commented, “The trends in the retail sector across the GCC region mirror the trends observed in the European market. Given the recent shift in consumer behavior and spending habits, retailers have focused on strengthening their online presence and using e-commerce platforms to make their products and services more accessible and available.”

“As per the recent analysis by Dubai Chamber of Commerce, the UAE, and Dubai, remain the hub for e-commerce growth in the MENA region. E-commerce has been predominant during the Covid-19 outbreak and many retailers have put much effort into building, improving and promoting their online shops.”

As widely noted, Majid Al Futtaim has placed some products by household retailers on its Carrefour shopping marketplace. Similarly, Emaar Malls has also supported its tenants at Dubai malls on Namshi and Noon.com.”

According to a recent analysis by Dubai Chamber, the value of the UAE retail e-commerce market hit record $3.9 billion in 2020, reflecting a 53 percent year-on-year increase driven by the Covid-19-led digital shift.

Consumer expectations to permanently spend online across different product categories

Evolution to online places increasing pressure on retailers

As retailers attempt to capture online market share, many will undergo a period of transition where profit margins come under intense pressure.

Online-only retailers typically operate on considerably lower margins than multi-channel and bricks-and-mortar business models, with analysis showing average pre-tax profit margins for pure online retailers across Europe residing at 1.4 percent, compared with 5.4 percent for the total industry. More competition and a greater use of online channels across the entire market will inevitably see these challenges intensify, particularly in categories like apparel where a greater proportion of spend will migrate.

The volume of online returns will likely drive further profit erosion for retailers. As store visits decrease, left unchecked, rising levels of online returns could create increasingly complex and fragmented logistics channels in efforts to cater to customer expectations for fast and efficient service. This scenario becomes more concerning given younger shoppers are almost twice as likely to return goods than their older counterparts.

Erin Brookes, Managing Director and Head of Retail and Consumer, Europe, A&M, said: “As digital becomes more critical across every stage of the customer journey, retailers face a make-or-break moment to prevent profits from spiraling downwards. There is no going back. Retailers must acknowledge changing consumer behavior and respond appropriately.

“This includes successfully transitioning away from some physical stores and re-imagining the purpose of others. Investments in efficient online operating models such as reverse logistics, strategic partnerships and intelligent data and technology are essential.”

Thriving in a digital-first environment

The study highlights that with retail industry transformation, businesses need to adopt a more detailed and data-driven approach to profitability. The shift towards online will exert greatest pressure on store-dependent operating models, requiring businesses to align with more digital-centric customer journeys.

For retailers, the priority of protecting margins and improving operational performance will mean utilizing data to gain improved visibility on ecommerce profit and loss. Retail strategies will vary widely depending upon factors such as category, customer demographics and the maturity of online propositions.

Irrespective of the nuances across operations, successful companies will quickly deploy effective margin improvement strategies targeted at the largest cost drivers underpinning the digital switch. For most retailers, these center around digital marketing, supply chain optimization and channel-mix management.

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 5,400 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators and industry authorities with a shared commitment to telling clients what’s really needed for turning change into a strategic business asset, managing risk and unlocking value at every stage of growth.

To learn more, visit: AlvarezandMarsal.com. Follow A&M on LinkedIn, Twitter, and Facebook.

###

CONTACT:

Kiran Makhija/ Prerna Agarwal, +971 55 471 0294/ +971 52 787 3189, Hanover Middle East

Sandra Sokoloff, Senior Director of Global Public Relations, Alvarez & Marsal, +1 212-763-9853