European Commission amendments to the Temporary State Aid Framework

The use of temporary state aid measures by EU member states: Balancing the economic impact of COVID-19 whilst maintaining level playing field

As the European Commission (EC) decides to extend and slightly amend the Temporary State Aid Framework in response to requests from member states, A&M Economics has taken a brief look at the temporary flexibilities afforded and how they have been taken up by member states.

Recap on the temporary state aid framework

State Aid is defined in Article 107(1) TFEU. The EC has defined COVID-19 as an exceptional occurrence and has put in place four temporary amendments to the state aid framework, Article 107(3). These temporary amendments recognise that the entire EU economy is experiencing a serious disturbance and enables Member States to use the “full flexibility foreseen under State aid rules” while limiting negative consequences to the level playing field. These aim to:

- Ensure that sufficient liquidity remains available to businesses of all types to preserve the continuity of economic activity during and after the COVID-19 outbreak.

- Enable targeted support to otherwise viable companies that have entered into financial difficulty as a result of the coronavirus outbreak.

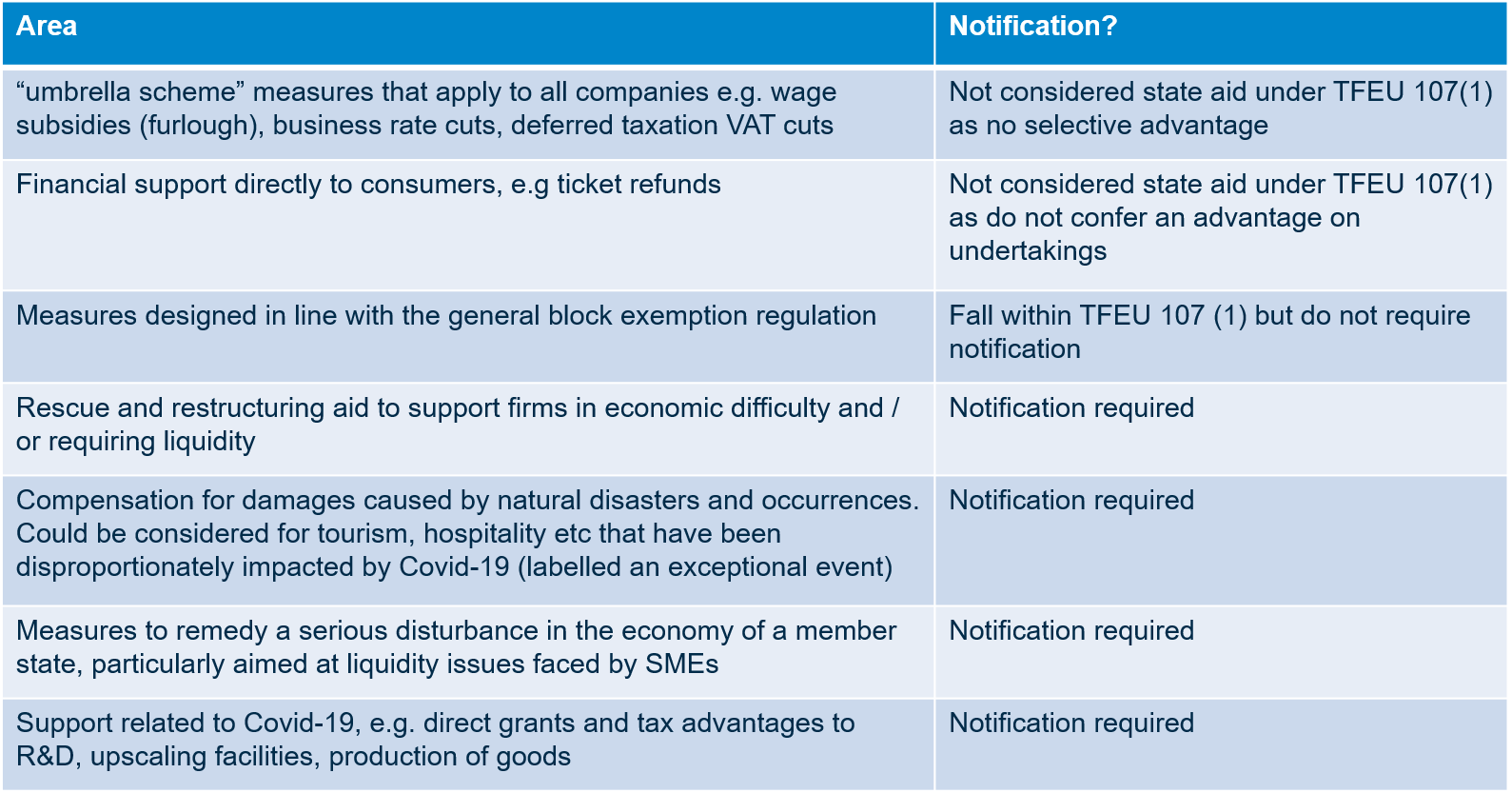

Many potential measures do not fall under State Aid control rules or are exempted and could therefore be put in place by Member States immediately, without prior notification to the Commission (see appendix 1 for details of each amendment).

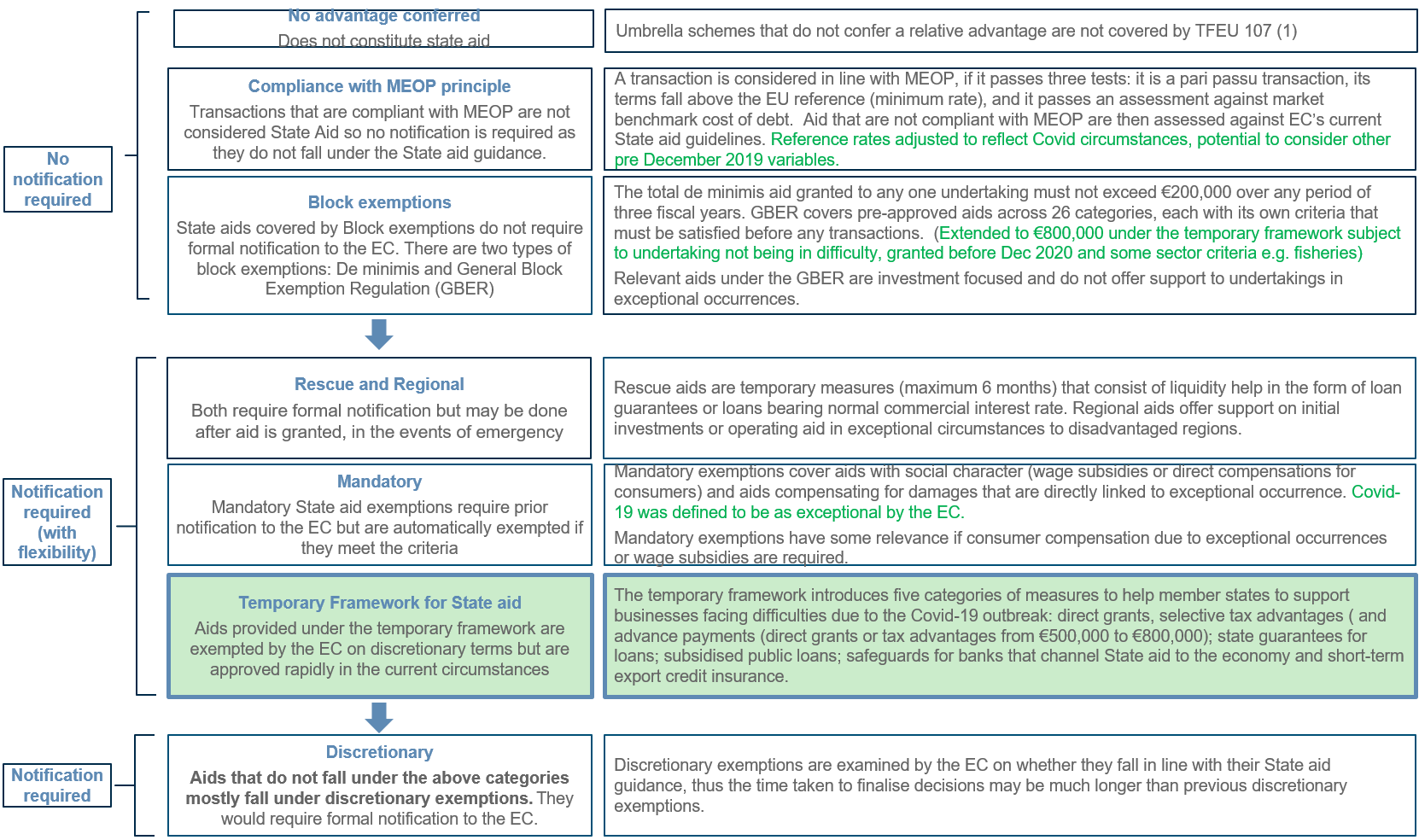

Options available to public bodies

The temporary framework amendments increase the range of options available to public bodies to provide support to companies during the period up to 30 June 2021, with the exception of recapitalisation measures that are extended to 30 September 2021.

Aid options available to public bodies and notification requirement

Source: A&M analysis. Green text and shading refers to temporary framework amendments

Actions taken by European countries

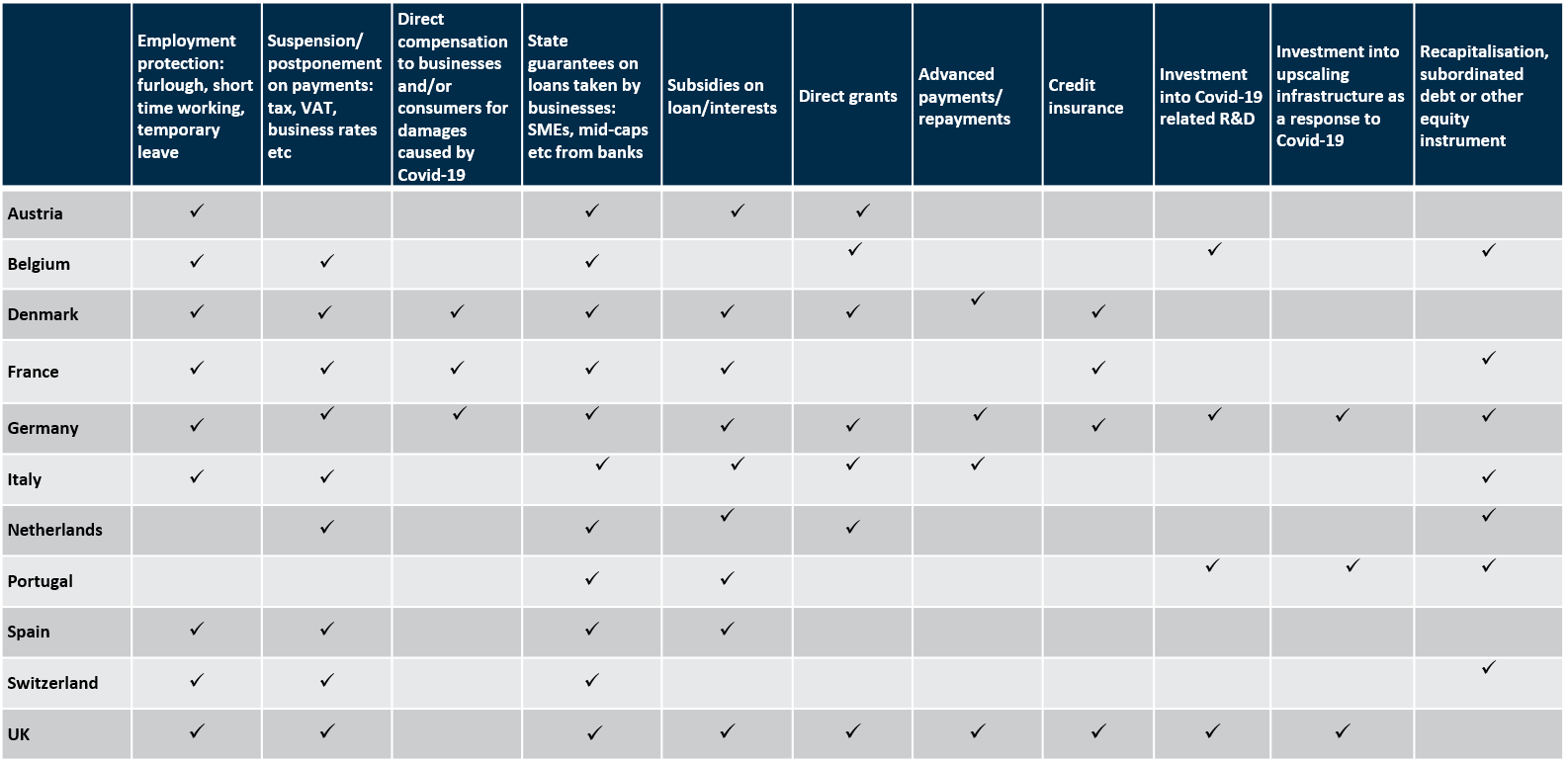

Most EC countries have now launched umbrella schemes that apply economy-wide or are directed to businesses based upon their size.

Schemes launched in a selection of EU countries

Source: A&M analysis based on information published by EC and individual government websites, 30th September 2020

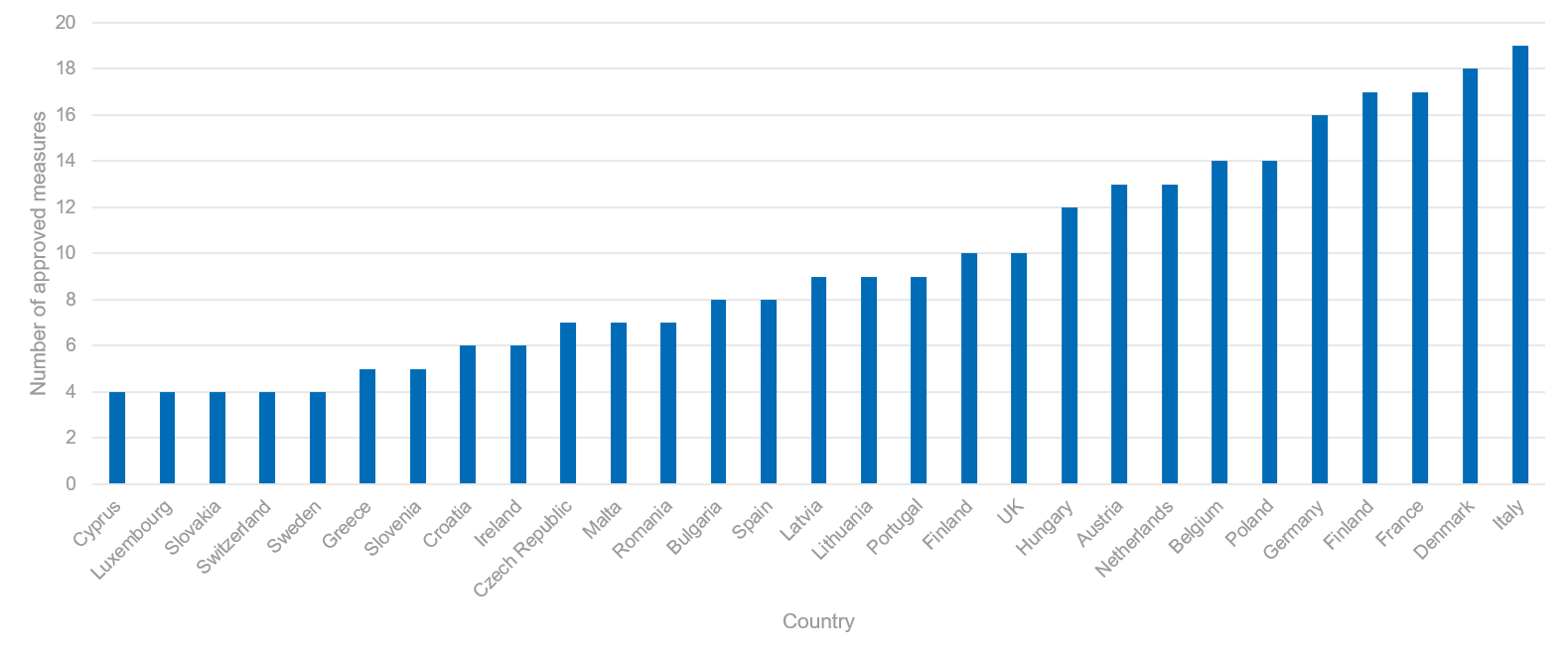

As at end September 2020, there has been a total of 279 approved State Aid schemes under the Temporary Framework and the amended Frameworks.

Temporary Framework State aid approved schemes by country

Source: A&M analysis based on information published by EC, 30th September 2020

The larger Member States, Germany, France and Italy, have notified the EC of more measures. Countries with the highest spending powers, including Germany and Denmark, have implemented considerably more schemes than some of the Southern countries.

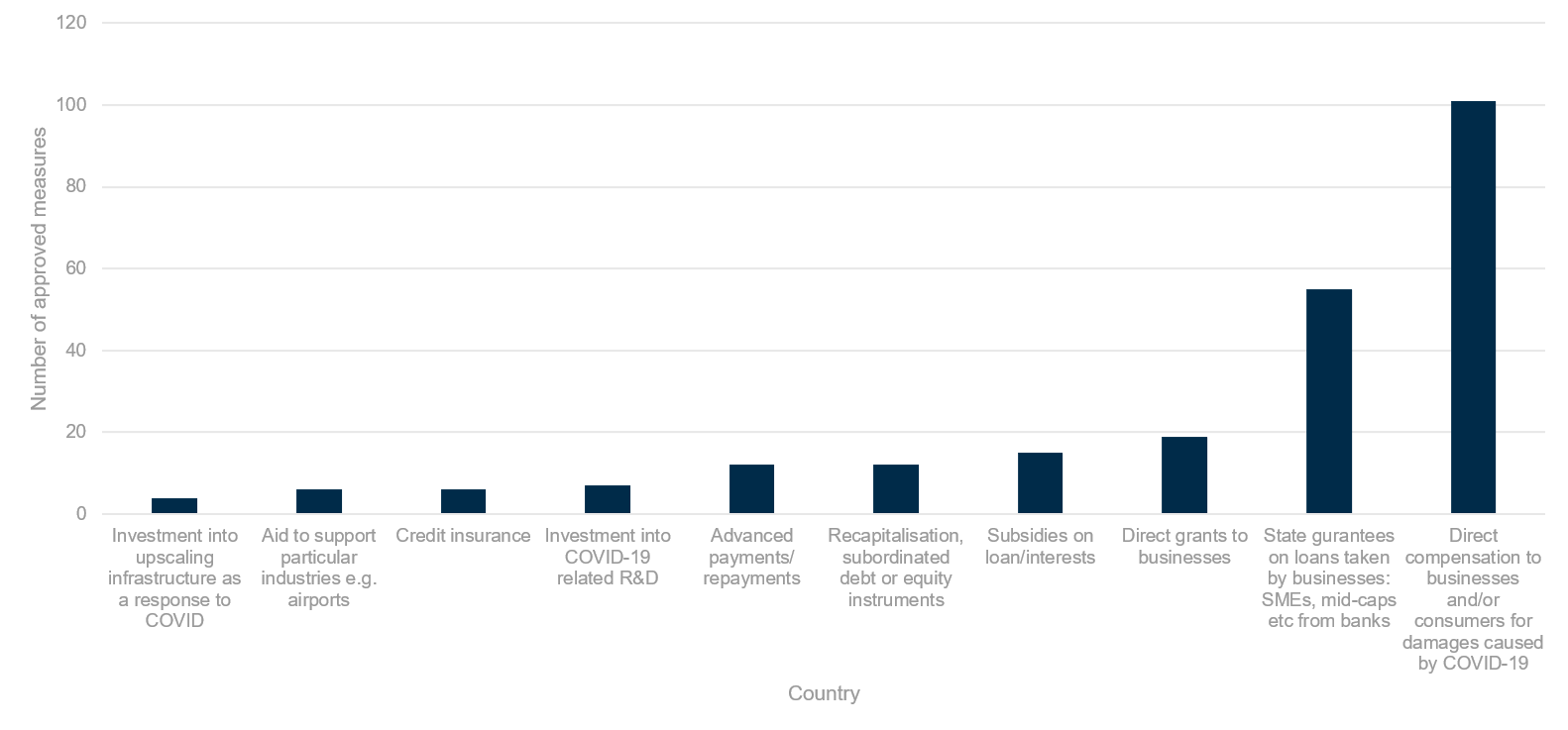

Most of the support measures are in the form of State guarantees on loans taken by companies from banks and direct grants (maximum of EUR 800,000).

Recapitalisation measures include support to airlines, including Air France and Lufthansa. These are the only known cases so far to have imposed green conditions on their support measures.

Most Member States have used targeted measures to support specific industries and companies, and geographical regions alongside their umbrella schemes. The travel and tourism industry has seen support across a wide number of member states, reflective of the impact the pandemic is having on this sector. Ten member states have provided support to airlines with a total aid value to date of over €25 billion. Putting into context, this is just below the annual GDP of Estonia. Similarly, there have been a number of schemes to support R&D related to COVID-19.

Examples of industry and company-specific aid, which demonstrates the range of support being offered, include:

- €84 million Austrian regional aid schemes to support companies and investment in research, development, testing and production of coronavirus relevant products in the regions of Carinthia, Styria, Tyrol, Upper Austria and Vienna;

- €290 million loan and an equity injection to support Brussels Airlines;

- €35 million Belgian scheme to support companies active in the potato and floricultural primary production sectors;

- €130 million granting tax deferrals and comparable measures to ease liquidity constraints of Danish SMEs;

- €26 million direct grant scheme to youth hostels, school country homes, youth education centres and family holiday centres in Bavaria.

Approvals by type of measure

Note: This is the number of measures approved and not the value of support

Source: A&M analysis based on information from EC, 30th September 2020

To 30 September the number of approvals may be lower than perhaps expected. However, this does not include investments by public bodies that conform to the Market Economy Operator Principle (MEOP) and are therefore not considered to be State aid or under exemptions and so will underestimate the true level of public body investment in companies.

Extension of the temporary framework

The EC has recently (12 October 2020) announced an extension to the temporary framework. However, there was not unilateral support from member states to an extension. Concerns have been expressed around achieving a balance between supporting businesses through the COVID pandemic, without unduly impacting the level playing field.

- Unequal use of aid by member states

One concern is on the perceived unequal use of aid by Member States, with Germany accounting for the largest number of Covid-19 State aid approvals made so far by the EC.

The EC sought to address this by establishing an EU Recovery Fund, with a total budget of 750 billion euro, set up with the aim of plugging the gap in spending power between Member States. Furthermore, historically member states have had different appetites towards state aid. For example, in 2018, the UK spent 0.38% of GDP on state aid, compared with 0.79% in France, 1.45% in Germany and 1.55% in Denmark.

Any extension might put pressure on Member States to provide further support when they may not have done so otherwise and this might put firms and industries in fiscally weaker States, that are unable to afford to offer ongoing support, at a disadvantage. Without a substantial expansion of the EU Recovery Fund this could create an imbalance within Europe and weaken the union.

- Driving out of efficient firms

Another concern relates to market efficiency with the risk that beneficiaries of equity support become “artificially” more competitive in their market to drive out other equally or more efficient rival companies.

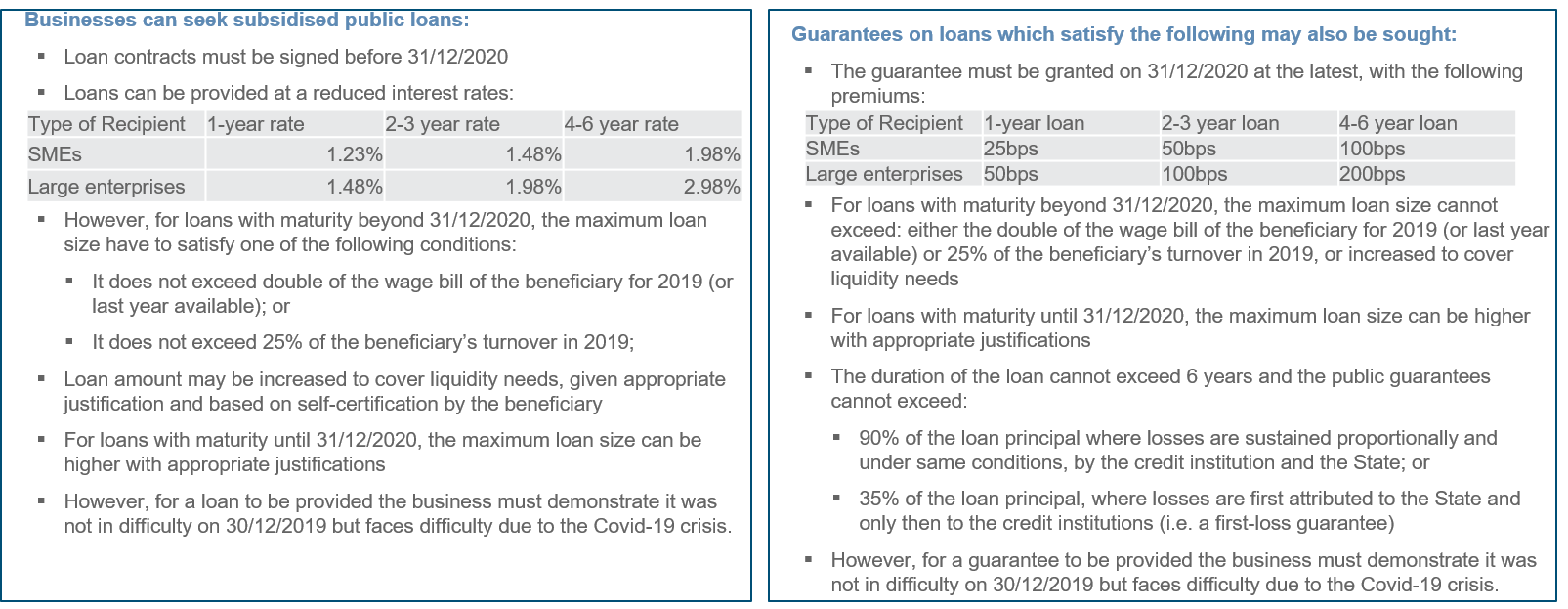

The EC has attempted to address these concerns by imposing strict conditions on commercial behaviour of beneficiaries and by linking the size of subsidised loans or guarantees made to businesses to the scale of their economic activity (by reference to the firm’s wage bill, turnover, or liquidity needs, for example) and to the use of the public support for working or investment capital.

However, there have been concerns that these conditions may have also contributed to inefficiencies, for example, by restricting the ability of private equity-backed firms and others with particular financing structures from accessing support on “financial difficulty” grounds.

- Unequitable access to aid measures

Many of the aid measures are channelled to firms through financial intermediaries (e.g. banks) and often through a subset of these. This has resulted in some firms not being able to access aid on a timely basis.

For example, many banks in the UK were slow to roll out State guarantee lending programmes. Those firms who were not existing customers of participating institutions found, in some cases, they were unable to access aid measures through new institutions who initially focussed on existing customers and then as a result of not having a financial history with them. This seemed to particularly impact foreign owned firms and may have, therefore conferred a relative advantage to domestic firms and undermined the single market approach.

- Moving the goal posts

As time moves on it becomes increasingly difficult to identify factors related to the ‘exceptional occurrence’ of COVID-19 from other developments in the market and from the longer-term wider structural changes that may make business unviable, complicating the State aid approvals process. It may increasingly become desirable to tailor support to adaptation to the new normal rather than the preservation of defunct business models.

Application to the UK

The application of the State Aid Framework to the UK after the end of the transition period has been the subject of debate. Broadly, the EU has said it will only grant tariff-free access to the single market if the UK respects European standards on environmental protection, workers’ rights and State Aid (to prevent British firms undercutting their European rivals). The UK Government argues any agreement to tie the UK to EU rules in perpetuity defeats the purpose of Brexit.

A compromise agreement has been suggested that would involve a “toolbox” approach for the UK whilst the potential Internal Market Bill also has implications.

Signing up to state aid rules and ensuring reciprocity from EU states could benefit the UK, as some EU states tend to be more “protectionist” than the UK traditionally and any rules might be expected to impose a greater restraint on those countries than the UK.

How can A&M’s Economic services team help?

Whilst the temporary framework opens the possibilities for government funding, some forms of support remain State Aid and will be treated by the EC and national courts accordingly. A&M Economics advises corporates and governments on opportunities for government support, potential state aid risks and mitigations.

Please get in touch with Schellion Horn to discuss any of the opportunities highlighted in this article.

Appendix 1: State aid amendments

Amendment 1 (3 April 2020) aimed at increasing possibilities for public support to research, testing and production of products relevant to fight the coronavirus outbreak as well as measures to protect jobs and to further support the economy.

Broad areas of options available after Amendment 1

Amendment 2 (8 May 2020) introduced recapitalisation and sub-ordinated debt measures, only applicable to companies not in financial difficulties as at 31st Dec 2019, with the encouragement of attaching green and digital conditions to support measures.

Safeguards were added to prevent undue distortion of competition. For example: the beneficiaries of recapitalisation measures will face: (i) ban on dividends and bonuses until the State is fully bought out; and (ii) acquisition ban for as long as the at least 75% of the State’s recapitalisation measures have not been redeemed and; (iii) advertising restrictions as beneficiaries cannot advertise the support for commercial purposes.

Amendment 2, subsidised loans and loan guarantees

Amendment 3 (29 June 2020) enables Member States to provide public support under the Temporary Framework to all micro and small companies, even if they were already in financial difficulty on 31 December 2019. It provides incentives for private investors to participate in coronavirus-related recapitalisation aid measures.

Through Amendment 3, the EC recognised the important contribution of small and micro enterprises in the EU (generating more than 37% of value added and 50% of employment in non-financial sectors) but that they may have fallen foul of the ‘undertaking in difficulty’ rules for technical reasons or due to sector-specific financing arrangements.

With this Amendment, the EC has clarified that aid should not be conditioned on the relocation of the production activity of the beneficiary from another country within the European Economic Area (EEA) to the territory of the Member State granting the aid.

Amendment 4 (12th October 2020) built in a further extension of three months, to September 2021, for the recapitalization measures. This is because states taking stakes in companies is often a complex exercise and takes longer to implement.

Secondly, the EC increased the level of support allowed to cover fixed costs that are not covered by corporate revenues. This is now set at a maximum amount of 3 million euros per company, instead of 2 million.