Alvarez & Marsal Releases First Ever KSA Banking Pulse Report to Assess Performance of Nation's Top Banks

Riyadh, Kingdom of Saudi Arabia – Leading global professional services firm Alvarez & Marsal (A&M) released its first ever edition of the KSA Banking Pulse today. The report reveals that the top banks in Saudi Arabia showed mixed performance in Q1 2020 as improved operating efficiency and lower provisioning was offset by the effect of reduced interest rates.

Despite the outbreak of COVID-19, the performance of KSA banks in terms of L&A growth has been encouraging as it grew by +4.9% QoQ in Q1’20. Profitability has also improved with RoE increasing to 12.5% in the first quarter of the year, as increased operating efficiency and lower provisioning helped in negating the effect of lower operating income. Total operating income fell 1.6% QoQ, as net interest income (NII) decreased 3.9% QoQ. Following the Q1’20 results major banks have also reduced their FY’20 guidance acknowledging the tough market conditions.

Alvarez & Marsal’s KSA Banking Pulse examines the data of the 10 largest listed banks in the KSA, comparing the first quarter of 2020 (Q1 2020) against the previous quarter (Q4 2019).

The prevailing trends identified for Q1 2020 are as follows:

1. Loans & advances (L&A) and deposits of the top ten banks in Saudi Arabia increased even with tough macroeconomic conditions. Despite the lockdown measures announced towards the end of Q1’20, L&A and deposits increased 4.9% QoQ and 1.5% QoQ, respectively. L&A growth was higher compared to the preceding quarter (3.2%), however, deposit growth was relatively lower (4.8%). Consequently, net loans to deposit ratio increased to 86.0% from 83.2%.

2. Decline in net interest income weighed on operating income. Total operating income fell 1.6% QoQ, as net interest income (NII) decreased 3.9% QoQ. NII dropped as low interest rates more than offset an increase in L&A. However, this was partially offset by an increase in non-interest income, which grew by ~7%. Non-interest income increased as certain banks reported strong trading income during the quarter.

3. Low interest rates weighed on NIM. Aggregate NIM fell by ~25 bps to 3.20% in Q1’20, largely on account of a 59-bps decline in yield on credit. NIM were at multi-period low levels in Q1’20, with almost all banks reporting decline in their NIM.

4. Cost-to-income ratio improved after rising in the previous quarter. Cost-to-income (C/I) ratio fell to 35.1% in Q1’20, compared to 37.4% in Q4’19. Total operating expenses for the coverage banks dropped 7.7%, on the back of cost efficiency measures. Six of the ten banks reported a decline in their C/I ratio.

5. Provisioning decreased on a sequential basis, but increased substantially annually. Total provisioning fell by 21.8% QoQ. However, NPL / net loans ratio increased from 1.8% in Q4’19 to 1.9% in Q1’20. Cost of risk decreased from 1.09% in Q4’19 to 0.82% in Q1’20. However, coverage ratio declined for the fourth consecutive quarter to reach 147.8%.

6. Profitability improved as cost efficiency measures and reduced provisioning helped in offsetting the effect of reduced interest rates. Net income increased 13.1% QoQ, as decline in operating expenses and provisioning more than offset a drop in total operating income. Consequently, RoE increased from 11.1% in Q4’19 to 12.5% in Q1’20.

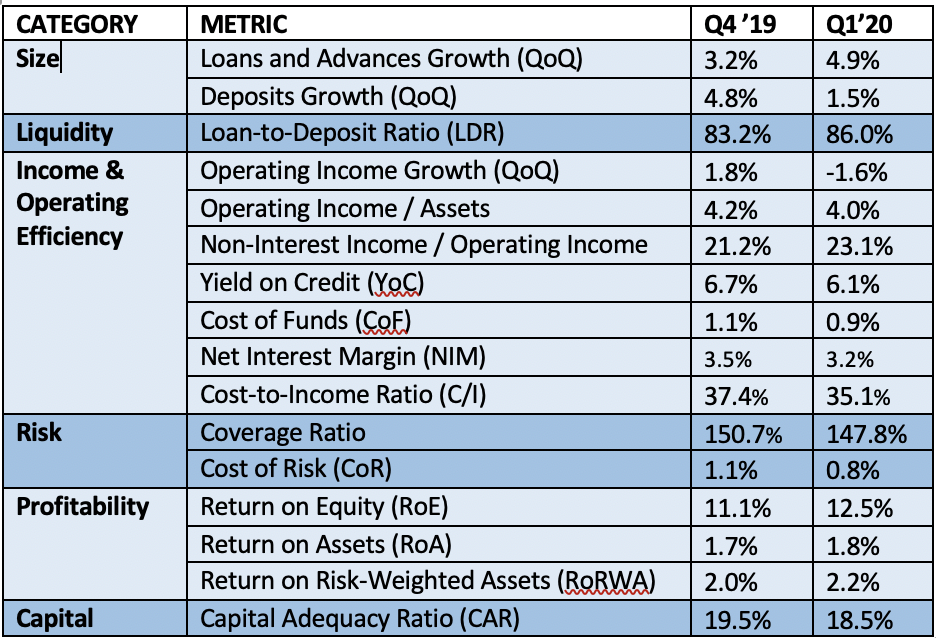

Alvarez & Marsal’s report uses independently sourced published market data and 16 different metrics to assess banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability and capital. The country’s 10 largest listed banks analysed in A&M’s KSA Banking Pulse are National Commercial Bank (NCB), Al Rajhi Bank, Riyad Bank, Samba Financial Group, Saudi British Bank, Banque Saudi Fransi, Arab National Bank, Alinma Bank, Saudi Investment Bank and Bank Al Jazira.

OVERVIEW

The table below sets out the key metrics:

Source: Financial statements, investor presentations, A&M analysis

Dr. Saeeda Jaffar, A&M Managing Director and Head of Middle East, said, “We are delighted to launch the first edition of the KSA banking pulse report; this comes at an especially important time as the banking sector, and wider business community, look to better understand the effects of Covid-19 on the performance of the Kingdom’s biggest banks. We have seen that profitability of the top KSA banks in Q1’20 showed substantial improvement.”

Asad Ahmed, A&M Managing Director, said, “The sector is likely to face a challenging environment due to Covid-19 headwinds. With oil prices dropping, austerity measures from the government are likely to delay major projects and impact demand in the economy. Thus, we expect loan growth to remain limited, while low interest rate regime coupled with a possible increase in provisioning will impact profitability. In the medium to long term, banks are likely to focus more on rationalizing their costs to hedge against the uncertain conditions.”

###

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) when conventional approaches are not enough to drive change and achieve results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services.

With over 4,500 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, help organizations transform operations, catapult growth and accelerate results through decisive action. Comprised of experienced operators, world-class consultants, former regulators and industry authorities, A&M leverages its restructuring heritage to turn change into a strategic business asset, manage risk and unlock value at every stage of growth.

To learn more, visit www.alvarezandmarsal.com. Follow A&M on LinkedIn, Facebook and Twitter.

CONTACT:

Kiran Makhija, Hanover Middle East, +971 5547 10294

Sandra Sokoloff, Senior Director of Global Public Relations, Alvarez & Marsal, +1 212 763 9853