Illiquidity vs. Volatility: The Tale of Two Market Downturns

By now many articles have been written about the stress in the markets and in homes created by COVID-19 and the economic disruption. In today’s 24-hour news cycle, bad news must sell better than good news as we are inundated with negativity. With all the doom and gloom around us, I wanted to take a moment to share some positive news related to the markets and contrast that with the market downturn in 2008. The current environment although volatile is very different than what occurred in 2008. The current market seems distressed, but on great volume and is so far orderly. This has so far allowed valuation professionals to use market inputs to fair value financial instruments and that is a bit of good news.

Click here to download a PDF version of the article.

By now many articles have been written about the stress in the markets and in homes created by COVID 19 and the resulting economic disruption. In today’s 24-hour news cycle, bad news sells better than good news as we are inundated with negativity. With all the doom and gloom around us, I wanted to take a moment to share some positive news related to the markets and contrast that with the market downturn in 2008. The current environment although volatile is very different than what occurred in 2008. The current market seems distressed, but on great volume and is so far orderly. This has so far allowed valuation professionals to use market inputs to fair value financial instruments and that is a bit of good news.

We have provided our quarterly valuations for March 31, 2020 and accounted for the economic distress to the best of our abilities. We had functioning equity, credit, and derivative markets to guide us in providing fair value for financial instruments. In 2008, some financial markets became illiquid due to capital constraints on the key provider of liquidity, the banks. The trigger for the 2008 market downturn was financial institutions’ exposure to risky mortgage backed securities with a housing market that was overbought relative to earnings potential. This required the financial institutions to hold capital to cover for the losses related to these instruments. With capital being conserved the derivative markets and auction markets found trading limited. Credit was an unknown because if Lehman can go under who is safe from a credit standpoint. The confluence of capital conservation and concern about credit caused certain financial markets in 2008 to be distressed and inactive.

This distress due to illiquidity led to guidance that allowed for fair value measurements to account for inactive markets. The FASB issued FSP 157-3 and 157-4 during the 2008 financial crisis to allow for fair value measurements to consider other valuation techniques in the case of distressed or inactive markets that do not represent an orderly transaction. It is important to note that the FASB did not suggest that using a longer hold view was appropriate, but instead required other valuation techniques that considered market evidence for a value at the measurement date.

We have heard anecdotally this guidance was considered in the quarter ending March 31, 2020. We found, that for most instruments being valued, sufficient liquidity was available to support our valuations. We did not experience a significant increase in valuations requiring disclosure for significant inputs that are not transparent as level 3 under ASC 820 (“level 3 valuations”). In 2008, the markets were inactive and required an increase in new approaches and level 3 valuations techniques. In this market downturn in 2020, the distress is not impacting bank’s capital as severely. In fact, the Federal Reserve is making an unprecedented amount of capital available. The impact to the financial system has been on a more human level as the hub of the US financial markets, New York City has been shut down. What we have found is that financial institutions were willing to transact in their pajamas. This allowed for continued liquidity and active markets.

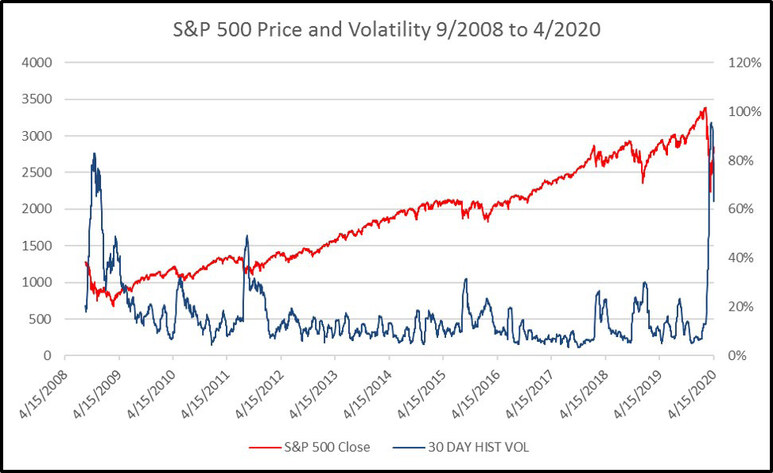

The impact of this downturn affected corporations, businesses, and people more than financial institutions. This of course impacts financial institutions as well. But the impact was not so severe that liquidity was an issue. The key financial instrument impact of COVID-19 is volatility. Note the difference in volatility between 2008 and 2020.

The good news for valuation professionals is that we can handle liquid and volatile markets like we have today. We may have to consider how we utilized volatility in our models due to steep surfaces, smiles, and skews. Providing fair value estimates for financial instruments giving consideration to the models and volatility is interesting and possible in active markets. Inactive markets and illiquidity, as occurred in 2008, made it much more difficult to ascertain fair value for financial instruments and was a different story.