Part I - Scaling up Corporate Governance is a Must for a Successful Capital Raise

The primary focus for any young private business or a startup is growth – how to capture market share and a critical mass of customers at the earliest stage possible. Accordingly, its entire business eco-system is geared towards agility, flexibility and speed in decision making, and hence the management and employees enjoy a great deal of autonomy. To ensure survival and liquidity, these companies are generally judicious in controlling spends and budgets. Further, the management structures are simpler and smaller which allows for transparent flow of information to young private business having an elaborate system of corporate governance.

However, as the business begins to grow and thinks about raising capital either from private equity players or through an IPO, it must start implementing a broader corporate governance framework.

Effective corporate governance at the time of capital raise offers several benefits. It prepares the company to meet the upcoming regulatory requirements mandated by investors or regulators. It also ensures a smooth transition and functioning of the owners’s new role. Exactly for these reasons, most of the corporate governance conventions in large companies do not apply to a start-up. Typically, we don’t see many start-ups with corporate governance processes until after an IPO. However, companies need to know that private equity investors take a favorable view of such company preparations, due to the implied absence of the “lemons problem” (the lack of transparency such a company offers into the affairs of the business). Further, a number of private equity players raise capital from institutional investors that believe in the philosophy of “responsible investing” and insist on deploying their funds in businesses that are managed ethically and responsibly. An effective corporate governance system strengthens investors’ confidence at the time of due diligence and also makes the due diligence process efficient and less expensive.

3 Key Building Blocks Required for Strong Corporate Governance Framework

In this paper, we will discuss the various components of an effective corporate governance program that a business should consider prior to a capital raise from a private equity player or through an IPO. In our view, private equity players are increasingly demanding strong corporate governance systems in line with that required by regulators.

We studied research conducted by the Corporate Governance Research Institute of the Stanford Graduate School Business[1] on 47 companies that successfully completed an IPO between 2010 and 2018 (“Stanford Study”). This research analyzed the evolution of corporate governance in these companies from their inception until they went public. While the pre-IPO corporate governance in these businesses varies, there are certain common principles that emerged. Based on this research and our experience, the businesses that should start implementing corporate governance frameworks are those that are VC-backed, demonstrate at least three to five years of successful revenue growth, acquired a critical revenue mass and are moving to a large employee base.

A typical pre-capital raise company will likely lack many of the features that are essential for a comprehensive corporate governance program. Its board of directors would comprise primarily of insiders – founders, investors, management teams and friends of the founders / investors. It would not have independent directors or formal audit committees. It will likely lack complete financial and operational internal control systems.

This Stanford Study found that 83 percent of the companies that developed a corporate governance system do so as part of their plan to go public and do not consider it essential if the company intends to remain private.

Hence, as the business acquires scale and intends to go public or use public money through large private equity funds (who deploy public money for e.g. pension funds) the founders and the investors need to start implementing an effective corporate governance system. Such a system may be implemented gradually rather than all at once.

The Stanford Study also found that while some of the practices required for corporate governance do exist, these are primarily to satisfy the investors, shareholders or because these are the “right things to do.” Such practices do not meet the rigor required by the regulators like the SEC.

The essential building blocks of an effective corporate governance framework are:

1. Board of Directors

The primary pillar of an effective corporate governance framework is to have an independent minded board of directors to oversee the management of the business and protect and further the interests of stakeholders. In order to perform their function effectively, it is imperative that not only the board composition and structure are appropriate, it should also be empowered to make critical decisions based on insightful information provided by the management. There is an urgent need to remove information asymmetry between the management and the board. While board effectiveness is a very complicated and broad area of discussion, some principles relevant from a corporate governance perspective are:

Independent Directors

As a business matures and seeks to implement corporate governance, it must appoint external independent directors that bring the necessary domain expertise as well as experience and wisdom.

As per the Organisation for Economic Co-operation and Development (OECD) Corporate Governance handbook 2019, almost all country jurisdictions require or recommend a minimum number or ratio of independent directors. Definitions of independent directors have also been evolving - 80 percent of jurisdictions now require directors to be independent of significant shareholders in order to be classified as independent, up from 64 percent in 2015.

Businesses can recruit the initial independent directors through the personal network of founders or investors. As the business scales, such recruitment may happen through professional recruitment agencies as well.

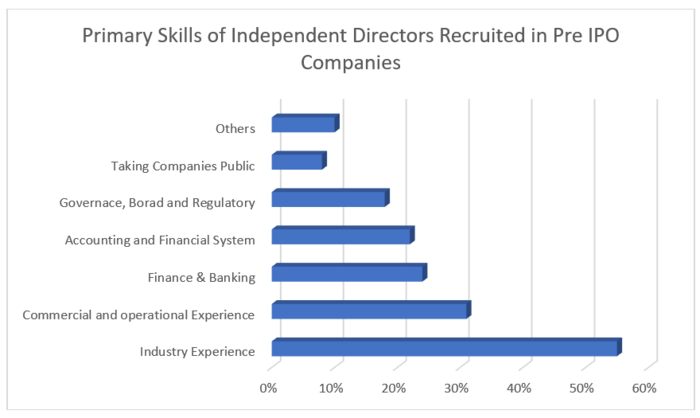

According to the research on the pre-IPO companies that went public, approximately 50 percnet started onboarding independent directors at least three years prior to the IPO. Further, most of the companies added an average of three independent directors. These directors had a wide array of skills for which they were hired. The research describes the distribution of the skills of the directors, as the graph indicates below.

Information Architecture

Information received by the board should be designed in such a way that it empowers them to make fully informed decisions. The information architecture should be such that it eliminates the information asymmetry between the management and the board. Since the board has only a limited access to the day-to-day activities of the business, they may have a less-complete understanding of the complexities faced by the business. The information they receive is generally in the form of presentations and reports. At times, such information may be scripted. Such dynamics may prevent the board from making good decisions on behalf of the shareholders / investors. Hence, the board should have systematic access to most relevant information and analysis of issues facing the business.

In certain situations, a good practice is to enable the board members to sit through select executive meetings, as an observer. This will provide the board members additional insights into the business for effective decision making. Further, the board may demand additional insightful and analysis-focused reports to support the presentations made by management.

Board Structure and Process

How a board is structured contributes greatly to its performance. While independence is crucial, a structured access to the right individual and information can greatly aid in enabling it to make the right decisions.

From a corporate governance standpoint, having a strong audit committee is crucial. According to the OECD Corporate Governance Handbook 2019, nearly all country jurisdictions require an independent audit committee. As such, the board should have a dedicated audit committee that should be managed by independent directors with skills and experience in corporate governance and financial management. The internal audit department should report directly to the audit committee. Even the CFO should have a dotted line to the audit committee, so far as the audit matters are concerned. The audit committee should have the overall oversight on all corporate governance related issues like internal audits, internal controls, processes, systems and investigations into fraud and reported violations.

Another key aspect is of an independent board evaluation of the functioning of the audit committee. A poor evaluation may lead to governance failure, and hence, the boards should engage in internal assessment or external assessment of the functioning of the audit committee, in terms of their roles, dynamics and their members’ performance. The larger board should put in place a robust and periodic evaluation criteria for the functioning of the audit committee. Such an evaluation can be conducted internally or externally. This evaluation criteria should be in writing and shared with the audit committee. The results of the evaluation should be reviewed by the board periodically.

Board dynamics is another critical aspect that can lead to failure of corporate governance despite board independence and strong processes. Poor board dynamics, often, are due to a poor board culture. Low energy boards, busy boards, sleepy boards and love boards[2] are examples of break downs in board dynamics which hinders their performance. Dysfunctional dynamics can also be employed deliberately at times, to set up the board for failure. Late distribution of information and not providing relevant information are examples of such tactics. Sometimes the board is appointed by the founder or the CEO who is circumscribed by their relationships. Director / management relationships are also crucial in an effective function. Disputes between them or a breakdown of communication among them is highly disruptive to the boards functioning.

In order to avoid the pitfalls of dysfunctional or poor board dynamics, the role of the chairman is critical. The board should appoint a chairman who should be able to minimize such rivalries and disputes by adopting and setting the right culture. Such a culture can be formalized in writing to enable sharing with a larger board.

2. Financial and Internal Control Systems

Young private companies normally do not invest significantly in developing strong and rigorous financial and control systems. They look at these systems purely from a perspective of aiding the operations and generating financial statements that are needed to file with the authorities.

One of the most important decisions to be made by such businesses is to hire a professional CFO who will eventually take the company public or help in raising capital. As noted in the Stanford Study, the companies that went public hired such a CFO approximately three years before going public. Such a CFO should have the experience in setting up and managing corporate governance in other public companies and he or she should be willing to bring in the right skill set from outside.

As the business prepares itself for going public or raising private equity money, it needs to start scaling up or implementing the below mentioned processes:

- Implement a rigorous financial accounting system (ERP) in place that integrates various functions to generate a consolidated view of the business;

- Implement a robust internal control system commensurate with the changing size of its operations;

- Hire an internal audit head to oversee the financial and operational control as well as put in place a system of internal audit;

- Appoint an established audit firm with the right skill and resources to audit the financial statements of the business. As per the Stanford Study, 77 percent of the companies had a Big Four audit firm as its external auditor at the time of IPO.

3. Ethics & Regulatory Compliance

The company may also consider appointing a general counsel to manage the various aspects related to regulatory compliances and ethical conduct of the business. In addition to managing the legal and regulatory matters in-house, the general counsel should also manage the ethics and compliance function. These aspects include the development of a robust whistle blower mechanism, and a business code of conduct, as well as managing and supervising ethical violations and other misconduct.

As indicated in the research, approximately 50 percent of the pre-IPO companies hired a general counsel two years prior to the IPO. However, it was also observed that cost consideration may prevent companies to hire a general counsel, as approximately 18 percent of the companies did not have any counsels within the organization.