Was 2019 a Turning Point for the Flow of Infrastructure Capital into the U.K. or Merely a Blip?

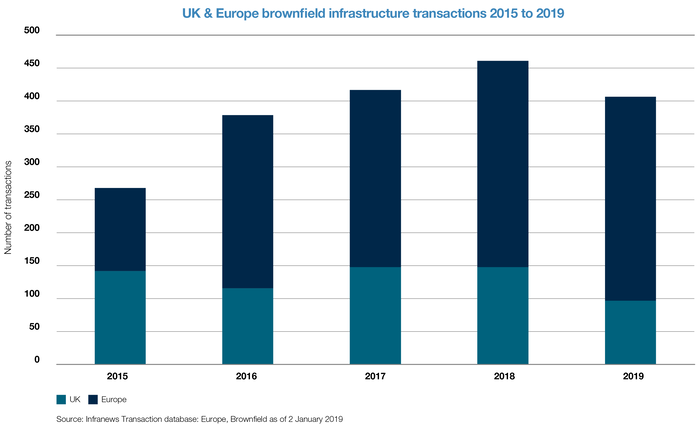

After leading the way as the primary home for brownfield infrastructure investors capital for much of the last ten years, a sharp reduction in U.K. transactions in 2019 drove a decrease in European volumes for the first time in five years. This, despite wider European activity remaining broadly stable.

Whilst U.K. transactions have fallen as a proportion of overall European transactions since 2015, the total U.K. activity remained broadly consistent through 2018, with the change driven by more capital allocated to, and transactions in, Europe as infrastructure allocations grew.

Of the 267 European brownfield transactions in 2015, 141 (53%) were in the U.K. compared to 147 (32%) of the 459 transactions in 2018 (Source: Infranews Transaction database: Europe, Brownfield as at 2 January 2019). However, in 2019 only 96 transactions were completed in the U.K., a drop of 35% with the U.K. accounting for 24% of the 405 European transactions.

Was 2019 a turning point for the flow of infrastructure capital into the U.K. or merely a blip?

In many respects, 2015-2018 were stellar years for U.K. infrastructure driven by:

- The maturity and exit of many “Fund 1s”, which were heavily weighted towards the U.K.

- Opportunistic disposals (to demonstrate a track record) as investors took to the market to raise funds 2,3 and 4).

- Continuing primary transactions as funds took advantage of market conditions.

- Continued growth in infrastructure equity allocations.

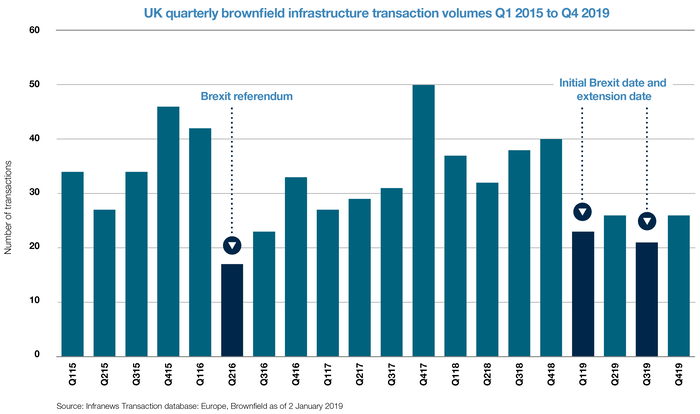

Together these factors maintained a robust level of U.K. brownfield infrastructure transaction activity, a Brexit blip aside in the run up to, and immediate aftermath of, the 2016 referendum.

Undoubtedly 2019 has been a year plagued by uncertainty in the U.K. which has influenced the mindset of investors and impacted the level of U.K. brownfield infrastructure transaction activity:

- Brexit stalemate, clearly influenced “Go-No-Go” disposal decisions around the initial 31 March 2019 deadline and acted as a drag on successful transactions in Q3 as the next 31 October 2019 “false” deadline loomed.

- Whilst there was some recovery in activity in Q4, further malaise and negative sentiment was experienced as we approached the General Election on 12 December due to the “Corbyn risk” and particularly the threat of renationalisation of water, energy and rail at below market value which, coupled with:

- (i) signalling of a more aggressive stance anticipated from Ofwat in its AMP 7.

- (ii) the Corbyn “free broadband for all” Manifesto promise

sent investors in water running for the hills and stopped fibre transactions in their tracks respectively; and

- Investors have recognised being overweight in GBP assets and refocussed attention on unlocking value in North-Western Europe with fibre, district heating and telco towers being particularly active during 2019.

What perhaps is most surprising, given the level of uncertainty, is that U.K. infrastructure investment maintained the level of activity it did with 96 deals (35% down on 2018). For the canny Euro or Dollar investors, U.K. assets have potentially represented good value due to the depreciation of sterling against both currencies since the Brexit referendum, countering the “negative” outlook.

What’s the outlook for 2020?

Clearly the decisive result in the General Election:

- Provides some certainty that we will “Get Brexit Done” with the withdrawal bill already moving through the Commons.

- Removes the threat of Nationalisation for the foreseeable future.

There does, however, remain a no-deal Brexit risk, with a new empowered Prime Minister inserting a clause into the Withdrawal Agreement to conclude trade negotiations by 31 December 2020 and rule out any extension to the Transition Period.

Here are our top five predictions for 2020:

(1) A lower absolute level of closed end fund disposals will continue to dampen U.K. secondary infrastructure transactions.

Fewer funds have < 3-year maturities than has been the case in recent years which, coupled with a number of opportunistic early disposals from those that do in 2018 and prior, reduces the number of assets remaining to transact.

Stand out assets to look out for in this bracket, which are anticipated to transact during 2020, include the much anticipated:

- (i) Edinburgh Airport (GIP fund II).

- (ii) Roadchef (Antin II).

(2) A tough, but less aggressive than signalled, Ofwat determination for AMP7 (commencing 1 April 2020), coupled with the absence of the Nationalisation risk following the Conservative election victory, should see a number of water stakes return to market which have struggled to progress or been shelved in the last 12 months.

The early years of each AMP have historically seen the greatest sector activity, with new equity having the opportunity to influence and benefit from outperformance of the new determination.

Given the lowest allowed rate of return since privatisation (2.96% weighted average cost of capital), transaction activity in the current cycle is more likely to reflect the desire for existing owners to sell due to fund expiry (e.g. Kelda) or a desire of higher cost of capital funds to rebalance away from U.K. water and indeed U.K. utilities more generally (as there is a similar, tougher, settlements anticipated in gas and electricity distribution in the coming years), rather than a burning desire to obtain the “badge” of having a U.K. water/utility stake, which may make it more of a buyer’s than a seller’s market.

(3) The rise in importance of Environmental, Social and Governance (ESG) will have an increased influence in the allocation of capital.

2019 saw a seismic shift in the “E” and “S” agenda amongst the general population as environmentalism has gained increased importance in society. This is feeding through to LP’s investment criteria and has influenced the lens through which GP’s are screening investment opportunities, with an increased focus on “decarbonisation”, “waste” and “recycling” projects. As one fund manager put it “ESG is an increasing priority for our LPs. Can we still invest in carbon-heavy assets? Yes. Is the hurdle higher than it used to be? Absolutely”. This should see notably higher levels of activity in the energy from waste/biomass space with transaction to watch out for potentially including Sleaford (in progress), Wheelabrator, Viridor and potentially Amey as well as a number of greenfield projects.

(4) Continued mandate drift will change the home allocated to Infrastructure capital.

Infrastructure funds are increasingly exploring new areas of opportunity, as competition for assets remains intense. Whilst this will see capital allocated increasing south and east in Europe, in more traditional territories like the U.K. it will see:

- A larger proportion of investment allocated to new the CREAM of “infrastructure like” “core plus plus” subsectors with a combination of:

- C: Consistent/reliable cash flow

- R: Regulated, having a contractual underpinning or sticky customers

- E: Essential service

- A: Asset-backed

- M: Monopolistic or with significant barriers to entry

- Funds taking on additional greenfield risk, particularly where assets tick the ESG box discussed above.

(5) A continuation of the overall U.K.- EU deal mix experienced in 2019.

Whilst the U.K. should see a rebound in activity for the reasons noted, further growth in European deals should also be sustained by deals in the “Hot” sectors which have driven 2019, notably district heating, fibre roll out and monetisation of tower networks with our prediction that combined U.K./European brownfield infra deals will break 500 for the first time.

Whatever the short-term outlook, there remains a medium-term requirement for accelerated infrastructure renewal and decarbonisation which should continue to deliver investment opportunities for infrastructure investors in both the U.K. and Europe.

About A&M’s Infrastructure Investors Services

Our dynamic and growing team at Alvarez & Marsal are ready to support investors across the spectrum, combining the core infrastructure credentials of our Infrastructure team, headed by Jason Clatworthy and Wayne Jephson with A&M’s traditional capabilities in some of the core-plus sectors of Technology, Healthcare, Education and Business Services.