The Financial Expert: Often the Link Between Damages and Causation

Let’s say a drunk driver neglected to stop at a stop sign at three in the morning. Only one other car was in the intersection, and it ended up with significant damage. The drunk driver broke the law and was clearly liable for not stopping at the stop sign. He must have caused the damage to the other car, right? But what if a deer had run across the intersection at the same time, and it was the act of hitting the deer that caused the other driver’s damage? Is the drunk driver liable for the damage?

While this is an overly simplified example, it demonstrates the importance of causation. Even with established liability, a plaintiff seeking damages must be able to calculate damages with reasonable certainty and demonstrate a causal link between the defendant’s acts and the plaintiff’s injury. The concept of causation is simple: did a defendant’s wrongful act cause the plaintiff’s damages? Proving causation, however, is not always as simple. Many times, damage experts simply assume causation. However, courts sometimes reject a finding on causation, and therefore the resulting damages, when an expert fails to consider alternative factors that could have caused or contributed to the plaintiff’s damages. Accordingly, a damage expert needs to understand and be prepared to explain five primary points related to causation:

- The defendant’s wrongful conduct;

- How the alleged wrongful conduct did or did not cause damages;

- The logic that connects the defendant’s alleged wrongful conduct to the plaintiff’s damages;

- Other factors that could have caused or contributed to the plaintiff’s damages; and

- Whether the damages would reasonably be expected to result from the alleged wrongful conduct (i.e., foreseeability).[1]

As causation and damages are linked, qualified damages experts may be in a position to provide the trier of fact with analyses that assist in deciding whether the causal link has been proven by the plaintiff.

Below we examine the ways a financial expert can assist in analyzing causation, both from an affirmative and rebuttal point of view.

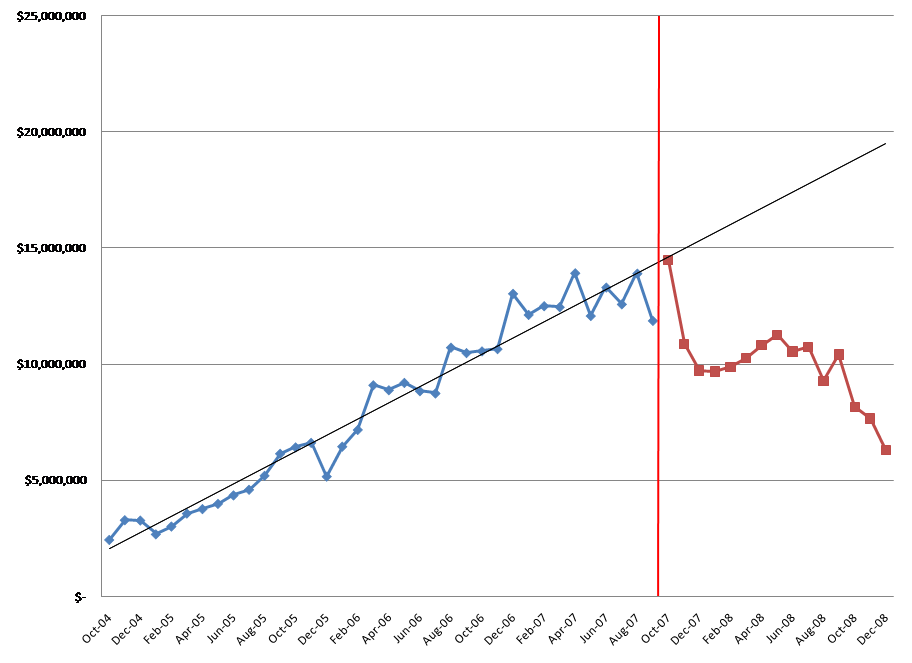

False and Defamatory Statements

An individual, who was subject to contractual confidentiality and non-disparagement provisions which he allegedly breached, made a series of false and defamatory statements regarding the safety of a health food product. The statements were spread rapidly on the internet, on “60 Minutes,” in newspapers and reported on the evening news. The defendant’s claims were intense, relentless and ultimately shown to be false. To help in establishing causation in connection with the plaintiff’s damages, we analyzed the sales of the product both before and after the start of the false statements as well as the frequency of false statements. As shown in the chart below, the sales of the health food product were growing at a strong and consistent rate over several years prior to the start of the false and defamatory statements. Once the false statements started and continued, the sales of the health product dropped significantly, as shown in the chart below.

Pre-Incident and Post-Incident Monthly Sales

The decline in sales clearly coincided with the advent of the false statements. However, in order to properly demonstrate that the decline was caused by the defendant’s actions, we needed to rule out any other factors that could have been the cause of the loss in sales. This was accomplished through several analyses, including an analysis of the industry and the performance of specific competitors during the same time period (which included the onset of the Great Recession that began in 2007). The analysis shows that the overall competitive set was growing by 6 percent during the twelve-month period following the start of the alleged actions, while the plaintiff suffered a decline in sales of more than 14 percent (with a continued decline after that twelve-month period). The analysis shows a clear link between the false and defamatory statements and the damages, and that no other industry or economic factors accounted for the material reduction in sales and resulting lost profits.

Alleged Trademark Infringement

A downtown Las Vegas casino (“Plaintiff Casino”) brought a trademark infringement action against a Las Vegas Strip property alleging damages because of market confusion and deceptive advertising relating to a trademarked name. The plaintiff’s expert did demonstrate that the Plaintiff Casino’s revenue and profitability dropped during the period of the alleged infringement. However, and importantly, he did not link the decline in revenue and profitability to the alleged infringement as the proximate cause of any lost profits.

To rebut the damage calculations on the basis of causation, we analyzed a number of factors that the plaintiff’s expert ignored, including:

1. Plaintiff Casino’s Pre-Infringement Operating Results

Our analysis showed that the Plaintiff Casino’s operating results had been deteriorating well before the alleged infringement. Revenue was dropping, hotel occupancy and average daily rates were down, and profit margins were deteriorating. The post infringement results were simply a continuation of the pre-incident trend.

The submarket in which the Plaintiff’s Casino operated was losing market share to the Strip and other “local” casinos pre-incident, and the trend simply continued. We analyzed and compared a number of market factors between the Strip, local and downtown submarkets, including occupancy, average room rates, food and beverage revenue, as well as win-per-unit. Each of the factors analyzed demonstrated an overall deterioration in the downtown market in which Plaintiff Casino operated.

2. Plaintiff Casino’s Capital Expenditures

The Plaintiff’s Casino was old and suffered from significant deferred maintenance. Our analysis showed that the plaintiff spent less on capital improvements than their downtown competitors, and even less than a property on the Las Vegas Strip.

Based on our analysis, the lawyers for the defendant were able to provide evidence that any loss in revenue or profits was not the result of the alleged infringement, but rather alternate factors.

Conclusion

Although a financial expert can assume causation, many times that expert is qualified to assess the causal relationship between the alleged actions and damages. The failure to address or understand the link between the alleged acts and damages can be fatal to a plaintiff’s damage claim, as shown in the trademark example. Conversely, as shown in the false and defamatory statements example, the financial expert can provide the analysis that helps the lawyer demonstrate to the trier of fact the link between the alleged bad acts and damages.

[1] Weil, Roman, et al., Litigation Services Handbook: The Role of the Financial Expert. 6th Edition., at 4.2.