Alvarez & Marsal Releases The UAE Banking Pulse Report Analyzing Q2 2017 Banking Sector Performance

A slight decline in Return on Equity (RoE) due to lower non-interest income and leverage is offset by an increase in Net Interest Margin (NIM); banks show significantly varied results

Dubai – Leading global professional services firm Alvarez & Marsal (A&M) today released its third UAE Banking Pulse, which finds that while overall profitability has decreased slightly due to lower non-interest income and leverage, net interest margins have increased. Moreover, the cost-to-income Ratio (C/I) has decreased, and the risk profile is broadly healthy.

This UAE Banking Pulse report compares the quarterly data of the 10 largest listed UAE banks in the second quarter of 2017 (Q2 2017) against the first quarter of 2017 (Q1 2017), as well as identifies prevailing trends throughout the intervening period.

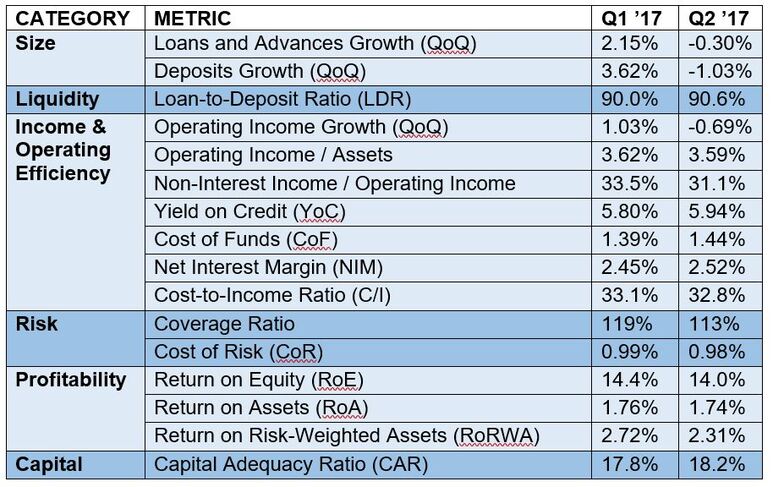

The report uses independently-sourced published market data and 16 different metrics to assess the key performance areas including size, liquidity, income, operating efficiency, risk, profitability and capital.

The banks analysed in A&M’s UAE Banking Pulse include First Abu Dhabi Bank (FAB), Emirates NBD (ENBD), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Mashreq Bank (Mashreq), Abu Dhabi Islamic Bank (ADIB), Union National Bank (UNB), Commercial Bank of Dubai (CBD), National Bank of Ras Al-Khaimah (RAK), and the National Bank of Fujairah (NBF).

OVERVIEW

The table below (which is explained on page four of the UAE Banking Pulse) sets out the key metrics applied, with some of the major trends identified.

The underlying theme is a modest decline in profitability, mainly driven by a decrease in both non-interest income and leverage. This has been offset by an increase in net interest margin (NIM) and continued cost control on the part of banks, resulting in an overall decrease in cost-to-income ratio. Risk metrics showed mixed results with decrease in both coverage ratio and cost of risk.

Notes:

1. QoQ stands for quarter over quarter

2. Growth in loans & advances and deposits was presented QoQ instead of YoY

3. Quarterly income used in the calculation of operating income growth

Source: Financial statements, investor presentations, A&M analysis

Trends identified:

1. Loans and advances (L&A) and deposits for the top 10 banks decreased by 0.30% and 1.03% respectively, despite most banks growing both. Seven of the top 10 banks grew their L&A market share and six banks grew their deposits market share

2. Operating income growth decreased due to a drop in non-interest income; eight of the top 10 banks grew non-interest income

3. Net interest margin increased from 2.45% to 2.52% on the back of an increase in yield on credit and LDR, reversing previous trend; seven of the top 10 banks improved their NIM, while one remained stable

4. Cost-to-income ratio decreased further from 33.1% to 32.8%, continuing previous quarter trend; six of the top 10 banks reduced their C/I compared to Q1’17

5. Risk metrics showed mixed performance with decline in both coverage ratio and cost of risk. The decrease in cost of risk is driven by a decrease in provisioning rather than an increase in the loans portfolio

6. RoE decreased marginally this quarter from 14.4% to 14.0%, on the back of a decrease in both income margins and leverage; but individual results were mixed and pure Islamic banks continue to outperform their conventional peers

A&M Managing Directors in the firm’s Financial Institutions Advisory Services practice Dr. Saeeda Jaffar and Asad Ahmed served as lead author and co-author respectively. Stephen Millington, a Managing Director and head of A&M Middle East, specializing in financial investigations and disputes, also served as a co-author.

Dr. Saeeda Jaffar commented:

“The banking sector’s overall performance during the most recent quarter has been modest, with profitability and returns on equity showing a small decline. However, this has been partially offset by a rise in net interest margin and banks have also been very sensible in managing their costs, with an improvement in cost-to-income ratio. The decline in cost of risk is a reassuring indicator of the sector’s overall stability, and liquidity remains at healthy levels. Looking ahead, we expect the market to return to a longer-term growth trajectory, especially as the initial impact of the NBAD / First Gulf Bank merger transforms into longer term performance.”

Click here to download the full report.

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) when conventional approaches are not enough to activate change and achieve results.

Privately held since 1983, A&M is a leading global professional services firm that delivers business performance improvement, turnaround management and advisory services to organizations seeking to transform operations, catapult growth and accelerate results through decisive action. Our senior professionals are experienced operators, world-class consultants and industry veterans who leverage the firm's restructuring heritage to help leaders turn change into a strategic business asset, manage risk and unlock value at every stage.

When action matters, find us at alvarezandmarsal.com. Follow A&M on LinkedIn , Twitter and Facebook.