Estimating IT Integration Costs for Mergers and Acquisitions

Information Technology integration costs are frequently the largest cost factor in an M&A transaction’s overall return. While many CIOs have the base knowledge needed to accurately estimate these costs, many are not experienced with articulating and defending their estimates in a meaningful way to the investment team. As a result, the combined entity’s desired IT capabilities may not be achieved or significant IT integration delays or cost overruns may be more likely.

However, a collaborative effort that leverages the CIOs technology experience coupled with the CFOs knowledge of expected synergies and related financial outcomes and business knowledge produces the best results – especially given the imperfect nature of the data that is typically available to the team.

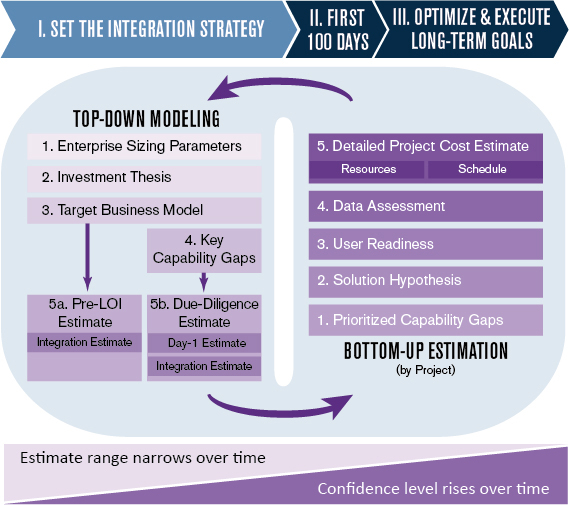

Best-in-class companies iterate and refine costs during each of three typical M&A integration phases:

- Phase 1: Target Screening

- Phase 2: Due Diligence

- Phase 3: Day-1 Planning and Additional Phases

Phase 1 – Target Screening and Pre-LOI Cost Forecasts

Access to information is significantly limited during the target screening and pre-letter of intent phase of a deal. The team relies mostly on publicly available information, which often rests somewhere between incomplete and even inaccurate. Despite this information vacuum, deal executives are required to forecast IT integration costs to support early-stage deal evaluation and negotiation efforts.

Each stage in a deal’s lifecycle requires a unique approach to cost estimation.

A top-down forecasting model is frequently used to estimate IT integration costs during the target screening phase. Key factors such as enterprise sizing parameters (industry, company size and complexity), deal value drivers (investment thesis), and the target’s intended business model and capability gaps are used to create a model that forecasts IT integration costs. For this undertaking, experience matters. Data from past merger integrations and expert judgment forms the basis for forecasting the future integration costs. Since this forecast is based primarily on publicly available information about the target, only a rough upper and lower bound is possible at this stage.

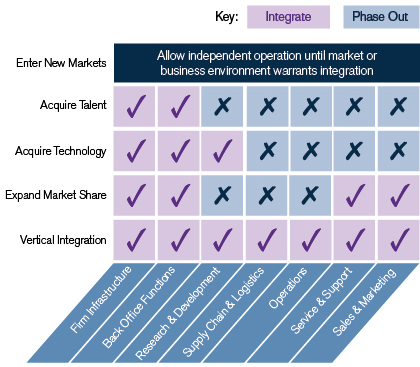

Estimating the longer-term business process integration costs based on enterprise-sizing criteria will establish a good baseline estimate. However, to create a more complete cost estimate, a broad understanding of the investment thesis can be used to narrow the focus and provide an effective model to analyze and communicate integration cost drivers with the investment team. The illustration below provides examples of investment theses and their potential IT integration impact areas.

The investment thesis drives the scope of the IT integration effort.

In addition, the deal team can assess the degree of overlap between the acquiring and target company business models to further gauge the cost and complexity of the business process integration required to achieve the intended future business model. As the target is evaluated and the deal develops, changes to any of these underlying factors are easily linked to explain updates to the corresponding integration cost estimates.

Phase 2 – Due Diligence Cost Estimates

Once a Letter Of Intent (LOI) is executed the target screening integration cost estimates can be reused to prioritize due diligence activities. For example, these (cost) estimates may be used to highlight the elements that are expected to be the largest contributors to overall IT integration costs (e.g., ERP systems, IT infrastructure such as networks and data centers and professional services). During the due diligence phase, the team will be granted access to more detailed information about the target. Gaps between the target’s IT capabilities and the needs of the combined entity are used to highlight potential points of integration. These capability gaps and related integration efforts should be identified separately in the estimating model and referred to when explaining significant IT integration costs.

Phase 3 – Day-1 Planning and Additional Phases

In the next deal stage, after a Purchase Agreement (PA) is executed, the breadth and depth of information available regarding the target typically increases considerably as additional target resources are brought in to participate in the Day-1 planning phase. At this stage, the focus should shift to gathering the information needed to build a bottom-up estimate of the IT key integration cost areas. While the additional functional resources will have critical business knowledge and valuable technical skills, many lack M&A experience. Moreover, these resources are not normally able to dedicate themselves to the transaction on a full-time basis. Under these situations, the CFO may choose to factor in the cost of external professional services to supplement the functional resources.

In most cases, Day-1 integration activities are performed in the days and weeks between the execution of the PA and deal close. Once the deal is closed, execution on the First 100 Days begins immediately and management has unfettered access to the target. At this point, planning teams can develop very detailed bottom-up estimates for the long-term integration activities. Potential long-term IT integration projects may include more complex endeavors such as application or infrastructure consolidation, the re-organization of the IT department, achieving compliance with the acquirer’s information and security policies, or rationalization of software licenses and service contracts.

Conclusion

With each successive phase, the cost estimating model for IT integration should be refined, and the confidence in estimates should increase. If the company plans to remain acquisitive in the future, the CFO should take the time after each deal close to improve the model accuracy through comparison to the bottom-up estimate and the actual integration costs. This will require aligning costs by similar categories, analyzing drivers for cost variances and updating the corresponding components in top-down models.

Laiq Chugtai contributed to this article.