What Is Lease Accounting?

What Is A Lease?

A lease is an agreement between a property owner and another party who wants to use their asset. The two parties come to a contractual consensus on what the owner will receive in exchange for the outside party to use their property or asset. There are generally two types of leases which are referred to as operating and financial (or capital) leases.

What Is a Lessor?

A lessor is a person or legal entity that owns an asset that is leased under an agreement to a lessee. The asset is most often housing, though assets can also include items such as vehicles, computers, office space, or an intangible property, such as a brand name. A lessor enters a binding agreement with a lessee that allows the lessee to make one or more payments to the lessor in exchange for use of the asset.

A lessor must notify a lessee of any maintenance or inspection that needs to be performed on or in the asset, and must have permission from the lessee to enter the asset. In the event that the lessee damages the asset, compensation will be owed to the lessor. If the damage is severe enough, or if the asset is used to commit illegal acts, the lessor may terminate the lease agreement immediately without notice. At the end of the contract period, the asset is returned to the lessor, though the lessee may have the option to purchase.

What Is a Lessee?

A lessee is a person, company, or organization that rents an asset from a lessor, exchanging one or periodic payments for use of the asset for the duration of the contract. The length of the lease depends on the type of asset and agreement arranged with the lessor. Though the lessee has temporary ownership of the asset, official ownership is retained by the lessor. For that reason, the lessee is not allowed to make certain changes to the asset without permission from the lessor, as laid out in the lease agreement. Should the lessee damage or lose the asset, compensation will be owed if the asset is not repaired or recovered. The lessee may be able to purchase the asset fully from the lessor at the end of the contract term.

Lessor vs. Lessee

There are several primary differences between a lessor and lessee. The most notable include:

Ownership - Though lessees temporarily own the asset, they are merely borrowers. Lessors retain legal ownership, though ownership may be transferred to the lessee if he, she, they, or it purchases the asset at the end of the contract term.

Access - During the contract term, the asset is in possession of the lessee, not the lessor.

Termination rights - The lessor may terminate the lease at any time if the lessee breaks any clause of the contract, including damage to or misuse of the asset.

Restrictions - The lessor has no restrictions except to notify and be given permission by the lessee to modify or enter the asset. The lessee has far more restrictions about changes that can be made to the asset and how it may be used, which are outlined in the contract.

Maintenance - While not under a lease agreement, the lessor must maintain and pay for the asset. Under a lease agreement, the lessee will maintain and pay for the asset, the extent of which should be outlined in the lease.

What Is Lease Accounting?

Lease accounting is the process by which an organization records the financial impacts of their leasing activities in their accounting calculations and reports.

New Lease Accounting Standards

The FASB new lease accounting standards, ASC 842, replaces the current guidance, ASC 840, effective December 15, 2018 for public companies. Private companies have been given an additional year to comply, so effective December 15, 2020. The new standards introduce changes to how companies are required to account for operating leases on the balance sheet. Previously, under ASC 840, companies were required to capitalize their financing leases while leaving their operating leases disclosed in the footnotes.

However, to increase transparency into the financial obligations of companies, FASB approved ASC 842 so that right-of-use assets and lease liabilities for all operating leases longer than 12 months are recorded on the balance sheet. The standards define operating leases as any lease other than a finance lease[1]. While the new lease accounting standards clearly communicate the required changes for lease accounting, companies will find that gathering the necessary inputs required to comply with them can be challenging.

Lease Classifications: Operating Lease vs. Capital Leases

Lease classifications roughly break down into two main types: operating leases and capital leases. Operating leases provide the lessee the right to use the asset without ownership rights. Capital leases, now referred to under ASC 842 as Finance Leases, are like operating leases except that the lease terms are more akin to ownership. This entails slightly different accounting for financial leases than for operating leases. There are 5 tests to determine if the lease is a finance lease. If any of these tests are met, the lease should be presented in the financial statements as a finance lease.

- Title transfers at the end of the lease term

- The lessee has a purchase option that is reasonably certain to be exercised

- The lease term is greater than 75% of the useful life of the leased asset

- The present value of the lease payments are greater than 90% of the fair value of the leased asset

- The leased asset is so specific to the lessee that the lessor has no ability to transfer the asset to another market participant

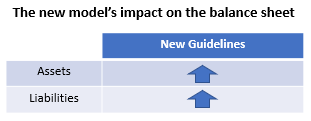

Prior to ASC 842 adoption, operating leases comprising of the leased asset and its attendant payment obligations were not recorded on the balance sheet. However, the new lease accounting standards require that lessees record right-of-use assets and corresponding lease liabilities for all operating leases greater than one year. Now having to account for their operating leases, most companies will recognize a significant increase in the overall number of leases recorded on their balance sheets, increasing the total value of their assets and liabilities.

The Advantages And Disadvantages Of Leasing

A lease accountant will tell you that there are multiple positives and negatives when it comes to leasing. For example, some of the benefits of entering a lease agreement include more flexible payment schedules, lower costs in relation to taxes, and lastly, easier financing. However, when it comes to working with leases and performing accounting for lease payments there are also some annoyances to deal with. For instance, lessees are under less of an obligation to take care of the property or asset. This can, of course, result in the need for costly maintenance and repairs.

Lease Liability

The lease liability generated from an operating lease is calculated by finding the present value of future lease payments at a discount rate which is defined as the collateralized incremental borrowing rate. Sourcing accurate inputs, namely the incremental borrowing rate (discount rate), will be important for companies to accurately present their lease liability on their balance sheet and in the footnotes.

Lease Accounting with LeaseSCRE

Operating leases have proliferated throughout the years for the accounting benefit as well as the move to outsourcing in general. Office supplies from copiers to laptops became leased items that were off balance sheet expenses. Under ASC 842 these leased assets that extend beyond 12 months in tenor will require a present value of future lease payments at the incremental borrowing rate. LeaseSCRE is a simple, compliant, and cost-effective tool that will estimate a collateralized incremental borrowing rate based on the lessee’s current financial statements.

Companies that don’t have a credit rating or active borrowing program that coincides with the tenors of their leases find LeaseSCRE useful to record their operating lease value and right of use asset value. LeaseSCRE makes accounting leases more efficient than ever before!

About The Author

Chandu Chilakapati is a Managing Director at Alvarez & Marsal. He is Head of Innovation for Valuation Services and has 20 years of experience providing fair value solutions. He is a frequent speaker at National Accounting and Valuation Conferences. Mr. Chilakapati is the national lead for complex financial instrument valuation at Alvarez & Marsal.

[1] Source: Financial Accounting Series, No. 2016-02 (https://www.fasb.org/jsp/FASB/Document_C/DocumentPage?cid=1176167901010&acceptedDisclaimer=true)

LeaseSCRE is the new frontier of lease accounting, don’t wait to get started: