Part 2: When a Fairness Opinion is Not Fair: Outdated Projections, Britney Spears and Market Multiples

Caesars Entertainment Operating Company (“CEOC” or the “Debtor”) filed for bankruptcy protection on January 15, 2015. CEOC was a subsidiary of Caesars Entertainment Corp. (“CEC”), a publicly traded company, and owned and managed a number of Caesars’ casino properties. CEC also owned other casino properties through two other subsidiaries: Caesars Entertainment Resort Properties (“CERP” (100% owned) and Caesars Growth Partners (“CGP”) (57% owned). In total, the Caesars gaming empire consisted of 43 casino properties, of which 28 were owned by CEOC.

The Debtor engaged in a series of complex sales of casinos and intellectual property as well as financings and related party transactions in the years prior to the bankruptcy filing. After the bankruptcy filing, an Examiner[1] was appointed to investigate and report on various pre-petition transactions entered into by CEOC. Alvarez & Marsal (“A&M”) was retained as financial advisor to the Examiner.

The Financial Times’s blog, FTAlphaville, describes the Examiner’s report: “For anyone who has followed the machinations at Caesars, the blow-by-blow accounts behind all the deals makes for an incredible read — the first 100 or so pages of executive summary has plenty of dirt. And even if you have not, just reading the lengths private equity firms will go to salvage bad investments is mind-blowing.[2]” The Examiner concluded that the value of claims related to fraudulent transfers, breaches of fiduciary duty, aiding and abetting breaches of Caesars management and its sponsors, and other actions ranged between $3.6 billion to $5.1 billion.[3]

This is the second in a four-part series highlighting some of the key investigation issues and findings of the Examiner’s report.[4] In this edition, we explore a portion of one of the related party asset transfers undertaken by CEOC in the years leading up to its ultimate bankruptcy filing. (Part 1 of this series, addressing Caesars’ Liquidity and Solvency, can be found here.)

The Growth Transaction – A Fraudulent Transfer?[5]

Coined the “Growth Transaction,” this asset transfer involved CEOC’s sale of two of its casino properties to CGP, a newly formed related entity owned by CEC and CEC’s shareholders (principally, its private equity owners (the “Sponsors”)). More specifically, in October 2013 CEOC sold its (i) Las Vegas Strip casino, Planet Hollywood; (ii) 65% equity interest in the Baltimore-based casino, Horseshoe Baltimore; and (iii) right to 50% of the management fees for the two properties.

On the surface, there is nothing inherently wrong with selling an asset to a related party. In fact, it is sometimes used as means to infuse liquidity into a struggling entity. However, in doing so, the parties should consider whether (i) the selling entity is/will be insolvent at the time of the transfer (which, as discussed in Part 1 of this series and at length in the Examiner’s report, CEOC clearly was), and (ii) the selling entity will receive “reasonably equivalent value” in exchange for the asset. Reasonably equivalent value is undefined; however, courts generally look to whether “the debtor received value that is substantially comparable to the worth of the transferred property.”[6] If the selling entity is/will be insolvent and will receive less than reasonably equivalent value, the transfer may be challenged and possibly avoided as a fraudulent transfer.

As discussions regarding the Growth Transaction began in late 2012, CEC formed a Valuation Committee to evaluate the transaction. This committee retained an investment bank as financial advisor (the “IB”) to assist in negotiating the price with the Sponsors and to issue a fairness opinion for the transaction. Ultimately, the price paid to CEOC in conjunction with the Growth Transaction was $360 million. The IB’s fairness opinion provided an overall value range for the equity in the Growth Assets of $268 million to $420 million, concluding that CEOC received reasonably equivalent value.

After completing the investigation, the Examiner (advised by A&M) concluded that the price paid for the Growth Transaction was materially less than reasonably equivalent value, assigning a fair market value range for the equity in the Growth Transaction’s assets of $797 million to $953 million, 121% to 164% higher than the transaction price.[7] The Examiner made certain observations of the shortcomings of the underlying data that formed the basis of the fairness opinion to help explain the significant difference in the fair market value assessment. The shortcomings related to the Planet Hollywood valuation are discussed below.[8]

Planet Hollywood Valuation Issues

In summary, the Examiner determined that the IB firm had understated the value for Planet Hollywood primarily due to the following factors:

- The fairness opinion was not based upon the most recent projections for Planet Hollywood’s revenue and EBITDA, as prepared by Caesars in the ordinary course of business. Although the IB requested updated projections, management did not provide them.

- The IB did not include the projected revenue and EBITDA increases from Project Songbird, the then new contract for Britney Spears’ residency at Planet Hollywood’s newly renovated theater, although it did deduct the related capital costs for the theater’s renovation.

- Planet Hollywood was treated as a regional property in determining appropriate market multiples. As discussed in Part 1 of this series, the market recognizes a distinction between Las Vegas Strip-based casino operators compared to regional and non-destination counterparts. This distinction was not afforded any weight in the fairness opinion.

Outdated Projections

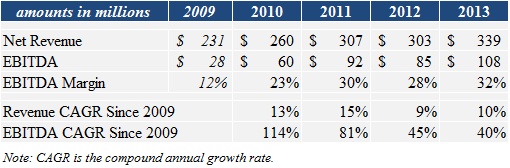

By all marks, Planet Hollywood was a highly profitable and growing casino, both prior to and at the time of the Growth Transaction. As shown in the table below, its annual revenue had grown from $231 million in 2009 to $303 million in 2012, and its EBITDA from $28 million to $85 million over the same period.

Planet Hollywood Financial Metrics

The IB issued a preliminary valuation of the Growth Transaction’s assets, including Planet Hollywood, in April 2013 using projections provided to it by the Sponsors that had been prepared in January 2013. These projections were largely identical to Caesars’ ordinary course long-range plan projections prepared in the fourth quarter of 2012.

Ultimately, despite the fact that the final transaction did not occur until October 2013, only two changes were made to the late 2012 projections:

- Based on information provided to the IB (which was inaccurate), the expected EBITDA projection for 2013 was lowered; and

- Due to Project Songbird, the timing of the projected capital expenditures were reallocated to front-load the expenditures required for the theater.[9]

These adjustments resulted in a decrease in Planet Hollywood’s expected cash flows using the 2012 long-range plan. In reality, however, Planet Hollywood significantly outperformed its 2013 projected EBITDA, both year-to-date as of the time the change was made and by the time the Growth Transaction closed in October 2013.

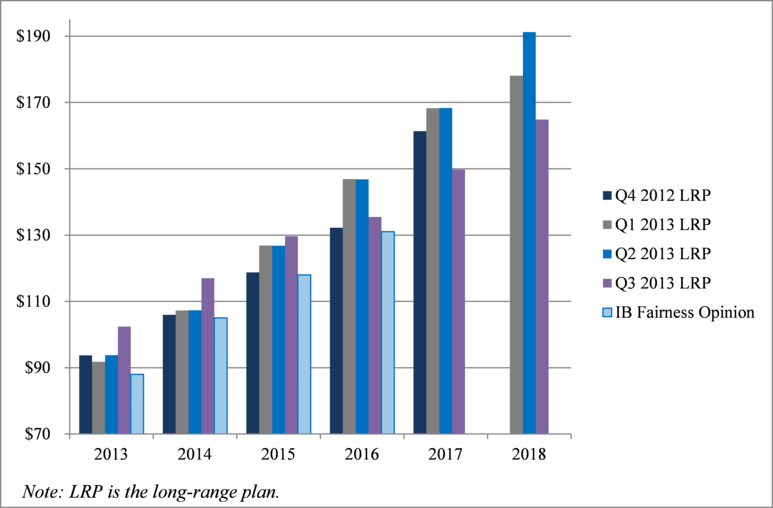

More importantly, despite numerous due diligence requests by the IB for updated projections, the IB was consistently told there were none. Yet, the truth was that Caesars continued to modify its ordinary course long-term projections quarterly throughout 2013, with material increases to the projected EBITDA. The chart below demonstrates the material increases to the quarterly long-range plan for projected EBITDA compared to the projections utilized by the IB in its fairness opinion.

Planet Hollywood Projections

Simply put, the IB’s use of projections outdated by more than 10 months, due to the failure of Caesars to provide the available updated projections, materially understated the fair market value of Planet Hollywood as it failed to appropriately capture its current and expected growth.[10]

Project Songbird

In July 2013, three months after the IB had prepared its preliminary valuation of Planet Hollywood for the Growth Transaction, Caesars entered into a performance agreement with Britney Spears for two years and 96 shows. Project Songbird required CEOC to invest $27 million to terminate the theater’s existing lease and to provide the renovations required to accommodate the Britney Spears residency. Not only did Project Songbird provide value to Planet Hollywood during the tenure of Britney Spears’ contract, but it provided long-term value to the casino as the renovated theater would be available for other artists.

As previously stated, the 2012 projections were updated for the required up-front capital investment for Project Songbird once known in July 2013, but no corresponding increase was made to projected revenue or EBITDA. In interviews, the IB’s professionals explained to the Examiner that they had been informed by Caesars that no updates were required to projected EBITDA and/or the projected EBITDA for Project Songbird was already captured in the projections. However, the Examiner identified Caesars’ Project Songbird cash flow model which projected incremental cash flows from Project Songbird of more than $8 million annually. The model was created after the 2012 projections had been prepared, rendering it implausible that the projections given to the IB included Project Songbird. As a result, this additional $8 million of annual EBITDA was not factored into the valuation of Planet Hollywood in the Growth Transaction’s fairness opinion.

By either applying a market multiple or incorporating this amount into a discounted cash flow analysis, the impact of excluding the expected EBITDA uptick from Project Songbird was significant. Based on the IB’s selected multiples for Planet Hollywood of 7.0x to 9.0x EBITDA, the value excluded from the IB’s fairness opinion associated with Project Songbird ranged from approximately $56 million to $72 million.

Market Multiples

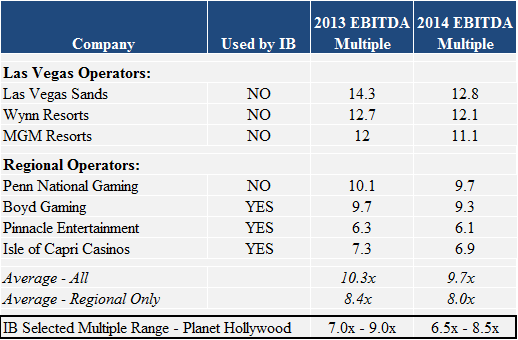

The fairness opinion presented data for seven publicly-traded companies, including three Las Vegas casino operators and four regional operators. However, only three regional operators (Boyd, Pinnacle and Isle of Capri) were ultimately utilized by the IB in the market approach to valuing Planet Hollywood. A summary of the market multiples referenced in the IB’s fairness opinion is reflected below.

IB Market Multiples for Planet Hollywood

The use of market multiples for select regional casino operators, coupled with the use of outdated projections, resulted in unreasonably low values for Planet Hollywood despite its prominent location in the center of the Las Vegas Strip and its high growth state.

The Examiner’s Valuation of Planet Hollywood

In the Examiner’s independent valuation of Planet Hollywood, as part of assessing whether CEOC received reasonably equivalent value for the Growth Transaction, a variety of factors, including but not limited to the following, were considered:

- Planet Hollywood’s historical financial performance, including how the property performed relative to Caesars’ historical projections (notably, the property had exceeded its annual budget over the prior three year period);

- CEOC’s historical and planned capital expenditures for the property and the ability for CEOC to fund ongoing capital expenditures for Planet Hollywood;

- The changes in Caesars’ projections for Planet Hollywood made over time;

- The expected impact of Project Songbird on projected revenue and EBITDA;

- Contemporaneous indicators of value, including (i) an appraisal of Planet Hollywood prepared by a third party for a lender, (ii) CEC’s impairment testing valuations prepared annually for each casino property for GAAP compliance (the methodology for which was reviewed by Caesars’ external auditors), and (iii) documents reflecting the Sponsors’ view of Planet Hollywood’s value prior to the Growth Transaction;

- Analyst report commentary reflecting market participants’ views of the Growth Transaction and the transferred assets; and

- Reasonably comparable guidelines public companies, with consideration of both Las Vegas-based and regional operators.

With respect to Planet Hollywood, the Examiner (advised by A&M) determined an equity value at the time of the Growth Transaction ranging from $643 million to $764 million, materially higher than the equity values determined by the IB of $192 million to $292 million.[11]

Conclusion

With A&M as financial advisor, the Examiner concluded that (i) the Growth Transaction, like numerous other asset transfers preceding the bankruptcy filing, occurred at a time when CEOC was insolvent, and (ii) CEOC failed to receive reasonably equivalent value for the assets sold. Further, the Examiner concluded that damages associated with the potential claims associated with the Growth Transaction were represented by the deficiency in the amount of the consideration – a total of $437 million and $593 million for the Growth Transaction alone.[12]

Importantly, the Examiner also found that none of the financial advisors who advised CEC and/or CEOC in the asset transfers, including the IB for the Growth Transaction, acted in bad faith, with improper motives, or with undisclosed conflicts of interest. Instead, the opinions rendered by the advisors relied heavily on what was, in certain instances, inaccurate information and assumptions provided by management.[13] The fairness opinion offered for Planet Hollywood represents an important example of how the accuracy of valuation inputs, for instance the projections, can materially impact the ultimate value conclusion.

[1] The bankruptcy code allows for the appointment of an examiner, as noted in the bankruptcy code, and examiner shall perform an investigation of the acts, conduct, assets, and financial condition of the debtor and other duties as ordered by the court.

[2] https://ftalphaville.ft.com/2016/04/11/2158973/liquidity-v-solvency-caesars-edition/

[3] Examiner’s Report at 78-80.

[4] https://cases.primeclerk.com/ceoc/Home-DownloadPDF?id1=MzM3Mzgx&id2=0

[5] The conclusions and analysis discussed in this article related to the Growth Transaction and Planet Hollywood may be found in the Examiner’s Report at 36-42 and Appendix 7 to Examiner’s Report at 85-121.

[6] Weisfelner, Edward. Advanced Fraudulent Transfers: A Litigation Guide. Alexandria: American Bankruptcy Institute, 2014, at 10.

[7] Appendix 7 to Examiner’s Report at 118.

[8] The Examiner’s Report addresses valuation concerns over each of the assets that were included in the Growth Transaction.

[9] This adjustment is addressed separately later in this article.

[10] In addition, the IB’s use of a three-year projection period instead of Caesars’ ordinary course five-year projection period failed to capture the substantial projected growth in the outer years.

[11] Appendix 7 to the Examiner’s Report at 90, 118.

[12] Examiner’s Report at 39. The Growth Transaction was one of many such transactions investigated by the Examiner, and in total across all asset transfers, the Examiner found total potential damages ranging from $2.5 billion to $3.6 billion. (Examiner’s Report at 80.)

[13] Examiner’s Report at 11-13.