U.K. retail profits to shrink by £8 billion by 2025

- Consumer migration to ecommerce accelerates declining retail profits

- Profit margins to fall to 3.2% by 2025 compared to 3.7% if the pandemic hadn’t begun – representing £8 billion in total

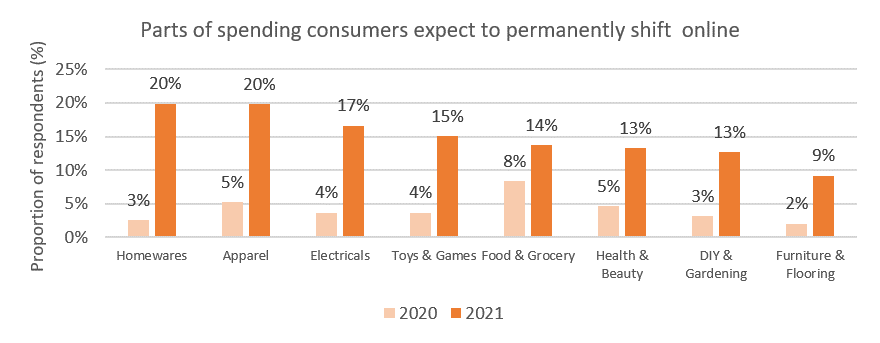

- Almost 20% of spending across apparel, homewares and electricals is expected to permanently shift online

London – A new report by global professional services firm Alvarez & Marsal (A&M), in partnership with Retail Economics, estimates that U.K. retailers will see profits fall by £8bn by 2025, a result of the seismic shift to ecommerce brought about by the COVID-19 pandemic.

Pre-tax profit margins are forecast to fall to 3.2% by 2025, compared to 3.7% in a ‘no COVID’ scenario where the trajectory for consumer behaviour would have remained unchanged.

However, the lasting impact of COVID-19 will not be felt equally across all retail categories, with some businesses significantly more vulnerable to pressures on profit margins than others. The research has identified apparel, homewares and electricals as those which will experience a permanent step-change in consumer behaviour, brought about by increased online engagement and discovery since the onset of the pandemic.

European consumers now expect to permanently shift approximately 20% of their spend across apparel, homewares and electricals online – an almost fourfold increase from the early stages of the pandemic in May 2020, after prolonged periods of lockdowns further embedded this way of shopping for many consumers.

In contrast, categories such as furniture and jewellery – where online experiences are typically less convenient compared to traditional shopping due to a preference for ‘touch and feel’ browsing – will be most likely return to pre-pandemic conditions, despite some shift in spending.

These changes will be felt most by retailers with a presence in the U.K., with 4 in 10 consumers stating that their shopping habits will change permanently – the highest across Europe.

Consumer expectations to permanently spend online across different product categories

Source: Retail Economics and Alvarez & Marsal

Richard Fleming, Managing Director and Head of Restructuring Europe, A&M, said: “COVID-19 has wrought irreversible change which has left the future of many retailers hanging in the balance.

“Those businesses that will remain relevant and survive the disruption will be those that are able to realign operating models with the new normal and meet the needs of a post-pandemic consumer – but there will be an inevitable shake out of those that cannot do so before it’s too late.”

Evolution to online places increasing pressure on retailers

As retailers attempt to capture online market share, many will undergo a period of transition where profit margins come under intense pressure.

Online-only retailers typically operate on considerably lower margins than multi-channel and bricks-and-mortar business models, with analysis showing average pre-tax profit margins for pure online retailers across Europe residing at 1.4%, compared with 5.4% for the total industry. More competition and a greater use of online channels across the entire market will inevitably see these challenges intensify, particularly in categories like apparel where a greater proportion of spend will migrate.

One major pressure likely to drive further profit erosion for retailers is the volume of online returns. As store visits decrease, left unchecked, rising levels could create increasingly complex and fragmented logistics channels in efforts to cater to customer expectations for fast and efficient service. This becomes more concerning given younger shoppers – the consumers of tomorrow – are almost twice as likely to return goods than their older counterparts. 18–24-year-olds in the U.K. return 15.8% of online products, compared to 7.5% of those aged 65+, a trend reflected elsewhere in Europe such as France (11.1% vs 6.2%) and Switzerland (20.5% vs 7.1%).

Erin Brookes, Managing Director and Head of Retail and Consumer, Europe, A&M, said: “As digital becomes more critical across every stage of the customer journey, retailers face a make-or-break moment to prevent profits from spiralling downwards. There is no going back – retailers must acknowledge changing consumer behaviour and respond appropriately.

“Yes, this includes successfully transitioning away from some physical stores and re-imagining the purpose of others, but investing in the building blocks for efficient online operating models such as reverse logistics, strategic partnerships and intelligent data and technology is essential.”

-Ends-

Methodology

- Retail Economics conducted a nationally representative consumer panel across six European countries including the U.K., Germany, Italy, Spain, France and Switzerland. The sample comprised more than 3,000 consumers with survey data collected between 19 April and 1 May 2021.

- Estimates for pre-tax profits are based on a sample of over 250 private and public European retailers that have operations in either the U.K., Germany, Italy, Spain, France or Switzerland. The sample of retailers have a combined turnover of over €2 trillion in 2019/20, accounting for c.40% of total retail sales across the six European countries.

- Pre-tax profit margin forecasts are based on a sample of over 250 private and public European retailers that have operations in either the U.K., Germany, Italy, Spain, France or Switzerland. Data was collected on their pre-tax profit from 2010/11 to 2019/20. Collectively, they accounted for over €2 trillion of retail sales in 2019/20.

Contact

Del Jones, Francesca Hart, Headland Consultancy, +44 (0)78 2655 0797

Miriam Jones, Senior Marketing Manager, Alvarez & Marsal, +44 (0)20 7072 3204