UK Research & Development Tax Relief

Now is the time to review your UK R&D processes and prepare for the future

HMRC continues to provide generous investment incentives to UK companies. Most significant amongst these is the UK R&D tax relief. Recent statistics showed that 60,000 companies received £7.5 billion of this long-standing R&D benefit. In a fiscally challenging environment, HMRC wants to ensure the taxpayers are getting value for money and thus placing claims under greater scrutiny and looking to better target the incentive, as demonstrated through recent HMRC announcements.

In parallel, tax departments are pressured to ‘do more with less’ to secure the incentives they are entitled to through more efficient and timely claim methodologies.

Are you eligible?

If you can answer yes to any of the queries below, then you are likely to be undertaking R&D, as defined for tax purposes:

- Do you employ in-house engineers/software developers?

- Do you develop new, or significantly improve existing, products, processes and services?

- Are you undertaking transformational programmes to improve cost parity or develop competitive advantage?

You can learn more about industry-specific case studies and the benefits our trusted advisors have delivered for clients by downloading our brochure.

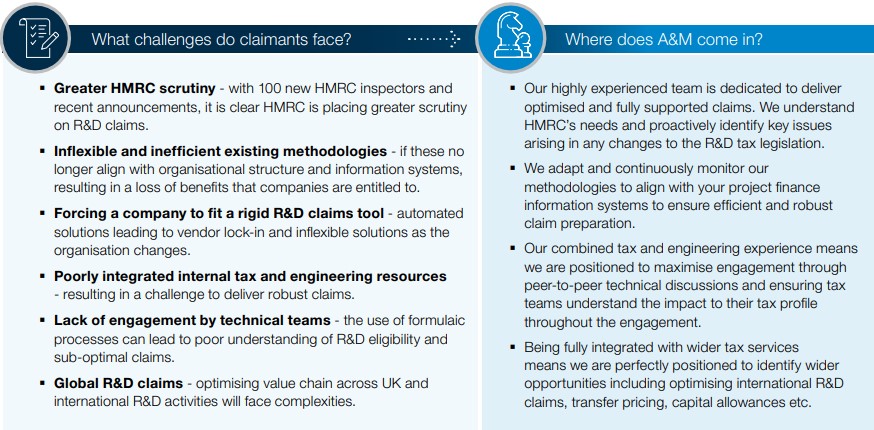

Companies faced with these conflicting pressures need a trusted advisor to guide their business through the increased HMRC scrutiny to efficiently secure the full R&D benefits that they are entitled to. This is where A&M comes in.

> More about why A&M is the right fit for your business.

Download the UK R&D Tax Relief brochure