Today’s Pharmacy Ecosystem Poised for Another Cycle of Disruptive Change

Evolution of the health plan and pharmacy benefit manager (PBM) marketplace has continued throughout the past year, and today’s Pharmacy Ecosystem continues to be poised for another cycle of disruptive change.

- The growth in specialty pharmacy trends have continued and now a small percentage of members account for the majority of pharmacy costs[i]

- Drug prices continue to increase more than any other medical good or service[ii]

- The gap between gross and net drug prices after discounts, continues to grown[iii]

- Employers and health plans are frustrated with the existing models, with only 33% of employers surveyed feeling that their PBM is strongly aligned with their objectives[iv]

With market pressures changing the calculus, organizations are re-thinking traditional strategies for creating and managing the pharmacy benefit. For the pragmatic healthcare executive focused on growth and profitability, several trends in the pharmacy and PBM marketplace will shape the actions of health care organizations over the next several years.

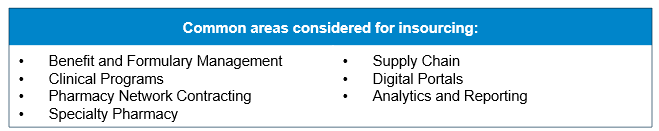

Health Plans are insourcing components of PBM functions

Seeking better alignment of incentives and outcomes, and to capture margins, health plans and Managed Care Organizations (MCOs) will selectively insource portions of the PBM function.

Recent market activity has shown an increased appetite among health plans for insourcing functions that were previously services provided by vendor PBMs. The ability to rationalize service with costs and benefits, integrate operations, align program design with overall health outcome targets and a desire to control the member experience are further being amplified as the focus of pharmacy benefits shifts from claims adjudication to care management. Furthermore, the changing emphasis from net drug costs to total ownership costs, in addition to the emergence of new vendor options, allows health plans to reconsider cost of administration versus the potential benefit from control of PBM functions.

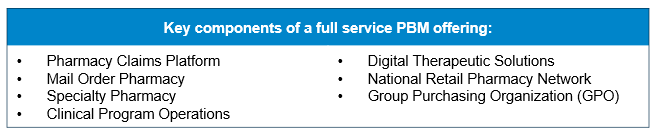

Plans are seeking single or multi-plan owned captive PBM models

Health plans are continuing to pursue captive ownership of PBMs for vertical integration and control of the PBM function.

Today, more than 90% of the PBM market share is controlled by a captive PBM[v]. Fueled by a desire to control the pharmacy function, create independence from competitors and capture margin, we expect additional health plans to seek captive PBM arrangements. Vertical integration could include individual health plans or a collective of plans, searching for either an acquisition or investment into a joint-venture with one of the available independent PBMs in the market. However, appetite for ownership will face challenges, as PBM and pharmacy asset valuations are elevated. Finally, any new captive PBM structures will need to keep pace with modernization and expansion of solution portfolios of the large national PBMs, which will move the goal posts for parity offerings.

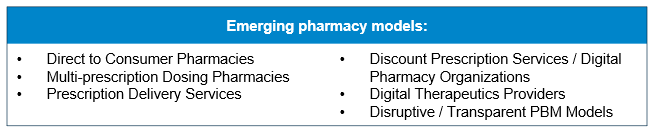

Experimentation with emerging pharmacy solutions is growing through partnership or acquisition of new disruptive entrants to the industry

Organizations with an eye toward modernization will take notice of the significant private equity (PE) and venture capital (VC) investment that has entered the pharmacy marketplace, creating a new set of threats and opportunities.

Online pharmacies alone accounted for $321 million in PE and VC investments in 2019[vi]. Using a combination of digital technology and “on-demand” consumer engagement models, new entrants are taking advantage of shifting consumer expectations to create consumer-centric pharmacy solutions. While incumbents must be watchful for loss of market share, they can strive to add new capabilities or use existing scales to leapfrog the market.

Incumbent PBMs are diversifying and expanding their platform of client solutions

As traditional PBM services face commoditization, organizations are expanding their portfolio of services with a focus on outcomes and value.

PBMs continue to focus on reduction of drug and administrative costs in their traditional business. However, we have seen a proliferation of offerings aimed at improving treatment outcomes and insights, and enabling consumer-facing features and functionality. The recent expansion of digital therapeutic offerings by multiple PBMs, as well as the acquisitions of DivvyDose by United Healthcare[vii] and ZipDrug by IngenioRx[viii], demonstrate a commitment to add consumer centric capabilities. We expect to see organizations continue to expand their digital platforms to include a suite of enabled services aimed at creating loyalty among their clients.

Healthcare organizations are seeking breakthrough alliances in pharmacy to control costs and improve competitive positioning

Attempts to solve escalating pharmacy costs, financial turmoil and/or weakened competitive positioning has created an environment for ecosystem partnerships with aligned incentives.

Struggling health plans need to find new and innovative ways to control cost of care and administrative expenses while also seeking a differentiated advantage in the marketplace. This necessity has prompted creative partnerships, alliances and joint ventures between hospital systems, physician groups, pharmacies or pharmaceutical companies whose goal is a mutually beneficial outcome. We expect to see continued experimentation among various constituents with attempts to control costs including value-based contracting, innovative specialty pharmacy networks, adoption of biosimilars and alignment of prescribing guidelines and care pathways.

Summary

Underlying economic forces in the healthcare industry will continue to create pressure to innovate and make meaningful impacts in the pharmacy space, and this issue will continue to be on the C-Suite agenda of healthcare organizations. As competition increases and new models emerge, organizations will need practical strategies and roadmaps to keep pace with changing pricing models and expanded and improving service offerings, be able to capture revenue and margin, and address threats just over the horizon. As such, pharmacy executives will need to stay abreast of the evolving landscape and evaluate which trends to follow, which strategies to employ and where to carve out a differentiated position.

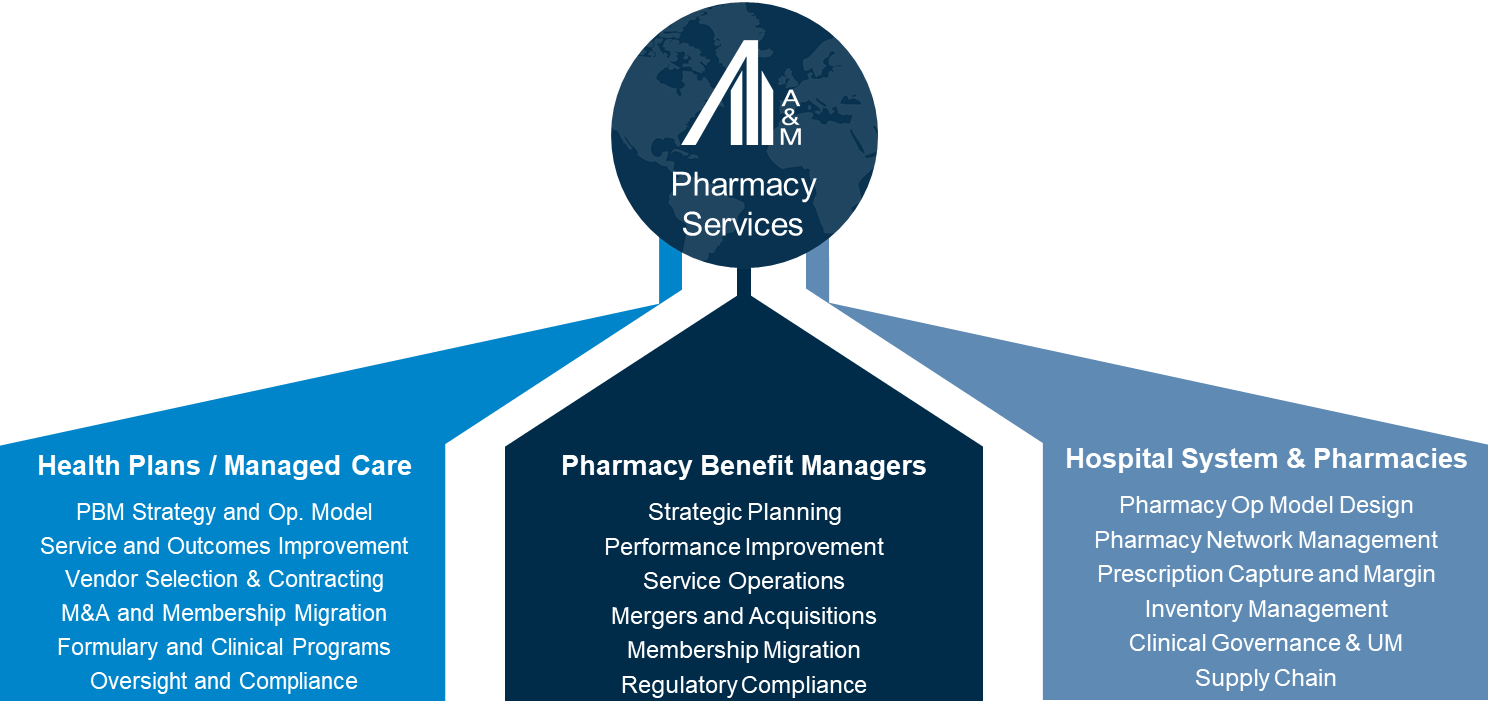

How A&M can help

A&M has a dedicated Pharmacy and PBM practice to help health plans, MCOs and PBMs address pharmacy strategy and operations. Contact our team today.

[i] King, R. (2019) ‘ Costly specialty drugs make up 40% of 2019 employer drug spending despite few prescriptions’, Fierce Healthcare, August 21, 2019

[ii] Marsh, T. MPH (2020), ‘Drug Prices are Growing Faster Than Any Other Commodity or Service’, GoodRx, June 25, 2020

[iii] Fein, A. J. (2020) ‘The Gross-to-Net Bubble Hit $175 Billion in 2019: What Patients Need Rebate Reform‘, Drug Channels, August 4, 2020

[iv] National Pharmaceutical Council (2017), ‘Survey of employers’, npcnow.org

[v] Fein, A. J. (2019). ‘PBM Market Share by Total Equivalent Prescription Claims Managed, 2018‘, Drug Channels, May 29, 2019

[vi] Babu, G (2020). ‘Online Pharmacies see record funding in 2019, investments double to $321 mn’, Business Standard, January 18, 2020

[vii] Farr, C. (2020). ‘UnitedHealth has acquired DivvyDose, a competitor to Amazon’s Pillpack’, CNBC, September 29, 2020

[viii] Reuter, E. (2020). ‘Anthem’s PBM buys pharmacy startup Zipdrug’, MedCityNews, July 6, 2020