Stepping Up the Fight Against Corporate Cartels

Corporate cartel detection and conviction rates have been growing significantly across the globe as authorities continue to develop and implement new tools and tactics. The U.K. regulator’s recent campaign shows that employing even relatively simple new approaches can be highly effective when it comes to fighting price-fixing agreements.

The war against corporate cartels is no different to that being waged against other types of white-collar or financial crime, be they Ponzi schemes, boiler rooms or corporate tax evasion. When crime pays and criminals become ever more sophisticated, enforcers need to get stronger, smarter and more tactical. Despite billions in fines being levied by competition watchdogs around the world and the growing threat of highly punitive third-party damages claims, price-fixing or market-sharing cartels remain a scourge both to the global economy and to consumers worldwide. [1], [2]

The U.K.’s Approach

This was highlighted in February 2018 in the U.K., when the Competition and Markets Authority (CMA) noted a 30 percent uplift in tip-offs on cartel activity, following its “Cracking down on Cartels” awareness campaign of 2017.[3] The campaign was noteworthy in that it had involved a change in tack by the CMA. Until then, in its efforts to stamp out cartels, the authority had relied primarily on a combination of hefty fines and a leniency program (allowing certain self-reporters a level of immunity). This has been a common approach seen internationally, with the U.S., the U.K. and other European authorities leading the way. With its 2017 campaign, the CMA not only went digital for the first time with its awareness efforts, it also revived the use of financial incentives, offering a cash reward of up to £100,000 ($129,000) to encourage any individual, for example a junior staff member, who may be aware of the cartel to whistle blow (while being protected by guaranteed anonymity, if required).[4]

The Rest of the World

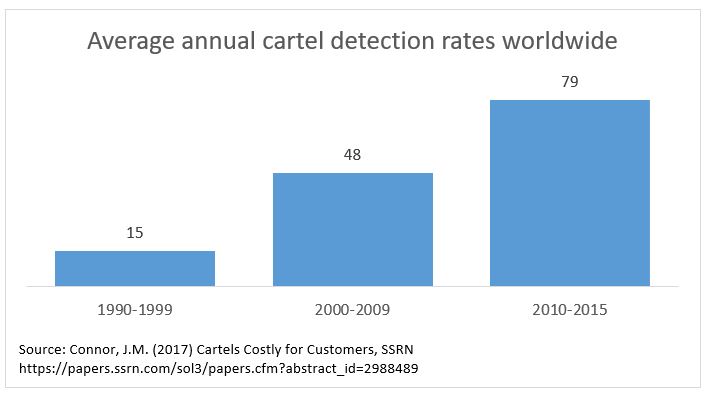

International cartel detection rates have been rising steadily over the last few decades and the number of jurisdictions with experience in prosecuting international cartels has climbed from only a few in early 1990 to nearly 70 by 2015[5]. What the new data brings into sharp relief, however, is that detection rates in a country can experience a marked uplift with the use of relatively simple tools by the relevant authority such as a digital awareness campaign or a modest financial incentive to a single individual. The result suggests that the conventional combination of fines and leniency may only go so far. In order to unearth the next, deeper tranche of cartel behaviour, the use of additional tools may be warranted, in the form of cash rewards, broader awareness campaigns or perhaps the increased usage of criminal sanctions, where available. Indeed, given the significant success of its 2017 efforts, the CMA has launched a 2018 campaign entitled “Safe, Not Sorry,” which is designed to encourage individuals to blow the whistle on cartels that they may be aware of, and which is being targeted at particular sectors that the CMA considers to be prone to cartel activity.[6]

Lessons Learned and a Warning

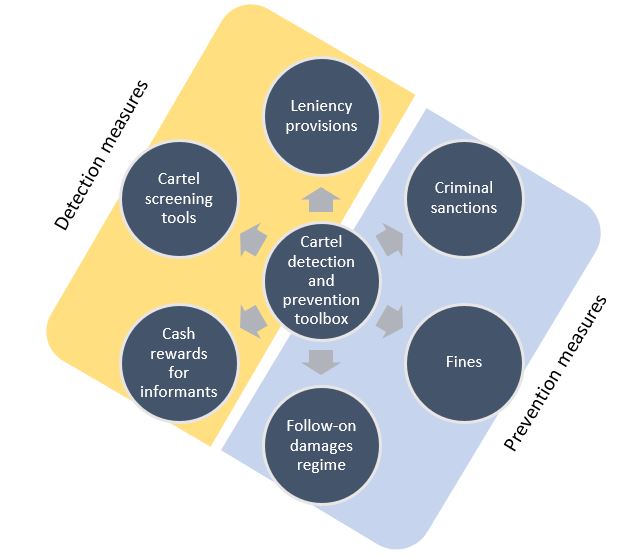

The wider lesson for authorities worldwide? If you are looking to increase detection rates, you may want to consider broadening your activities and using the full weight of your arsenal. Take an all-encompassing approach to the use of the tools within your toolkit: fines, leniency, criminal sanctions, awareness programmes and cash rewards. Moreover, you may consider looking into other cartel screening tools which may assist in unearthing price-fixing or market-sharing behaviour.[7] Where you do not have the requisite set of powers, you may want to lobby your governments for them. In the ongoing battle to stop firms circumventing competition laws and exploiting consumers, each and every tool has the potential to help bring about better market outcomes, lower prices and improved consumer choice.

The lesson for corporate leaders? Strengthen your internal compliance programmes, ensure that your staff are made aware of the repercussions and risks of breaching competition rules. As needed, invest in training programmes, easy-to-use hotlines, protection protocols for internal informants, triggers for internal investigations and clear roles and mandates for compliance officers. Above all, use any and all information you may become aware of in order to protect your business interests. Uncovering misconduct early enough to address it may well save you from substantial fines, intense regulatory scrutiny, costly and prolonged litigation, and not to mention potentially irreparable harm to your reputation.

Finally, the message to any potential cartelists out there? If you feel confident your activities can remain hidden: beware, you may yet be exposed as the next Bernie Madoff of the corporate cartel world. Indeed, your risks of being caught have just shot up. No matter how clever or sophisticated you think your approach may be, your undoing may be a colleague nearby. While you may not be covering the traces of secret meetings with co-conspirators in smoke-filled bars, choosing instead to scheme under the cover of newer communication channels;[8] what you may never be able to account for is that colleague who has either seen or heard enough and is just so tempted enough by a cash reward, to turn you in to the authorities.

[1] Price-fixing cartels are generally agreements between or among competitors (either written, verbal, or inferred from conduct) that may raise, lower, or stabilize prices or other terms. Market-sharing agreements, on the other hand, may involve the division of sales territories or the assignment of customers.

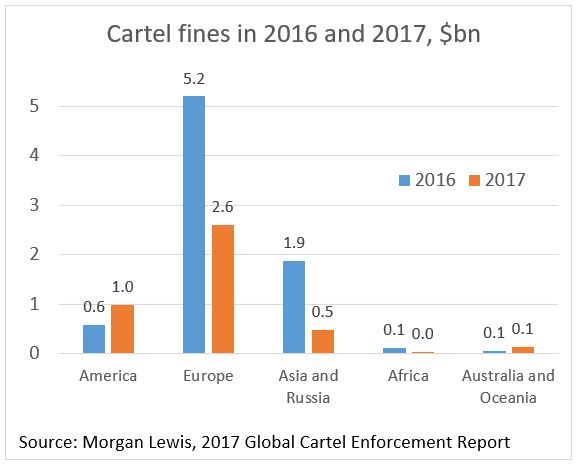

[2] Total global cartel fines amounted to some $4.2bn and $7.9bn in 2017 and 2016, respectively, with the highest fines imposed in the European Union, South Korea and the United States (see: https://www.morganlewis.com/documents/m /documents/cartel/cartel_report_2017_year_end_180091.pdf). The ten highest individual cartel fines imposed by the European Commission between 2000 and 2018 ranged from between €0.46bn and €1.01bn.

[3] “Cracking down on Cartels” was the CMA’s first digital advertising campaign designed to stamp out cartel activity and encourage people to report it. Adverts appeared on social media feeds such as Twitter and LinkedIn, and on selected websites (see: https://www.gov.uk/government/news/cma-launches-campaign-to-crack-down-on-cartels, and https://www.gov.uk/government/news/new-campaign-targets-cartels-as-tip-offs-rise-by-third).

[4] This is not the first time financial incentives have been used. For example, Korea and Singapore use financial incentives to encourage just such whistle-blowing, and the Office of Fair Trading, the CMA’s predecessor, introduced the feature some ten years ago in the UK, albeit with the scheme being scarcely used. Having said this, in order to protect the identify of its informants, authorities would typically not be likely to reveal whether or not they had paid for information on a cartel. As such, related figures may be under-reported thus far.

[5] Connor, J. M. (2017) ‘Cartels costly for customers’ (see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2988489).

[6] The new campaign is particularly focused on construction, manufacturing and business support services industries that, according to the CMA, are at a greater risk of cartel forming due to history of cartel behaviour or industry characteristics (see: https://stopcartels.campaign.gov.uk/).

[7] Cartel screens can be used to flag suspicious behaviour using the detailed analysis of data on particular industry characteristics and firm level behaviour (See examples of such cartel screening tools in this OECD paper: http://www.oecd.org/daf/competition/exofficio-cartel-investigation-2013.pdf).

[8] Financial chat rooms and trading room phone calls and messaging services were used by traders involved in the Libor cartel (http://www.perc.org.uk/project_posts/perc-paper-15-the-libor-scandal-mediation-and-information-issues/)