Spanish Telecom Industry View

The riders of lost value in the telecom industry

Executive Summary

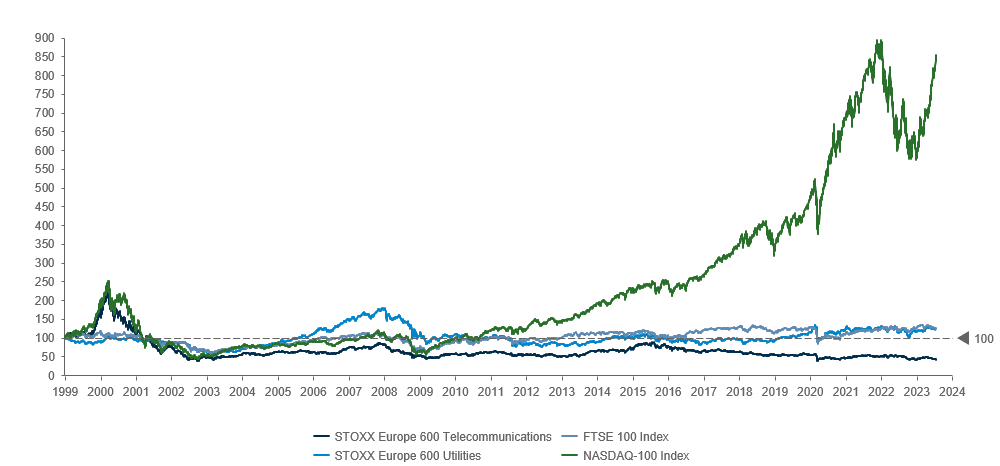

The telecom industry is far away from the days of glitz and glamour it enjoyed prior to the dotcom bubble. Today’s industry value (STOXX Europe 600 Telecoms Index) shows a cumulative decline of -81% vs. its peak in March 2000, while Nasdaq-100 has achieved a cumulative 346% increase over the same period. Ultimately, there was value on the Internet, but it would not be the telcos to capture.

Nevertheless, recent history does not paint the same picture everywhere. While the European telecom industry has declined by c. -6% pa. in the period 2015-2021, the US industry has demonstrated solid growth at c. 7%.

A significant part of this underperformance may be explained by a European regulatory framework that has promoted fierce competition and fragmented infrastructure. Additionally, legacy technology and heavy organizations make it difficult for European incumbents to adapt to increasingly rapid changes.

Although this context has frightened away retail and corporate investors alike and is increasingly pressuring for every industry Board, there remains a significant amount of value creation potential in the industry.

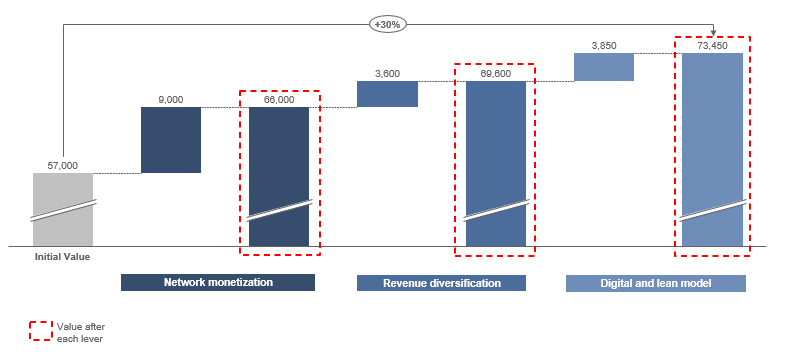

In fact, an outside-in value creation analysis of the Spanish market, that acts as spearhead for many telecom changes in Europe (fiber, convergence, 5G, etc), shows c. 30% value creation potential in the telecom industry through the application of three major levers:

- Infrastructure monetization Pushed by heavily indebted balance sheets, telcos have started to carve out some non-core infrastructures like towers, data centers and rural fiber. Acceleration of this activity (including potential InfraCo-ServCo segregation), consolidation of fixed network infrastructures, as well as integration of long-tail retail operators could release € 9 bn value growth.

- Revenue diversification. Telcos should target above 5% of total revenues from new services to compensate continued price erosion in core business lines. The provision of adjacent services like home security, energy, cybersecurity, and IT services (B2B and B2C) could result in € 6 bn value growth. Asian operators such as Softbank, KDDI and SK Telecom report more than 35% of their revenues from diversified non-core services

- Decisive transformation of legacy operating models. Digitalization of front-line activities above 50% of customer interactions, adoption of lean network operating models and deployment of new network technologies (like network virtualization and Open RAN) would generate incremental value well above € 4 bn.

That value growth would be captured by the collaboration of three different type of players: i) telco operators thinking out of the box, ii) investors participating in the segregation, consolidation, and development of future infrastructures; and iii) subcontractors and service providers supporting telcos transformation into a digital and lean operating model.

The outcome would be a very different industry structure in terms of size and number of competitors, ownership and management of assets, and boundaries with adjacent industries. It goes without saying that regulators should also participate in bringing this transformation to fruition.