Spanish Banking Pulse Q2 Update 2020

As part of our periodical series “El Pulso de la banca”, and as the global impact of COVID-19 continues, our experts have analysed the profitability performance and resilience of the Spanish banks in the second quarter of 2020.

Headline trends for this quarter include:

- Loans and Advances (L&A) increased this quarter by 3.8% driven by public guaranties and corporate loan growth, deposits also grew by 4.9%. Net interest margin declined due to lower rate environment and the funding cost is flat.

- Net Interest Margin (‘NIM’) decreased slightly to 1.10%, driven by lower yield on credit

- Operating income margin decreased due to lower interest and fees and commissions income

- Cost of Risk (CoR) and Non-Performing Loans (‘NPL’) to increase driven by macro scenario and higher defaults. Expected flexibility of supervisory NPL definitions.

- Cost-to-income (‘C/I’) ratio increased to 58.1% as a result of the lower income.

- NPL ratio declined, driven by the increase in gross customer loans, while Cost of Risk (CoR) keeps at Q1 levels of 1%

- Return on Equity (‘RoE’) and other profitability ratios remain at similarly low levels of previous quarter

- CET1 fully loaded ratio increased 30 bps to 12.4% driven by a decrease in Risk-weighted Assets (‘RWA’) due to regulatory release

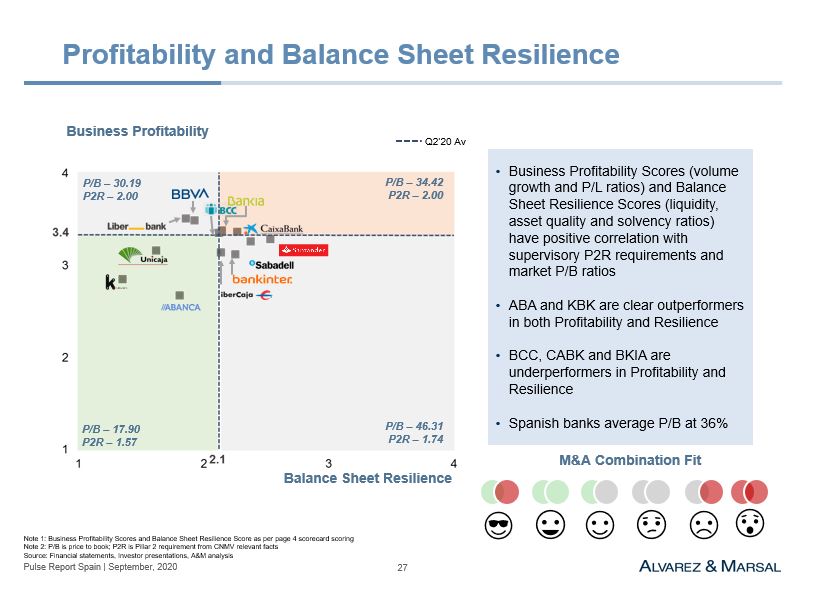

Scorecard analysis

Profitability and balance sheet resilience scores per bank

What should banks be considering?

The present crisis is increasing profitability problems of the sector given the business decline, the narrowing of the margins and the increase in cost of risk. To deal with these challenges the Spanish banks must articulate disruptive cost cutting measures, an active management of the corporate portfolio, as well as an ongoing capital optimization based on regulatory flexibility and public aid optimization. All of that combined with the consolidation process, which has been relaunched and will be key to meet efficiency targets.

How can A&M help?

A&M’s dedicated Financial Industry Services practice helps financial institutions, government enterprises and Central Banks, and other financial services companies to successfully execute business strategy and maximise growth, while minimising risk and navigating regulatory issues.

A&M has relevant and credible skills and capabilities to assist financial institutions with the challenges mentioned: A&M can help transform, restructure and optimize performance by managing revenue, cost, risk, regulation, strategy and digital transformation.

If you would like to discuss the findings from our analysis in more detail or would like a copy of the report, please contact Eduardo Areilza.