Reducing the European NPL burden

European non-performing loans (NPLs) stocks have increased significantly across Europe since 2008 reaching circa €1 trillion in 2016. This build up was accelerated due to the financial crisis, however the main causes were due to poor supervision and governance, aggressive lending and acquisition strategies, loose credit underwriting policies, high exposure to sectors that were most impacted by the financial crisis (such as real estate) and lax credit controls.

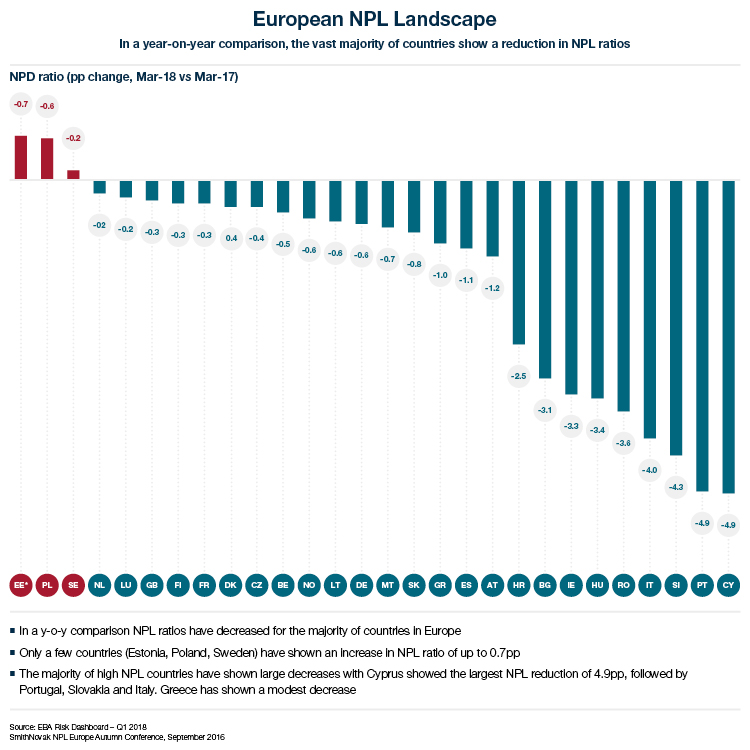

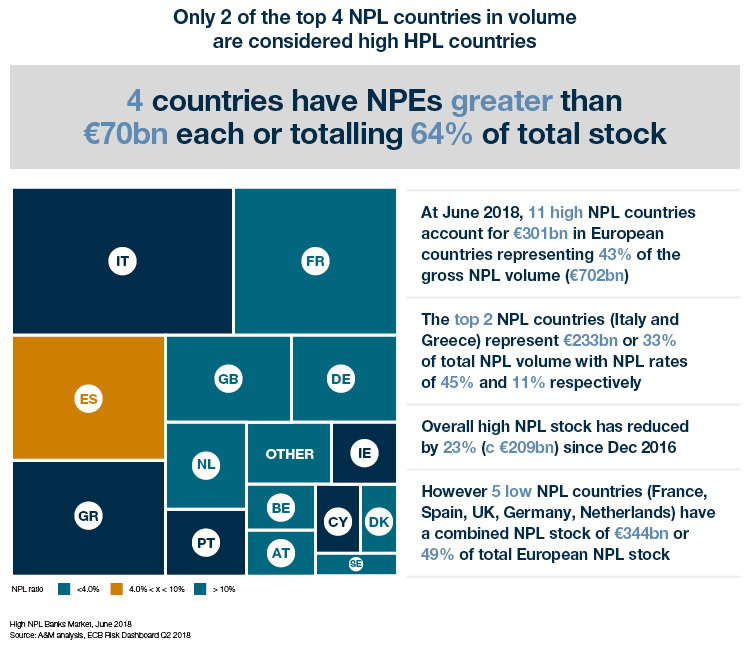

However, the level of NPLs in the banking system in Europe has reduced materially by circa 30% in the last six quarters from €994 billion in Q3’16 to €703 billion in Q1’18. In the same period, the NPL% ratio has reduced by 1.5 percentage points from 5.4% to 3.9%. During this period the total loans stock has reduced by 3% from €18.6 trillion to €18 trillion. These numbers include the overall volumes in the European banking system but not the NPLs acquired by non-bank investors sold by NPL banks.

Even though there had been decent overall reductions the absolute levels of stock still remain high and needs continued attention as a high volume of NPLs causes significant drag on a bank’s performance.

Countries like France who have a low NPL ratio (3.2%) but still have a high NPL stock (second highest in Europe with €121 billion in NPLs behind Italy at €161 billion) should not ignore a concerted stock reduction plan.

Regulatory response

The ECB issued new guidelines in March 2017 with respect to the management of non-performing loans with a clear focus on the main high NPL banks in Europe to aggressively reduce their NPL stocks over a 3-year period through restructuring, sales (loan and assets), enforcement, etc. These guidelines will ensure that banks continue to use loan sales as a key tool in managing their NPL stocks and increased provisions should close any potential ‘pricing gap’ between seller (banks) and buyer (Private Equity investors) expectations.

NPL loan sales market

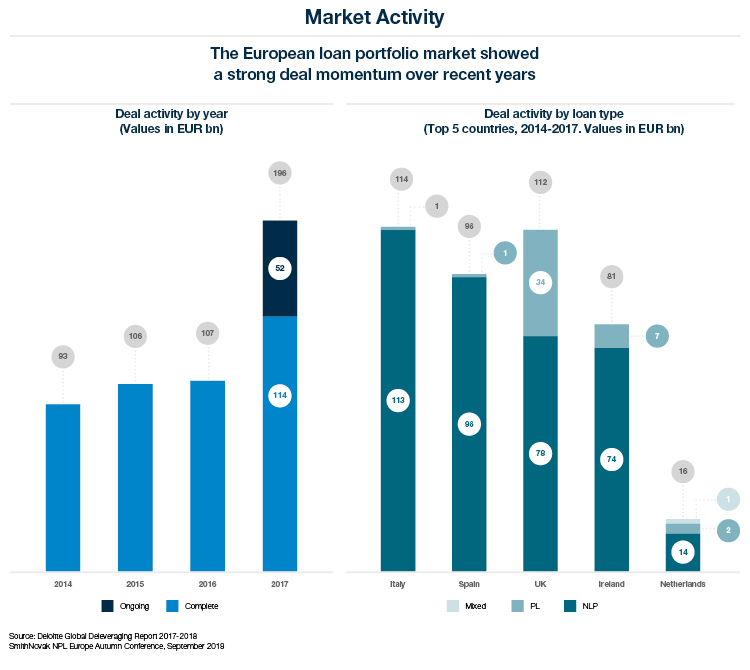

The investor market has been buoyant over the past four years (2014 – 2017) with loan sales exceeding €100 billion each year. 2017 was a significant year with loan sales of €144 billion dominated by Italy, Spain and UK. 2018 is expected to also exceed €100 billion with strong deal activity in mature markets (Italy, Spain, Ireland) and new markets opening up (Greece (Project Amoeba €2 billion SME loan sale to Bain in May 2018)) and Cyprus (Bank of Cyprus €2.8 billion corporate / SME loans sale to Apollo).

A healthy loan sales market needs the necessary servicing infrastructure to support the resolution of NPLs acquired by investors. The servicing market has also evolved along with the continued growth in the loan sales market. This has developed through (i) M&A activity, (ii) licensing activity, (iii) bank carve-outs and (iv) structured transactions as follows:

- Over the past year there has been steady M&A activity (e.g. the acquisition of Capita Asset Services by Link, the acquisition of Pepper by KKR).

- Greece, being the country with the highest NPL ratio (45%), introduced a servicing licensing regime two years ago. Over 20 licences have been issued in the past year in order to support an anticipated increase in loan sales (c. €16 billion in 2018). The ECB will be introducing a pan-European servicing legislation later this year.

- As part of the overall loan sales transactions package, banks have also offered to sell their work-out unit (or part thereof), in order to provide a servicing option to investors. These transactions have been prevalent in Spain, Cyprus and Greece.

- In addition, we have seen some interesting new innovations like the Intrum – Intesa JV which may be a template for future bank / servicer co-operation. Intrum, the servicer, recently announced the establishment of a servicer of non-performing loans (NPLs) of Intesa Sanpaolo in Italy, Intrum will own 51% of the Joint Venture Servicer and service Intesa’s NPL flow for 10 years. Intrum, together with CarVal Investors, will acquire a 51% participation of a NPL portfolio with a GBV of EUR 10.8 billion, with the JV and NPLs to be deconsolidated from Intesa’s balance sheet.

Outlook

Overall the outlook is still good for the European NPL market with a strong pipeline of supply in the main NPL countries (driven by NPL reduction plans), a continued strong demand from investors, renewed regulatory focus on NPL management / sales, remaining benign funding conditions and a growing selection of competent servicers in the main locations.

About the author

Tom McAleese, is Managing Director and Head of European Bank Restructuring in Europe at Alvarez & Marsal. In Europe A&M have been involved in over €350 billion of loan sale transactions in over 20 countries in the last four years.