Product Governance & Target Markets: It’s not just MiFID II

The financial regulatory focus in Europe on Product Governance is forcing fundamental changes in how financial products are expected to be manufactured and distributed. The MiFID II approach to Product Governance has created a benchmark for investment services and products, but the same principles can be applied across all activities and services. A well-designed and well-executed Product Governance process is central to an integrated conduct risk framework and operating a successful business strategy.

Importance of early issue identification

If the risk of client detriment is to be managed actively, then any issues which are emerging downstream in the product manufacture and distribution process need to be identified as soon as possible. This is arguably the most important element of the Product Governance process. Experience shows that events that become major regulatory issues (such as IRS mis-selling, PPI, mortgage failings) could have been identified and headed off before they escalated to become a systemic shock. Stress-test and scenario analysis are important tools here, but they need to be complemented by active monitoring of actual experience, based on collation and analysis of all relevant information, in a well-developed control framework that feeds into the conduct risk oversight mechanism.

Optimising data management

Firms should not underestimate the complexity of the challenge, especially when operating on a multi-jurisdictional basis, or offering a wide range of products. New regulation has impacted the entire product lifecycle, and firms will need to specifically look at their current data management capabilities (e.g. sales data, target markets and product information) to ensure effective information flow and interaction between all parties in the product value chain.

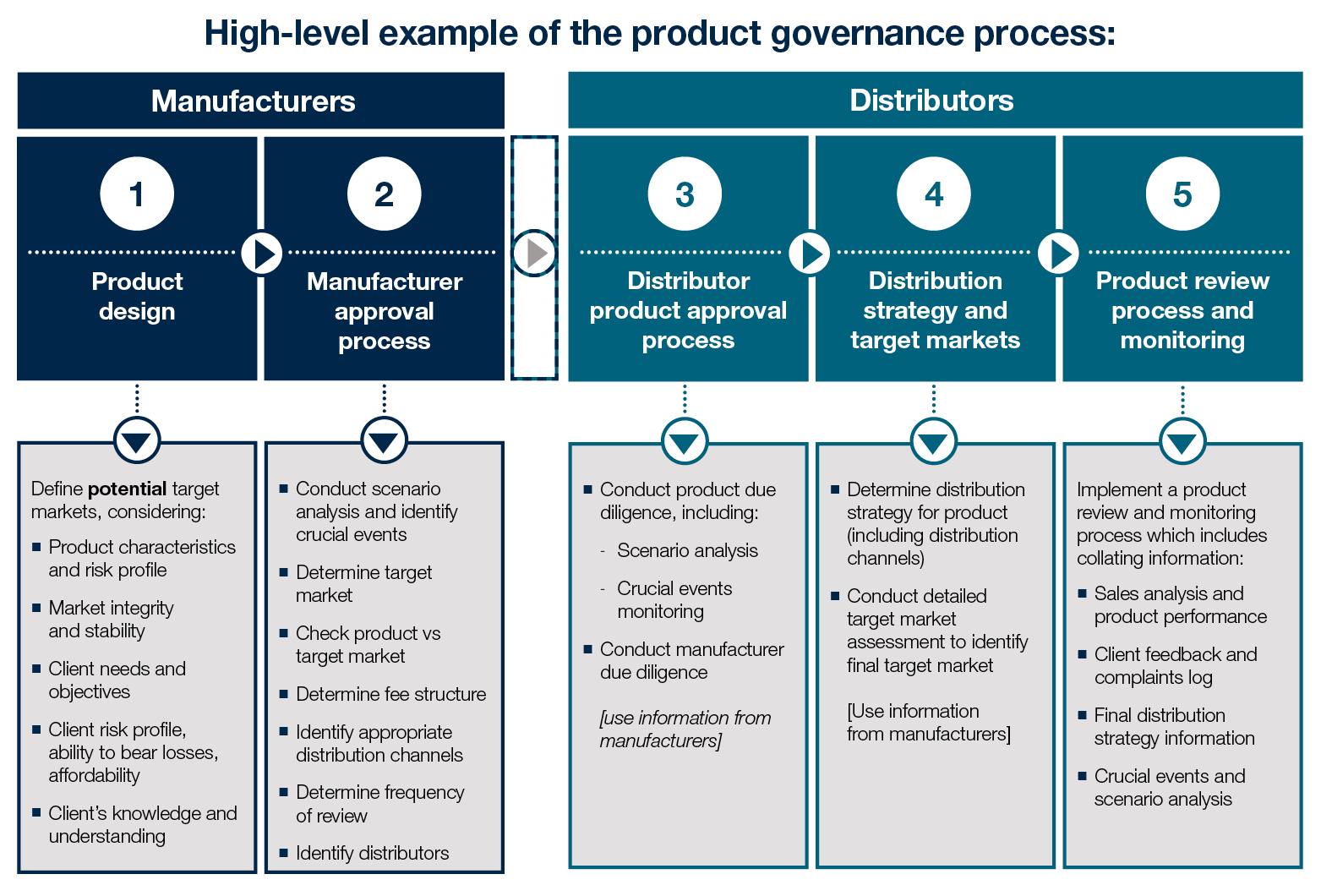

What does the Product Governance framework look like?

Some of the features of the MiFID II Product Governance arrangements are already being reflected elsewhere, in broader regulatory requirements to incorporate increased control and oversight over the product lifecycle of non-MiFID instruments.

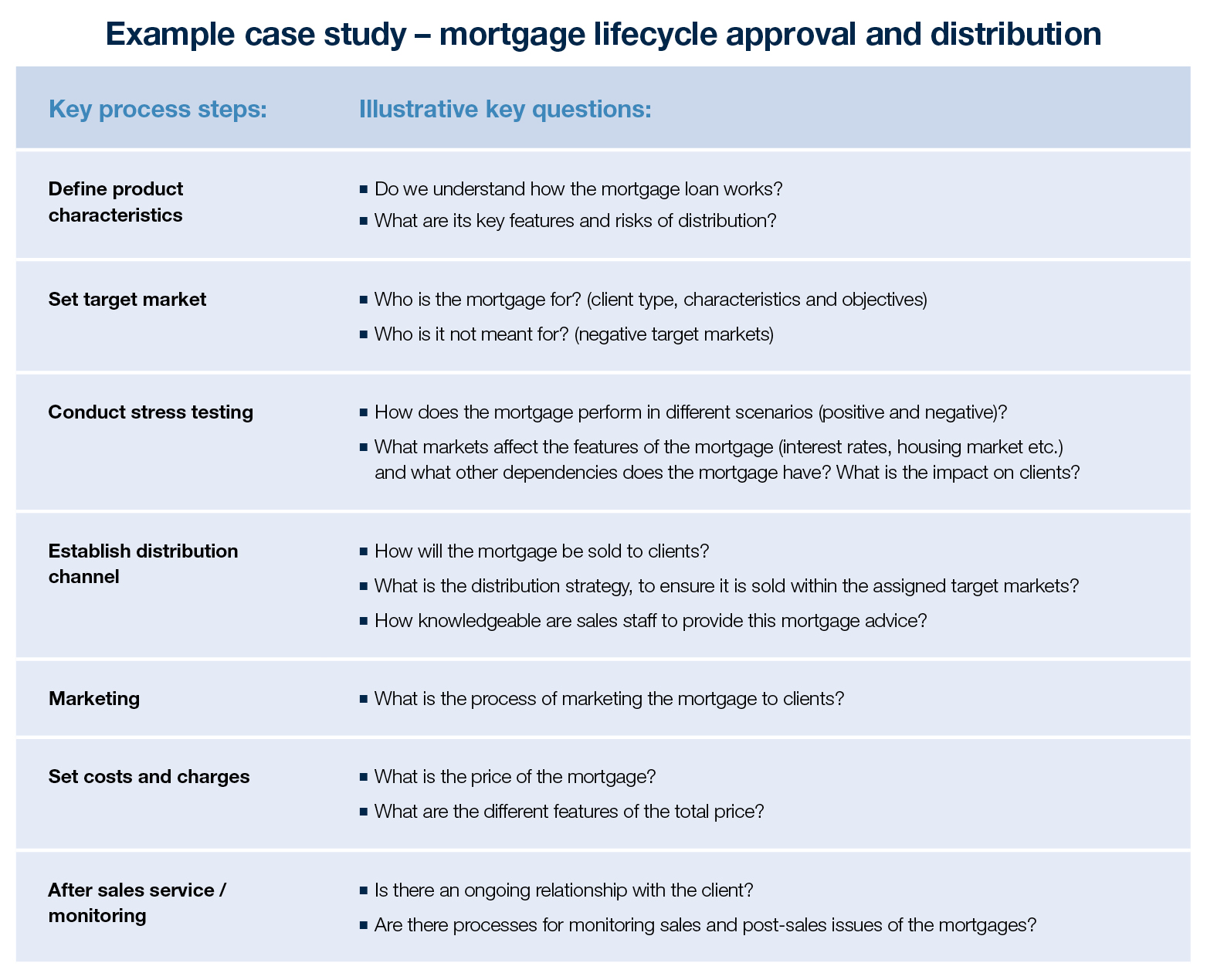

A key example is the EU Mortgage Credit Directive 2014 (refer to diagram 2). It was revised to incorporate stricter requirements around:

- Stress testing

- Information disclosure to clients

- Enhancing broker assessments

Applying a holistic approach to assessing the lifecycle for all products can put a firm in a strong position to meet regulatory obligations more broadly.

Key considerations when developing a Product Governance framework

- Design products that meet the needs and objectives of customers in identified target markets;

- Stress-test products to ensure they are capable of delivering fair outcomes for the target market on an ongoing basis;

- Ensure there is a robust product approval process applied to new products and services; and

- Monitor the distribution and performance of products as part of a continuous review process, applied through to the end of the product’s lifecycle.

A&M approach – Meeting your regulatory obligations

Regulators expect that any Product Governance framework will align with the nature, scale and complexity of a firm’s operations. The onus is on individual firms to define how they apply a proportionate approach to the context of their own institutions and the products and services that they provide to their clients. Policies and procedures should be updated in line with regulatory requirements with a specific focus on;

- Understanding the needs of your clients;

- Aligning products with your client target markets (including justifications for those target markets); and

- Effective oversight by Senior Management.

A&M’s Product Governance Framework solution captures the whole of the product lifecycle from product manufacture to distribution, and incorporates the complications from factors such as third-party relationships, co-manufacturing responsibilities and ongoing monitoring. A&M’s appreciation of regulatory requirements and thorough understanding of industry practice ensures that recommendations are aligned with your commercial and regulatory obligations.

For more information please click here to contact a member of our team.