Powerful Returns: Leveraging ESG to Drive Human Capital ROI

For many companies environmental, social and governance — or ESG — is an unavoidable and growing area of focus, showing up in customer questionnaires and employee town halls, lender calls and proxy battles.

First underscored by the investment community and then propelled by recent global events, ESG has transitioned from a niche concern to an expected business focus, with companies moving to implement new standards, practices and targets designed to create stronger organizations, more societal good and greater tangible value.

This rise of ESG has dramatic and surprising implications for human capital and how companies recruit, retain, incentivize and optimize the workforce. Specifically, companies are taking a hard look how investment in diversity and inclusion, pay equity, executive compensation and human capital governance work to help companies not only function effectively, but thrive — shall we say — sustainably.

Recruit – Drive Diversity and Inclusion

A record 41 women are CEOs of Fortune 500 companies. That’s the good news. The bad news? On a proportionate basis with the population, the Fortune 500 should have 256 women at the helm. That’s just one reminder that, in 2021, diversity in companies has a long way to go.

Diversity and inclusion initiatives also are imperative for companies to attract new talent. For millennials, who now represent the majority of the U.S. workforce and will hold about 75 percent of positions by 2030, it’s no longer enough to talk about diversity — companies need to show it.

The availability of information on companies, whether accurate or not, is readily available for potential recruits, and sites like Glassdoor and Indeed make it easy to get a pulse on how well companies score on diversity and inclusion attributes.

According to a recent survey, 76 percent of employees and job seekers believe a diverse workforce was important when evaluating companies and job offers.[1] In fact, about one in three employees and job seekers said they would not apply to a company where there is lack of diversity among its workforce.

Diverse workforces take effort to build, and this means taking a look at recruitment practices, including:

- Revising job descriptions with more inclusive language and avoiding gender-coded words

- Offering internships to underrepresented groups

- Seeking referrals from diverse employees

- Partnering with multicultural professional organizations and associations

In recruiting, companies should be the best source of information for potential hires, which means communication is key. Diversity and inclusion priorities should be reflected in policies and practices and shared externally. Diverse employees should be represented on the corporate website and flagship materials. And leadership should serve as ambassadors for diversity and inclusion by continuing to emphasize actions, targets and progress across the organization.

Retain – Focus on Employee Pay Equity

Social and racial justice awareness has put gender and racial pay equity further under the microscope in the past year. As the corporate landscape changes, employee-population statistics are becoming frequently tracked by the public, and it is critical for companies to recognize and begin to address this component of ESG pressure before they are put on the hot seat by external stakeholders.

Racial and Gender Pay Equity

A diagnostic of payroll data to determine any irregularities between gender and/or race can be a good place to start. If potential issues are identified, companies can take a deeper look at those data points to determine if there is a reasonable explanation. Often, tenure, education or performance ratings justify differences in pay levels. If legitimate discrepancies still exist, evaluate the various ways to correct the issue while mitigating potential legal and financial exposure.

Internal Pay Equity

Internal pay equity also deserves revisiting, as the pandemic may have exacerbated an already-wide divide between rank-and-file workers and the C-suite.

Some organizations are considering expanding who is eligible for incentive bonuses and equity awards that had historically been reserved for top management. Such efforts, even if limited in amount, can go a long way to improve employee satisfaction and performance. Ultimately, employees who do not feel that they are both part of a diverse team and compensated equitably in relation to their peers often underperform and/or leave. Ensuring diversity and fair pay at all levels of the organization is paramount when considering the long-term success of a company.

Incentivize – Tie ESG Goals to Executive Compensation

Corporate boards go to great lengths to design compensation policies to align executives’ actions with overall company goals and objectives. While the alignment of executive compensation metrics with organizational financial metrics is widely used and accepted, organizations across all industries in both the public and private sectors are now adopting ESG-based incentives structured around a number of nonfinancial, or better yet, pre-financial targets. Unlike straightforward financial targets, certain ESG incentives can be more difficult to identify and quantify, often resulting in a mismatch of motivation, goals and overall business performance. Companies looking to build ESG into compensation programs should first focus on the basics and understand the factors that drive value for the enterprise. Important questions to consider before implementing ESG within a compensation plan include:

- What policies and practices are established within the organization?

- What reporting or data collection mechanisms exist?

- How is ESG part of the management and board-level agenda?

- What goals does the company look to achieve?

Organizations should avoid overcommitting to goals without a clear path for achievement, or underwhelming stakeholders with targets that are not actually advancing the core business. While there are no “one size fits all” options here, below are some of the factors to consider when implementing ESG metrics into compensation programs:

What Metrics to Utilize

ESG metrics must be carefully chosen and structured to be sufficiently challenging based on the circumstances of the particular company. The metrics utilized by an oil and gas company will vary greatly from those of a software company simply due to the nature of their business. Companies also need to consider the number of ESG metrics to utilize and how to weigh them relative to other metrics within the plan.

Common ESG metrics used by companies include:

- Environmental metrics such as greenhouse gas emissions, land protection, water use, etc.

- Social metrics such as diversity initiatives and safety performance

- Governance metrics such as risk management and compliance initiatives

Where to Incorporate the Metrics

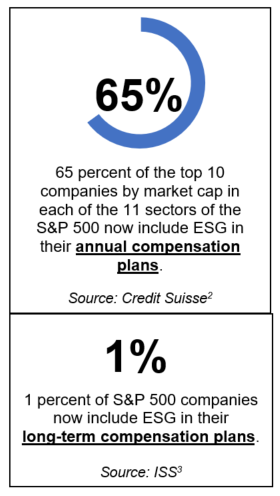

Due to increasing pressures, organizations have begun to accelerate their timelines for ESG progress, which in turn has led to a great number of companies incorporating ESG metrics into their annual bonus plans to ensure immediate attention to these goals and objectives. A recent study by Credit Suisse found that 65 percent of the top 10 companies by market cap in each of the 11 sectors of the S&P 500 now include ESG considerations in annual compensation plans.[2]

However, meaningful change in some ESG areas (for example, certain environmental efforts) cannot be enacted overnight — they require years of investment before results may be realized. In those circumstances, some companies are incorporating ESG metrics into their long-term incentive plans to align with the multi-year strategy. However, this is still a minority practice with a mere 1 percent of S&P 500 companies linking ESG performance to long-term incentive programs, according to an analysis by Institutional Shareholder Services (ISS).[3]

Over time, we expect the gap between annual and long-term ESG metric adoption to narrow as companies reflect on continuous, longstanding improvements related to ESG priorities.

How to Measure Performance

Generally, performance under executive compensation plans is largely measured based on objective criteria with some discretion retained by the board in certain areas. However, objective bright-line tests may prove difficult with certain ESG metrics, especially in rapidly evolving areas of the ESG frontier. Boards should weigh whether subjective goals are more appropriate on a case-by-case basis while being cognizant of how outside stakeholders may view such discretion.

Ultimately, ESG is about driving positive change through managed and measurable programs. Compensation is a well-demonstrated motivator for performance and also an indicator of intent, reflecting a company’s values and priorities. When done well, ESG incentives are a powerful demonstration of a company’s commitment to do better — and be better for the benefit of all stakeholders.

Optimize – Promote Human Capital Governance

“People are our most important asset” is a phrase that is as frequently uttered as it is overlooked. The concept of human capital governance, thoughtfully developed and carefully implemented, is not only a path toward elevating people to a level pari passu with “tangible” assets. It is also recognizing more fundamentally that the purview is not just of the human resources group, but of the board.

Foundational to a company’s approach to optimize its workforce are its culture, purpose, mission, vision and values, which characterize the heart and soul of an organization and provide a roadmap that guides daily behaviors and difficult decision-making. But human capital priorities at the governance level stretch far beyond these foundational ingredients. Good human capital governance requires board interest, oversight and commitment around all aspects of the employee experience.

The fact remains that many boards continue to grapple with addressing ESG-related issues involving human capital management. In fact, research shows that only 21 percent of directors have relevant ‘S’ experience.[4]

But all boards can positively turn the corner here. Consider:

- Evaluating measurability and accountability – Human capital metrics should be reported to the board and carry the same measurability and accountability as financial aspects.

- Reflecting on impact – Target practices that are relevant to the industry or company stakeholders. Practices should not be established to simply check the box but should address factors that could have a significant impact on the performance of the business.

- Getting educated – Bring in experts to advise on industry trends and best practices in human capital management to ensure meaningful oversight.

Bottom Line

Well before the rise in ESG, companies recognized that a strong workforce can lead to better results. While this sentiment remains, companies must reevaluate the ways they attract, maintain and cultivate the best possible workforce for long-term success.

Effective approaches to ESG and human capital management play an essential role in ensuring that goals are met — some may call this good business, we call it good return on investment.

At Alvarez & Marsal, we have worked with clients across all industries to help build practical ESG initiatives and tie those efforts with compensation programs to drive real results. Please reach out to our team if you need assistance navigating this ever-evolving area of ESG.

[1] Glassdoor, Diversity and Inclusion Workplace Survey, September 2020.

[2] Credit Suisse ESG Research: Examining ESG Links in Executive Compensation, May 2021.

[3] Corporate Secretary, “Trying to tie executive compensation into ESG,” May 2021.

[4] NYU Stern Center for Sustainable Business, “U.S. Corporate Boards Suffer From Inadequate Expertise in Financially Material ESG Matters,” March 2021.