Observations On CLO Market and Value

We are three quarters of the way into the year and there are many uncertainties that can affect values for the coming year end, most notably the U.S. presidential election and threat of terrorism. As mentioned last quarter, the December compliance deadline for risk-retention is of little concern as the majority of U.S. collateralized loan obligations (CLOs) either incorporate compliant structural features or clearly articulate a risk-retention plan. We continue to track market participants’ views on defaults.

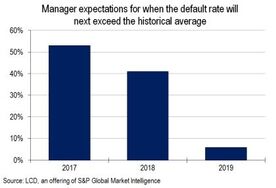

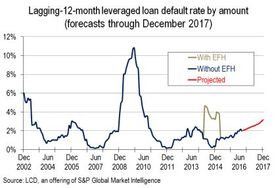

There were no new defaults among issuers in the S&P/LSTA Leveraged Loan Index for September which resulted in a lagging 12-month loan default rate of 1.95 percent by principal amount, down from 1.97 percent in June. According to Leveraged Commentary & Data (LCD), many expect the loan default rate to rise over the next 12 months and the default rate by principal amount to climb to 2.77 percent by the end of September 2017, before pushing higher to 3.16 percent by year-end 2017. Estimations of the loan default rate ranged from 1.18 percent to 3.5 percent for the next 12 months, and from 2.5 percent to 4 percent for 2017. There is therefore a consensus for a spike in defaults between 2017 and 2018. We find that price can still be an indicator of possible defaults with most of the likely issuers still centered on commodities. The oil and gas and metals and mining sectors together account for more than 32 percent of loan defaults this year, according to LCD. We have observed in the past quarters that a price below the 70s strongly captures the majority of issuers under distress and coincides with a rating of CCC while the prices in the 70s or even low 80s capture some of the outliers but may penalize other credits.

A new development this quarter is the appearance of CLOs issued with longer reinvestment periods, contrasting with the trend in the last few years for shorter reinvestment periods of around four years. These new CLOs have been ranging from 4.5 to five years of reinvestment. Longer reinvestment periods give CLO managers more time to actively manage their portfolios, build par and hopefully recover from a downturn in the credit cycle. It was the ability to reinvest for a longer period that helped many CLOs to recover after the financial crisis. However, most CLOs at the time made use of silent post-reinvestment period purchases. At that time, additional trading helped the most subordinated tranches but put the more senior tranches at greater risk. As a result, this time around many investors in senior tranches may not be as willing to extend their investments. Also, in order to take advantage of the extended trading, supply and market conditions need to be favorable during the extended reinvestment period.

|

|

Maria Nizza is a Senior Director with Alvarez & Marsal Valuation Services in New York, where she focuses on alternative asset manager advisory services. She specializes in the valuation of illiquid and complex securities.