June 17, 2024

Navigating Sales and Use Tax Audits: Proactive Measures and Strategies for Business Success

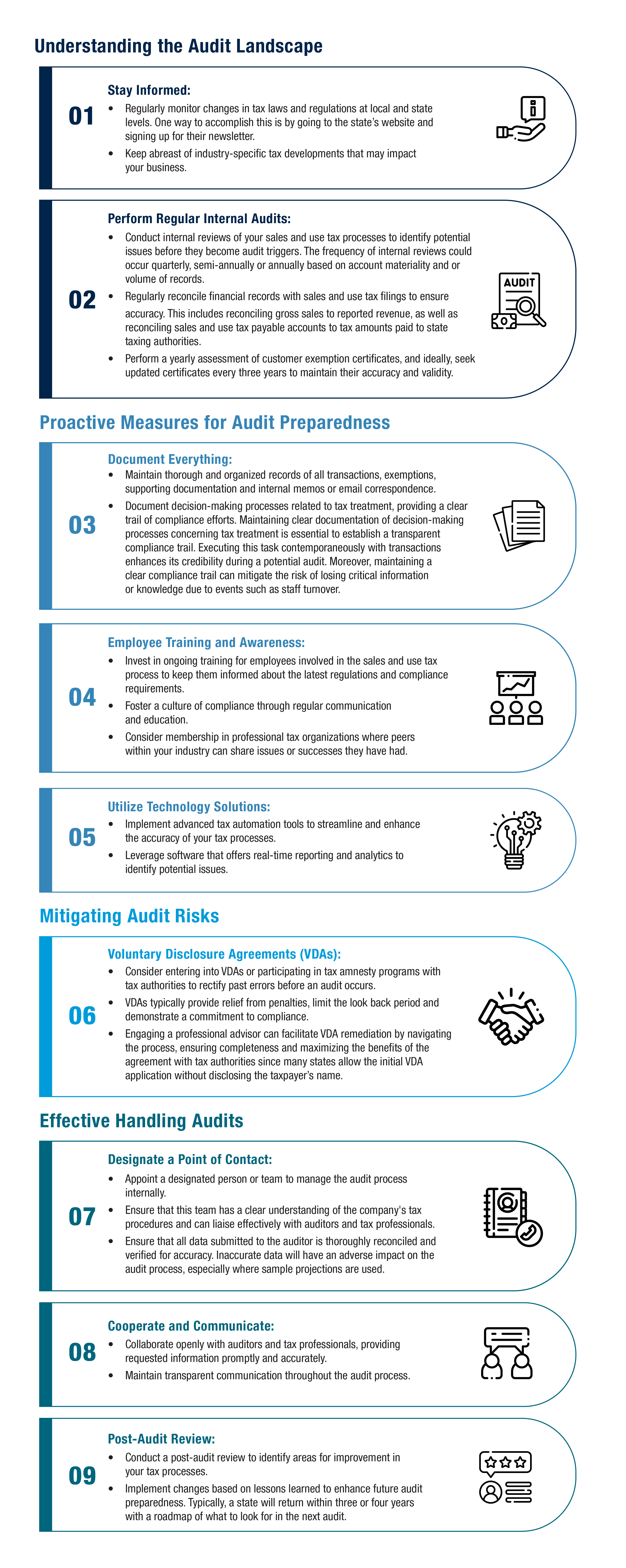

In the ever-evolving landscape of sales and use tax regulations, businesses face the constant challenge of staying compliant with an intricate web of laws. One crucial aspect of this compliance journey is audit preparedness. Being ready for a sales and use tax audit is not just about avoiding penalties but also about ensuring financial stability and minimizing disruption to the business. This thought leadership piece explores proactive measures and strategies that businesses can implement to be well-prepared for audits, mitigate risks and navigate the sales and use tax audit process more effectively.

Related Insights