Middle East Tax Alert | Oman Customs Announces New GCC Unified Tariff Effective 1 January 2025

Oman Customs has announced the implementation of a new version of the GCC Unified Tariff, which will come into effect on 1 January 2025. This significant update will change Oman’s Harmonized System (HS) code structure from 8 to 12 digits for all products. The primary objective of this change is to improve the accuracy of statistical data and information on imports and exports, thereby making the system more efficient for both businesses and the customs authority.

Key Highlights of the New Tariff*

- Unchanged First 8 Digits: The first 8 digits of each HS code will remain the same, ensuring continuity and minimizing disruption for businesses already familiar with the existing codes.

- No changes in customs duty rates: The customs duty rates assigned to each 8-digit tariff code will not change, meaning that there should be minimal duty impacts to businesses importing to Oman.

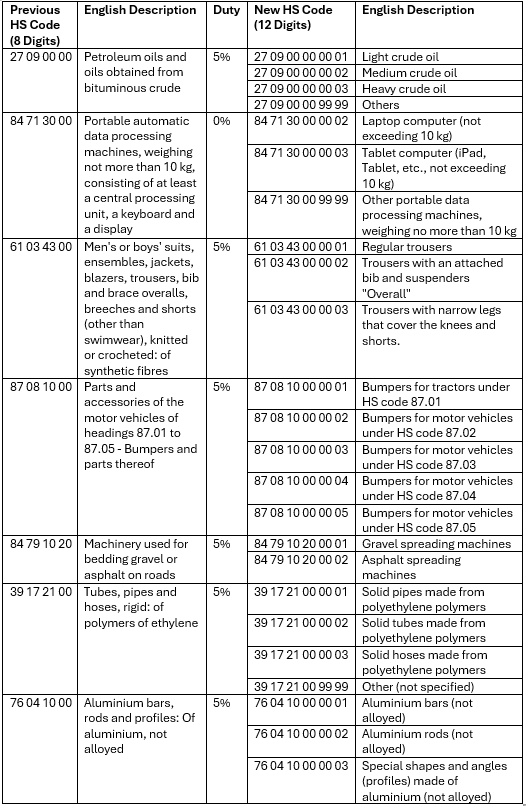

- Introduced subcodes: Most tariff codes will be expanded to include additional 4-digit subcodes, allowing for more specific categorisation of products. For example, the current code for laptops (84 71 30 00) will be split into separate subcodes for laptops (84 71 30 00 00 02) and tablets (84 71 30 00 00 03). This granularity will help in better tracking and management of different product types.

- Usage of “Other" product codes: Codes for "other" types of products will be characterized by "99 99" at the end, providing a catch-all category for items that do not fit into the more specific subcodes.

- Unchanged codes with "0000": Some tariff codes will remain the same but will have "0000" added at the end to fit the new 12-digit format.

- Chapter 99 for hazardous items: A new Chapter 99 is included, which lists all hazardous items. This will help in the proper identification and handling of dangerous goods, ensuring compliance local requirements and obtaining the necessary import/export permits.

*Please note that the above is based on a broad review of the new tariff and not a line-by-line review. There may be exceptions to the above that have not been captured.

Examples of HS Code Changes

Examples of the HS code changes have been included below for reference.

Next Steps for Businesses:

To prepare for the upcoming changes, businesses should take the following steps:

- Obtain a listing of your HS codes: Compile a comprehensive list of all HS codes for goods imported into Oman. This will serve as the foundation for transitioning to the new system.

- Reconciliation exercise: Undertake a reconciliation exercise to determine the new HS codes as per the updated tariff. If the list of codes is extensive, it is recommended to prioritize high-value items or upcoming imports/exports first.

- Maintain a listing of new HS codes: Keep an updated list of the new HS codes for any repeat shipments to ensure smooth processing through customs.

- Communicate changes to your customs broker: Inform your customs broker about the new HS code changes well in advance of any shipments to avoid delays and ensure compliance.

- Recordkeeping: Maintain detailed records of all imports and exports taking place after January 1, 2025. This will help in tracking and auditing shipments under the new system.

Compliance with these new requirements should be a top priority for businesses undertaking import and export activities in Oman. A&M is available to assist businesses with any HS mapping requirements and planning activities needed to adapt to the new changes.

For more detailed information, businesses can refer to the new tariff document, which is available in Arabic: [GCC Unified Tariff]