A Look Into Key Themes to Monitor During 2025

This edition of the Automotive Industry Spotlight will focus on key industry themes for 2025.

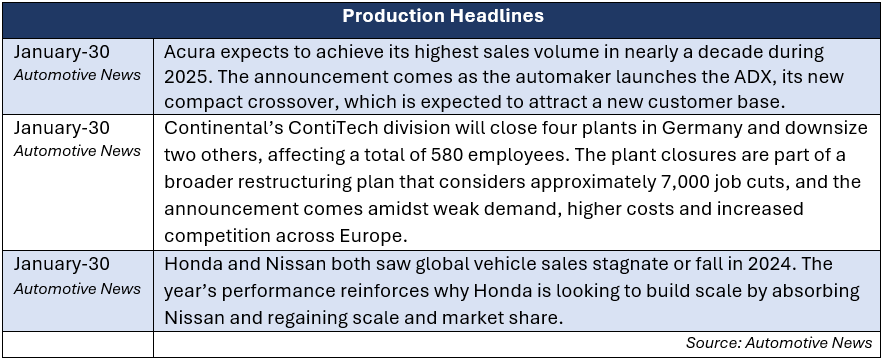

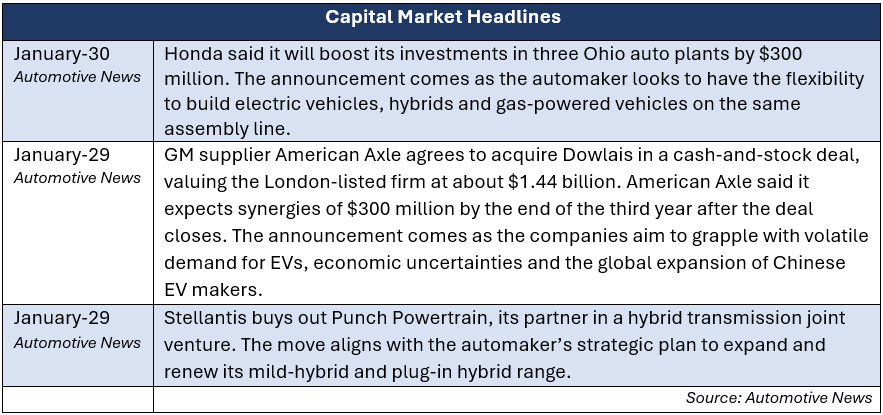

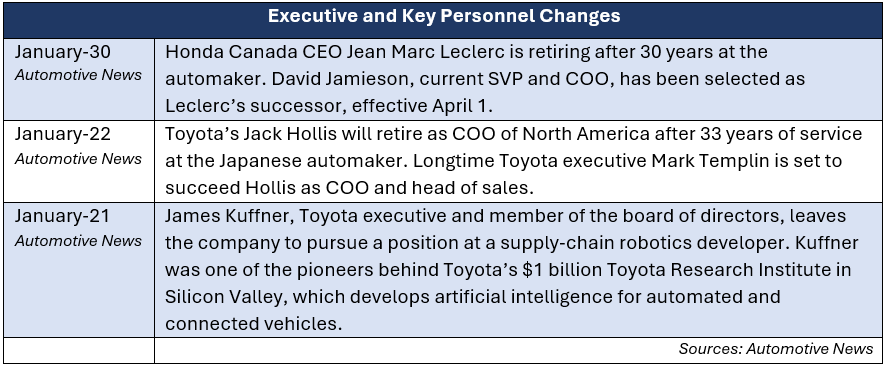

In industry news, Honda and Nissan both experienced declining or flat global vehicle sales in 2024 as the automakers pushed toward a potential merger. American Axle formally announced its $1.4 billion acquisition of London-listed Dowlais, the parent of GKN Automotive, aiming to realize nearly $300 million in synergies. Toyota North America’s COO, Jack Hollis, retires after nearly 33 years of service at the automaker.

In regulatory news, Honda recalled nearly 300,000 vehicles in the U.S. related to potential software issues. The newly appointed U.S. Transportation Secretary aims to repeal Biden-era fuel economy standards. Ford announced a recall of nearly 280,000 vehicles in the U.S., citing potential battery defects impacting electrical accessories.

Industry Focus: Key Areas to Watch in 2025

As we enter 2025, the automotive industry stands at a crossroads, driven by technological innovation, policy shifts and evolving market dynamics. Electric vehicle (EV) adoption remains volatile, industry consolidation among major automakers signals a new era of strategic realignment and trade policies under the new administration continue to take shape.

EVs: Volatility Continues

The EV market is entering 2025 with strong momentum. U.S. EV sales ended 2024 at approximately 1.3 million units, marking an increase of 7.3 percent over 2023 sales.1 The year’s strong sales were supported by continued original equipment manufacturer (OEM) and government incentive offerings. However, with the transition of the White House to the Trump Administration, federal support and incentives for EVs could be on the chopping block, which might hinder or slow EV sales growth moving forward.

Government policies remain a critical factor in shaping the EV landscape. In the U.S., the Inflation Reduction Act currently drives EV production through tax credits and higher emission standards. As these policies evolve under the Trump Administration, automakers will continue to adjust their product mix between traditional internal combustion engine (ICE), EV and hybrid vehicle offerings. Some initial production forecasts expect reductions in EV volumes going forward following a shift back toward ICE vehicles.2 The uncertainty in near- and long-term demand for EVs poises challenges for OEMs as they work to achieve an optimal mix of ICE, EV and hybrid vehicle production. Not only are OEMs navigating the ever-fluid regulatory environment, but they are also facing increasing levels of competition among peers and industry disruptors.

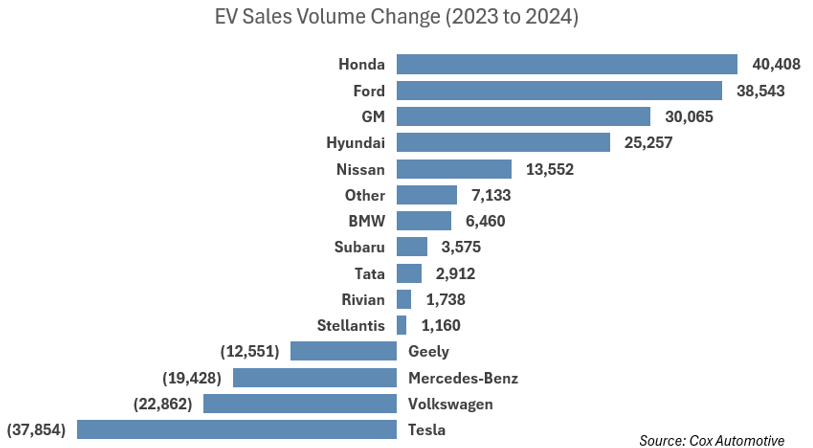

The competition in the EV market is heating up. Tesla, while still a dominant player, is facing increasing pressure from traditional OEMs and rising Chinese giants like BYD. Legacy OEMs such as Ford, GM and Honda are also ramping up production and launching new EV models across various price points. As traditional OEMs gain traction in the EV market, Tesla will continue to face increasing levels of competition in the market that it usually dominates. Throughout 2025, the competition for EV market share will likely continue as new products are launched. The change in EV sales by automaker between 2023 and 2024 showcases this rising level of competition from legacy automakers, as illustrated below.

|

Industry Consolidation

Developments regarding a potential merger between Honda and Nissan have dominated industry headlines as of late. If realized, this consolidation could create a formidable alliance that would rival the world’s largest automakers in scale and capability, which are becoming increasingly vital during the shift to EVs and as other technological advancements influence the industry. This strategic move is driven by the need to enhance competitiveness in the rapidly evolving industry, particularly in the EV sector. By combining resources, Honda and Nissan aim to reduce costs and share research and development efforts to better compete with industry leaders like Toyota and Volkswagen as well as emerging Chinese EV manufacturers such as BYD. Intensifying competition from Tesla, BYD and other disruptors is pressuring traditional players to streamline operations and leverage economies of scale.

The merger reflects what could be a broader trend toward consolidation throughout the industry. As the sector faces technological advances, increased competition and overcapacity issues, companies are seeking partnerships and mergers to achieve economies of scale, share technological expertise and mitigate financial risks. If consolidation efforts gain momentum, the industry could experience a new wave of strategic alliances that would fundamentally alter the competitive dynamics of the industry. Legacy automakers, particularly in Europe and North America, have historically relied on China as a large profit center due to the market’s expansion that began around the global financial crisis.2 However, as local manufacturers in China continue to gain local market share, European and North American automakers are left to tackle overcapacity issues that may be exacerbated by their declining market share in China. Beyond cost savings, larger entities can better withstand supply chain disruptions, fund massive research and development efforts and accelerate the rollout of new technologies. As consumer preferences shift and new market entrants challenge the status quo, consolidation offers traditional manufacturers a way to remain agile, competitive and financially resilient in an industry undergoing continuous change.

Tariffs

Developments in trade policy will be a focal point throughout the next year as the industry navigates the direction of the new Trump administration. However, tariffs are not new — during Trump’s first term, tariffs were imposed on imports from Canada, Mexico, China and other countries, targeting steel, aluminum, automobiles and various other goods in an effort to bolster domestic manufacturing. Under the Biden administration, many of these tariffs remained in place, while new tariffs were introduced on Chinese products and EV imports to counter growing competition and protect the U.S. EV industry.3

In February 2025, President Trump signed an executive order imposing 25 percent tariffs on goods from Mexico and Canada and 10 percent tariffs on imports from China. While some of these tariffs have been temporarily paused for one month as negotiations continue, the industry is bracing for a potential trade war that could ripple across the supply chain. On one hand, higher tariffs could protect domestic production and jobs; on the other, they could drive price inflation for manufacturers and consumers alike. Specifically, the Detroit Big Three automakers source a significant share of parts and materials from Mexico, meaning these tariffs could sharply increase costs, forcing the automakers to either push the burden onto suppliers — who are already facing rising expenses — or pass it along to consumers, who are already strained by inflation. Automakers will most likely choose a combination of the two. While the U.S. automotive industry — particularly EVs — could benefit from the protection tariffs would offer against rising Chinese competition, a trade war could also disrupt supply chains and further increase costs. Automakers, suppliers and end consumers will face both opportunities and challenges from the evolving tariff landscape

As 2025 unfolds, the automotive industry must navigate a rapidly evolving landscape shaped by shifting trade policies, intensifying competition and strategic realignments. The trajectory of EV adoption remains uncertain as government incentives and regulatory frameworks shift, while industry consolidation signals a new era of collaboration among legacy automakers. Meanwhile, trade policies — including newly imposed tariffs — will add another layer of complexity, influencing manufacturing costs and global supply chains. Automakers will need to remain agile, balancing innovation with operational efficiency to stay competitive in an industry undergoing profound transformation.

Sources

- Cox Automotive: Electric Vehicle Sales Jump Higher in Q4, Pushing U.S. Sales to a Record 1.3 Million (https://www.wsj.com/business/autos/trump-auto-business-car-sales-126eb40c?mod=autos_more_article_pos1)

- Bank of America Global Research – Automotive Industry, January 2025

- Tax Foundation: Tracking the Economic Impact of the Trump Trade War (https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/)

Additional January insights are included below.

Industry Update

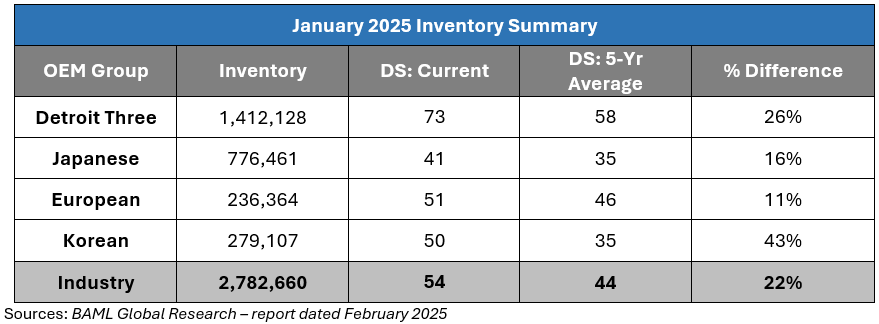

January inventory levels ended at 2.78 million units, a 7,000-unit decrease from December. Days’ supply closed at 54, approximately 22 percent above the five-year average. The decline in inventory levels was primarily driven by the Detroit Big Three and European OEMs, but was partially offset by inventory increases at Japanese and Korean OEMs.

Regulatory Landscape

Honda Recall: Honda announced the recall of nearly 300,000 vehicles in the U.S. due to a software error causing engine stalls. The recall impacts various models from the 2021 to 2025 production years. The fuel injection electronic control unit on these vehicles may have faulty settings, causing the engine to potentially lose power, hesitate or stall after sudden changes in the throttle opening.1

Repeal of Biden Vehicle Fuel Economy Standards: Sean Duffy, the newly appointed U.S. Transportation Secretary, signed an order directing regulators to rescind the fuel economy standards issued under the Biden Administration, which aimed to drastically reduce fuel use for cards and trucks. 2

Ford Recall: Ford announced the recall of nearly 280,000 vehicles in the U.S., citing concerns regarding battery failure. The recall affects 2021 to 2023 production years of the Bronco Sport and 2022 to 2023 production years of the Maverick pickup. The National Highway Traffic Safety Administration said the 12-volt batteries equipped in these vehicles may experience degradation and suddenly fail, which can result in a loss of electrical accessories.3

Regulatory News Source

- Automotive News: Honda to recall nearly 300,000 vehicles in U.S. over software error causing engines to stall (https://www.autonews.com/honda/an-honda-recall-software-issue-stalling-engines/)

- Automotive News: Newly confirmed U.S. Transportation chief moves to repeal Biden vehicle fuel economy standards (https://www.autonews.com/regulation-safety/an-us-moves-repeal-fuel-economy/)

- Automotive News: NHTSA says Ford to recall more than 270,000 Bronco Sports, Mavericks in U.S. over battery concern (https://www.autonews.com/ford/an-ford-bronco-recall/)

Stay connected to industry financial indicators and check back in March for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive