A Look Ahead at Future Operating Challenges in the Dealership Segment

This edition of the Automotive Industry Spotlight will focus on the potential changes facing the automotive dealership segment.

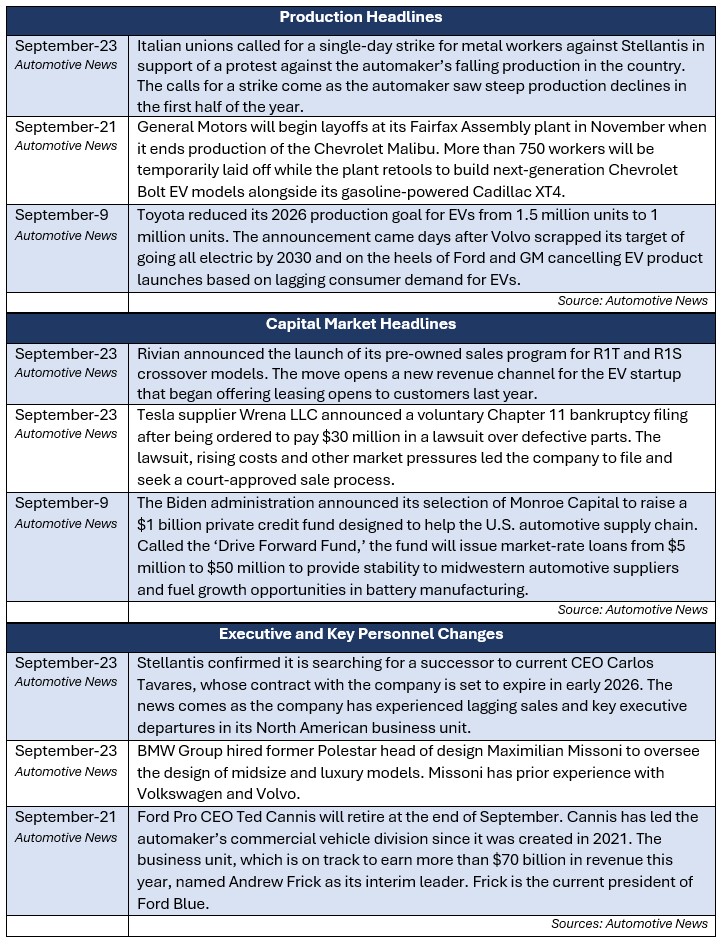

In industry news, Stellantis faces potential international labor strikes as production lags expectations on a year-to-date basis. Rivian announced the launch of its pre-owned vehicle sales program, following in the footsteps of Tesla and other legacy original equipment manufacturers (OEMs) to grow its potential revenue pool. The Biden administration announced a billion-dollar fund for automotive suppliers that is designed to offer stability and growth opportunities for suppliers looking to expand their electric vehicle (EV) capabilities.

In regulatory news, GM announced a significant recall affecting pickup trucks and SUVs related to a brake fluid warning system. Volkswagen halted production and sales of its popular ID4 model, citing a water sealing issue with its door handles that could lead to faulty electrical components. A recent study by the Insurance Institute for Highway Safety (IIHS) found that autonomous systems in vehicles led to increased driver complacency and distracted driving behaviors, placing further scrutiny on autonomous vehicles.

Industry Focus: Automotive Dealerships

The new-car dealership segment has recently undergone significant changes in operating models and customer experience, driven largely by changes arising from the COVID-19 pandemic. In addition, the rapidly evolving landscape of EVs is expected to impact core profitability and further impact operations — specifically to service and parts. Looking ahead, auto dealers face potential disruptions to key profit centers, driven by the continued production and adoption of EVs, shifting consumer preferences and broader economic conditions.

Consumer Preference for Dealership Experience Is Shifting … Right?

The customer experience has long been an important piece of the traditional dealership model: showrooms, sales professionals and test drives have long been central to the car-buying experience. However, consumer preferences are shifting and are changing the traditional layout of dealerships as they increasingly seek digitally oriented purchasing platforms for large purchases, including vehicles. Carvana and Vroom have led the shift to digital car buying — and selling — experiences. Traditional dealerships have already recognized this shift and have developed online infrastructure and features for customers. According to a study conducted by Cox Automotive, nearly four out of 10 dealerships offer customers the option to complete all vehicle purchasing steps online [1].

Despite this, not all stakeholders believe that a direct-to-consumer distribution model is an improvement. According to a recent Oliver Wyman study, traditional automotive dealership models may be the most cost-effective way to sell vehicles [2]. The study finds that the net-cost difference between the traditional and direct-to-consumer modes of distribution is approximately $200 per vehicle sold [3]. To that end, it has been a bumpy road for certain “online retailers” such as Carvana. The high-profile startup made headlines in recent years due to bankruptcy concerns resulting from a steep decline in vehicles sold and significant cash burn [4]. This leaves traditional dealerships with a strategic opportunity to shift existing infrastructure into a hybrid model to efficiently capture the cost savings associated with omnichannel experiences.

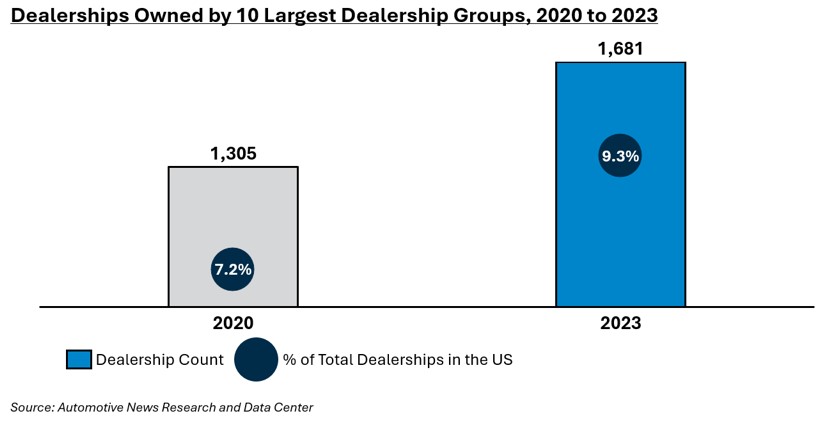

Shifting consumer preferences, changes in operations and profitability and uncertainty surrounding EVs leaves dealerships with large hurdles to clear. Given the industry remains highly fragmented, smaller dealerships will be less well-equipped — or capitalized — to make the necessary investments associated with these changes. Consolidation across the dealership industry has been a major trend since 2020 and is expected to continue; of the approximately 18,000 dealerships in the United States, a record number are now owned by the top 10.

EVs Are in the Driver’s Seat for Influence on Dealership Behavior

While the speed at which EVs are further adopted remains uncertain, it appears likely that they will continue to gain market share relative to internal combustion engine (ICE) vehicles in the long term. The transition to EVs has not come without additional costs for all involved in the value chain. As OEMs shift production toward EVs, dealerships will also be required to update their facilities to accommodate the technology-driven experience of EVs. In September 2022, Ford announced an “EV-Certified” program for dealerships to be eligible to sell EVs, which required dealerships to make capital investments upwards of $1 million [5]. While Ford terminated the program earlier this year — presumably due to lower-than-expected EV demand — it set an early precedent for what dealerships could face in the future.

Capital investments are not the only EV-related challenge for dealerships. Recent data from Cars.com shows new and used EVs spend approximately 81 days on dealership lots, compared to the average of 66 days that a new ICE car spends on a lot [6]. Furthermore, EV inventory levels continue to rise amidst lower-than-expected customer demand due to vehicle cost, “range anxiety” and uncertainty surrounding widespread charging infrastructure [7].

Service Model Is a Double-edged Opportunity

As EVs grow in market share with consumers, simplified manufacturing will likely lead to less frequent consumer visits to dealerships after a purchase. According to Ford CEO Jim Farley, EVs require 40 percent fewer parts than their ICE counterparts [8]. Furthermore, it has been estimated that EV batteries will have service lives of up to 15 years [9]. With fewer parts and a longer useful life on these parts, there will be less maintenance throughout the life of EVs, which will force dealerships to rethink their strategies to keep consumers engaged. Dealerships will need to repurpose their service bays, tools and staff to accommodate the maintenance needs of EVs. This will include, among other things, specialized charging stations, high-voltage electrical equipment and battery-handling equipment. Moreover, equipment and service upgrades to accommodate EVs also bear additional costs related to upgrading the electrical infrastructure of the general facilities. According to a report published by the National Automobile Dealers Association (NADA), dealerships were previously on track to invest nearly $6 billion in EV infrastructure upgrades [10]. Amidst the recent slowdown in EV investments and production, dealerships will be closely monitoring any developments from OEMs as future advancements in EV production will pose a significant change to the traditional dealership model and will likely require a significant investment.

Despite the unique challenges ahead, there are also opportunities for dealerships to benefit from a transition to EVs. Currently, the vast majority of EVs are sold as new vehicles through dealerships, where parts and service offerings, including options for warranties, can be a selling point due to customer convenience. Further, as EVs gain market share, OEM-licensed dealerships will be better positioned than independent garages or service providers to develop and deliver the specific expertise required for EV maintenance. OEM-licensed dealerships will also be uniquely positioned to leverage the incremental data provided by EVs for predictive maintenance, ease of customer use and general delivery of the service model.

As the future of EVs becomes clearer and the shift in consumer preferences takes hold, dealerships will be required to invest in the capabilities needed to sell and service EVs, but they must be carefully timed with the broader EV market and consumer demand.

Sources

[1]. Cox Automotive’s 2023 Digitization of Car Buying Study. https://www.coxautoinc.com/wp-content/uploads/2023/11/2023-Digitization-of-Car-Buying_FINAL.pdf

[2]. Automotive News: Traditional Auto Dealership Franchises Might Work Best. https://www.autonews.com/dealers/auto-dealer-franchises-may-beat-out-hybrid-dtc-models-study-says.

[3]. Financial Times: How Debtors and Creditors Steered Carvana Away from Bankruptcy. https://www.ft.com/content/5633d613-3a92-477d-85b8-aab4894d2202.

[4]. Automotive News: Consolidation Continues to Reshape Auto Retail. https://www.autonews.com/dealers/2023-top-150-dealership-groups-consolidation-reshapes-auto-retail.

[5]. CNBC: Ford Ends EV Dealership Program that Required Hefty Investment to Sell Electric Models. https://www.cnbc.com/2024/06/13/ford-ends-ev-dealership-program.html.

[6]. Cars.com: It’s a Great Time to Shop for an Electric Vehicle. https://www.cars.com/articles/its-a-great-time-to-shop-for-an-electric-vehicle-report-483282/.

[7]. NewsData: U.S. Electric Inventories Outpace Sales Volumes. https://www.newsdata.com/clearing_up/clearing_it_up/u-s-electric-vehicle-inventories-outpace-sales-volumes/article_fdf093fe-f859-11ee-a2f7-a738aca34a2b.html.

[8]. Automotive News: Ford CEO: Insourcing is Key to Protecting Jobs in EV Transition. https://www.autonews.com/executives/ford-ceo-jim-farley-insourcing-key-protecting-jobs.

[9]. Car and Driver: Electric Car Maintenance: Everything You Need to Know. https://www.caranddriver.com/shopping-advice/a40957766/electric-car-maintenance/.

[10]. NADA: Dealerships on Track to Invest $5.5 Billion in EV Infrastructure. https://www.nada.org/nada/nada-headlines/dealerships-track-invest-55-billion-ev-infrastructure.

Additional September insights are included below.

Industry Update

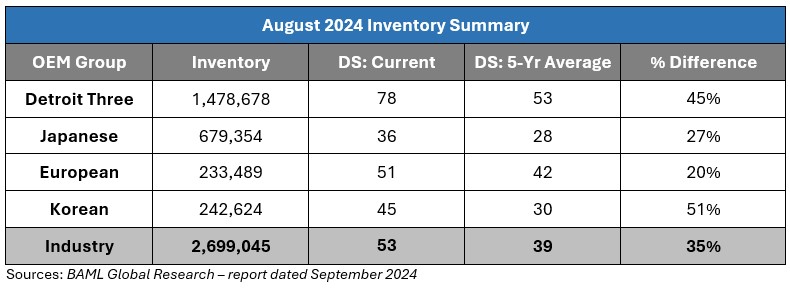

August inventory levels ended at 2.699 million units, a 44,000-unit increase from July. Days’ supply closed at 53, approximately 35 percent above the five-year average. GM, plus 49,000 units, and Ford, plus 37,000 units, led the way for domestic increases while Stellantis saw an 18,000 unit decrease.

Regulatory Landscape

GM Truck Recall: GM announced a recall of more than 449,000 pickup trucks and SUVs across its Silverado, Sierra, Tahoe, Suburban and Yukon product lines, citing an inoperative low brake fluid warning. The company announced dealers would be able to fix the issue with an over-the-air software update that would fix the electronic brake control module software [1].

Volkswagen Halts Sales and Production of ID4: Volkswagen announced it would pause production, furlough employees and stop sales of its ID4 electric crossover as it searches for a solution to faulty door handles. The company announced it would recall nearly 100,000 vehicles because of door handles not offering sufficient water protection, leading to circuit board malfunctions. The automaker hopes to resume production for the model by early 2025 [2].

IIHS Study on Partial Automation: A new study by the IIHS found that partial automation systems in vehicles increased the likelihood of drivers engaging in distracted behaviors such as checking their phones or eating while driving. The study specifically focused on Volvo’s Pilot Assist System and Tesla’s Autopilot system, citing results that showed drivers could manipulate the timing of attention reminders to avoid system interventions [3].

Regulatory News source

[1]. Automotive News: GM to recall over 449,000 pickup trucks, SUVs in US. https://www.autonews.com/regulation-safety/gm-recall-over-449000-pickup-trucks-suvs-us.

[2]. Automotive News: VW stops sale of ID4 over faulty door handles, halts output and furloughs employees. https://www.autonews.com/regulation-safety/why-vw-issued-2021-24-id4-stop-sale-and-plans-halt-output.

[3]. Automotive News: Partial automation technology encourages distraction, IIHS finds. https://www.autonews.com/regulation-safety/partial-automation-increases-distraction-risks-iihs-says.

Stay connected to industry financial indicators and check back in October for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive