Legislation Continues to Push Electric Vehicle Development as Cost Cutting Efforts Intensify

Lawmakers and government agencies lay out new guidelines for the U.S. automotive industry that will require a heavy push in electric vehicle (EV) and charging network development. Mixed earnings results are driving robust cost cutting efforts from major automakers. Inventory continues to gradually improve as automakers beat consensus sales estimates.

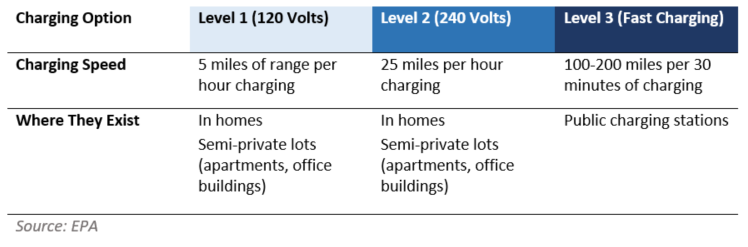

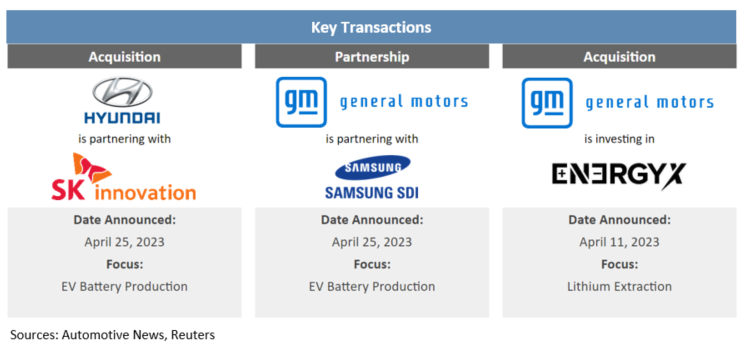

In transaction news, Hyundai and SK Innovation finalized partnership plans for a battery plant in Georgia. General Motors announced a partnership with Samsung SDI and an investment in EnergyX, continuing its focused push into electric vehicle battery development and lithium extraction.

In regulatory news, Kia and Hyundai face lawsuits from several cities for lacking anti-theft capabilities. Tesla reports another fatal accident tied to its Autopilot system as the Department of Justice investigation continues. New EPA standards for the auto industry feature the strictest-ever emission requirements for cars and light trucks.

Additional April insights are included below.

Financial Performance

The global semiconductor shortage has now cut more than 1 million vehicles from automakers’ production plans for this year as of last week, according to AutoForecast Solutions (AFS). Last week’s cuts to production plans came primarily from North American and Asian manufacturers. AFS still expects approximately 2.8 million vehicles will be cut from production plans for lack of chips in 2023, down from 4.38 million in 2022 and 10.56 million in 2021. March U.S. light vehicle sales were up 9.3 percent year over year, beating out Bloomberg consensus estimates.

Industry Update

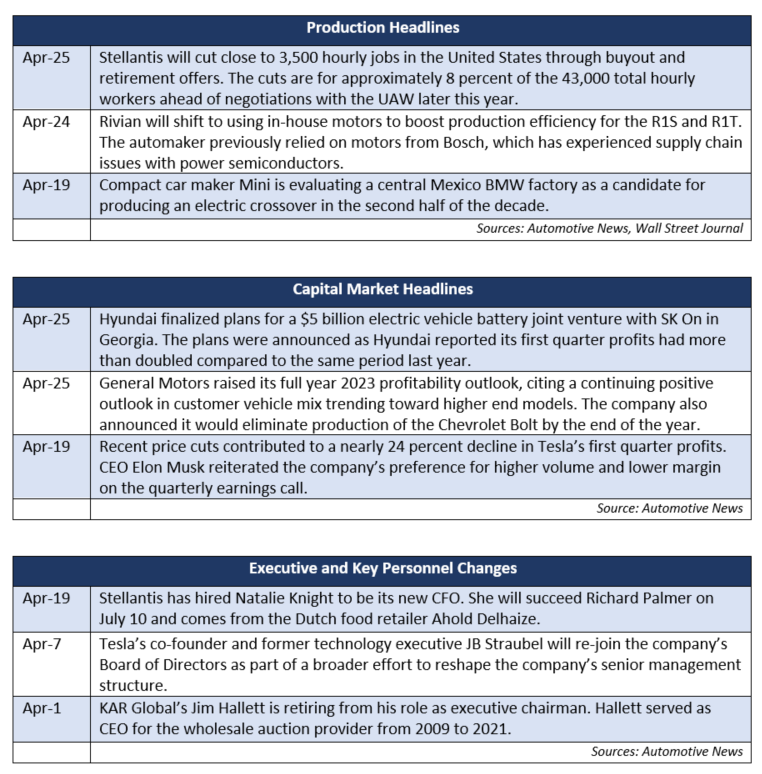

March inventory levels ended at 1.84 million units, their highest level since April 2021. Days’ supply (DS) closed at 40, approximately 22 percent below the five-year average, a minor improvement compared to the last several months of results. The improvement in inventory comes as March sales reached their highest level since early 2021 on a unit basis.

March U.S. light vehicle sales increased 9.3 percent year over year, beating consensus estimates from Bloomberg. Vehicle mix continues to improve to record levels of large vehicles as average transaction prices remain steady but are elevated compared to this time last year. Expectations for full year 2023 remain moderate based on continuously growing production cuts, but signs continue to point toward a steeper recovery in 2024.

Industry Focus — EV Charging Infrastructure

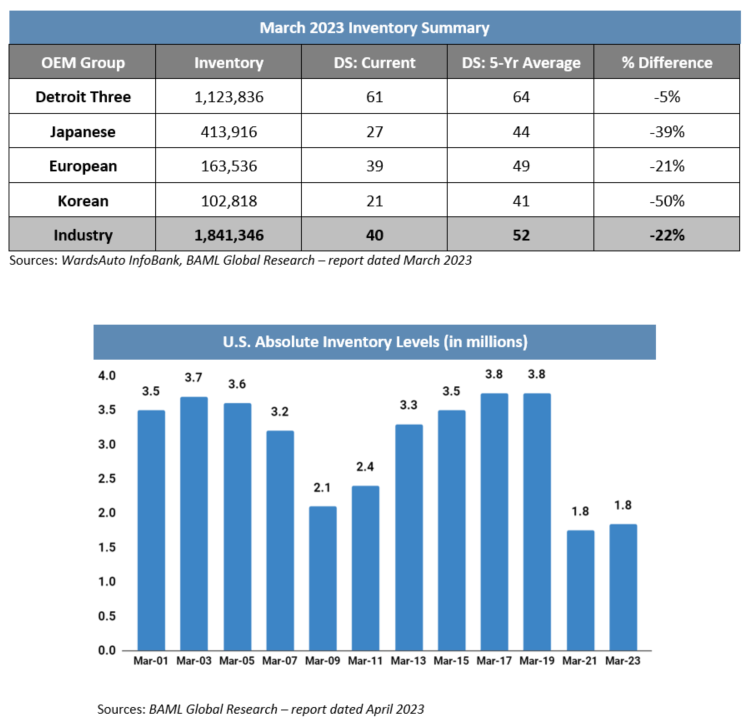

As federal legislation continues to incentivize automaker investment in the development of electric vehicles and batteries, vehicle charging infrastructure remains a significant barrier to mass consumer adoption. The Biden administration’s goal of having zero-emission vehicles make up half of all new vehicles sold in 2030 is paired with a goal of having 500,000 charging ports in place.

There are roadblocks to the effectiveness of such a broad network of charging ports for electric vehicles. Utility providers and state lawmakers have suggested that charging stations could run at operating losses for nearly a decade (until broader EV adoption among consumers is achieved). Speed of charging remains a massive hurdle for consumers to overcome, with Tesla’s private Supercharger network holding a significant advantage over its competitors.

Utility and Infrastructure Roadblocks

The $1 trillion infrastructure bill passed at the end of 2021 includes $7.5 billion to be distributed by states to increase the availability of chargers, but conflict has arisen between utility companies and businesses such as gas stations and convenience stores in how these funds will be allocated. For utility providers, owning and operating charging networks present an opportunity to extend electricity sales into a new market. They hold a significant advantage over small businesses that might construct their own charging stations at their own expense: with approval from state regulators, utility companies can pass the cost of infrastructure and power to all rate payers.

Beyond questions about who will build the network, state legislators have raised several financial concerns with the practical elements of the administration’s plan — primarily, issues with requiring charging stations to be installed every 50 miles along the interstate. States such as Montana, Utah, and Wyoming have suggested this requirement will stretch financial and grid resources for a utility that is not anticipated to be profitable for many years, and believe many stations constructed to fit this requirement would operate for significant stretches of time without use.

Charging Speed and “Range Anxiety”

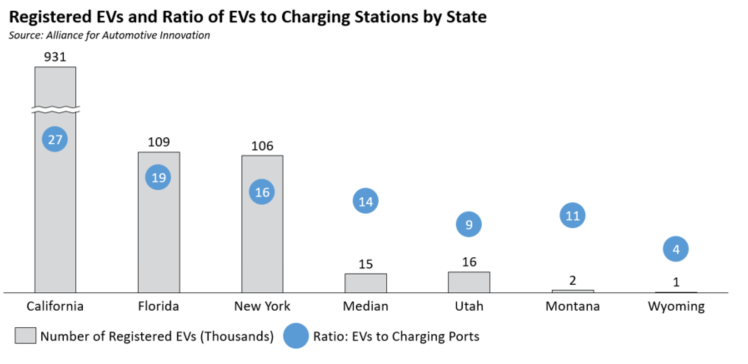

While challenges with setting up a national charging network persist, perhaps a more pressing issue with consumers is the speed of charging. Charging options for electric vehicles are segmented into three main categories:

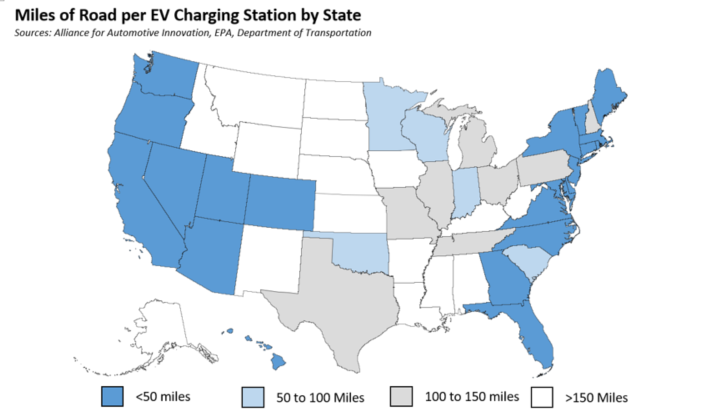

Of the approximately 150,000 public chargers in the U.S., only 38,000 are level 3 fast chargers, while a majority are level 2. While the charger network expansion has shrunk the average distance between stations, a majority of states still exceed the 50-mile target when comparing the total miles of road in a state to the number of publicly available chargers:

Automakers are starting their own efforts to expand charging networks as well. General Motors has recently announced plans to build a network of 40,000 level 2 chargers in partnership with its dealerships. Nearly 1,100 dealerships have enrolled in the access program with the automaker to place up to 10 chargers at their dealership. The company’s decision to install level 2 chargers instead of level 3 fast chargers was driven by cost — by sticking to level 2, the company can increase the network’s reach to areas that don’t have the complex infrastructure required to accommodate level 3 fast chargers.

Transaction Activity

A $5 billion electric vehicle battery joint venture between Hyundai and SK On leads the way in transaction news this month. General Motors is also looking to accelerate electric vehicle battery production through a partnership with Samsung SDI for a new production facility and a Series B investment in EnergyX, a startup focused on lithium extraction and refinement.

See below for additional detail on recently announced transactions.

- (4/25) Hyundai has finalized plans for a joint venture with SK On, a battery unit of SK Innovation, for an electric vehicle battery manufacturing plant in Georgia. The project is estimated to cost $5 billion and will “further accelerate the group’s electrification efforts.”

- (4/25) General Motors and Samsung SDI will invest $3 billion in a joint venture electric vehicle battery plant. The facility’s location has yet to be decided but is planned to start in 2026 and will have an annual production of capacity of 30 gigawatt hours.

- (4/11) General Motors’ venture capital arm will lead a $50 million Series B financing for EnergyX, a startup that specializes in lithium extraction technology. The deal also includes a strategic agreement for GM to contribute to the development of lithium extraction and refinery technology.

Regulatory Landscape

Kia and Hyundai Lawsuits: Several cities in the United States, including Cleveland and Seattle, have sued Kia and Hyundai. The lawsuits allege the automakers did not install robust anti-theft technology to cut costs, making vehicles easier to steal and cities less safe. The lawsuits do not specify how much the auto makers would owe in damages.

Tesla Autopilot: Tesla reported another fatal crash linked to its automated driver-assist systems, the company’s 17th instance since the government required carmakers to submit data on accidents related to such systems.

New EPA Guidelines: The EPA recently released its strictest-ever vehicle pollution standards for cars and light trucks for the 2027-to-2032 model years. The standards feature a 56 percent reduction in emission target levels from the 2026 model years. If passed through, the updated standards could lead to electric vehicles making up half of all vehicles sold by 2030, compared to 5.6 percent in 2022.

Stay connected to industry financial indicators and check back in May for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive